Summary:

- NextEra Energy’s share price has declined by -19.24% in 2023, presenting a potential buying opportunity.

- The company is well positioned to capitalize on the growth of renewables, particularly in solar and wind energy.

- NextEra is a profitable company with a strong dividend growth profile, making it an attractive investment option.

PM Images

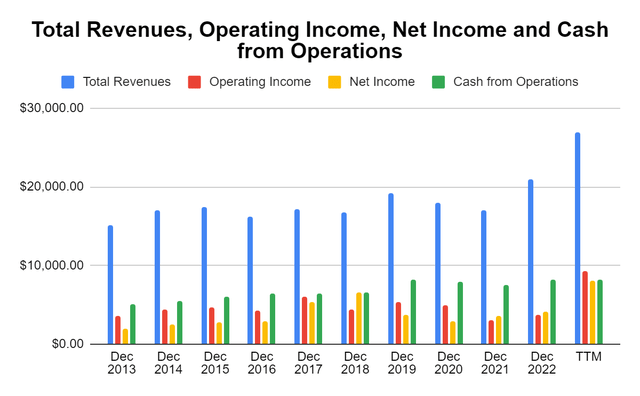

NextEra Energy (NYSE:NEE) has seen better days as its share price has declined by -19.24% in 2023. NextEra has broken through the bottom of a multiyear range, and shares are trading at the same valuation as in the summer of 2020. I normally write articles about energy infrastructure companies in the oil and gas industry, but I have always said I am pro-renewables and continue to look for investments in the renewable space. I had previously written an article on NextEra in 2020 (can be read here) and since then NextEra has increased its revenue by 49.74% to $26.85 billion and its cash from operations by 3.07% to $8.23 billion. I wanted to revisit this idea as NextEra continues to thrive in an emerging green space. NextEra could continue to see its share price erode, but I believe it has become one of the best times in recent history to either start a position or add to an existing position in NextEra. Since the beginning of 2022, every time shares of NextEra retraced into the low $70s, they have always bounced back to the upper $70s or low $80s until now. NextEra has broken a long-term trend, which I believe is an opportunity for this Dividend Aristocrat. Solar and wind have a long runway of growth ahead of them, and while they will not replace traditional fossil fuels anytime soon, NextEra is an interesting approach to gaining exposure to the industry. NextEra has been a dividend growth machine for its shareholders, and I am very interested in adding this Dividend Aristocrat to my Dividend Harvesting Portfolio on Seeking Alpha (can be read here) and possibly in my dividend portfolio.

Renewables are expected to increase their relevancy over the next several decades, and I like NextEra Energy as exposure to the space

My stance on energy hasn’t changed as I have continuously said that eliminating fossil fuels isn’t realistic and that an evolution in the global energy mix will be the most likely outcome. Energy isn’t a zero-sum game, as fossil fuels play a much greater societal role than simply providing an energy source. My position is that renewables such as solar and wind will continue to increase their position in the global energy mix, and eventually, coal will be phased out. I could be incorrect, as nobody can predict the future, but I still see this as the most likely scenario. I conducted a tremendous amount of research in the commodity markets, and while the data indicates oil and gas will still be relevant in 2050, the story for renewables is full of growth. The future of renewables is setting up well for NextEra.

All the data I am going to cite comes from the publications below. If you are interested in the energy market, I suggest reading through these. From all of the actual energy companies, I personally feel that BP p.l.c (BP) puts out the best independent research, and that is why I use their reports in addition to government publications.

