NextEra Energy’s Good Generation Fundamentals

Summary:

- NextEra Energy is a $144 billion company comprising a significant utility-FPL-and a renewables project division, NEER. The company’s dividend is 2.9% currently.

- NextEra Energy took significant write-offs on its Mountain Valley Pipeline interest in 2022, but now–pending FERC approval–MVP is expected to begin operations by the end of May 2024.

- NextEra Energy owns and/or operates a total of 6.5 gigawatts of nuclear capacity, 8.8% of total FPL and NEER capacity.

Alex Potemkin/iStock via Getty Images

I am keeping low-beta (0.51) NextEra Energy (NYSE:NEE) at “buy” as with my previous report. NextEra has two primary parts: its Florida utility business (FPL) which serves 5.9 million customer accounts (about 12 million people) and its national renewables energy project business, NextEra Energy Resources (NEER).

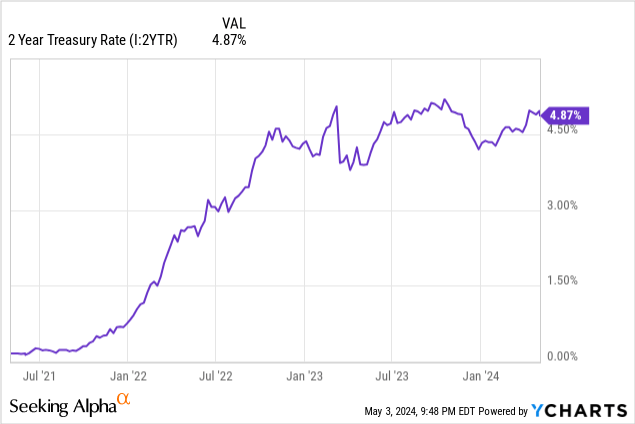

This rating applies only for NextEra Energy and not for NextEra Energy Partners (NEP). It also applies only for investors seeking capital appreciation; dividend hunters will prefer stocks with higher dividend rates or even short-term US Treasuries (two-year rate at 4.87%) or other interest-bearing instruments.

Favorable factors include:

- The sheer size of NEE’s generation fleet: it has 74 gigawatts total. Of these, 35 gigawatts are at FPL and 39 gigawatts are at NEER.

- Substantial nuclear power capacity at both FPL and NEER.

- Moderate to low-cost natural gas, FPL’s major generation fuel.

- Although uncertain until the last moment, the expected start-up of the 2 BCF/D Mountain Valley Pipeline will enhance NextEra’s access to the natural gas excess supply in Appalachia.

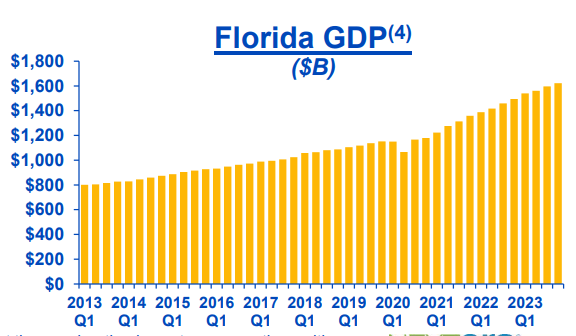

- The strong Florida economy supports continued growth at FPL.

- Macro growth in electricity demand due to data centers and artificial intelligence.

First Quarter 2024 Results and Guidance

NextEra Energy reported first quarter 2024 net income of $2.27 billion, or $1.10/share compared to Q1’23 net income of $2.09 billion or $1.04/share.

Adjusted Q1’24 earnings were $1.87 billion or $0.91/share compared to $1.68 billion or $0.84/share for Q1’23. The major difference between net income and adjusted earnings in Q’124 were +$444 million of non-qualified hedges.

Dividing the net income: FPL reported net income of $1.172 billion and NEER reported net income of $966 million.

Company management forecasts adjusted EPS for 2024 to be between $3.23 and $3.43. Beyond 2024 the company expects an annual growth rate of 6-8% off the 2024 level. NextEra also expects to grow dividends per share at 10%/year through at least 2026 off a 2024 base.

Among many positive developments, in its Q1’24 presentation NextEra mentioned the growth in the Florida economy, illustrated below.

