NextEra Energy: An Impressive Dividend Aristocrat To Buy Now

Summary:

- My investing strategy centers around buying wonderful businesses at appealing valuations.

- NextEra Energy’s operating revenue and adjusted diluted EPS each grew in the fourth quarter.

- The Dividend Aristocrat possesses an A- credit rating from S&P on a stable outlook.

- Shares of NextEra Energy could be 24% undervalued relative to fair value.

- The electric utility could be set up to outperform the S&P 500 index over both the next two years and 10 years.

Engineers working at a solar power plant. Luis Alvarez

I believe the key to my journey toward achieving success as a long-term investor started by expressing a simple truth: I don’t have a crystal ball. I recognize that in the short term, fundamentals are often overshadowed by market sentiment.

In a one-year timeframe, Dividend Kings estimates that merely 5% of total returns are explained by fundamentals and valuation. But over time, market sentiment tends to more appropriately reflect fundamentals. Over 30 or more years, fundamentals and valuation account for an estimated 97% of total returns.

In a nutshell, this is why I insist on buying high-quality businesses on sale. Once I buy a business, I plan to hold it for decades, or at least as long as fundamentals appear to be intact.

One of the holdings in my portfolio is none other than America’s largest electric utility, NextEra Energy (NYSE:NEE). Since I initiated coverage in the electric utility last November, its shares have moved 1% lower. This is a contrast to the S&P 500 (SP500), which has rallied 12% in that same time.

As I’ll explain in this update, I believe this shortsightedness from the market can only stand for so long. Without further ado, please allow me to highlight why I am maintaining my buy rating on NextEra.

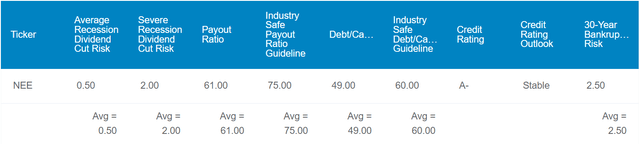

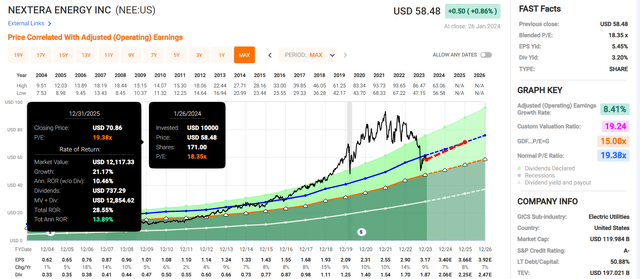

Dividend Kings Zen Research Terminal

NextEra’s 3.2% dividend yield registers at more than twice the 1.4% yield of the S&P. As if this superior starting income wasn’t enough, there also appears to be room for the payout to run higher in the years to come.

For one, NextEra’s EPS payout ratio is 61%. For context, that’s well below the 75% EPS payout ratio that rating agencies have established as the industry-safe guideline for electric utilities.

Additionally, NextEra’s debt-to-capital ratio is just 49%. That clocks in at moderately less than the 60% debt-to-capital ratio that rating agencies view as safe.

As a result, NextEra’s long-term debt is rated A- by S&P on a stable outlook. That suggests the risk of the company going out of business in the next 30 years is only 2.5%.

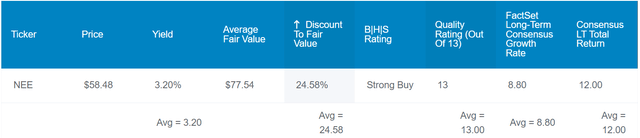

Dividend Kings Zen Research Terminal

NextEra’s valuation also appears to be attractive. Using 10-year and 25-year valuation metrics, including the historical dividend yield and P/E ratio, the company’s shares could be worth $78 apiece. Since I believe an examination of NextEra demonstrates its fundamentals to be intact, it’s my opinion that these valuation metrics are applicable. Relative to its current $59 share price (as of January 29, 2024), that would imply shares of the electric utility are discounted by 24%.