- 72nd Edition of the Statistical Review of World Energy (can be read here)

- U.S. Energy Information Administration Annual Energy Outlook 2023 (can be read here)

- U.S. Energy Information Administration Short-Term Energy Outlook July 2023 (can be read here)

- BP Energy Outlook 2023 (can be read here)

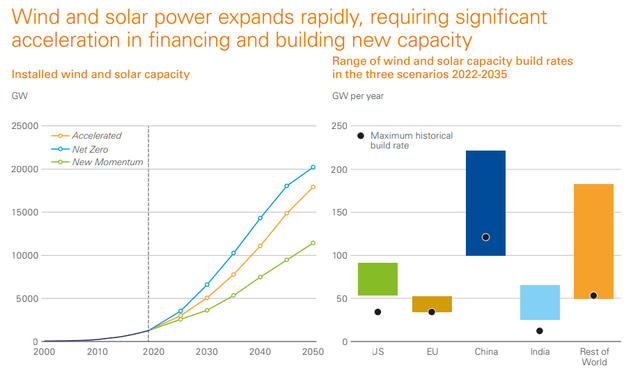

The 2023 BP Energy Outlook provides 3 scenarios for the adoption of renewable energy. BP sees wind and solar installed capacity increasing by roughly 9x in their new momentum. Most of the capacity comes from providing electricity for final consumption.

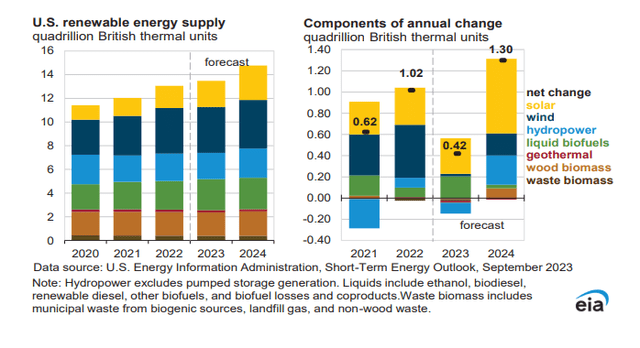

In the EIA Short-Term Energy Outlook, they are projecting that U.S. renewable energy supply will continue to increase. Within the renewable energy mix, solar and wind are expected to see significant growth.

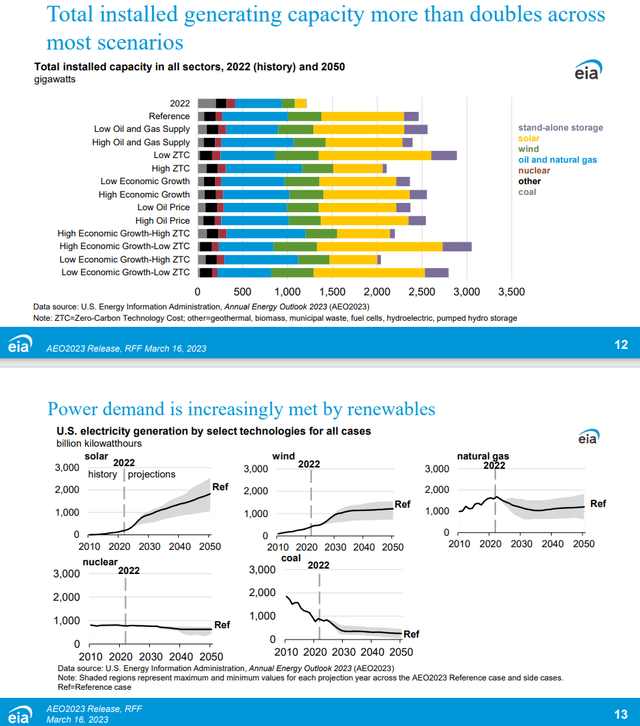

In the EIA Annual Energy Outlook to 2050, they predict that in most scenarios, the amount of energy generating capacity will more than double from the 2022 levels. More specifically, they see coal drastically declining, while solar sees the largest utilization increase and wind recognizes the 2nd largest increase.

I am pro-oil and gas the same way that I am pro-renewables. When I look at the energy landscape, I see it evolving over the next several decades. Based on the data, there is no scenario where renewables don’t increase their position in the overall energy mix, nor is there a scenario where renewables replaces oil and gas. The projections are clear, and renewables, specifically wind and solar, have large runways for expansion over the next several decades. This is why I am interested in the renewable space, and I believe NextEra is a good play to capitalize on the growing renewable trend.

