Summary:

- NEER solidified its growth outlook this quarter with yet another strong origination, alongside two framework agreements signed with Fortune 50 companies.

- FPL executed well amidst the two hurricanes, demonstrating the high quality nature of the business and the management team.

- The fundamentals in Florida remain solid, which will likely continue to be a growth driver for the business.

- With the growing backlog that extends well into 2027, the visibility into their 2027 targets continue to improve, which makes me confident about the company’s ability to exceed the high end of guidance.

Justin Paget

I see NextEra Energy’s (NYSE:NEE) 3Q24 results as reaffirming my investment thesis that the company is well positioned to benefit from the expected growth to come in power demand.

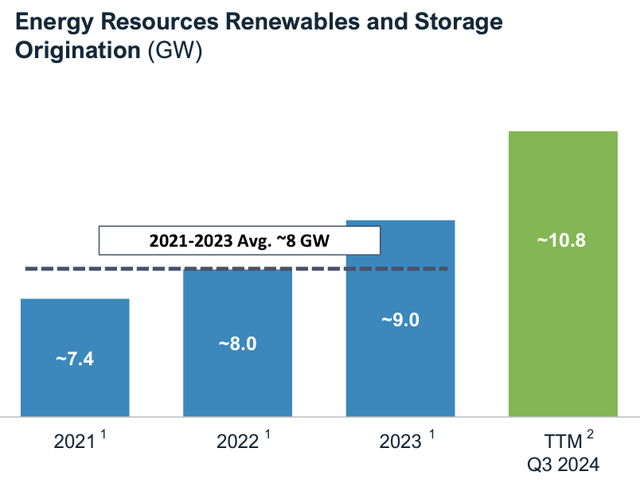

As expected, we saw NextEra Energy Resources (“NEER”) originations hit 3 gigawatts once again this quarter, which is a very significant milestone.

This came alongside two other rather unexpected agreements with Fortune 50 customers that are significant in size, which has not yet been included in the backlog numbers.

Florida Power & Light (“FPL”), the utility arm of NextEra Energy, also executed very well this quarter, in my view, despite the recent storms that happened in Florida.

This 3Q24 print further validates my investment thesis that FPL is one of the best-in-class utilities in the US given its strong fundamentals and continued investments to improve the resilience of the grid.

I have written about NextEra Energy on Seeking Alpha, and in my previous article, I highlighted the strength of both the business models of FPL and NEER, which I continue to see in the 3Q24 results as the company continues to shine bright amidst the storm.

3Q24 analysis

Let us first look at how NextEra Energy did on a high level.

Both FPL and NEER surpassed expectations to help the company deliver a beat to investor expectations.

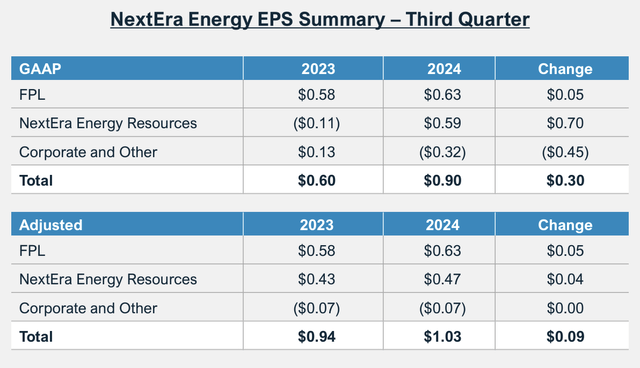

NextEra Energy’s adjusted EPS came in at $1.03 per share for 3Q24, 10% higher than the prior year’s $0.94 per share and 4% ahead of consensus expectations.

FPL’s adjusted EPS for 3Q24 came in at $0.63 per share, 9% higher than the prior year’s $0.58.

NEER’s adjusted EPS came in at $0.47, 9% higher than the prior year’s $0.43 per share.

