Summary:

- NextEra Energy is a dividend aristocrat with a focus on green energy, offering solid growth in sales and EPS, and has several growth opportunities.

- The company’s valuation is high, with a P/E ratio of 24, which leaves little margin of safety for investors, making it a HOLD recommendation.

- NextEra Energy faces risks due to its negative free cash flow, reliance on share issuance and debt issuance, and high debt to EBITDA ratio.

pidjoe

Introduction

As an investor mainly focusing on dividend growth stocks, I always look for investment opportunities in income-producing assets. Mostly, I add to my existing positions when I find them attractive. I also use market volatility to my advantage by starting new positions to diversify my holdings and increase my dividend income for less capital.

In my opinion, the utility sector is attractive as the higher interest rate may create opportunities. When interest rates are higher, investors flock to safer investments as risk-free interest is attractive. Therefore, they may sell assets like utilities as they tend to be a replacement for income investors. Therefore, some companies may be attractively valued, and long-term investors can lock on a higher entry yield. In this article, I will look at NextEra Energy (NYSE:NEE), a company I own and analyzed a year ago.

I will analyze NextEra Energy using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

NextEra Energy generates, transmits, distributes, and sells electric power to retail and wholesale customers in North America. The company generates electricity through wind, solar, nuclear, coal, and natural gas facilities. It also develops, constructs, and operates long-term contracted assets that consist of clean energy solutions, such as renewable generation facilities, battery storage projects, and electric transmission facilities, sells energy commodities, and owns, develops, constructs, manages, and operates electric generation facilities in wholesale energy markets.

Fundamentals

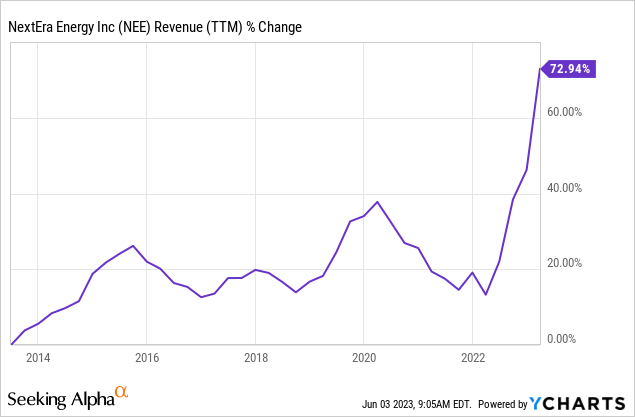

Revenues of NextEra Energy have increased by 73% over the last decade. This increase results from more customers, higher prices in its regulated business, and more demand for renewables and green energy projects. The graph below shows how steep the increase in sales has been over the last twelve months. In the future, as seen on Seeking Alpha, the analyst consensus expects NextEra Energy to keep growing sales at an annual rate of ~11% in the medium term.

