Summary:

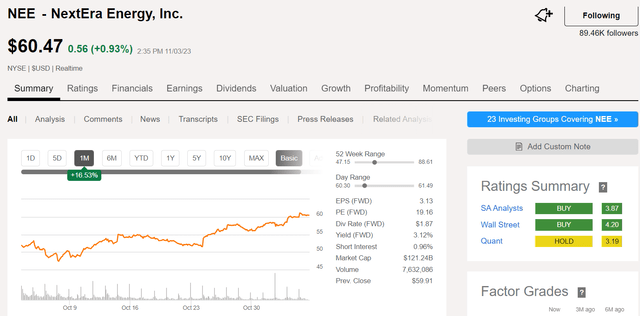

- Shares of NextEra Energy have rallied sharply in the last month.

- The company’s recent operating results suggest that its fundamentals remain intact.

- The electric utility enjoys an impressive credit rating from S&P.

- NextEra Energy is priced well below the average of my fair value and Dividend Kings’ fair value for the stock.

- The Dividend Aristocrat offers enticing total return potential both through 2025 and over the next 10-year period.

This ship has sailed on a businessperson. Have investors missed the boat on NEE? DNY59

As easily as the stock market can wipe away tens or hundreds of billions of dollars of a company’s market value, it can also give it right back. This is because in the near-term, market sentiment can swing wildly from pessimistic to neutral or optimistic quickly.

The largest electric company in the world, NextEra Energy (NYSE:NEE), is the most recent example supporting this argument. After taking a beating and bottoming at $47 a share early last month, shares have ripped 28% higher.

This presumably has a lot to do with the more dovish tone that Jerome Powell has taken as of late due to positive recent economic data. The market interpreted recent comments from the Federal Reserve Chairman as the Fed being done with rate hikes for the rest of this year. Historically, this has typically been a great sign for the utility sector.

Here’s why even after NextEra’s big recent gains, I am initiating a buy rating on the stock here on Seeking Alpha.

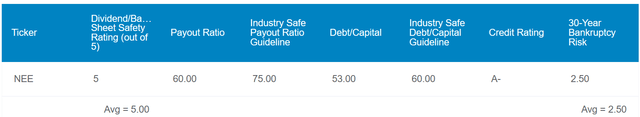

NextEra’s 3.1% dividend yield isn’t eye-popping relative to the risk-free 4.6% rate of U.S. 10-year treasuries. However, the company’s dividend is very safe. This is because NextEra’s EPS payout ratio is just 60%, which is secure compared to the 75% that rating agencies prefer from electric utilities.

From a balance sheet perspective, the company is also conservatively run. NextEra’s debt-to-capital ratio of 0.53 is less than the 0.60 ratio that rating agencies consider to be safe for electric utilities. Thus, S&P rates the company’s debt at an A- on a stable outlook. This implies that NextEra’s probability of going bankrupt by 2053 is merely 2.5%. For these reasons, Dividend Kings ranks the company’s dividend and balance sheet safety at a flawless 5/5.

So, NextEra is clearly an ultra SWAN based on fundamentals. But that isn’t all there is to like about the company. NextEra looks to be 25% discounted from its current $60 share price relative to Dividend Kings’ $81 fair value based on the historical P/E ratio and dividend yield.

Additionally, my inputs into the dividend discount model reinforce this point. Using its $1.87 annualized dividend per share, a 10% discount rate, and a 7.5% annual dividend growth rate for the long haul, I get a fair value of about $75 a share. Given NextEra’s roughly 10% annual dividend growth as of now, I believe a 7.5% annual rate can be justified.

If the company grows as expected and its stock returns to an average fair value of $78 a share, here are the returns that investors could expect from the present valuation:

- 3.1% yield + 6.8% FactSet Research annual growth consensus + a 2.6% annual valuation multiple expansion = 12.5% annual total return potential or a 225% cumulative total return versus the 10.1% annual total return profile or a 162% cumulative total return for the S&P 500 (SP500)

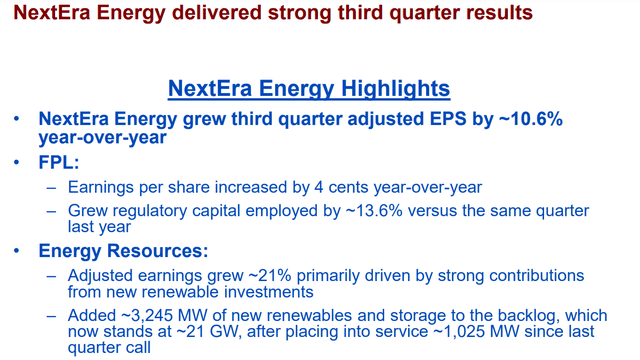

Robust Third-Quarter Results

NextEra Q3 2023 Earnings Presentation

When you own a portfolio of excellent companies, quarterly results are like clockwork: Revenue and earnings consistently grow over time. Unsurprisingly, this is exactly what transpired with NextEra’s results for the third quarter ended September 30, 2023.

