Summary:

- NextEra Energy has benefitted from a rise in the Utilities sector, with XLU second only to XLK since April.

- Solid earnings from power-generation group helped back in springtime, with key earnings from NEE on tap next week.

- Interest rates have fallen amid a bull steepener across the yield curve, likely a tailwind for the yield-sensitive Utilities sector.

- While I am increasing my fair value estimate to $76, shares up 20% since April result in a stock near full valuation.

- I highlight key price levels to monitor ahead of earnings next week.

felixmizioznikov/iStock via Getty Images

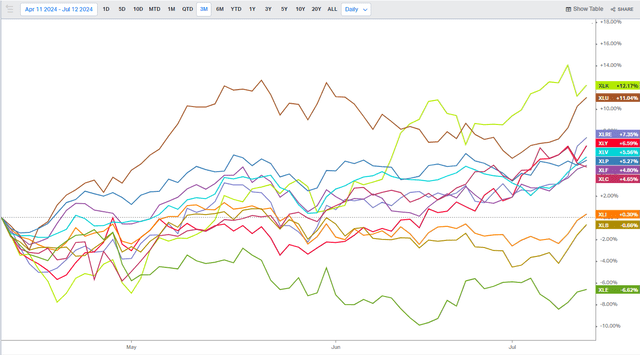

NextEra Energy (NYSE:NEE) has benefitted from an overall rise in the Utilities sector over the past three months. The Utilities Select Sector SPDR ETF (XLU) is second only to the Information Technology ETF (XLK) since the middle of April. Solid earnings from the power-generation group helped back in the springtime, and key earnings from NEE are on tap next week. Since April, interest rates have fallen amid a bull steepener across the yield curve, which is likely a tailwind for the yield-sensitive Utilities sector.

I am downgrading shares of NextEra from a buy to a hold, however. This is not a sudden bearish outlook on the biggest stock in XLU, but rather a call on valuation. What’s more, NEE’s technical situation is above a key spot on the chart that I detailed earlier this year, which is a positive sign.

Utilities Post Big Returns Last 3 Months

Koyfin Charts

Back in April, NextEra reported a mixed set of quarterly results. Q1 non-GAAP EPS of $0.91 topped consensus expectations by $0.13, but revenue of $5.73 billion, down almost 15% from year-ago levels, was a significant $750 million miss compared to Wall Street estimates. The solid bottom-line beat came amid gains from new projects and existing customer revenue, offsetting volatility in the interest rate market and a continued muddled trend in the renewables market. Florida Power & Light saw a healthy profit jump, and NextEra Energy Resources contributed $0.40 to EPS.

The management team reaffirmed its 2024 EPS guidance to be in the range of $3.23 to $3.43 with a long-term EPS target range of 6% to 8% growth. The company also aims to increase its dividend by 10% annually through 2026. It was the 17th consecutive quarter of NEE beating earnings estimates, and shares traded higher by 1.4% in the following session.

Looking ahead to next week’s earnings report, analysts anticipate $0.98 of non-GAAP per-share earnings, which would be above last year’s $0.88 figure. The options market has priced in a near-average 3.9% earnings-related stock price swing when analyzing the straddle pricing today.

Then at its Investor Day in June, the tone was rather upbeat. The firm detailed its robust financial position and plans for tech-centered investments. But many of these investments may not be all that earnings accretive for many quarters. NextEra also highlighted capital funding plans in the range of $97 to $107 billion, which will come from a mix of debt, equity, and asset recycling.

Overall, everything appears on track with NEE, and lower interest rates today are certainly a boon. But key risks include an uncertain regulatory backdrop ahead of US elections, heightened risk around natural disasters this year in particular, given hurricane season forecasts, volatility in the commodity markets, namely with natural gas, and a renewables market that remains risky following boom years looking back.

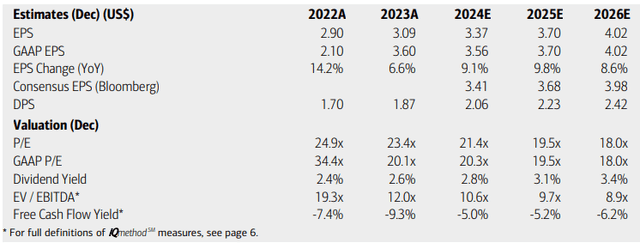

On the earnings outlook, analysts at BofA see operating EPS increasing 9% this year and continuing near that clip through the out year and 2026, resulting in perhaps more than $4 of per-share earnings two and a half years from now. The current Seeking Alpha consensus numbers are about on par with what BofA sees, while sales are expected to decline modestly this year before rising better than 9% next year.

Dividends, meanwhile, are forecast to increase to above $2 this year given the rate of increase detailed earlier, while NEE’s EV/EBITDA multiple is now close to that of the broader market. Being a capital-intensive utility, free cash flow is negative, so that’s not a major red flat here.

NextEra: Earnings, Valuation, Dividend Yield Forecasts

BofA Global Research

I think the fundamentals with NEE are just fine today, but shares have rallied 20% since my previous outlook as the sector stabilizes and catches some AI intrigue. If we assume $3.55 of non-GAAP EPS over the next 12 months and apply the stock’s five-year average earnings multiple of 21.8, then shares should trade near $76.

While that is a nice bump up from my earlier valuation this year, it is right near where the $156 billion market cap company trades today, making it a hold.

