Summary:

- NextEra Energy’s investments in renewable energy facilities are expected to yield significant long-term profits, particularly in Florida.

- The company’s high leverage condition and negative free cash flow over the past six years raise concerns about its financial stability.

- Due to uncertainties surrounding commodity prices and inflation combat through increased interest rates require management to focus on leverage risks and improving liquidity conditions.

Sakorn Sukkasemsakorn

Introduction

NextEra Energy (NYSE:NEE) is a leading provider of electronic power and energy infrastructure in the United States and Canada, with a strong presence in the renewable energy industry. The company’s primary businesses include FPL, one of the largest electric utilities in the U.S., serving approximately 5.8 million customers with a focus on delivering clean energy and exceptional customer service. NEER is another major division, boasting the world’s largest renewable energy generation capacity from wind, solar, and battery storage. NextEra Energy’s ultimate objective is to outperform its competitors by meeting customers’ needs more efficiently and dependably.

NEE’s business outlook

In recent years, the management has focused on strengthening FPL and NEER businesses. One growth opportunity that has been pursued is the acquisition of Gulf Power Company, an electric utility company that is involved in the generation, transmission, distribution, and sale of electric energy in Florida. The aim is to lower costs and improve efficiency in both FPL and NEER businesses. In this regard, the Inflation Reduction Act (IRA) signed in 2022 will extend wind and solar tax credits to support more renewable technologies. This will provide long-term support for the growth of NEE’s businesses

To analyze NextEra Energy’s financial structure, I prefer to investigate its principal businesses separately: FPL and NEEL. FPL is the largest electric utility in the US, providing electricity to approximately 12 million people through 5.8 million accounts. In the first quarter of 2023, FPL’s net income was $1070 million, which is a 22% increase year over year compared to $875 million in the first quarter of 2022. This surge in net income was mainly driven by FPL’s investments, with capital expenditures of around $2.3 billion in 1Q and an expected reach of $8-9 billion by the end of 2023. These capital expenditures have led to some strategic movements, such as placing 970 megawatts of new solar and adding to their existing solar portfolio of 4,600 megawatts, making it the largest solar portfolio in the United States. Additionally, their 2023 plan includes providing 20,000 megawatts of new low-cost solar capacity over the next ten years. As a result, by 2032, about 35% of their energy will be generated from cost-effective solar generation compared to only 5% at the end of 2022.

Regarding NextEra Energy’s NEER business, which is the competitive clean energy business, earnings for the previous quarter ended at $732 million, up from $628 million in the prior-year quarter. Similar to FPL’s business structure, Energy Resources is focused on investing capital in new renewables and strong origination. In the first quarter of 2023, they added approximately 2,020 megawatts of new renewables and storage to their backlog, including an increase in solar, storage, and wind. In addition to these improvements, Energy Resources has acquired a portfolio of gas-to-electric facilities to further strengthen their operating portfolio. Expanding their portfolio of renewable natural gas assets is a long-term investment that will lead to ample returns for the company.

Renewable energy is expected to continue its growth in the United States, with a projected increase in market share. By 2023, renewable energy is expected to provide 23% of the U.S. energy market, rising to 26% by 2024. This represents a significant increase from the 22% share in 2022. The rise of renewable energy will likely lead to a decline in fossil fuel shares due to lower operating costs for wind and solar energies. However, the extent of electricity consumption in the industrial sector will depend on wider economic conditions. The U.S. real GDP is projected to grow by an average of 1.6% throughout 2023 and 1.8% in 2024.