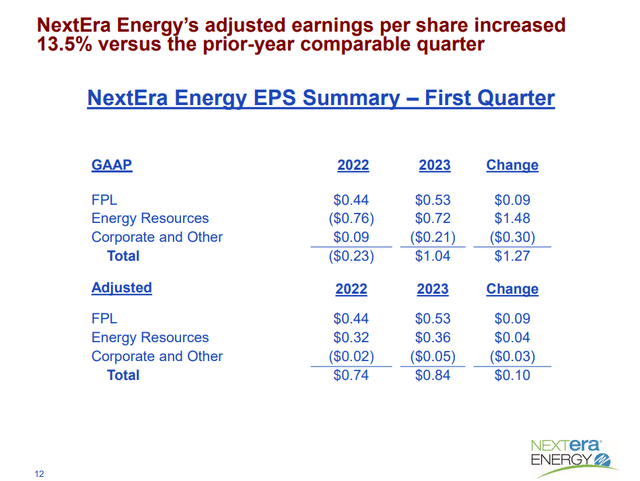

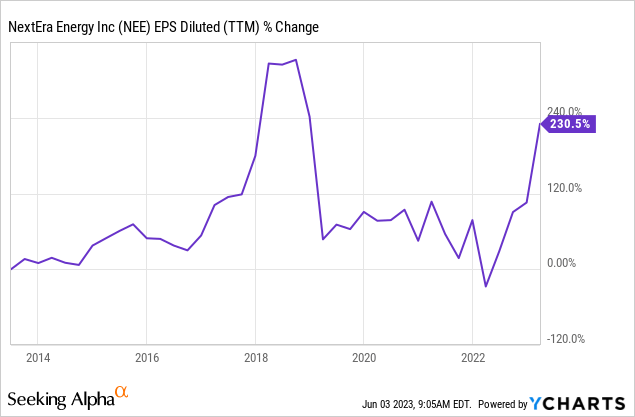

The EPS (earnings per share) has increased much faster. The company more than tripled its GAAP EPS over the last decade. The increase in EPS happened despite the company issuing more shares. It is the result of higher prices combined with lower expenses. In the future, as seen on Seeking Alpha, the analyst consensus expects NextEra Energy to keep growing EPS at an annual rate of ~8% in the medium term.

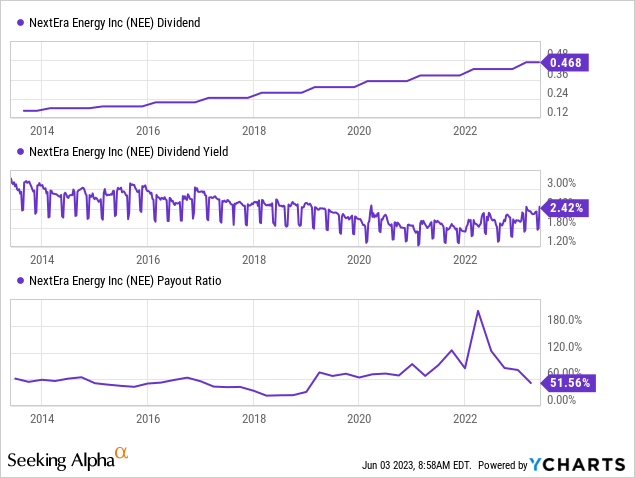

The company is a dividend aristocrat. It has been paying and growing its dividend annually for the last 27 years. NextEra Energy pays a 2.42% dividend, which seems safe as the company is primarily a regulated utility, and its payout ratio is around 50%. Therefore, investors should expect additional dividend increases to align with EPS increases of about 10%, which is the company’s declared goal. The dividend offered by the company seems safe and growing faster than inflation.

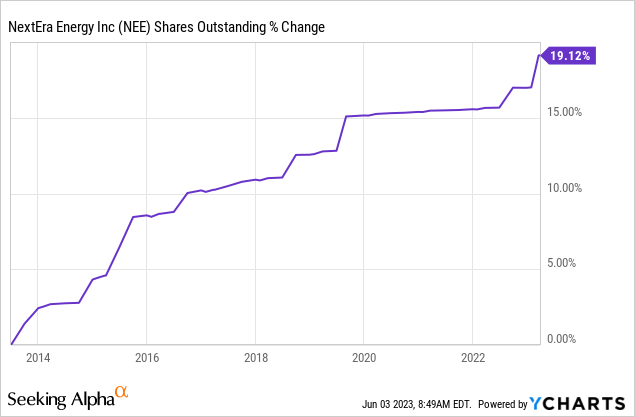

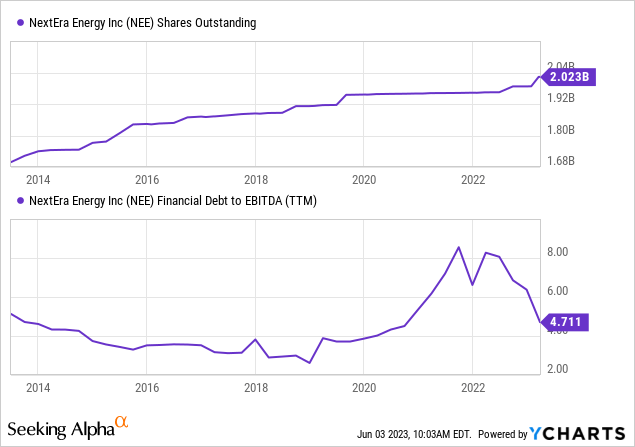

In addition to dividends, companies tend to return capital to shareholders via share repurchase plans. These buyback plans support EPS growth by lowering the number of shares outstanding. In the case of NextEra Energy, we can see that the number of shares increased. It increased by 19% over the last decade as the company uses its shares to raise capital for its projects. It dilutes shareholders. Therefore, the company must be very successful in its capital allocation to justify it.