NextEra Energy EPS summary (NextEra Energy)

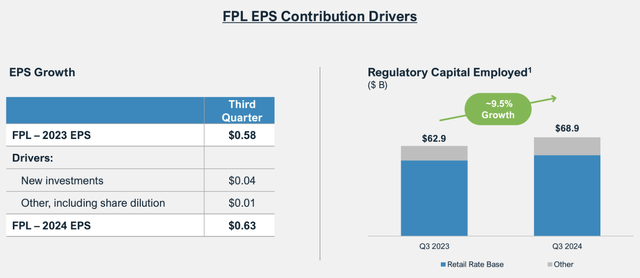

As mentioned above, FPL’s EPS in 3Q24 came in at $0.63 per share, with the growth in regulatory capital employed being the main growth driver.

FPL expects to continue to see an average of 10% growth in regulatory capital employed until the end of its current rate agreement, which lasts four years until 2025.

In terms of costs related to the hurricanes (more on that later), FPL has a storm reserve, which it utilized during the quarter. To recharge the storm reserve after use during the quarter, FPL then charges a storm surcharge on customer bills in the subsequent year, in 2025.

FPL EPS contribution drivers (NextEra Energy)

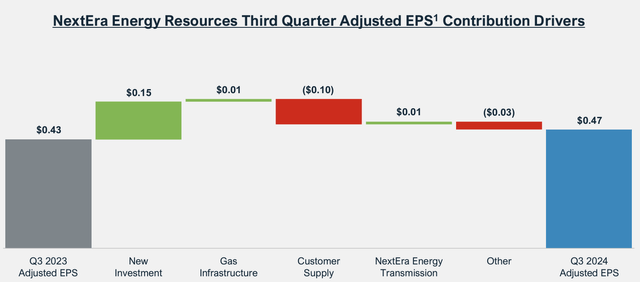

As mentioned above, NEER’s EPS in 3Q24 came in at $0.47 per share.

The main driver of this growth is new investment, bringing in an additional EPS of $0.15 per share, while customer supply was a headwind of negative $0.10 per share to EPS for NEER.

NEER EPS contribution (NextEra Energy)

Historic year for NEER

It has been a strong year for NEER.

Likewise, this quarter was no exception.

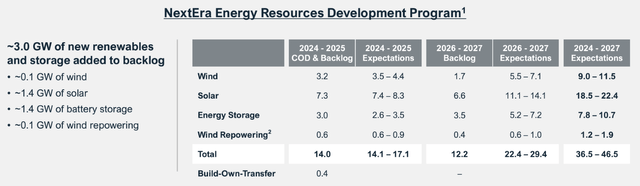

This is the second consecutive quarter where NEER once again brought in 3 gigawatts to its backlog.

For reference, last quarter, NEER brought in 3 gigawatts to its backlog, and this was the second largest quarter for NEER in terms of origination.

In my opinion, for NEER to achieve this twice in a row really does show the very strong demand for renewables and storage.

As such, as of 3Q24, the year-to-date originations of NEER amount to 10.8 gigawatts, 35% higher than the average for the past three years.

NEER origination (NextEra Energy)

This quarter was a strong one for NEER.

In fact, I think we are seeing the growth outlook for NextEra Energy solidify.

Apart from the usual renewables and storage originations, NEER also announced that there are two Fortune 50 customers which have signed framework agreements with NEER.

These two agreements amount to potential renewable and storage projects that add up to 10.5 gigawatts, which is meant to be fulfilled during the time period between now and 2030.

I would also note that this has not yet been added to the backlog given these are not binding, and along with the joint development agreement signed with Entergy, these three agreements total an additional 15 gigawatts of potential renewable and storage projects.

In my opinion, given that these large, established companies are looking to secure their power requirements with NEER shows the strong confidence in the company’s ability to execute.

After adding in the additional 3 gigawatts of origination from this quarter, NEER now has solid 24 gigawatts of backlog that span across 2024 to 2027.

This essentially means that the low end of 2024 to 2025 expectations have been met by the backlog, while about half of 2026 to 2027 expectations have been met by the current backlog.

