Summary:

- NextEra Energy has a track record of executing and delivering shareholder value in dividend growth and outperforming total returns.

- Therefore, it commands a premium valuation.

- Its relatively high valuation results in a lacklustre dividend yield of about 2.4%.

- From 2023 to 2026, it expects adjusted EPS growth at a CAGR of about 7%.

- Interest rate cuts in the future can spur higher growth, a higher valuation, and consequently higher total returns.

Sjo/E+ via Getty Images

NextEra Energy (NYSE:NEE) is a solid utility that has $159 billion of assets and approximately 65 GW in operation. Its clean energy generation portfolio provides predictable results with power delivery and transmission that are essential to the customers it serves.

The utility consists of two operating business segments. Rate-regulated Florida Power & Light (“FPL”) is the largest U.S. electric utility by retail MWh sales and customer numbers. It serves approximately 5.8 million customer accounts in Florida. NextEra Energy Resources (“NEER”) is a leader in wind and solar energy generation and battery storage. Its operating revenue mix is approximately 80% in FPL and 20% in NEER.

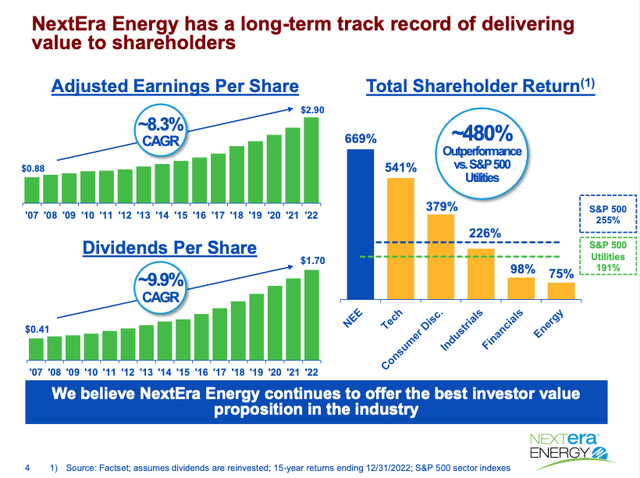

Track record of delivering value to investors

As expected of a quality utility, NextEra Energy has delivered a stable rate of earnings and dividend growth. Additionally, it has outperformed the U.S. stock market and the utility sector in the long run.

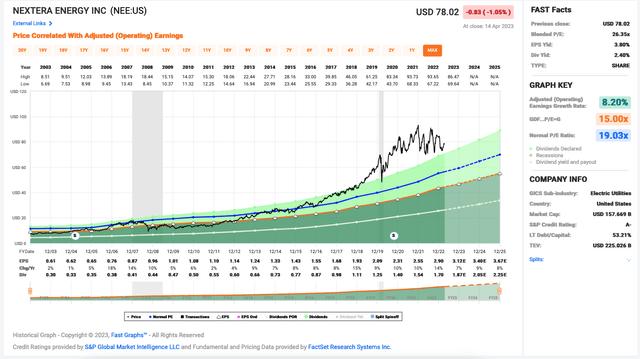

Specifically, in the past 15 years, NextEra Energy increased its adjusted earnings per share (“EPS”) at a compound annual growth rate (“CAGR”) of about 8.3%. In the period, it raised its dividend at an even higher CAGR of approximately 9.9% by expanding its payout ratio from roughly 47% to 59%. Simultaneously, it outperformed the S&P 500 (SPY) by 2.6x and the S&P 500 Utilities (SP500-55) by 3.5x.

Recent results

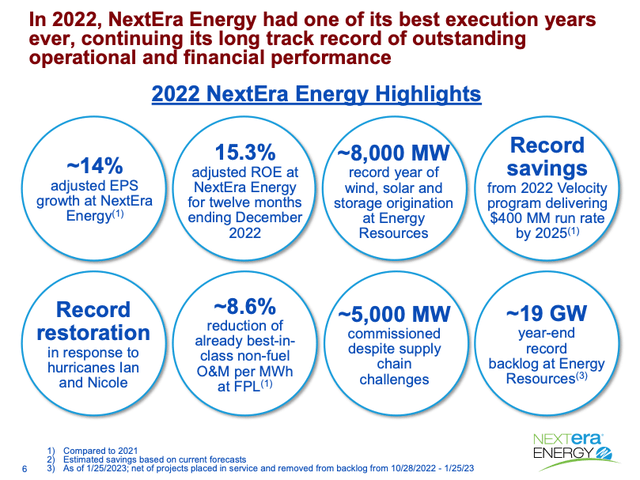

NextEra Energy last reported its Q4 and full-year 2022 earnings results on January 25. Specifically, for the year, operating revenues rose 23% to just under $20,956 million, while operating income jumped 40% to $4,081 million, as management kept good control of its operating expenses.

Ultimately, adjusted earnings rose 14% to $5,742 million, which resulted in the adjusted EPS also increasing close to 14% to $2.90. Year over year, the number of weighted average outstanding shares increased at a negligible percentage of about 0.35%.

