Summary:

- NextEra Energy is a large utility company with a market capitalization of $117.48 billion.

- NextEra has a strong presence in the renewable energy industry through its subsidiary NEER, which has seen great results as of late.

- Financial results for the final quarter of 2023 are expected to show an increase in revenue but a decrease in profits.

- One-time results make NEE look more appealing than it is.

Sirisak Boakaew/Moment via Getty Images

One of the largest publicly traded companies out there, especially in the utility market, is NextEra Energy (NYSE:NEE). The firm boasts a market capitalization as of this writing of $117.48 billion. Few companies make it that large. According to management, it is one of the largest electric power and energy infrastructure businesses in North America and it is making major inroads into the renewable energy industry. Operationally speaking, it has two different segments. The first of these is FPL, which is the largest electric utility operator in Florida with 5.8 million customer accounts under its belt. Then, there is NEER, which management considers to be the largest generator of renewable energy from wind and solar sources on the planet. It also has a battery storage business under that umbrella.

Utilities can be very interesting prospects. Outside of mergers and acquisitions activities, they tend to grow at a fairly slow rate. They almost always carry a significant amount of debt and the healthy ones can generate attractive cash flows. Recently, NextEra Energy has done quite well for itself from a fundamental perspective. However, it’s important to know that the picture could change at any moment. And in all likelihood, such a change would occur when management reports financial results for any given quarter. It just so happens that, on January 25th, before the market opens, the management team at NextEra Energy will be announcing financial results covering the final quarter of the 2023 fiscal year. Leading up to that time, investors should be paying careful attention, especially because while analysts are forecasting a year over year increase in revenue, profits are expected to come in on the weak end.

NextEra Energy – A solid business worth looking into

With the exception of a brief mention in an article that I wrote several years ago now, the first time I really became acquainted with NextEra Energy was back in September of last year when I wrote an article detailing how Chesapeake Utilities (CPK) had struck a deal to acquire Florida City Gas from NextEra Energy at a price of $923.4 million. With an approved base rate of only $487 million, and 3,880 miles of pipe that served just eight of the 67 counties within Florida, this was a fairly small asset for NextEra Energy to unload. To put this in perspective, in 2022 alone, NextEra Energy in its entirety generated revenue of $20.96 billion. That’s up nicely from the roughly 18 billion dollars reported in 2020.

The fact of the matter is that NextEra Energy truly is a behemoth in its space. For instance, FPL has a significant asset base that includes natural gas, nuclear power, solar power, and other energy sources. At the end of 2022, for instance, it had four different nuclear operations with a combined 3,502 MW of net generating capacity. And in spite of that, nuclear accounted for only 11% of the net generating capacity of FPL in its entirety. Solar accounted for another 11%, while natural gas comprised a shocking 76%. NEER, on the other hand, is a different kind of animal. It’s a true clean energy business that had, at the end of 2022, 25,534 MW of total net generating capacity. 61% of this was in the form of wind power, with another 14% in the form of solar. 8% involved nuclear, with the remaining 9% in the form of ‘other’ sources, the majority of which was natural gas. Its generation and battery power projects are spread across almost every state as well as no fewer than three different Canadian provinces.

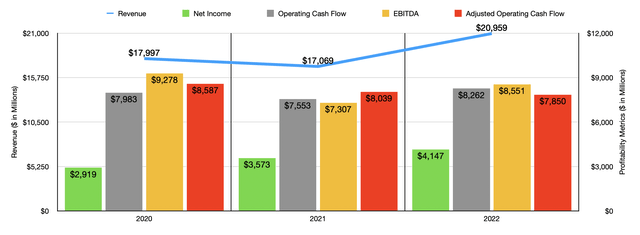

Author – SEC EDGAR Data

As I mentioned already, revenue for the business grew nicely from 2020 through 2022. Profits and cash flows followed suit. Net income went from $2.92 billion to $4.15 billion. Operating cash flow grew more modestly from $7.98 billion to $8.26 billion. Though if we adjust for changes in working capital, we would actually have a decline from $8.59 billion to $7.85 billion, while EBITDA for the business shrank from $9.28 billion to $8.55 billion.