Again, these do not yet reflect the three agreements signed above, that are sizable but not binding.

NEER backlog (NextEra Energy)

The US has been looking to recommission old nuclear plants to meet the growing needs for clean energy.

Likewise, NextEra Energy is doing the same.

At present, Next Era Energy is assessing recommissioning its Duane Arnold nuclear plant in Iowa.

However, the company is clear about its view that while nuclear will contribute in supplementing power generation, given the limited number of nuclear plants that can be recommissioned, these would make up less than 1% of the demand we need in the future.

For NEER’s assessment of the Duane Arnold nuclear plant, this is a 600 MW plant and management noted that there is no shortage of interest in potential off-takers for the power from the plant.

FPL endures the hurricanes

Black swan events are often talked about within finance, and these are basically events that are nearly impossible to predict, but have the potential to bring about huge negative implications due to this difficulty to predict.

FPL experienced a black swan event in the form of a category 4 hurricane, Hurricane Helene and a category 3 hurricane, Hurricane Milton.

If you think these are just small hurricanes, FPL stated that these two hurricanes affected 680k and 2 million FPL customers respectively.

Clearly, these are not your usual storms.

Back to the topic of black swans.

Because black swans are basically not predictable, their damage could have been vast and massive, but in this case FPL has taken two proactive steps such that the risk management for these black swans were really impressive.

Firstly, even before any hurricanes, for the past few years, FPL has been investing in the resilience of its grids across Florida, putting more of it underground and automating more of it.

Secondly, once news of the storms started, FPL reacted quickly to prepare for the hurricanes, with 30k workers gathered across the two hurricanes to help get ready for the event and thereafter, to help recovery efforts.

The results?

While many investors were expecting worse damage, FPL managed to restore 95% of customers within two days after Hurricane Helene and within four days for Hurricane Milton.

FPL is seeking to recoup the costs associated with the hurricanes, which amount to $1.2 billion, through a “temporary surcharge on customer bills” in 2025.

In my opinion, this black swan event is significant for investors because it showed that FPL is a high quality company operated by seasoned executives that understand risk management and crisis management well.

The series of hurricanes could have resulted in catastrophic losses for customers and FPL, but that was not the case due what FPL has been doing all these past years and what FPL did after the hurricanes.

FPL did not just experience a black swan event, but it managed and executed against it really well.

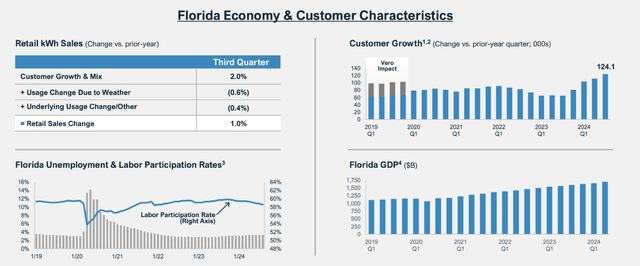

I always share the following statistics about the fundamentals of the Florida market in which FPL operates in because it is so important to the investment case for FPL and NextEra Energy.

As can be seen below, while there were certainly headwinds from Hurricane Helene and Milton this quarter, that was more than offset by the customer growth and mix tailwind.

In my opinion, this tailwind should continue over the next few years as we continue to see low unemployment rates and strong GDP growth contribute to continued customer growth.

Florida economy and customer characteristics (NextEra Energy)

Outlook

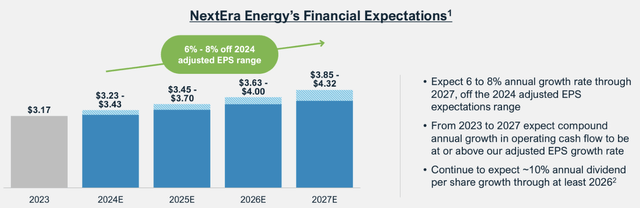

I like NextEra Energy’s business because of the strong visibility and low volatility of the business model.

As a result, management has high visibility into what earnings should look like not just one year from now, but further out to 2027.

