Summary:

- NextEra Energy is a leading renewable energy company with a $175 billion market cap and a 2.4% dividend yield, but it is overvalued.

- The company is aggressively expanding its renewable portfolio, expecting to double its size by 2027, focusing on solar and wind.

- Florida’s growth is slowing due to climate change and insurance crises, potentially impacting NextEra’s future growth and valuation.

- Despite strong financials and market positioning, NextEra’s high valuation and external risks could hinder its ability to sustain growth and shareholder returns.

zu-kuni/iStock via Getty Images

NextEra Energy (NYSE:NEE) is an American energy company and one of the largest in the world. The company has a market cap of almost $175 billion, with a dividend yield of just over 2.4%, and it’s one of the largest renewable companies in the U.S. The company and Florida have both benefited from increased renewables as the company adjusts to climate change.

However, as we discussed in our recent article, the company is overvalued, and as we’ll see in this article its earnings support that overvalued nature.

Power Sector Growth

The power sector in the U.S. is seeing substantial datacenter and AI-driven demand, although whether that’ll continue forever remains to be seen.

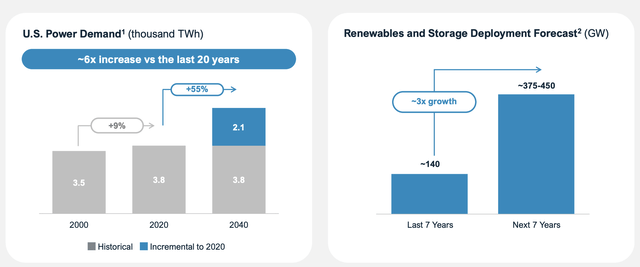

NextEra Energy Investor Presentation

The company saw 9% increase in power demand from 2000 to 2020 and is forecasting 55% growth to 2040. The company expects 2040 demand to be 5900 TWh up from 3800 TWh in 2020. More importantly, renewables and storage are expected to be a growing portion of the power sector, where NextEra is building out aggressively.

NextEra Energy Positioning

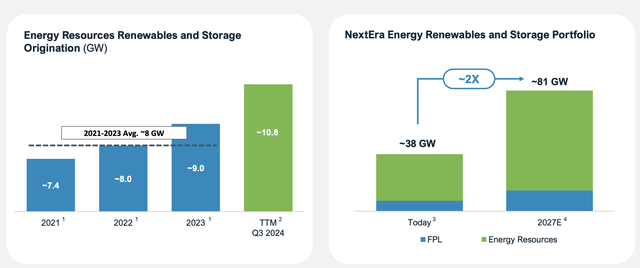

The company has one of the largest renewable portfolios in the U.S. with ~38 GW of renewables and storage.

NextEra Energy Investor Presentation

The company expects its portfolio size to more than double going into 2027. Regardless of political sentiment in the country, renewables have become cheaper and more reliable when paired with storage. The company is taking advantage of that, and it expects to profit massively from those decisions. This will help its margins at existing rates.

Florida Positioning

However, the company doesn’t stand to perfectly profit off of growth.

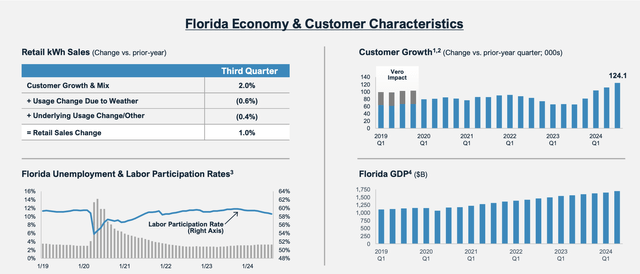

NextEra Energy Investor Presentation

Much of the demand growth is expected to come from datacenters, which are positioned in the northeast. That’s not surprising, a substantial portion of the cost of datacenters is cooling, if you put it in a state that averages 30 degrees lower, that’s massive electrical savings. The company, in its Florida market, has seen ~1% change in retail sales.

While the company has seen customer growth in recent quarters, and Florida’s GDP has remained strong, the labor participation rate has been trending down. Florida is undergoing an insurance crisis, and homeowners are leaving in droves, as the state government figures out how to handle the risks brought on by climate change. Two hurricanes a week apart show these risks.

Florida’s growth has made it much less profitable of a state to retire in, and overall, we expect the state’s growth to slow down. That concentration could put substantial pressure on NextEra Energy’s continued growth plans.

NextEra Energy Development

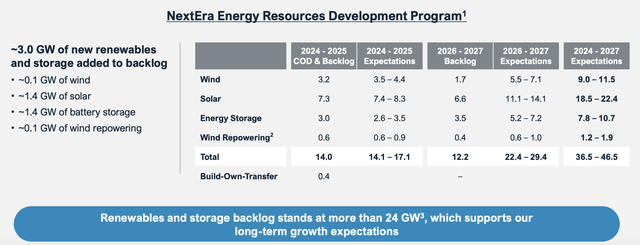

The company is continuing to develop new assets and by 2027 it expects to develop ~41.5 GW of new renewables and storage.

NextEra Energy Investor Presentation

Most of that growth is expected to come from solar, which is obviously a phenomenal renewable in the company’s asset location. The company is also investing heavily in wind, which is a much lower cost and more reliable renewable, which will support future growth. The company expects to continue expanding its backlog past current levels.

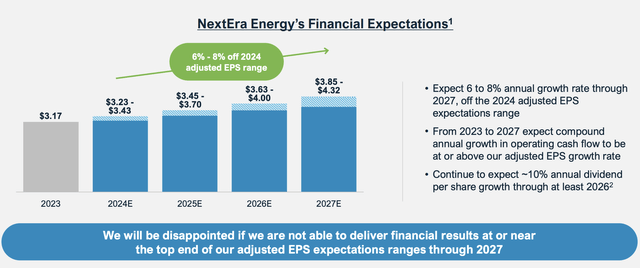

NextEra Energy Financial Guidance

Financially, the company is planning to continue earnings growth, which isn’t surprising.

NextEra Energy Investor Presentation

The company has a share price of almost $85/share, meaning at current levels, it has a P/E of more than 25x. By 2027 the company expects that to grow towards a P/E of ~20x, however, being 3-years down the road the company will need to maintain the S&P 500’s guidance of high single-digit average returns.

The company’s shareholder returns come entirely through a 2.4% dividend yield. The company expects ~10% annual dividend per share growth, however, given the company’s EPS growth forecast, that will partially come from a growing payout ratio. That means it’s not a sustainable dividend growth ratio for the company for the long term.

Thesis Risk

The largest risk to our thesis is that NextEra has an impressive market positioning and strong earnings. The company also has the ability to continue those earnings. It’s at a lofty valuation, however, if market expectations for returns go down, that could hurt the company’s ability to drive future shareholder returns.

Conclusion

NextEra Energy has an impressive portfolio of assets, and the company is improving its portfolio, especially in terms of low-cost renewables. The company’s portfolio has enabled it to respond to hurricanes in record time, which will help reduce its costs. The company expects to continue generating strong FCF, which will support growth.

The company trades at a lofty valuation, and we expect it to face some secular threats. The growth in demand for datacenter will be primarily centered outside of the company’s operating zone. At the same time, Florida continues to be impacted by climate change and is a much more expensive place to live, which, we think, will slow down growth rates.

That could hurt the company’s ability to continue its growth and justify its valuation over the long term. Let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.