Summary:

- NextEra Energy’s valuation is unjustifiable despite its significant renewable portfolio and $170 billion market cap, making it a poor investment.

- The company’s 9% YoY improvement and 2.4% dividend yield align it with S&P 500 returns, but don’t justify its P/E ratio in the 20s.

- Florida Power & Light drives growth, but Florida’s slowing population growth could limit future earnings.

- NextEra’s 30 GW renewable backlog and 6%-8% earnings growth forecast are promising, but the transition is costly and relies on rate adjustments.

Umarin Nakamura/iStock via Getty Images

NextEra Energy, Inc. (NYSE:NEE) is one of the largest US energy companies with a market capitalization of more than $170 billion. The company has one of the largest renewable portfolios of any company and continues to generate massive amounts of electricity. However, as we’ll see throughout this article, the company simply can’t justify its valuation, making it a poor investment.

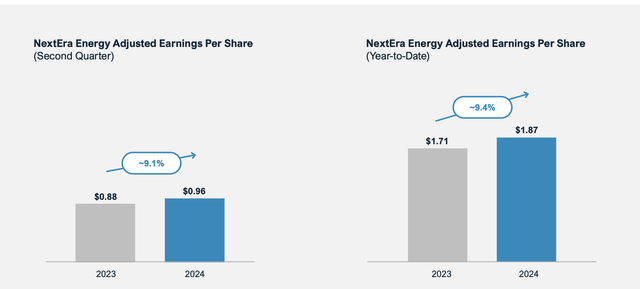

NextEra Energy Results

The company has worked to improve its results with 9% YoY improvement in EPS.

NextEra Energy Investor Presentation

The company’s earnings growth is respectable, but the company is trading at a P/E ratio in the 20s, which means its max annual shareholder returns are ~4% (100% of profits). Presently, the company has a dividend of ~2.4% which forms the vast majority of its shareholder returns. This lines up the company with the S&P 500 in terms of shareholder returns.

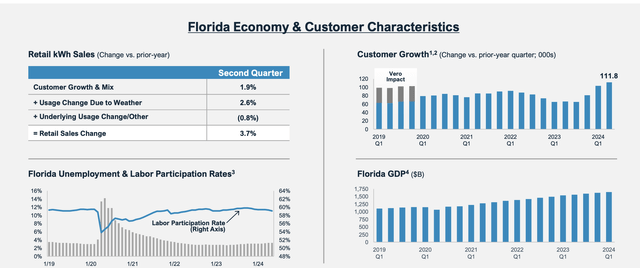

Florida Power and Light

The company’s largest segment is Florida Power & Light, its massive utility business.

NextEra Energy Investor Presentation

The company has seen some customer growth with growth at ~100,000 subscribers a quarter as Florida has continued to grow. However, Florid has a home insurance crisis, and as the state gets more expensive, population growth will slow down. Florida’s population is only expected to grow 20% by 2040, which could put limits on the company’s continued earnings growth.

That’s vs. 30% growth over the past 20 years. Now it’s worth noting Florida will remain one of the fastest-growing states in the country. However, for the company’s growth and comparing its growth to its past, our view is that, fundamentally, the company needs a similar population growth rate, so a slowdown there could have a strong impact.

Also of note is the slowdown in the growth of electricity consumption as appliances and technology become more and more energy efficient. That’s the KWh that residents are fundamentally paying for at the end of the day. We expect both of these trends to put pressure on Florida Power & Light and whether the company’s largest segment can continue to see the same earnings growth rates.

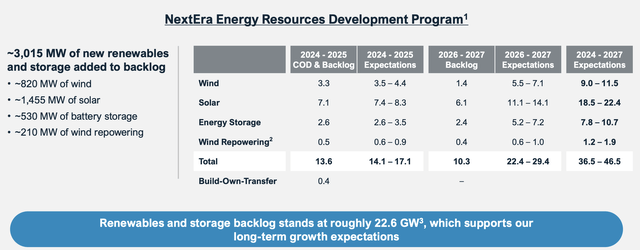

NextEra Energy Development

The company is continuing to chase a number of development projects, especially lower-cost renewables.

NextEra Energy Investor Presentation

The company has added 3 GW of new renewables and storage to its backlog. The company’s total backlog is more than 30 GW, a massive amount for the company that will help reduce emissions and costs for the company. While it will enable the company to handle long-term concerns about emissions, it’s an expensive transition for the company.

Fortunately for the company, most of these capital expenditures can be handled through its rates.

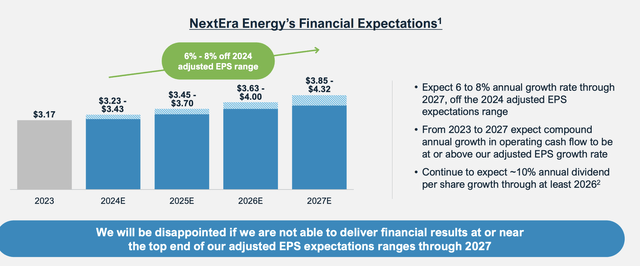

NextEra Energy Investor Presentation

The company is forecasting 6%-8% adjusted earnings growth based on its 2024 range. The company is also guiding for 10% dividend growth annually. However, that’s mostly from expanding its payout ratio. The company’s financial future is based on projections that result in a growing population and demand.

We don’t necessarily see that continue for the long term, as discussed above. That’s a potential long-term risk for the company given that its valuation requires continued growth above its current earnings.

Peer Valuation

Valuing NextEra Energy vs. its peers, we can see that the company clearly commands a premium.

| Peer | P/E | Market Cap | Dividend |

| American Electric Power | 20.6 | $54.9 billion | 3.4% |

| Duke Energy | 21.3 | $89.5 billion | 3.6% |

| NextEra Energy | 27.3 | $173.1 billion | 2.4% |

| Consolidated Edison | 20.1 | $35.8 billion | 3.2% |

| PG&E | 16.9 | $51.0 billion | 0.2% |

The company is a reliable company with strong assets, but it’s clear that you’re paying a premium that affects the P/E and the resulting yield as well. This is vs. some of the largest utility companies in the country that offer similar diversification and reliable cash flow businesses (we included PG&E for the sake of completeness, but it has issues with wildfires).

At the end of the day, you’re paying 20% more than what you can buy another utility for minimal additional diversification benefits in a larger company.

Thesis Risk

The largest risk to our thesis is NextEra Energy is a strong and reliable utility company that generates strong and growing cash flow in central markets. If Florida can continue growing for the long run, NextEra Energy can continue its growth, and earnings, which will enable increased shareholder returns.

Conclusion

NextEra Energy is a strong utility company and Florida Power & Light is one of the best-operated utility companies in the country. The company continues to earn strong profits while using increasing amounts of cheap renewables, which will enable earnings to grow going forward. However, it also commands a premium versus its peers.

We don’t feel that premium is worth it, especially with secular trends such as a slowing growth rate from Florida and a cap on how much more the company can lower costs. That’s especially true as it mostly replaces the market with renewables. Putting this all together, NextEra Energy is a poor investment at this time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.