NextEra Energy reaffirmed 2024 EPS guidance of $3.23 to $3.43.

More importantly, NextEra Energy once again not only reiterated its financial expectations through 2027, but also reiterated its longstanding language that it would be disappointed if it does not deliver results at or near the top end of its guidance range through 2027.

This amounts to 6% to 8% EPS CAGR through 2027. and the company’s 6% to 8% EPS growth rate while reiterating longstanding language that they would be disappointed if not at or near the top end of adjusted EPS guidance through 2027.

Financial expectations (NextEra Energy)

New equity issuance

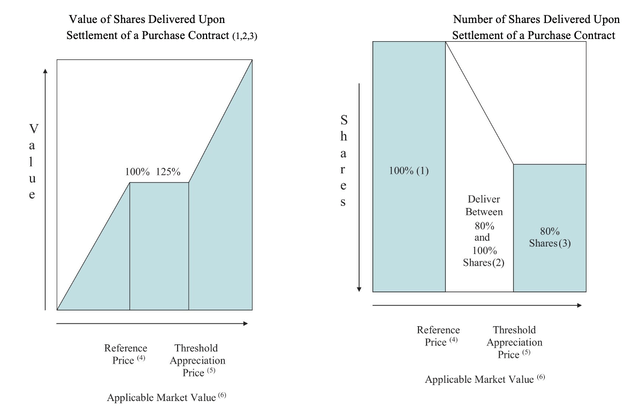

Shortly after its earnings results, NextEra Energy made the announcement it will be selling $1.5 billion in new equity.

This is the second time NextEra Energy will be doing so, and I am not surprised to see it doing so as it has been raising equity to pay off higher interest rate debt and to raise funds for investments into the power infrastructure.

In this round of new equity issuance, it will be paying down commercial paper obligations with interest rates between 4.92% and 5.44% to reduce interest costs, while the rest of the fund will go to “investments into energy and power projects“.

For the new equity units issued, there are anti-dilutive adjustments within the contract, such that if the share price goes above the threshold appreciation price (25% above reference price), only 80% shares are delivered, while if share price goes below the reference price ($82.87), 100% of the shares are delivered.

Anti-dilution adjustments (NextEra Energy)

All in all, the new equity issuance will lead to minimal dilution for existing shareholders, especially if they partake in the exercise and including the effect of the anti-dilution adjustment. On top of that, the new equity issuance helps with debt and interest rate management will providing the company with additional funds for investment to bolster the resilience of its power and grid infrastructure.

Valuation

NEER’s scale and strong track record in development and FPL’s strong fundamentals support the premium in valuation multiples, in my view, given the more durable nature of NextEra Energy’s businesses.

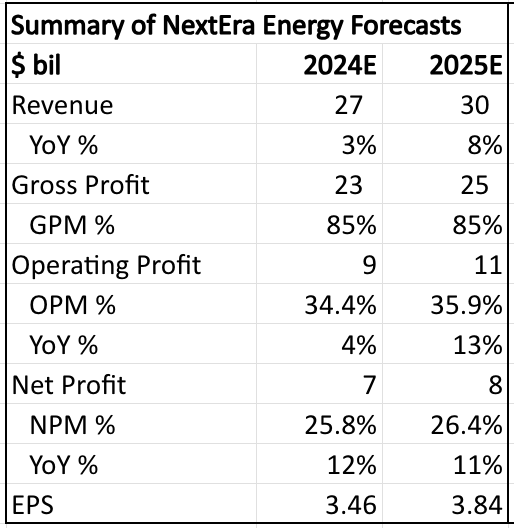

How do I get my financial forecasts for 2025?

Let’s break it down.

NextEra Energy provides guidance for adjusted EPS for 2025 to be between $3.45 to $3.70.

However, I am of the view that at the current rate, NextEra Energy looks set to beat the high end of its guidance range for 2025.

This is due to:

- Outperformance from 2024

- Strong origination adds to backlog for 2025

- Operating margin expansion due to higher return, higher margin projects in the backlog for NEER and the storm recovery mechanism for FPL.