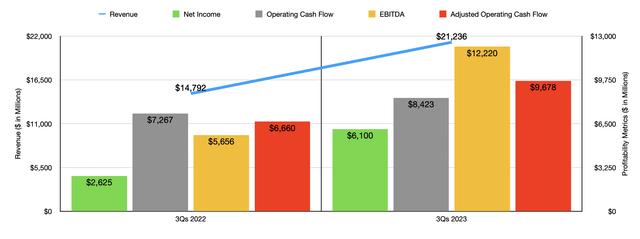

Although the cash flow picture did worsen during that three-year window, this is not all the data that we have. We also have results for the first nine months of the 2023 fiscal year relative to the same time one year earlier. And when we incorporate that data, we get something different entirely. Revenue, for instance, shot up from $14.79 billion in the first nine months of 2022 to $21.24 billion in the same time of 2023. Some of this increase was driven by FPL, with a rise in the base rate allowing revenue to grow from $13.21 billion to $14.17 billion. But most of the increase actually came from NEER, which saw revenue spike from $1.63 billion to $7.02 billion.

Author – SEC EDGAR Data

Now, to be very clear, some of this increase was certainly one time in nature. For instance, the company saw a massive impact of non-qualifying commodity hedges that paid off. These amounted to $1.61 billion worth of gains in the first nine months of 2023 compared to $3.11 billion of losses for the same time of 2022. This was all thanks to fluctuations in energy prices that the company experienced. However, the firm also did benefit to the tune of $602 million from the customer supply, proprietary power, and gas trading and gas infrastructure operations that it has. New investments added another $283 million in sales, while another subsidiary, NEET, contributed $65 million worth of an increase.

The rise in revenue for the company was instrumental in pushing up profits rather materially. Net income of $6.10 billion dwarfed the $2.63 billion reported one year earlier. Operating cash flow expanded from $7.27 billion to $8.42 billion, while the adjusted figure for it grew from $6.66 billion to $9.68 billion. And last say, EBITDA for the business expanded from $5.66 billion to $12.22 billion.

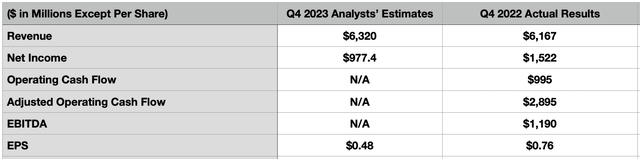

Author

Given this robust performance, you might think that the final quarter of 2023 would also see a significant year over year increase. But that’s not exactly the case. At present, analysts are forecasting revenue of $6.32 billion. That would be up modestly from the $6.17 billion reported for the final quarter of 2022. Earnings per share is actually expected to come in weak at only $0.48. That would be down considerably from the $0.76 per share reported the same time of 2022, implying a decrease in net profits from $1.52 billion to $977.4 million. Estimates were not provided when it comes to other profitability metrics. But in the table above, you can see what those were for the final quarter of 2022. If profits are lower, it’s highly likely that these other metrics will worsen year over year as well.

