Summary:

- NextEra Energy is positioned to benefit from AI, electrification, and reshoring trends in the United States.

- Lower than expected fiscal 2027 EPS guidance led to a share price drop, but the long-term growth potential remains strong.

- NEE outlined its advantages and positioning in its annual investor conference presentation.

- The company’s scale, experience, and technological capabilities make it a solid investment for long-term shareholders.

4kodiak

Investment Thesis

We might be coming upon a new era of power generation in the United States, driven by artificial intelligence (AI), electrification, and reshoring. I believe that AI will deliver winning businesses and stocks for years to come, but the winners will come in stages, NextEra Energy (NYSE:NEE) appears to be positioned to be one of those winners. After catching a boost in share price from the early AI hype, some analysts have scaled back estimates of the company’s growth potential following its recent investor conference. It’s important to remember that not all companies will experience revenue inflection at the same point in time, but I believe that NEE will have its day in the sun. In May, UBS highlighted NEE and other stocks as ways to gain access to the generative AI trend. I agree with UBS, but think that the gains NEE will experience are going to be less accelerated but very long-lived.

On Tuesday, June 11th, 2024, NEE held its annual investor conference and released FY 2027 EPS guidance that did not meet consensus analyst’s expectations, sending the stock down over 5% during trading. I think analysts were anticipating too much growth to be pulled forward in the first few years of the AI hype cycle. Now that the stock has been downgraded, it’s time to see whether this is warranted.

Despite the near-term setback, it’s important to note that power load demand from modern data center buildouts, industrial electrification, and reshoring will likely increase the opportunity for NextEra. That growth might be backloaded beyond 2027, which is beyond the three years that NEE has guided for. I believe that NextEra still has a long tail for growth in renewables in the years ahead, and overall load demands should support this. NextEra appears to be well-positioned for this growth.

Key Points From The Conference

The following information and slide images come from the NextEra Energy Investor Conference that took place on June 11 th, 2024. I have added some of my opinions to this and have clearly stated which opinions are mine; all else is from the conference or general industry information.

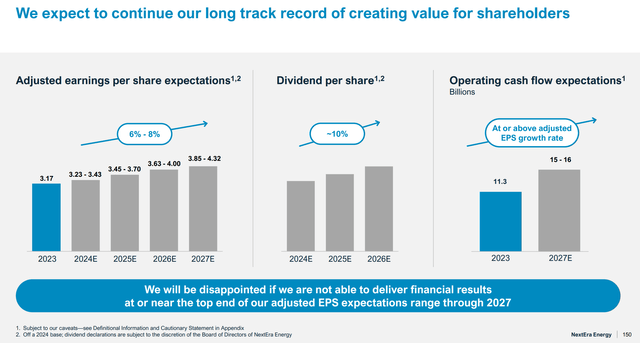

NextEra CEO John Ketchum started the conference by highlighting the company’s outperformance of its objectives laid out during the 2022 investor conference. NEE surpassed its goal of 6% to 8% adjusted EPS growth and 10% dividend per share growth by achieving a greater than 11% adjusted EPS CAGR and matching its DPS growth objective of 10%.

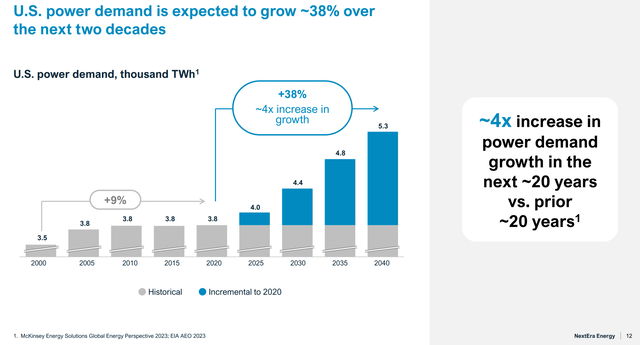

During the conference, Ketchum outlined NEE’s strategic vision, viewing the present time as an inflection point in the U.S. power market. Over the next two decades, U.S. power demand is projected to grow by 38%, which is a 4x increase in growth compared to the last two decades. The primary drivers of this growth are expected to be data centers, industrial electrification, and reshoring, all of which NEE is strategically positioned to capitalize on.