Firstly, 2024 is already almost over with 3Q24 reported and NextEra Energy looks set to outperform its guidance for 2024.

With only one quarter remaining, the adjusted EPS achieved for the first three quarters was $2.90 per share, which is already 85% of the high end of 2024’s adjusted EPS guidance range.

Secondly, after including the additional 3 gigawatts of origination from this quarter, the backlog for 2024 to 2025 already makes up 82% of the high-end of the guidance for the period and 100% of the low-end of the guidance.

For the high-end of the guidance to be met, NextEra Energy just needs an additional 3.1 gigawatts to be added to 2025, which it has five more quarters to do so.

For reference, NEER achieved 10.8 gigawatts of originations this year, as highlighted above.

Lastly, on operating margin expansion of 150 basis points in 2025 relative to 2024, this comes largely due to NextEra Energy’s focus on higher return, higher margin projects that will help with expansion of operating margin, alongside continued investments in the FPL side of things that helps to lower the cost of operating the business and storm recovery mechanisms that will allow FPL to recover the costs incurred in 2024 for the hurricanes mentioned above.

Net profit margin expands by 60 basis points, with the operating margin expansion flowing down to be offset by higher interest expenses.

All in all, all that leads me to my adjusted EPS for 2025 of $3.84, which implies a 4% beat to the high end of the guidance range for 2025.

Summary of my financial forecasts for NextEra Energy (Author generated)

My 1-year price target for NextEra Energy is $94.

This price target is derived using my forecasted 2025 EPS above and multiplying that by a 25x P/E multiple to get my 1-year price target for NextEra Energy

The 25x terminal multiple is justified given NextEra Energy has a 10-year average P/E multiple of 25x. Furthermore, the company’s fundamentals and growth prospects remain solid, if not stronger than in the past 10 years, driven by strong demand for renewable energy for NEER and continued growth in the fundamentals of Florida for FPL.

Risks

Political and regulatory risks

Probably one of the biggest risks on investors minds is the political and regulatory risks that come with a new President.

With Trump being the 47th president of the US, there is uncertainty about what he would do to the Inflation Reduction Act, thereby likely causing an overhang for NextEra Energy.

Trump has previously “vowed to repeal the Inflation Reduction Act“.

However, it is not as clear cut because firstly, the Inflation Reduction Act benefits many Republican districts, and secondly, it helps to support energy independence and re-shoring efforts that Trump too supports.

A repeal of the Inflation Reduction Act could slow renewable development and growth, which would be a headwind to NextEra Energy’s NEER business given that it is the market leader in this area.

Interest rates

Higher interest rates could be a headwind for NextEra Energy.

This is because its customers could potentially reduce demand for renewables given the higher financing cost.

In addition, NextEra Energy’s own financing cost would also increase as a result of the higher interest rates.

Conclusion

I think NextEra Energy’s 3Q24 results continue to give me confidence in the company’s businesses.

FPL had a somewhat difficult quarter with the storms as headwinds but given the strong fundamentals of the market and the company, the execution from FPL resulted in minimal impact for customers and investors.

NEER continues to benefit from the expected growth in power demand and renewable energy, with a significant 3 gigawatts origination achieved this quarter adding to the backlog and giving management further visibility into 2027.

The reiteration of the financial expectations and language for financial results through 2027 shows management remains confident in meeting these near to medium term guidance targets and that the business remains on track.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NEE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Outperforming the Market

Outperforming the Market is focused on helping you outperform the market while having downside protection during volatile markets by providing you with comprehensive deep dive analysis articles, the AI deep dive report, and access to The Barbell Portfolio.

The Barbell Portfolio outperformed the S&P 500 by 50% in the past year through owning high conviction growth and contrarian stocks.

Apart from providing bottom-up fundamental research, we also provide you with intrinsic value, 1-year and 3-year price targets in The Price Target report.

Join Outperforming the Market before the 20% price hike next month.