NextEra Energy continues to be extremely profitable and is projecting to see EPS expansion

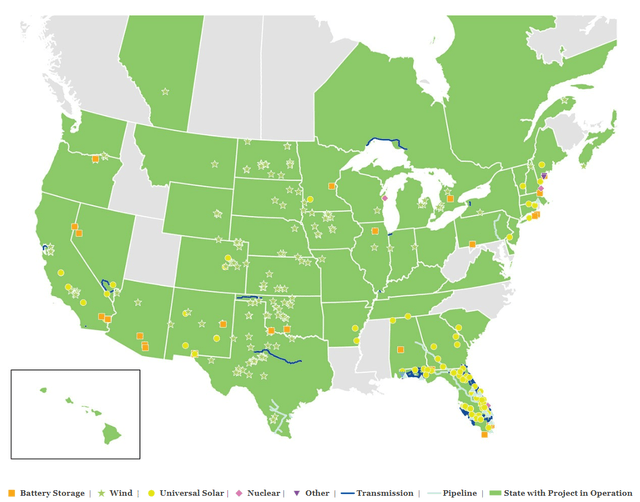

NextEra is one of the largest clean energy companies in the United States and owns Florida Power & Light Company. Florida Power is America’s largest electric utility, selling more power than any other utility to approximately 5.8 million accounts and serving over 12 million people across Florida. NextEra has several affiliated entities and subsidiary companies that create the world’s largest generator of renewable energy from the wind and sun, a world leader in battery storage, and an emerging nuclear power leader with 7 commercial nuclear power units.

When I look at NextEra’s financials, they are a cash cow. In the TTM, NextEra has generated $26.95 billion in revenue with an operating income of $9.27 billion, net income of $8.1 billion, and produced $8.23 billion in cash from operations. NextEra has a 30.53% cash yield from its revenue, and its bottom-line profit margin is 30.05%. Power companies are not typically exciting, but NextEra is generating a windfall of profits with excellent margins. This is allowing NextEra to continue its growth trajectory, as it now has roughly 20 GW of development in its backlog of projects. Over the span of 3 months from Q1 to Q2 2023, NextEra had placed over 1,800 megawatts into commercial operations and added approximately 1,665 megawatts of new renewable and storage projects to its backlog.