Valuation

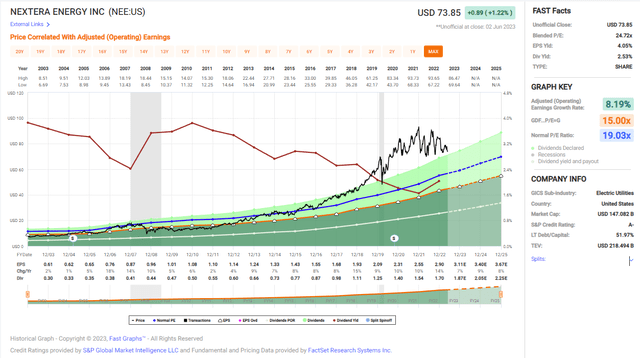

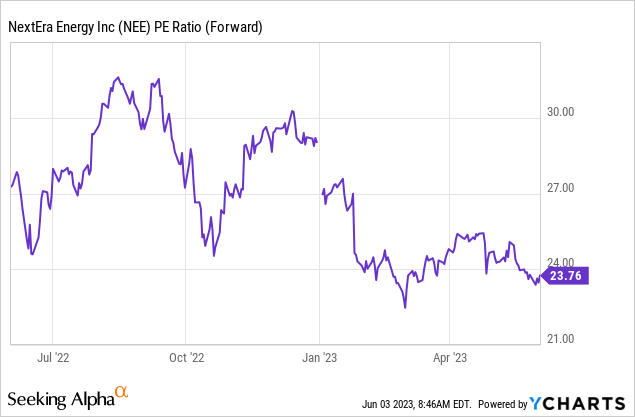

The P/E (price to earnings) of NextEra Energy, when using the estimated EPS for 2023, stands at almost 24. This is the lowest valuation we have seen over the last twelve months. However, this is still a high valuation, as the company is only expected to grow at ~8% annually. When interest is high, companies must show impressive growth to justify such a valuation. Therefore, I believe that the company is trading for a premium.

The graph below from Fast Graphs emphasizes that shares of NextEra Energy are not cheap. The company has shown an annual growth rate of 8% over the last two decades. It aligns with the current estimates by analysts, who predict that the company will keep growing at 8% a year. However, the current P/E ratio of 24 is significantly higher than the average P/E ratio we have seen over the last two decades, which stands at 19. Therefore, the shares seem overvalued.

Opportunities

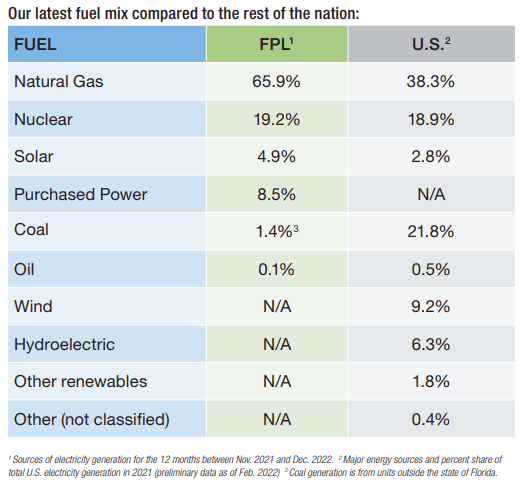

NextEra Energy is promoting the use of green energy across the United States. It does in Florida, where it operates as a regulated utility. It shows higher reliance on relatively clean solar energy and nuclear energy. It also offers higher reliance on natural gas which is much cleaner than coal. Moreover, the company’s projects initiated by its Energy Resources subsidiary focus on renewables, mainly solar and wind energy.