NextEra Energy

Mountain Valley Pipeline

Mountain Valley Pipeline (MVP) is a 303-mile line from northwestern West Virginia to southern Virginia. MVP is owned by EQM Midstream Partners, operator at 45.5%, with NextEra holding 31%, Consolidated Edison Transmission 12.5%, WGL Midstream (owned by AltaGas) 10%, and RGC Midstream 1%. MVP will carry 2 BCF/D (2 million dekatherms/day) of natural gas.

After much litigation, including a case ultimately decided by the US Supreme Court, Mountain Valley Pipeline is expected to complete construction at the end of May 2024. However, it must receive authorization from the Federal Energy Regulatory Commission (FERC) before beginning commercial operation.

Also note that EQM Midstream Partners is owned by Equitrans Midstream Corporation (ETRN). Equitrans, in turn, is due to merge with EQT Corporation (EQT) IF the Federal Energy Regulatory Commission authorizes Mountain Valley Pipeline to begin operations.

Because completion previously looked so uncertain, NextEra took a complete write-off/impairment charges-including $800 million in Q1’22--on its MVP investment.

Macro

Last week, Federal Reserve chair Jerome Powell signaled no rate changes from currently. Depending on future inflation data, experts believe rate cuts may occur in September and/or December 2024. Interest rates are important both directly in debt costs (utilities have significant debt in their structure) and indirectly as Treasuries and debt instruments compete with dividend-paying equities for investment.

The Florida state economy is strong as illustrated above. Electricity demand is directly tied to economic growth, so FPL’s demand prospects are good. While the interest in EVs has cooled, extensive growth is seen as likely throughout the US grid due to electricity-hungry requirements of artificial intelligence, part of the overall growth of data center demand. Crypto mining also has developed as a demand factor in some regions.

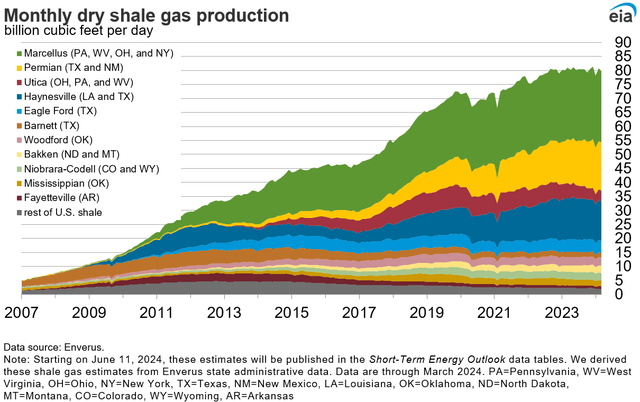

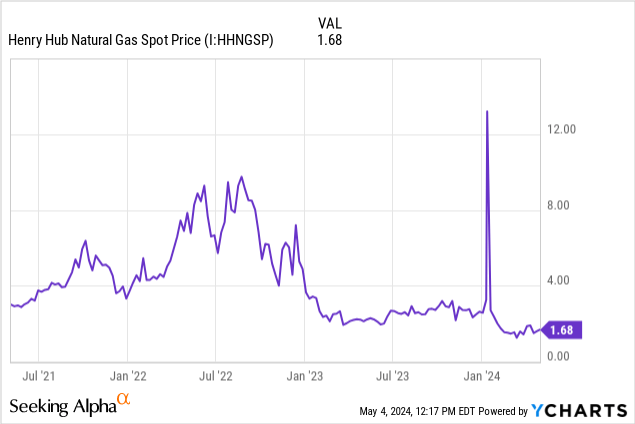

In addition to the expected new flexibility from MVP, natural gas prices generally are relatively low. This is due to the Biden administration pause on new LNG export permitting, the naturally abundant supply in the Marcellus and Utica (PA-OH-WV) basins and to the fact that large volumes of associated gas is automatically produced (zero marginal cost) with oil from the large west Texas Permian basin.

Nuclear power has gained appreciation and status as a non-hydrocarbon baseload source. Although nuclear is a distant second to natural gas as a generation fuel in Florida, as described below, NextEra has access to nuclear plants for generation.

A different leg of the NextEra Energy juggernaut had continued issues from the last few years. Profitability from renewables projects at NEER slowed for several reasons: oversupply of projects relative to demand by utilities (important to recall the electric utilities are the customer for renewable-sourced electricity); long queues for connecting projects to transmission, supply chain issues, tariffs on imported parts, utility and consumer concerns about intermittency, cost, disposal, need for back-up at 1.1x capacity, cost of batteries, and land use concerns.