If NextEra can revert to an average of its fair value yield and P/E ratio and match the growth consensus, here is what total returns could resemble in the coming 10 years:

- 3.2% yield + 8.8% FactSet Research annual growth consensus + a 2.8% annual valuation multiple boost = 14.8% annual total return potential or a 298% 10-year cumulative total return versus the 9.8% annual total return potential of the S&P or a 155% 10-year cumulative total return

The Business Is Doing Well

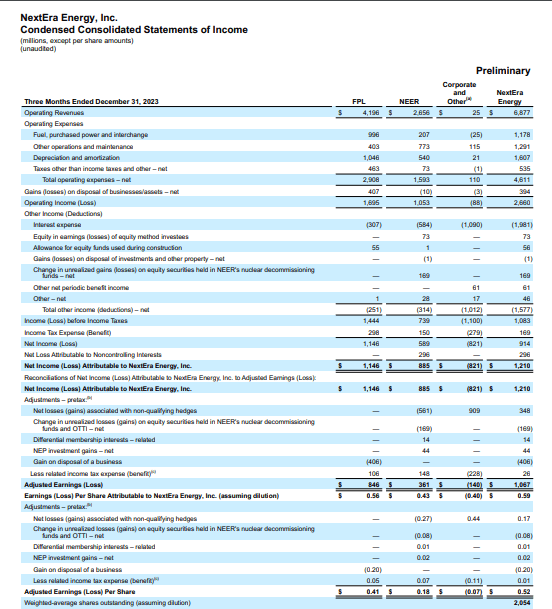

NextEra Energy Q4 2023 Earnings Press Release

In the fourth quarter that ended December 31, NextEra again did exactly what I expect from a company of its caliber: Beat the analyst consensus for revenue and adjusted diluted EPS. The company’s operating revenue climbed 11.6% higher year-over-year to $6.9 billion during the fourth quarter. For perspective, that was $550 million better than the analyst consensus.

NextEra’s growth was primarily driven by its NextEra Energy Resources segment, which is the world’s largest producer of wind and solar energy. The segment’s operating revenue soared 26.9% over the year-ago period to $2.7 billion for the fourth quarter. According to NextEra’s Chairman and CEO John Ketchum’s opening remarks during the Q4 2023 earnings call, the company originated over 17 gigawatts of new renewables projects in 2022 and 2023 alone. These two straight record years of new renewables originations should also bode well for the future.

In the Florida Power and Light segment, operating revenue edged higher by 3.1% year-over-year to $4.2 billion in the fourth quarter. Per Ketchum’s remarks during the recent earnings call, the company placed 1.2 gigawatts of cost-effective solar into service in 2023. That is largely what fueled growth in NextEra’s predominant segment.

The company’s adjusted diluted EPS increased by 2% over the year-ago period to $0.52 during the fourth quarter. This was $0.03 ahead of the analyst consensus. Due to higher interest expenses, NextEra’s non-GAAP net profit margin contracted by 90 basis points to 15.5% for the quarter. Combined with a 3.1% increase in the share count, this is why the company’s adjusted diluted EPS growth rate was outpaced by operating revenue growth in the quarter (unless otherwise stated, all details sourced from NextEra’s Q4 2023 Earnings Press Release).