NEE’s financial outlook

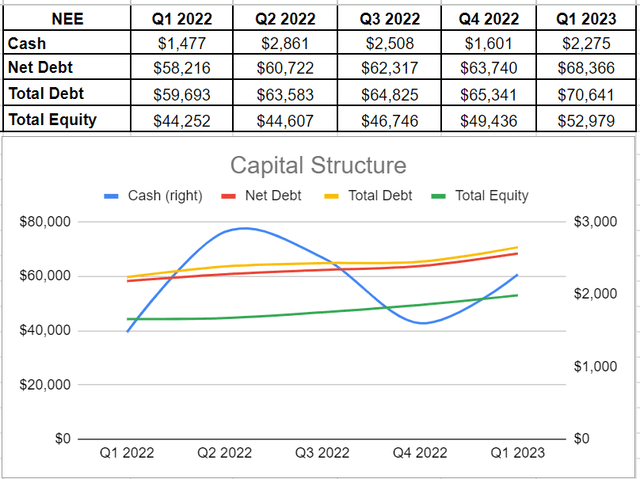

After conducting a thorough investigation, it is evident that investing in renewable energy facilities for the long-term will yield significant profits, as evidenced by Florida’s rapid growth. However, I have reservations about NextEra Energy’s leverage and cash conditions. In the first quarter of 2023, NEE generated $2.2 billion in cash balance, indicating a 54% increase compared to the previous year’s comparable quarter of $1.4 billion. While their equity level improved by 19% over the past year and reached approximately $53 billion. On the other hand, they increased their debt financing during the same period, resulting in a net debt of $68.3 billion in 1Q 2023. This amount is significantly higher than the same quarter of 2022 when it was $58.2 billion (see Figure 1).

Figure 1 – NEE’s capital structures (in millions)

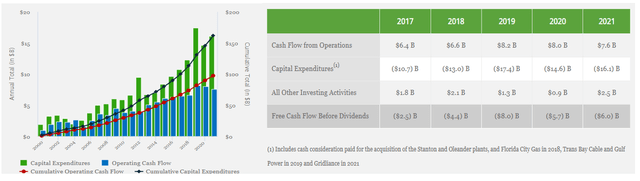

Additionally, NextEra Energy’s cash structure reveals that both cash from operating activities and capital expenditures have been increasing, with capital spending growing at a faster rate. Consequently, this has resulted in negative free cash flow over the past six years. In the first quarter of 2023, NextEra Energy’s net cash provided by operating activities was $1,962 million, while their cash used in investing activities was significantly higher at $4,693 million. Although NextEra Energy’s investments in renewables and diversified portfolio are expected to yield profitable operations in the long-term, it is important to consider companies with strong financial standings during these uncertain economic times caused by the COVID-19 pandemic and rising interest rates to combat inflation. Furthermore, according to S&P Global Ratings, one of the key risks associated with NextEra Energy is their high capital spending which may result in negative discretionary and free cash flows. This issue could lead to challenging financing conditions and increase the risk of fluctuating commodity prices in the coming years (see Figure 2).

Also, the management outlooks for the next few years are to increase their adjusted EPS to the range of $2.98 to $3.13 in 2023 and $3.23 to $3.43 in 2024. When looking ahead, their adjusted EPS is expected to grow by 6% to 8% in 2025 and 2026. Also, they have targeted to grow the dividend payment by 10% every year.

Figure 2 – NEE’s cash structure

NEE’s cash flow quality and leverage

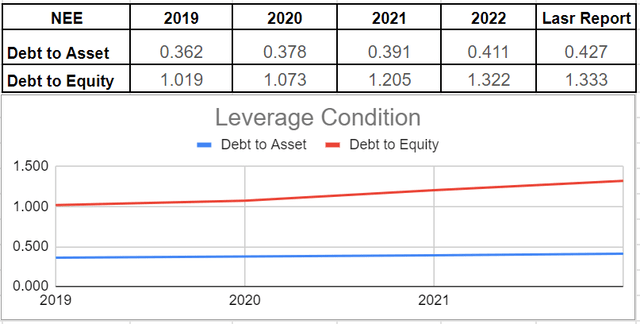

Upon analyzing their cash and capital structures, it comes as no surprise that their leverage ratios across the board of debt-to-asset and debt-to-equity ratios have increased in recent years. Figure 3 illustrates that NEE’s debt-to-asset ratio has been steadily rising and reached 0.42x in the previous quarter, the highest level since 2019. Additionally, their debt-to-equity ratio of 1.33x indicates a high level of leverage. These ratios provide a clearer picture of the company’s capital structure, which is largely financed by debt.

Figure 3 – NEE’s leverage condition

Conclusion

In this analysis, we thoroughly examined NextEra Energy’s business structures within FPL and NEEL businesses, both of which aim to provide customers with lower costs and increased efficiencies. During the first quarter of 2023, FPL, the largest electric utility in the US, made significant investments in its solar portfolio. Similarly, Energy Resources has focused on investing in renewables and strong origination. Despite profitable investments in renewable energy, NextEra Energy’s high leverage condition leaves me neutral about their stock. While positive macroeconomic conditions, supportive commodity prices, and affordable capital access will likely lead to fast-paced improvement under normal operating conditions, uncertainties surrounding commodity prices and inflation combat through increased interest rates require management to focus on leverage risks and improving liquidity conditions. Therefore, I recommend a hold rating for NEE stock.

Please share your thoughts about NextEra Energy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.