Summary:

- I predicted that NextEra Energy stock could stage a remarkable recovery.

- I’m not surprised by NEE stock’s recent outperformance against the S&P 500.

- NextEra is a fundamentally strong renewable energy leader with a robust long-term backlog.

- NEE is well-positioned to capitalize on the surge in energy demand driven by AI data center buildout.

- While the valuation bifurcation in NEE has closed, the recovery is still early. I explain why you should let your winners run. Read on.

Justin Paget

NextEra Investors Can Finally Cheer

NextEra Energy (NYSE:NEE) investors who ignored the market’s whims and fancies over the past six months have been well-rewarded. I highlighted several times since NEE stock bottomed in late 2023 to avoid falling prey to the market’s pessimism. Investors who understand the fundamentally strong thesis of NextEra Energy’s proposition likely bought those moments aggressively. Investors who followed NEE’s price action closely likely assessed accumulation opportunities, even as sentiments seemed highly pessimistic (remember, markets typically bottom when people feel bearish, not bullish). As a result, NEE’s price action, strong fundamentals, and reasonable valuation offered investors a trifecta of factors to consider buying into the leading utilities sector player.

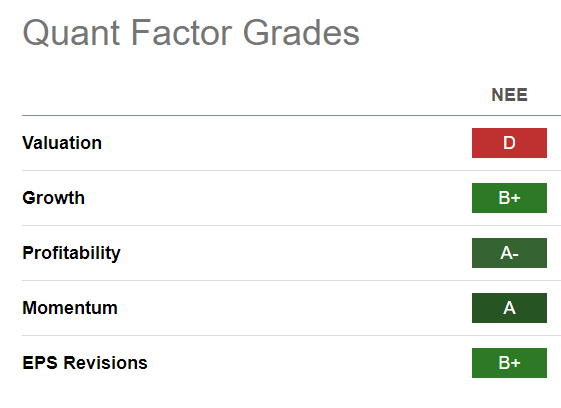

NEE Quant Grades (Seeking Alpha)

As seen above, buying momentum has returned with a vengeance to NEE stock as the market finally awakened to its folly of underestimating its bullish thesis and solid execution (“B+” earnings revisions grade). NEE’s “A” momentum grade was in the doldrums three months ago, marked with a tepid “D” grade. Therefore, NextEra Energy’s robust profitability likely attracted utilities investors to return quickly. The company underscored its ability to capture the surge in renewable energy generation and storage in the medium- to long term. As a result, I’m not surprised that NEE has significantly outperformed the S&P 500 since my previous bullish NEE article in March 2024. Consequently, given NEE’s market leadership in its sector, I gleaned that the market likely reallocated to battered utilities leaders like NEE.

NextEra posted solid earnings in late April. Furthermore, NextEra Energy’s Q1 earnings release demonstrated growth momentum in several long-term projects, lowering the execution risks in meeting NextEra’s adjusted EPS guidance through 2026.

Accordingly, NextEra posted an 8.3% growth in adjusted EPS in Q1, up from last quarter’s 2% uptick. Analysts’ estimates suggest a 7.4% growth in adjusted EPS for FY2024. Therefore, NextEra’s ability to produce profitable and sustainable high-single-digit earnings growth momentum should assure investors about its business model in a potentially higher-for-longer interest rate environment. Notwithstanding 2023’s relatively solid 9.3% adjusted EPS growth, NextEra’s bullish momentum was hit hard by the surge in interest rates as the Fed went on a rate hike rampage.

However, with interest rates likely peaked, bottom-fishing NEE investors who astutely bought aggressively late last year and earlier this year correctly anticipated its recovery. Take note that NextEra maintained its medium-term guidance of achieving “at or near the top end of adjusted EPS expectation ranges in 2024, 2025, and 2026.” NextEra management has also kept its confidence in achieving about 10% annual growth in dividend per share payouts between 2024 and 2026. Therefore, NextEra hasn’t wavered from its outlook, although the market environment and growth opportunities from the surge in data center energy demand have likely improved its execution clarity.