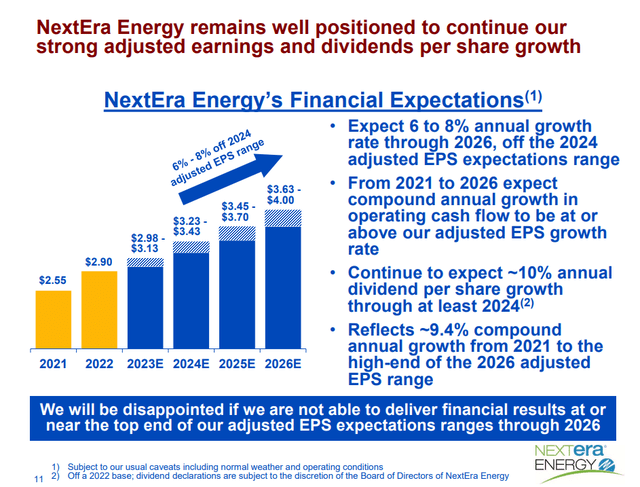

Steven Fiorillo, Seeking Alpha

NextEra has become a larger profit center, allowing them to expand their backlog of growth projects. NextEra has projected that they will finish 2023 having generated between $2.98 – $3.13 of EPS per share. At the low end of the range, NextEra will see a $0.08 increase (2.76%) YoY compared to the $2.90 of EPS generated in 2022. Sticking with the low end of the forward guidance, NextEra is projecting that they will see a $0.25 (7.74%) increase YoY in EPS for 2024, then EPS will grow $0.22 in 2025 and by another $0.18 in 2026. NextEra is projecting that its EPS will grow by $0.65 or 21.81% on the low end from the end of 2023- 2026. In their Q2 slide deck, NextEra stated that they will be disappointed if they aren’t delivering near the top end of their projected range. The top end sees EPS growing to $4 in 2026, which is a 27.79% increase or $0.87 addition in EPS if the top end of 2023 and 2026 are achieved. The future projections from the EIA certainly support the forward growth that NextEra can achieve, and NextEra is certainly in a position to capitalize on an increasing green future.

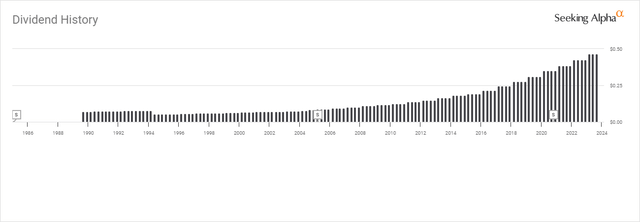

NextEra is a Dividend Aristocrat with a tremendous growth profile

Some people may be surprised that NextEra is a Dividend Aristocrat, having increased their dividend annually for 27 consecutive years. NextEra’s share price continues to fall, which has increased its dividend yield to 2.76% as it pays a dividend of $1.87 per share. The payout ratio is currently 57.95%, leaving a tremendous amount of room in their remaining EPS to increase the dividend. NextEra has an impressive dividend growth profile, as its dividend has a 5-year growth rate of 11.13%. Despite the sub 3% yield, NextEra’s dividend characteristics are some of the strongest I have seen in a long time.

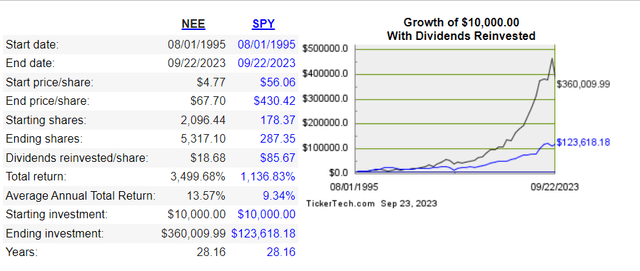

Going back to 1995, the results from reinvesting NextEra’s dividend have been tremendous. By reinvesting the dividend over the last 28 years, a $10,000 investment in NextEra would have increased by 3,499.68%, as the value today would be $360,009.00. This is just shy of tripling the results of investing in the SPDR S&P 500 Trust (SPY), which would have resulted in an increase of 1,136.83%. The initial investment in NextEra would have purchased 2,086.44 shares, and at the 1995 dividend rate, the forward projected income would have been $503.15. Over the years, the initial share count would have grown by 3,220.56 shares (153.62%) to 5,317, while the dividend grew 683.33% to $1.87. Today, the $5,317 shares would be producing $9,492.81 in annualized dividend income, which is a 1,886.69% increase from when the initial investment occurred. Even with a low yield, NextEra’s dividend has worked its magic through the benefits of compounding, and its dividend growth is projected to continue growing as NextEra’s EPS increases.

Why I see value in shares of NextEra

Utility companies aren’t typically exciting as they are often used as a proxy for bonds given the amount of income generated. Investors looking for capital appreciation usually gravitate toward technology as utility companies often have limited prospects to generate organic growth. While utility companies are not top-tier growth companies, income investors like that they are typically less volatile and operate in a heavily regulated industry that provides protection for the generated income stream.

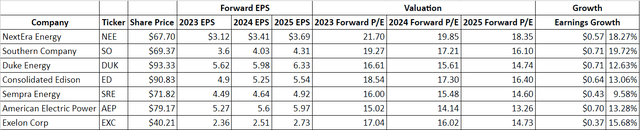

I compared NextEra to several of its peers that are held within the Utilities Select Sector SPDR Fund ETF (XLU) to see how shares were being valued.