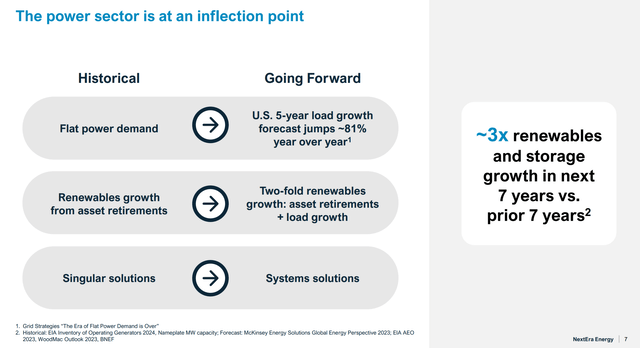

This inflection provides a two-fold opportunity for NEE. First, higher cost, lower efficiency equipment will be retired due to age or operating costs. Modern grid technology requires a more interconnected approach than the legacy grid technology that will be replaced. According to the company, a lot of this will be replaced with renewable energy equipment and storage, which will allow NEE to provide systems solutions as replacements for singular assets. Second, overall load growth from high-performance computing and data center proliferation, industrial electrification, and reshoring provides a volume component for NEE.

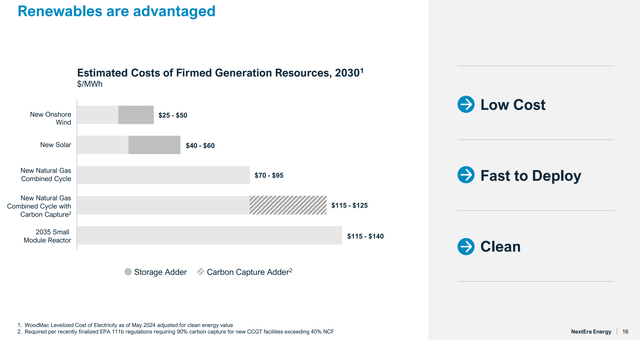

Ketchum said the shift toward renewables is supported by lower total costs and quicker time-to-market capabilities. Natural gas is a bridge fuel, but the cost of building and deployment times for pipelines and other gas infrastructure are substantial. He highlighted the Mountain Valley Pipeline impediments and stated that “Gas pipeline capacity only works in a handful of states in this country.” Additionally, nuclear energy is a very long-term solution, with significant regulatory hurdles, and may not fill the gap needed for power generation for quite a while. The chart below shows NEE’s projected total costs for different forms of power generation. These factors make renewable energy at large scales particularly attractive for utilities. It will also potentially be a way for increased demand to be solved in short order, as natural gas and nuclear projects will take far longer to begin and complete than solar and storage projects.

Industrial electrification is being driven by necessity, cost, and environmental purposes. Reshoring is driving increased investments in the domestic production of semiconductors, various chemicals, medical equipment, and electronics. During the conference, Ketchum cited the $200 billion in new data centers investments being made by Microsoft (MSFT), Alphabet (GOOGL) (GOOG), and Meta (META). Amazon (AMZN) was not mentioned, but they are also a big contributor of data center investment dollars. To me, it’s easy to see that all these data centers are going to need power supply, water for cooling purposes, and smart designs to improve cost-efficiency. NEE can offer end-to-end solutions for its customers looking to build data centers, helping them from the siting and designing process through to the long-term power generation contracts. Further explanation?