NEE Stock’s Recovery Is Far From Over

NEE remains reasonably valued relative to its long-term average. Accordingly, NEE stock is valued at a forward adjusted EBITDA of 13.8x, in line with its 10Y average of 13.8x. Hence, NEE’s valuation re-rating and relative outperformance merely closed the gap on its unjustified valuation bifurcation (since NextEra has maintained its outlook). As a result, I assessed that utilities investors have likely become more confident about NextEra’s execution capabilities as it continued to accrue projects to its long-term backlog.

Accordingly, NextEra’s Florida Power & Light segment added 1,640 MW in new solar capacity. NextEra Energy Resources grew its renewables and storage backlog by 2,765 MW in Q1. Notably, Energy Resources achieved its “second-best origination quarter ever,” underscoring significant growth momentum.

NextEra management also provided keen insights into the growth verticals, as NEE appears well-positioned to capitalize on the surge in renewable energy generation. NextEra “expects renewable generation to increase threefold or more to a capacity range of 370 to 450 gigawatts.” Key growth drivers include the proliferation of data center energy demand as enterprise AI workload and adoption broadens. In addition, the “trend of industry re-domestication to the US” is also anticipated to bolster the country’s electrification needs. Coupled with NextEra’s ability to monetize these projections profitably despite their long-duration nature, I assessed the market’s renewed vigor in NEE stock isn’t misplaced.

Notwithstanding my optimism, investing in leading utilities players like NEE isn’t without risk. FPL’s investigation on campaign finance violations has closed, mitigating the headwinds that affected clarity over its potential sanctions. FPL remains NextEra’s key profitability driver as the company ramps up its long-term projects in Energy Resources. Therefore, unanticipated and adverse changes in allowed ROCE in future base rate negotiations could affect NEE’s buying sentiments.

In addition, NEE stock trades at a discernible premium against its utilities sector peers. NEE is valued at a forward adjusted EPS multiple of 22.3x, well above its peers’ median of 15.5x. While it’s aligned with NEE’s long-term averages, the valuation premium could be prone to a derating if the market anticipates worse-than-expected execution risks moving ahead. Given its premium valuation, potentially significant changes intensifying the Fed’s hawkish positioning could impede NEE’s buying momentum, leading to a selloff.

Is NEE Stock A Buy, Sell, Or Hold?

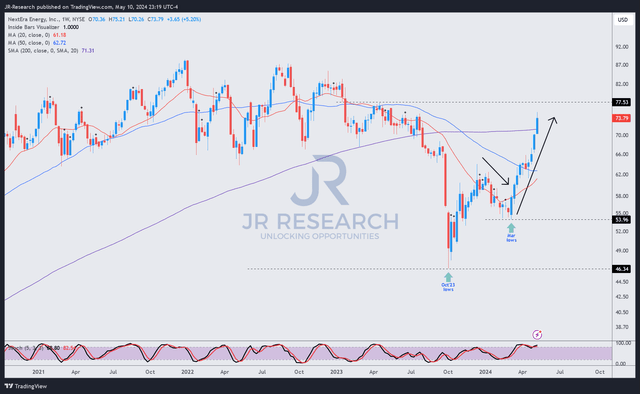

NEE price chart (weekly, medium-term, adjusted for dividends) (TradingView)

NextEra’s commitment to maintaining its dividend policy is pivotal to keeping income investors on its side. In addition, NEE’s robust growth thesis likely attracts growth investors looking to partake in its long-term secular opportunities in renewable energy generation and storage. Value investors who added aggressively to NEE’s battered opportunity in late 2023 aren’t expected to give up their positions.

As a result, I believe NEE experienced another robust accumulation phase as it bottomed out in March, preceding the remarkable surge over the past two months.

Given NEE’s increasingly constructive price action, a consolidation phase allowing profit-taking and reallocation could be near. I assessed the $78 level as another possibly stiff resistance zone that could attract selling pressure, leading to another selloff.

However, I also assessed NEE’s relative valuation as still reasonable, underpinned by its fundamentally strong growth story. With that in mind, I urge investors to capitalize on any possible selloff to add more aggressively, as the medium-term rally is considered far from over.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!