Natural Gas Prices

Given NextEra’s 31% ownership in Mountain Valley Pipeline as described above and MVP’s expected start-up (pending FERC approval, not guaranteed) in late May 2024 may make Appalachian and Utica gas (green and red-brown bands) more readily available for Florida.

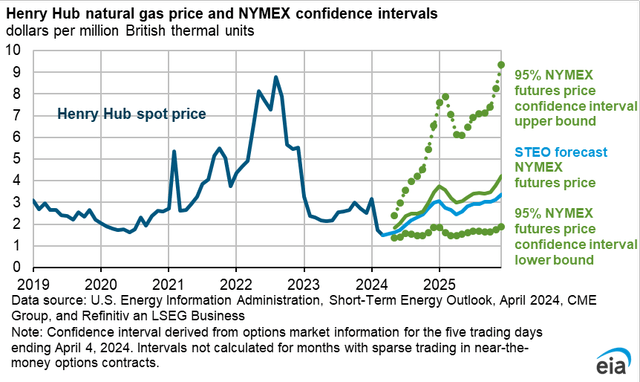

The Henry Hub (Louisiana) natural gas futures price for June 2024 closed at $2.14/MMBTU on May 3, 2024. The forward curve rises through the summer and fall to $2.63/MMBTU in October 2024.

The 5-95 confidence interval of price projections from the EIA’s April 4, 2024, Short Term Energy Outlook are shown below.

NextEra’s Nuclear Power

The onboarding of Georgia Power’s (The Southern Company’s (SO)) nuclear power plants Vogtle 3 and Vogtle 4 has drawn new attention to this baseload, non-hydrocarbon electricity generating fuel. As another example, Vistra (VST) has just acquired substantial additional nuclear generating capacity.

NextEra, through FPL, owns two large nuclear plants in Florida-St. Lucie and Turkey Point-with combined capacity of 3484 megawatts.

NextEra’s NEER also operates another three nuclear plants with a combined capacity of 3065 megawatts. Nuclear is 13% of NEER’s portfolio. The three plants are:

- Seabrook (New Hampshire) 1250 MW

- Duane Arnold (Iowa) 615 MW

- Point Beach (Wisconsin) 1200 MW.

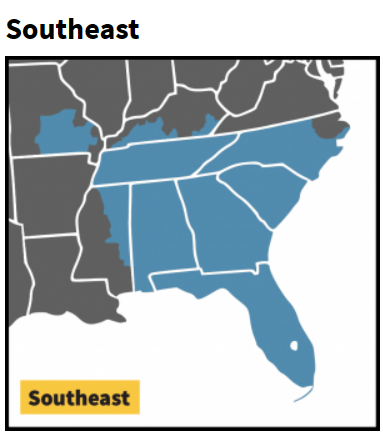

FPL is part of the Southeast electricity market. With projects across the US, NEER projects supply several electricity markets.

FERC.gov

Governance

NextEra Energy grew from a utility founded in 1925. The company is headquartered in Juno Beach, Florida and is among the largest global generators in the world of electricity from wind and solar power.

At May 1, 2024, Institutional Shareholder Services ranked NextEra’s overall governance as an (improved from my last report) 4, with sub-scores of audit (7), board (4), shareholder rights (3), and compensation (6). On the ISS scale, 1 represents lower governance risk and 10 represents higher governance risk.

In September 2023, Sustainalytics ranked NextEra at 23.3 (41st percentile, or “medium” risk) with sub-scores of 9.4-environmental, 8.3-social, and 5.6-governance. A factor in NextEra Energy’s score is its use of thermal coal.

On April 15, 2024, shorted shares were only 1.2% of floated shares.

Insiders own a negligible 0.1% of stock.

NextEra’s beta is an attractive 0.51: its stock moves directionally with the overall market but to a smaller extent (less volatility). This is characteristic of utility stocks.

On December 31, 2023, the four largest institutional stockholders, some of which represent index fund investments that match the overall market, were Vanguard (9.7%), BlackRock (7.3%), State Street (5.7%), and JP Morgan Chase (4.3%).