Over the next seven years, renewables are expected to grow at roughly 3x the rate they have over the past seven years. I agree with NEE, as the largest renewable company in the USA, the company is well-positioned for this gradual and long-lasting shift towards renewables. Its experience and scale make NEE the perfect partner for utilities. As one of the premier utility companies in the U.S., NEE has proven that it has the knowledge to operate more efficiently than most others. This knowledge enables the company to build better systems for utility companies, making NEE a perfect partner for them.

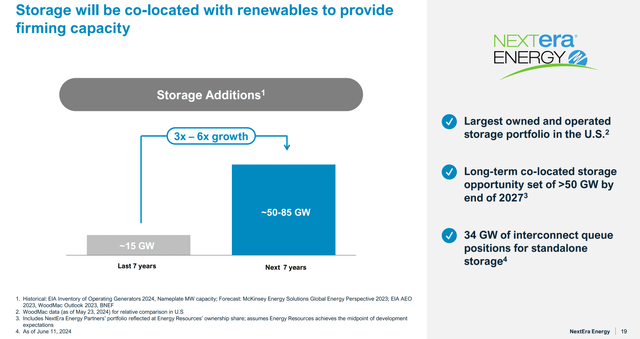

The renewables tailwind also appears to provide a network effect of sorts. As renewables grow, especially solar, battery storage will grow along with it. NEE expects 3x – 6x the growth rate over the next seven years in combined battery storage system additions.

NEE’s Moat

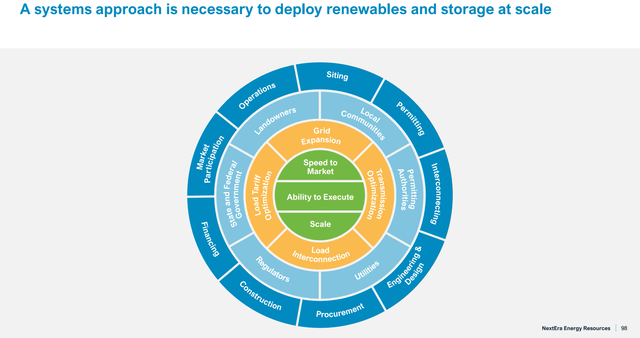

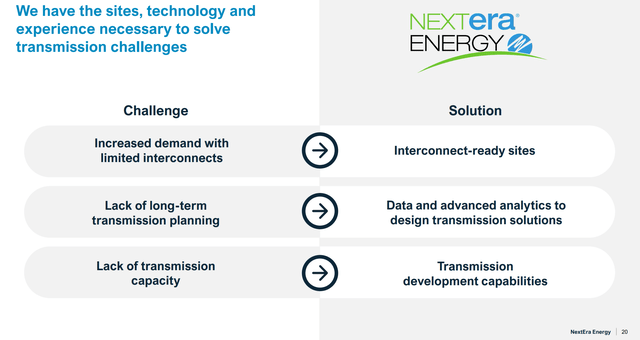

NEE says its long-term competitive advantages enable the company to be better positioned for success, as its advanced technological capabilities, interconnect-ready sites that improve its speed-to-market abilities, advanced analytics to identify and develop the best sites for its assets, and design solutions and development capabilities separate it from the competition. The company shared this slide illustrating the systems approach it believes is necessary to deploy renewables and storage at scale. NEE is able to fulfill or facilitate every aspect on the outer rim of this process, from siting and permitting all the way to designing, financing, and operating the assets.

NEE highlighted its systems approach (NEE Investor Conference)

This is why the company is able to be the partner that other utilities need to modernize their power grids and meet environmental goals. This is evidenced by recent deals with Entergy, and in California.

NEE’s solutions (NEE Investor Conference)

During the conference, Ketchum confidently told the crowd that

“Scale matters more than ever before in this industry…no one can match our scale…and our scale advantages grow every day.”