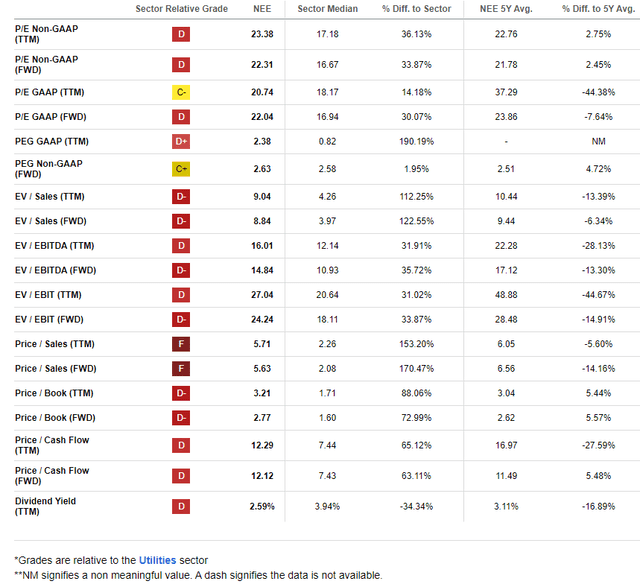

NextEra: P/E and PEG Ratio Now Close to the LTA

Seeking Alpha

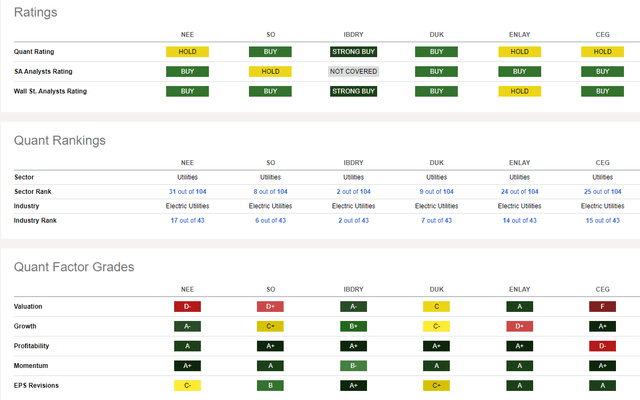

Compared to its peers, NextEra has a soft valuation rating while its growth trajectory is quite healthy. With likewise strong profitability trends and a high 2.7% forward dividend yield, there are certainly quality characteristics of the Florida-based company.

Moreover, share-price momentum is sound despite a mixed picture when it comes to sellside EPS revisions in the past 90 days.

Competitor Analysis

Seeking Alpha

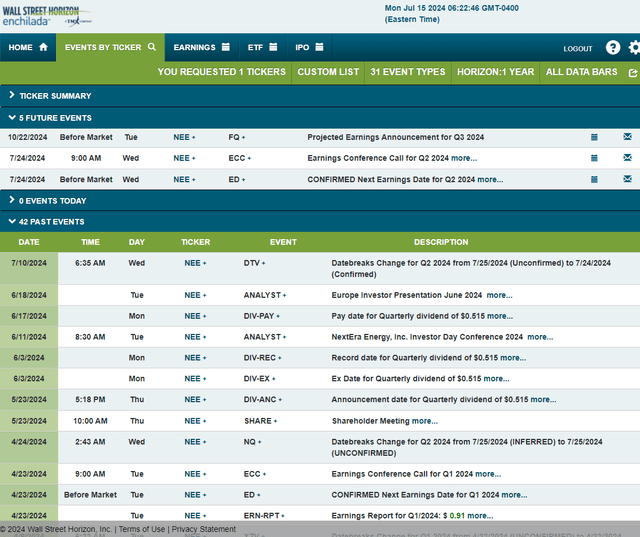

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q2 2024 earnings date of Wednesday, July 24 BMO with a conference call later that morning. You can listen live here. No other volatility catalysts are seen on the calendar.

Corporate Event Risk Calendar

Wall Street Horizon

The Technical Take

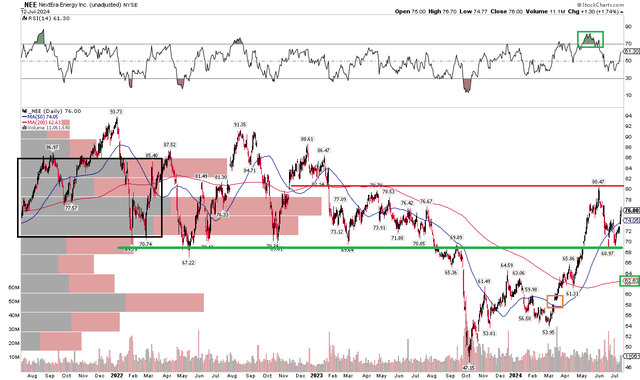

With a fair valuation and solid execution by NextEra’s management team, NEE’s technical situation is generally attractive. Notice in the chart below that shares have rallied through the key $70 mark that I have been discussing over the past year with this stock. Now, about that point of polarity, the next layer of potential selling pressure likely comes into play in the $80 to $82 range – that’s the high from last quarter and where the bulls and bears battled from late 2022 through the middle part of last year.

Also take a look at the RSI momentum oscillator at the top of the graph – it reached overbought conditions in May shortly before the stock price hit its YTD high. After a successful test of the $70 area, the stock has bounced back big. Furthermore, the long-term 200-day moving average is now rising, suggesting that the bulls have grabbed control of the primary trend. I also like that the bears were unable to take the stock down to a gap level in the upper $50s in late Q1.

Overall, support is near $70 with $82 being resistance.

NEE: Shares Rally Through Long-Term Resistance

StockCharts.com

The Bottom Line

I have a hold rating on NextEra. The company is executing well and there are some macro tailwinds, but its valuation is simply at a fair level right now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.