Florida Power and Light

Another opportunity that NextEra Energy has compared to other utility companies is its diversification. Most utility companies are regulated utilities that have almost zero pricing power. They must approach the state to increase prices and hope it will be approved. NextEra Energy has Energy Resources, a subsidiary that engages in non-regulated activities. It allows the parent company to diversify its income and achieve additional growth while limiting the risk as the regulated business is an anchor of stability.

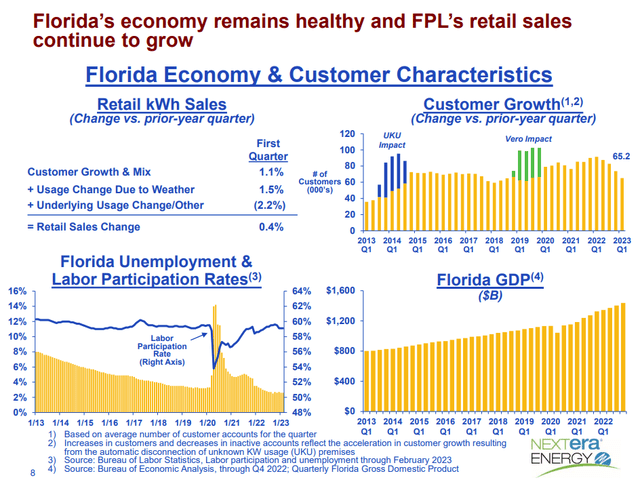

The company’s focus on Florida is another growth opportunity. Florida is a growing state in the Sun Belt. It grows both in terms of population and economic activity. With more people who later open more businesses and factories, the energy demand, mainly electricity, increases. Therefore, NextEra Energy will enjoy a higher need to supply and will be able to grow faster than most utilities.

Risks

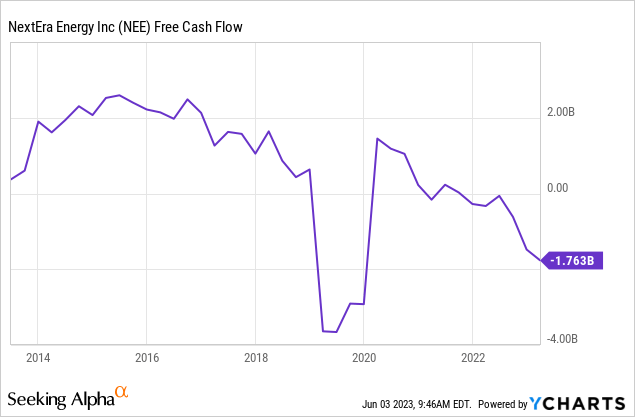

NextEra struggles to make money in terms of actual cash flow. The company earns a lot, yet it invests heavily in projects that will come to fruition in the future. Therefore, these significant investments turn into a negative free cash flow. This is a risk as some projects, mainly unregulated ones, are not guaranteed success. Therefore, the company invests in advance, hoping to achieve high returns.

Without significant free cash flow, the company relies heavily on share issuance and debt issuance to fund its growth. While the strategy has been working well so far, it is risky. The debt to EBITDA is still high at almost 5, and the company now has over 2B shares, a 20% increase in a decade. Therefore, it must keep allocating capital well, or the debt and dilution may burden it.

Moreover, there is almost no margin of safety for investment in NextEra Energy. There are risks for the company, primarily due to how it funds its projects without free cash flow. However, the shares’ pricing and valuation do not consider it. The company is cheaper today than it was a year ago, but it still offers almost no margin of safety if it fails to execute as well as it did.

Conclusions

To conclude, NextEra Energy is a great company. It is my favorite company in the sector, and it’s easy to understand why. The company offers solid growth of sales and EPS and translates them into dividend growth. The company has several growth opportunities, and while it deals with some risks, I believe it has what it takes to manage the risk well. As the company becomes more experienced in such projects, it becomes more unique and valuable.

However, the current valuation leaves no margin of safety for investors. I rated the company a HOLD a year ago due to its valuation. A year has passed, and the valuation today is more attractive. However, in my opinion, it is still too high for a company that is mainly regulated, deals with high debt, and must issue shares and additional debt to keep growing. Therefore, the company is still a HOLD and will be interesting when the P/E ratio is around 18-20.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NEE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.