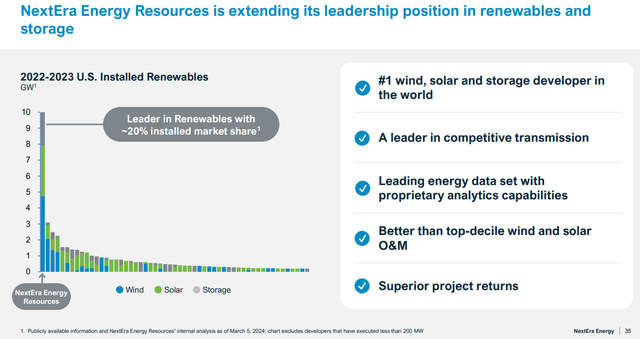

NextEra is far and away the leader in renewables, with a 20% installed market share. Its ability to do this cost-effectively and save its customers money is evidence that the company can do this effectively and at scale, when done the right way. Because of the heavy capital investments required to do this, its market-leading position and experience designing and operating systems for hyperscalers and other utility companies acts as a very strong competitive advantage, and its positioning as part utility and part renewable energy company gives it a moat that will be difficult for competitors to cross in my opinion.

NEE – Renewable market share leader (NEE Investor Conference)

FPL – The Utility Business

Florida Power and Light (FPL) is rebuilding itself around solar and battery storage and leveraging new tools and processes to combine automation, analytics, robotics and generative AI to drive out costs, build cheaper, and operate more efficiently. Of course, FPL already does this, as evidenced by its customers paying roughly 40% less than the national average. It has already been leveraging AI to pick the best sites and improve technology and design for years.

Florida’s GDP is expected to grow 44% between 2023 and 2040 and the state’s population is expected to grow around 45% over that period. NEE has significant upfront costs and a growing base of customers who have no choice but to turn to it for power. This will allow it to take advantage of operating leverage, and supports continued profit growth.

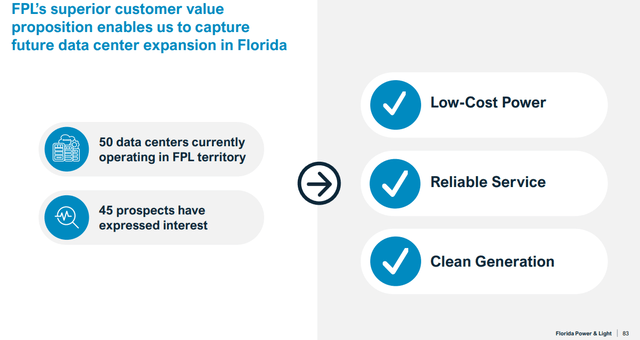

FPL has a huge opportunity for data center growth in Florida in the coming years. Its current data centers are significantly smaller in size than the projects in the pipeline. These projects are expected to come online in the second half of the decade.

These data centers are likely to come with far more than power generation revenues for the company, as NEE is a partner with hyperscalers and is likely to be intricately involved in the design and planning process with these companies. These hyperscalers will benefit from NEE’s ability to identify the best locations for their data centers. These companies can also utilize NEE to help meet corporate environmental initiatives by ensuring that these locations are in close proximity to clean water and renewable sources of electricity. During the presentation, Petter Skantze, Vice President of Infrastructure Development, talked about how hyperscalers no longer come to NEE with their data center designed and its location picked out, they turn to NEE to help them design and build it with them.

NEE Data Center Growth Opportunity (NEE Investor Conference)

The Forward Outlook

During the presentation, it was stated that these data center projects aren’t expected to come online until the second half of this decade. I take that to mean the second half of the remainder of this decade, meaning the positive impact to NEE’s financials might not come until after fiscal 2027. Going back to the reason for the recent decline in share price following disappointing fiscal 2027 EPS estimates, it seems that analysts may be doubting or underappreciating the long-term opportunity the company has. EPS is expected to grow 6%-8% for the next three years, what if there is an earnings inflection starting in 2028 or 2029? I think this is possible, which is very bullish for long-term shareholders.