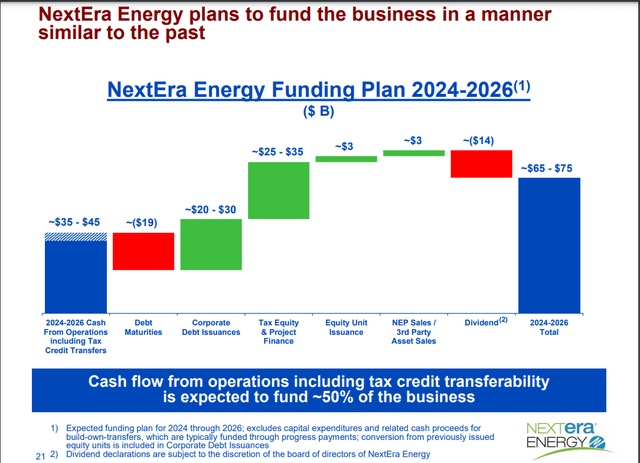

NextEra Energy Q4 2023 Earnings Presentation

Looking ahead, NextEra projects that it will be investing heavily in capital projects from 2024 to 2026. The company’s operating cash flow of $35 billion to $45 billion coupled with tax credits is expected to fund approximately 50% of its obligations during that time. The vast majority of remaining spending will be funded by the issuance of between $20 billion and $30 billion in debt, with approximately $3 billion in share issuances as well.

Financially, NextEra is in good health. Even as interest rates rocketed higher, the company’s interest coverage ratio was 3.2 in 2023. That is high enough for a utility that NextEra shouldn’t have difficulty servicing its debt for the foreseeable future.

A Dividend Aristocrat With Plenty Of Dividend Growth Left

As I argued in my previous article, NextEra has been a dividend growth machine. For instance, the last year that the company didn’t deliver double-digit dividend growth to shareholders was back in 2015.

In 2024, NextEra looks like it will keep this streak of double-digit payout growth alive. This is because, per slide 13 of 48 of its most recent Earnings Presentation, the company specifically outlined its expectation of “~10% annual dividend per share growth through at least 2024.”

It’s not like NextEra can’t afford it, either. Assuming a 10.2% raise in the quarterly dividend per share to $0.515 in February, the company would pay $2.06 in dividends in 2024. Against the $3.33 in midpoint adjusted diluted EPS expected for the year (per slide 13 of 48 as well), that would equate to a modest 61.9% payout ratio.

Risks To Consider

NextEra is a top-notch utility in my view, but it still has risks that merit at least brief mentions.

As part of its commitment to the green energy transition, NextEra operates nuclear power plants. While the incidence of nuclear incidents is rare, the ramifications of such an event can be very costly to both the human quality of life and the affected company’s financials. If such an event happened, NextEra could face billions of dollars in fines and litigation beyond its insurance coverage. Separately, decommissioning such facilities is often a capital-intensive process as well.

Another risk is that NextEra is a sponsor of a pension plan for most of its employees. If the market performs worse than expected, the company could be on the hook to contribute enough funds to meet its obligations to employees.

Summary: NextEra Energy Is Still Compelling Here

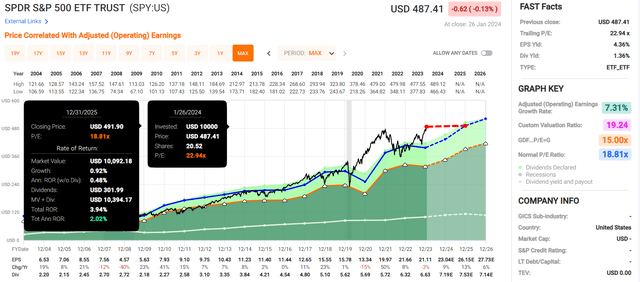

FAST Graphs, FactSet FAST Graphs, FactSet

Having grown its earnings in each of the last 20 years per FAST Graphs, NextEra has been a remarkably consistent business. Of all the businesses I have covered, I don’t recall any that can lay claim to that amazing accomplishment. Add in the utility’s status as a Dividend Aristocrat with an A-rated balance sheet and this is why I believe it is a world-class business.

The company’s blended P/E ratio of 18.4 is also trading slightly below its normal P/E ratio of 19.4. As interest rates come down, I believe NextEra will rebound to its normal P/E ratio. If this happens and the company grows as anticipated, 27% cumulative total returns could lie ahead through 2025. That would be head and shoulders better than the 4% cumulative total returns that are expected from the SPDR S&P 500 ETF Trust (SPY) in the same circumstances through next year. Thus, I am reiterating my buy rating on NextEra stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NEE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.