Going Forward

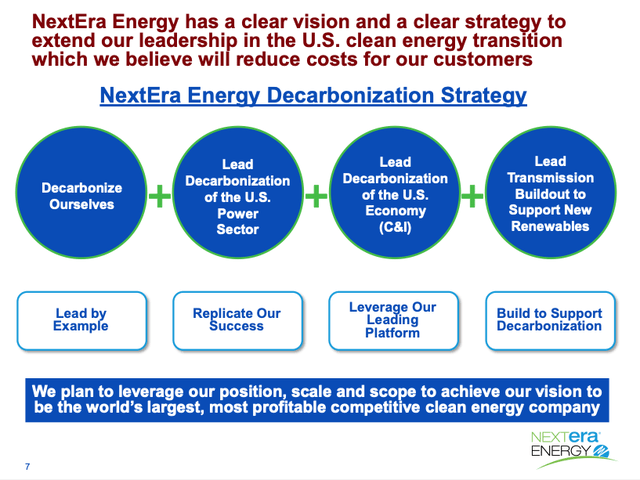

Decarbonization is the core of NextEra Energy’s journey. The utility is a good ESG stock for consideration.

FPL currently has about 33 GW in operation and $87 billion in assets. Management expects that the decarbonization of FPL will have no incremental cost to customers. As well, FPL presents almost 160 GW of investment opportunities (92 GW in new solar capacity, 50 GW in new battery storage capacity, and 16 GW of green hydrogen capacity).

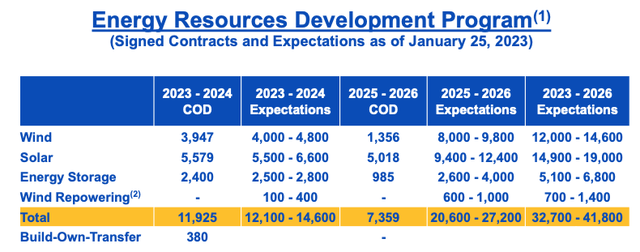

Today, NEER has roughly 30 GW of clean energy in operation (22 GW wind, 5 GW solar, 2 GW nuclear, 1 GW battery storage) and $71 billion in assets. It has foreseeable growth with approximately 19 GW backlog of signed wind, solar, and storage contracts. In fact, it anticipates to build about 33-42 GW of new renewables and storage projects from 2023 to 2026.

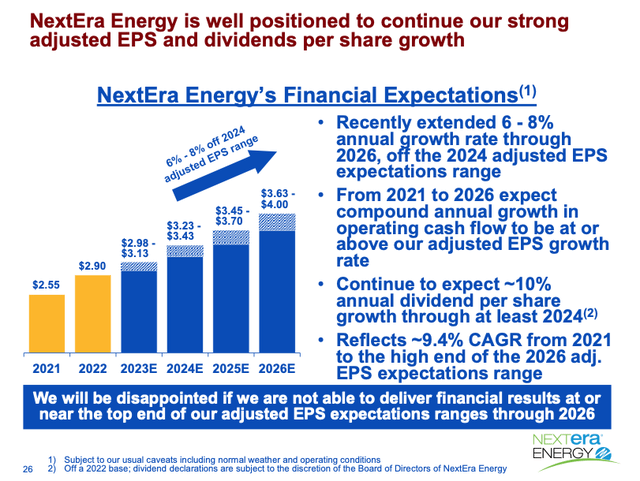

The utility’s latest updates suggest a midpoint adjusted EPS growth rate of approximately 7% through 2026. Although the company just raised its dividend by 10% in February and management stated that it expects to increase its dividend by about 10% for 2024 as well, based on its earnings projections, it’d be more conservative to assume a dividend growth rate that’s also around 7% for 2025 and 2026. If so, then, the target annual dividend payout in 2026 is projected to be $2.35.

Valuation and Returns Potential

Because of its quality and stable earnings growth, NextEra Energy stock commands a premium valuation. The graph below shows a premium price-to-earnings ratio (“P/E”) of about 19 from the starting year of 2003. The premium P/E jumped to about 20.5 in the last 15 years and about 23.5 in the last decade. The decade’s higher valuation was, perhaps, driven by lower interest rates and higher growth.

Of course, we’re now in a period of higher interest rates that could stay until a recession hits and the Federal Reserve decides to cut interest rates to stimulate economic growth. So, it’s difficult to assign a target P/E for the stock. Perhaps, based on its mid-point 7% adjusted EPS growth target through 2026, a target P/E of about 23 may make sense. If so, it suggests annualized returns of only about 5.5% through 2026. This estimated return is not good enough for most stock investors.

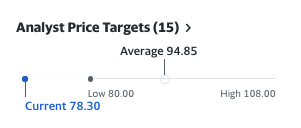

Yet, analysts are much more optimistic on the stock. Year to date, the stock down 6%. And at $78.30 per share at writing, analysts think the utility stock trades with a discount of about 17%.

Yahoo Finance

According to the analyst consensus 12-month price target of $94.85 the stock can appreciate 21% over the next 12 months. This implies near-term total returns potential of approximately 23.5% combined with its dividend yield of just under 2.4%. If materialized, that’d be a very good return on an investment in a defensive business.

Investor Takeaway

Looking at NextEra Energy’s track record of delivering above-average returns and dividend growth, it is the kind of quality and predictability that investors want from a utility stock in their diversified investment portfolios.

Unfortunately, because of this, versus the U.S. stock market being up ~7.5%, NEE still trades at a premium valuation despite falling 6%. It also provides a lacklustre dividend yield of roughly 2.4%. My estimated returns of the stock are low. However, a reversion of interest rates can quickly turn the table and spur higher growth for the quality utility. As such, I’m more inclined to rate the stock as a “Hold” than a “Sell”.

Interested investors should look out for NextEra Energy’s Q1 earnings report that’s expected to be released on April 25.

References

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: This article consists of my opinions and is for informational purposes only. Please do your own research and due diligence and consult a financial advisor and or tax professional if necessary before making any investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.