Regarding overall FPL growth, the population and GDP growth expected in Florida may support the company’s heavy investments in capex. The ability to maintain the typical FPL consumer’s energy bill 40% lower than the national average is both evidence of FPL’s & NEE’s ability to operate better than its peers, and an advantage when it comes to profits. In my opinion, a utility company that benefits the community through lower prices, is more likely to get extra leeway to make profits when rates and profit levels are being negotiated with state regulators.

My Opinion On NEE

During the conference, management from the company spoke a lot about how its scale advantages, experience, and its technological prowess are advantages. I share the belief that scale and experience allow NEE to be well-positioned for success during the long and gradual shift toward renewables. It was mentioned during the conference that thinking the USA will run out of power is probably a little far-fetched, but that new power generation assets will be a required part of meeting the demand for this power. The ability to utilize systems thinking and designs rather than singular approaches is something that NEE excels at and something that will likely be needed for the buildout of data centers and more efficient and cost-effective electricity solutions for a growing Florida and electrification of industry nationwide.

The regulated utility business, FPL, and the development side from NextEra Energy Resources seem to be synergistically beneficial to each other. The utility company side gives NEE a huge customer base and makes it the go-to player in power within Florida. It also provides for stable cash flows and superior credit availability. The Resources business allows NEE to chase high growth projects and serve utilities and businesses that need to complete large long-tailed projects, some of which provide opportunities for FPL to grow its business.

Valuation

During the conference, NEE laid out its 3-year growth estimates. The company is expecting to grow adjusted EPS in a range of 6% to 8% annually, and its dividend per share at a rate of 10% annually. They highlighted how the company would be disappointed to not deliver results at the top end of this range, giving me reason to believe this guidance might be conservative.

NEE Growth Estimates 2024-2027 (NEE Investor Conference)

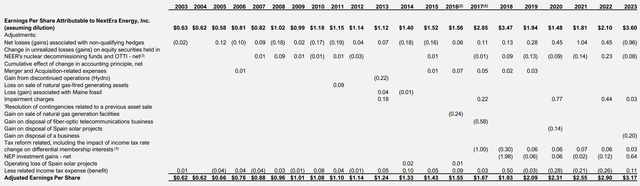

Over the last twenty years, NEE has delivered GAAP diluted EPS and adjusted EPS growth CAGR’s of 9.1%, and 8.5%, respectively. With data center growth, electrification of industries, a push for reshoring and population growth in Florida, NextEra seems likely to continue its past growth trajectory and an 8% CAGR over the next ten years seems reasonable to me.

NEE Historical Growth (NEE Investor Conference)

Valuation Model

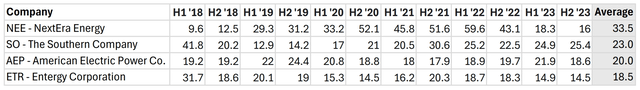

I used a price-to-earnings exit multiple for valuation purposes. NEE has historically traded at an average premium TTM P/E multiple, but I do not expect the stock to trade in its average range of 33.5x. A range of 15x to 20x might be realistic going forward.

NEE Valuation Comps and Average P/E (Data from FinChat)

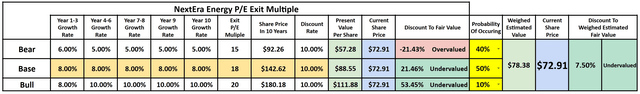

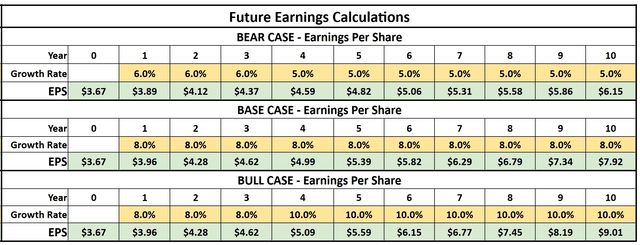

For my base case, I am using 8% as EPS growth rate over the next ten years and a P/E exit multiple of 18x. Management appears to be confident in the 8% growth rate for the next three years, and I have already outlined reasons to believe that demand will be maintained or grow beyond then. If the full effect of reshoring, electrification, population growth and data center buildouts take place, we could see growth inflect higher within a few years, which might provide more support for my bull case.

