Summary:

- NextEra Energy, Inc.’s share price has dropped by almost 40% but still commands a yield of just over 3%.

- The company’s core earnings remained strong, with EPS growing by 10.6% YoY.

- NextEra Energy has a strong development program focused on renewable energy and expects a 7% annualized growth rate through 2026.

pixdeluxe

Despite NextEra Energy, Inc. (NYSE:NEE) share price weakness over the past year, dropping almost 40%, the company still commands a yield of just over 3%. That’s surprising in the high-yield environment that we’re currently in. There’s a good reason. As we’ll see throughout this article, the company’s assets and growth will support strong returns.

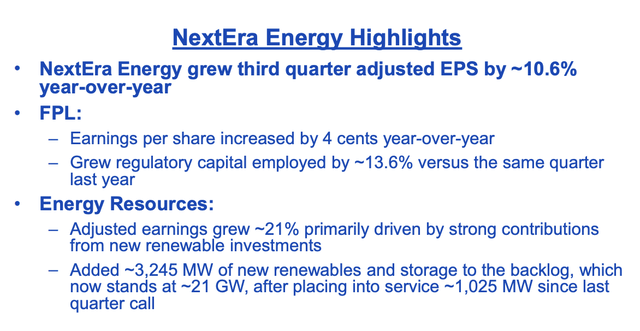

NextEra Energy Earnings

The company’s core earnings remained strong, with EPS growing by 10.6% YoY.

NextEra Energy Investor Presentation

The company has managed to grow regulatory capital, with FPL EPS growing by 4% YoY. Energy Resources managed to grow earnings by a massive 21%, as continued investment in renewable energy gives a strong cash flow base. We’ll discuss this backlog program in more detail below, but the company has a massive growing capital program here.

NextEra Energy Investor Presentation

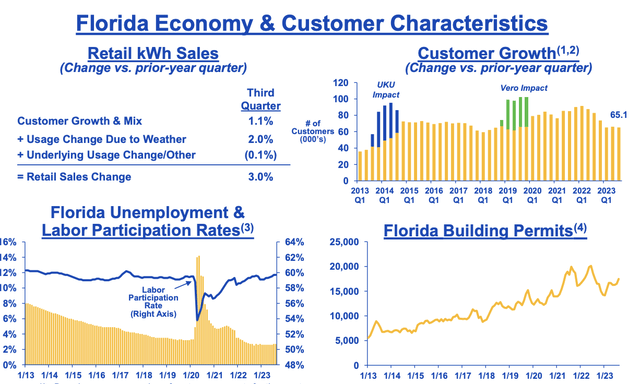

At FPL, the company continues to benefit from the state of Florida’s strong economy, as phenomenal weather and low costs make it a popular place to live. The company saw retail kWh sales improve by 3%, mainly driven by weather, and the overall economy and unemployment rate in the state remains strong.

The company has seen customer growth remain strong versus prior quarters, as the company continues to add more than 65 thousand customers a quarter. That long-term sustained growth rate will continue to be a strong base for customer growth for the company. More and more building permits will help support long-term growth.

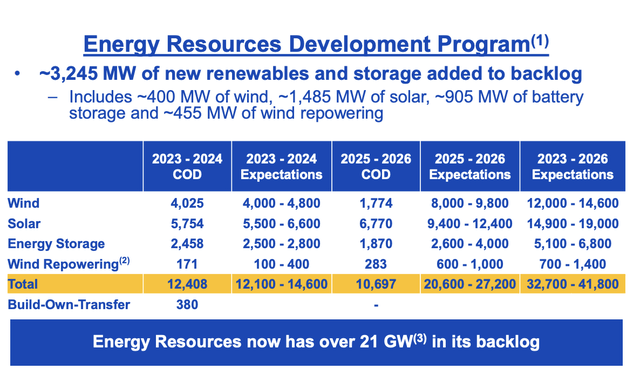

NextEra Energy Development Program

The company has a strong development program and it’s shifting to renewables to help maximize margins.