- Southern Company (SO)

- Duke Energy (DUK)

- Consolidated Edison (ED)

- Sempra Energy (SRE)

- American Electric Power (AEP)

- Exelon Corp (EXC)

Steven Fiorillo, Seeking Alpha

NextEra is trading at 21.70x 2023 earnings and looking forward it trades at 19.85x 2024 earnings and 18.35x 2025 earnings. NextEra happens to trade at the largest valuation in each forward year in its peer group which would normally be a red flag but this is a sector that normally trades at low P/E levels. NextEra is expected to see 18.27% growth in its earnings from 2023 – 2025 which represents the 2nd largest amount of growth in its peer group. I am happy to pay under 20x 2024 and 2025 earnings for NextEra considering their forward EPS guidance.

Steven Fiorillo, Seeking Alpha

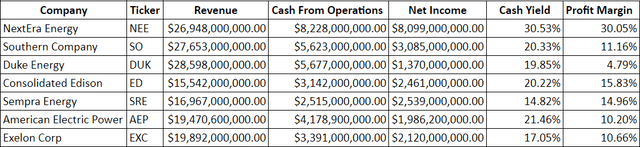

Profitability is where NextEra’s valuation gets interesting. Given the sector, I look at things a bit differently. I am looking for the largest amount of profits with the best margins. As green energy becomes more popular and more cost-effective for the end consumer I want to be invested in utilities that are able to reinvest in their operations. NextEra is generating the largest amount of net income and cash from operations with the best margins. The peer group has an average of generating $4.68 billion in cash from operations, and $3.09 billion in net income while having a 20.61% cash yield and 13.95% profit margin. NextEra has generated $8.23 billion of cash from operations and $8.1 billion in net income over the TTM. This places its profit margin at 30.05% and the amount of cash its operations yield at 30.53%.

While I would be paying slightly higher for NextEra’s earnings, their profitability is the largest from the peer group. This will allow NextEra to continue investing in new projects to grow the amount of green energy they produce. I think the valuation is attractive for NextEra because their oversized profits will allow them to reinvest in their business and continue growing their bottom line. This will also help them come in at the top end of their EPS guidance which could lower their forward P/E ratios and make NextEra look even less expensive.

Risks that NextEra could face

While everyone needs energy and utilities are heavily regulated investing in them does come with an appropriate level of risk. The business landscape that NextEra operates in contains a variety of risks that are outside of NextEra’s control. NextEra is subject to complex and comprehensive federal, state, and other regulations. As regulation changes it could create situations where NextEra would need to address aspects of their business immediately, or even curtail operations in certain areas. NextEra is also dependent on government and local legislation for approvals on future projects and at any time changes to NEER could cancel or delay planned development activities. NextEra also operates in a market where customers have choice, and as solar systems become less expensive there could come a point where a percentage of their customers decide to purchase a solar system and go off the grid which means less revenue for NextEra. We have already seen the government provide large tax incentives to go solar and if these incentives become larger and are paired with less expensive solar options it could become more of a reality for homeowners. Just because energy is required by the end user doesn’t mean that NextEra is immune to risks, and most of the risk that they face is outside of their control.

Conclusion

Shares of NextEra are trading at their lowest valuation in several years, having recently broken through a long-term resistance level. NextEra is a premier clean energy company with a large backlog of projects that should support its future EPS projections. I am bullish on NextEra because solar and wind are expected to see the largest amount of consumption growth in the energy generation sector, and NextEra is a leader in the field. NextEra has remained a profit center, and its current margins exceed 30%. I think NextEra can benefit from the expansion into an evolving energy sector while continuing to grow its dividend and eventually go from being a Dividend Aristocrat to a Dividend King.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SO, ED either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

By the time this article is publish I may have started a position in NEE

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.