The company’s operating revenue increased by 6.7% year-over-year to $7.2 billion during the third quarter. These results were driven by a 3% retail sales growth in kilowatt hours over the year-ago period. That was due to a growth in customers from net migration into Florida and favorable weather patterns. Additionally, a greater rate base than the year prior was the other factor that propelled operating revenue higher. The company’s regulatory capital employed rose by 13.6% to $62.9 billion as of the third quarter. As the utility keeps investing in a variety of renewable projects, this rate base should keep growing. That’s why FactSet Research believes the company’s earnings will compound by 6.8% annually over the long run.

On the subject of earnings growth, NextEra’s adjusted diluted EPS climbed 10.6% year-over-year to $0.94 in the third quarter. Besides the greater operating revenue base, the company also became more efficient. This is how its adjusted earnings margin expanded by 170 basis points over the year-ago period to 26.8% for the quarter.

Financially, NextEra is also a healthy business. The company’s interest coverage ratio through the first nine months of 2023 was 5.6. While that would be low for most other businesses, the predictability of the utility business model makes this a very vigorous interest coverage ratio. Short of a nuclear war, there is just about no scenario where NextEra’s EBIT would fall enough to not service its debt obligations (details sourced from NextEra Q3 2023 Earnings Press Release and NextEra Q3 2023 Earnings Presentation).

Double-Digit Dividend Growth Isn’t Done Yet

NextEra Energy is a remarkable dividend grower with 27 years of dividend growth to its credit. In the last five years alone, the company’s quarterly dividend per share has grown by 68.5% to the current rate of $0.4675 – – an 11% compound annual growth rate.

NextEra Energy also expects similar dividend growth to continue at least through next year: The company projects that it will up its quarterly dividend per share by 10% again in 2024.

It’s not hard to understand why NextEra is so upbeat. The company is guiding for $3.33 in midpoint adjusted diluted EPS for 2024 (slide 11 of 47 of NextEra Q3 2023 Earnings Presentation). Against my projected annual dividends per share mark of $2.055, this is just a 61.7% payout ratio.

Risks To Consider

NextEra is a must-own utility in my opinion. Yet, it’s important to understand the company’s risk profile before buying.

As a regulated utility, NextEra faces regulatory risk. The Florida Public Service Commission has the ultimate authority to set base rates and decide cost recovery issues for the company. Although the Florida PSC has been friendly to NextEra Energy to date, there are no guarantees that will be the case forever. If the company had unfavorable rate case outcomes, its growth could be dampened.

Another risk is that NextEra’s operations could be disrupted by natural disasters like hurricanes and flooding. This could weigh on the company’s financial results in the near term. If NextEra’s insurance coverage is inadequate relative to damage done by natural disasters, the company’s fundamentals could also suffer in a more meaningful way.

Finally, interest rates remain a risk. If the Fed does decide upon further interest rate hikes, there could be more downside ahead for NextEra as the utility would become less attractive to some investors.

Summary: An Undervalued, Phenomenal Business With Exceptional Return Potential

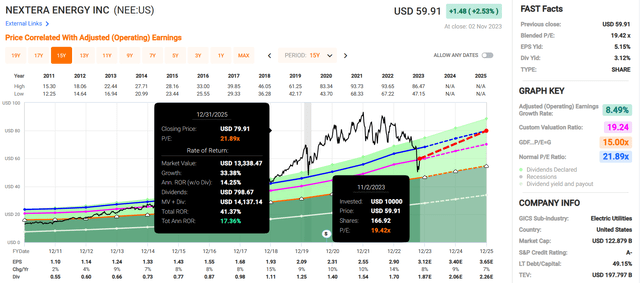

As we can see above, NextEra Energy appears to be discounted: The stock’s blended P/E ratio of 19.4 is less than its 15-year normal P/E ratio of 21.9. Yes, this was a period of predominantly lower interest rates that justified that higher multiple.

But as interest rates eventually move back down in the next 12 to 24 months, it wouldn’t be irrational to think NextEra could return to such a multiple. If the stock did, it could generate annual total returns of around 17% through 2025. Over 10 years, NextEra’s annual total return potential could be high as well at 12.5%. For these reasons, I like the stock quite a bit around $60 a share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NEE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.