NextEra Energy Investor Presentation

The company now has a massive backlog of 21 gigawatts. The company added 3.2 gigawatts to its backlog in the most recent quarter, as Florida remains an obvious place for solar paired with battery storage. The company expects to continue ramping up its renewable energy deployed. Solar in Florida now makes up 4% of energy generation w/ 5.9 Gwh installed capacity.

While Energy Resources maintains cheap natural gas payload capacity, solar represents an incredibly low cost utility scale addition that the company can continue adding.

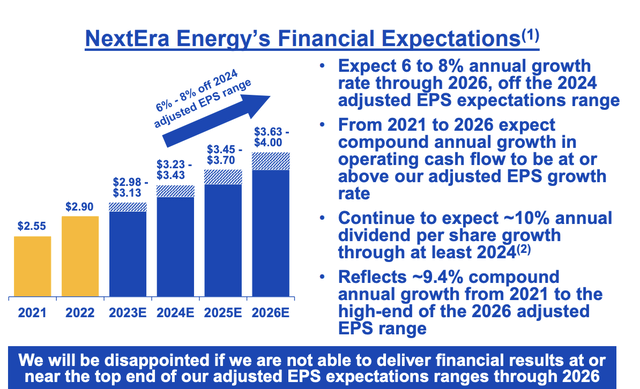

NextEra Energy Financial Guidance

The company’s financial guidance is based on its ability to continue driving shareholder returns.

NextEra Energy Investor Presentation

The company expects a 7% annualized growth rate through 2026 as it continues to invest. 2026 EPS forecast is $3.8 / share, representing a P/E of just under 15. That shows the impact of the company’s recent share price decline as a result of rising interest rates. The company expects its cash flow growth to be higher, and high dividend growth to continue.

The company’s strong cash flow growth here, and long-term outlook, forgives some of its higher valuation, and helps highlight the company as a valuable investment.

NextEra Energy Partners

The company’s subsidiary is NextEra Energy Partners, an integrated subsidiary with long-term growth assets.

NextEra Energy Investor Presentation

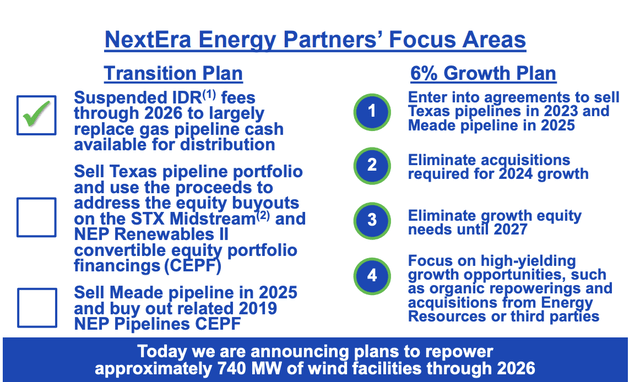

The company has suspended IDR fees temporarily, to help support distributions and continue to focus on dividends. The company is also selling out some of the assets, to no longer need to use growth equity or acquisitions for its future growth. NextEra Partners represents a valuable place for the company to continue raising capital as needed.

Thesis Risk

The largest risk to our thesis is Florida’s susceptibility to catastrophe and a major event / storm, the risks of which are rising due to climate change. A massive direct hit from a Category 5 hurricane, or multiple hits, could not only decrease the rate of those moving to the state but also cause massive damage to its economy and infrastructure.

That could significantly impact the company’s growth plans.

Conclusion

NextEra Energy has an impressive portfolio of assets and historically we’ve found them to be on the more expensive side. That’s despite their impressive growth rate. However, a new opportunity has arrived. Higher interest rates mean that the company’s share price has dropped by more than 30%, lifting its dividend yield and raising its yield.

With NextEra Energy, Inc. expecting a strong return from its investments in the upcoming years, its dividend and earnings should increase substantially. That helps the company to drive hefty returns for those who invest now. Let us know what your thoughts are in the comments below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NEE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.