Blackrock, State Street, and JP Morgan Chase are signatories to the Net Zero Asset Managers initiative, a group that manages $57 trillion in assets in assets worldwide and which limits hydrocarbon investment via its commitment to achieve net zero alignment by 2050.

Regulators

The company’s most significant regulator for FPL is the Florida Public Service Commission. In rate cases, NextEra responds to input from a wide variety of customer-stakeholders.

NextEra’s ownership interest in Mountain Valley Pipeline was affected by federal regulatory and judicial decisions. As noted above, MVP is waiting on FERC approval to begin operations in late May 2024.

Stock and Financial Highlights

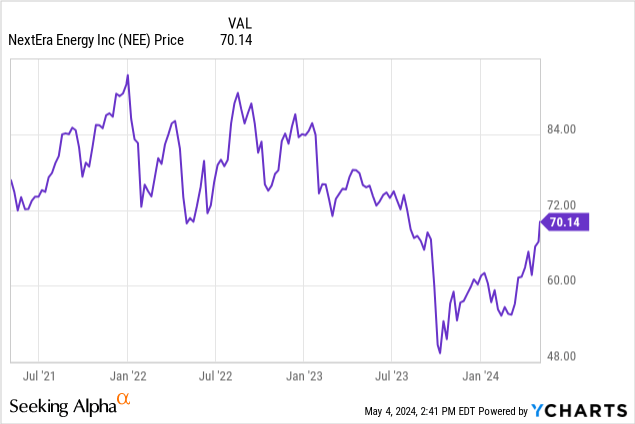

NextEra’s May 3, 2024, closing price was $70.14/share, 89% of its 52-week high of $78.53/share and 96% of its one-year target of $73.22/share. Market capitalization is $144.1 billion.

Current price-earnings ratio is 19.2 at the trailing twelve months’ (TTM) earnings per share (EPS) of $3.66. Analysts’ EPS projections for 2024 and 2025 average $3.40 and $3.68, respectively, for a forward price-earnings ratio of 19-21.

TTM operating cash flow is $12.7 billion and levered free cash flow is -$19.8 billion.

TTM return on assets is 3.3% and return on equity is 11.5%.

On March 31, 2024, NextEra had liabilities of $120.6 billion, including $72.1 billion of total (current and non-current) long-term debt, and assets of $180.0 billion, giving a liability-to-asset ratio of 67%, standard for a utility and lower than many.

The company’s market value per share is about three times the book value per share of $23.67, indicating very positive market sentiment. The ratio of enterprise value to EBITDA is 14.4, above the level of 10.0 or less that would indicate a bargain.

A dividend of $2.06/share yields 2.9%.

NextEra has an average rating from fifteen analysts of 1.8, or “buy” leaning toward “strong buy.”

Positive and Negative Risks

Higher interest rates will continue to impact NextEra and all utilities due to both high debt costs and the need for dividend-paying equities to compete for investors with debt instruments. For example, the current 2-year Treasury yield is near 4.9%.

The lengthy MVP court case delay saga means investors will want to know MVP actually begins operations, e.g. “I’ll believe it when I see it.” However, the offsetting positive risk is more access to affordable natural gas as a generating fuel.

Weather, including hurricanes, always remains a risk for Florida utilities.

As noted, the market for utility-scale renewables like the projects NextEra builds has cooled as utilities in the US and abroad prioritized grid resilience and back-ups to ensure 24/7 reliability.

Positive risks are the continued growth of Florida’s population and economy and thus electricity use, very moderate natural gas prices, and expected demand growth from the use of artificial intelligence.

Recommendations for NextEra Energy

While I do not recommend NextEra Energy to dividend-seekers, I am keeping it at “buy” for investors seeking capital appreciation.

The company’s steady low beta of 0.51 is indicative of its solid utility business in a growth market with lower-cost generation fuels that balances its entrepreneurial clean-energy projects division.

Although not bargain-priced, NextEra has good future growth prospects both as a sector (electricity) and regionally (Florida) as well as a sizeable NEER energy project backlog. FPL’s major generating fuels of natural gas and nuclear are low- or no-carbon. The company’s natural gas costs are affordable and may become more so with the completion of Mountain Valley Pipeline, of which NextEra Energy owns 31%.

I own shares of NextEra Energy.

investor.nexteraenergy.com

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VST, NEE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.