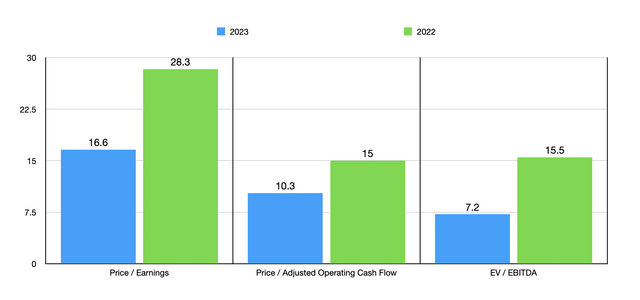

Author – SEC EDGAR Data

In terms of valuing the company, recent financial performance has made things a bit tricky. If we just take analysts guidance for the final quarter, then total net profits for 2023 would be $7.08 billion. If we then annualize results experienced for the first nine months when it comes to the other profitability metrics, we would get adjusted operating cash flow of $11.41 billion and EBITDA totaling $18.48 billion. Using these estimates, I was able to value the company as shown in the chart above. That chart also shows the company valued using the data from 2022. As part of my analysis, I also compared the firm to five similar enterprises. These can be shown in the table below. If we do use the more aggressive 2023 estimates, you can see that one of the five companies was cheaper than NextEra Energy on a price to earnings basis. Three of the four that had positive readings were cheaper on a price to operating cash flow basis, while our prospect was the cheapest of the group involving the EV to EBITDA approach. This picture does change we use the 2022 figures. In this case, NextEra Energy ends up being the most expensive of the group across the board.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| NextEra Energy | 16.6 | 10.3 | 7.2 |

| Southern Company (SO) | 25.0 | 10.7 | 13.7 |

| Enel SpA (OTCPK:ENLAY) | 13.2 | 3.9 | 7.9 |

| Duke Energy (DUK) | 19.9 | 9.2 | 12.3 |

| American Electric Power Company (AEP) | 17.8 | 9.7 | 11.9 |

| Constellation Energy Corporation (CEG) | 22.1 | N/A | 10.4 |

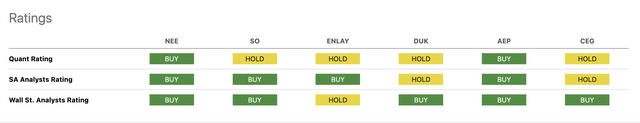

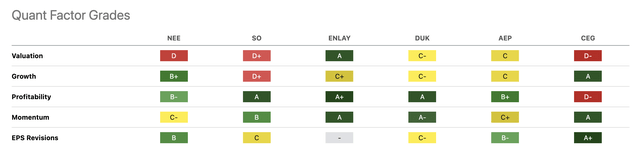

I rarely find myself interested in companies that are trading at rather lofty multiples. And today is no exception. My overall rating for NextEra Energy at this time is a ‘hold’ because that is the rating that reflects a scenario where the stock should perform at about the same level as the broader market for the foreseeable future. But it is worth noting that I am something of a lone wolf in this regard. As you can see in the first image below, ratings for NextEra Energy are quite high. This includes Seeking Alpha’s Quant Rating, which has a ‘buy’ rating for the stock. Only one of the five companies that I compared it to has ‘buy’ ratings across the board. And digging deeper, as shown in the second image below, you can see what went into the Quant Rating. Using the more conservative estimates from 2022, I would agree that the valuation for the business is far from great. But more heavily weighted seemed to be the growth and profitability measures shown. Clearly, the company’s continued investments, particularly in renewable sources of energy, are paving the way for long term growth. However, I want to see more of that growth before I get terribly excited.

Seeking Alpha

Seeking Alpha

Takeaway

Based on the data provided, NextEra Energy is an interesting company. But it’s not one that I am currently all that optimistic about. Don’t get me wrong. This is not a bad business. It is a healthy firm that has access to a really popular part of the country. However, some of the recent growth has been driven by temporary changes, and there’s the fact that shares are not as cheap as I would like them to be. If this picture changes, my own mindset could change as well. But for now, I believe that a ‘hold’ rating makes the most sense.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is an exclusive community of investors who have a taste for oil and natural gas firms. Our main interest is on cash flow and the value and growth prospects that generate the strongest potential for investors. You get access to a 50+ stock model account, in-depth cash flow analyses of E&P firms, and a Live Chat where members can share their knowledge and experiences with one another. Sign up now and your first two weeks are free!