For my bull case, I am modeling an 8% growth in EPS for the next 3 years, and a 10% EPS growth from years 4-10. The P/E exit multiple used for the bull case is 20x.

For my bear case, I am using the lower end of NEE’s guidance for EPS growth, 6% annually for years 1-3, then lowering EPS growth to a 5% CAGR for years 4-10 and using a P/E exit multiple of only 15x.

I believe the base case is very reasonable and give it a 50% probability, while the bear case gets a 40% for conservatism, and the bull cases gets a 10% probability.

NextEra Valuation (Author-generated exit multiple model) Exit Multiple Calculations (Author-Generated Model)

Given these assumptions, the stock could be undervalued by about 7.5%.

Valuation models are inherently flawed, and mine will not be accurate. However, it shows the potential for NextEra to be a reasonable investment case that might favor long-term investors.

Risks

Debt Risk

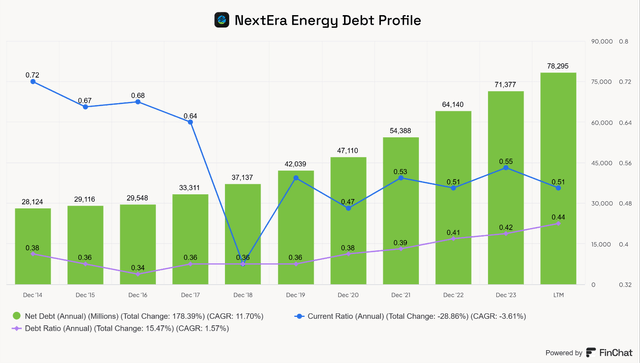

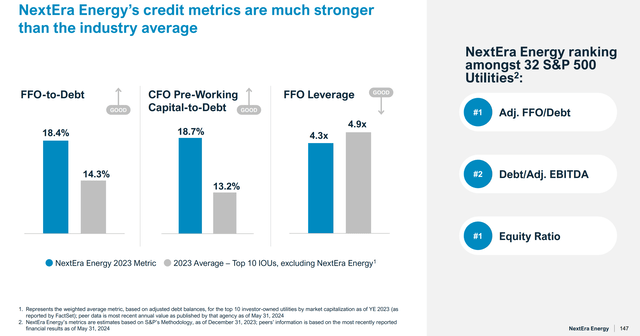

Debt is the biggest risk to NEE’s investment case. The company has been taking on debt to fund growth in renewables. However, there are many factors that lessen the risk of this debt, such as stable revenues, long-term power purchase agreements, and federal tax credits that the company strategically targets. The debt ratio has increased steadily, showing the company’s growing reliance on debt for its growth. The current ratio has been improving since 2018. NEE’s net debt has grown faster than earnings, at a rate of 11.7% annualized since 2014. At some point, the debt levels will have to start decreasing.

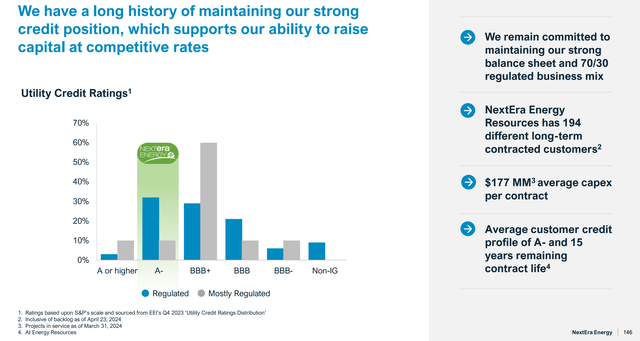

During the investor conference presentation, NEE emphasized its strong financial standing by pointing out its relative ranking in the utilities sector.

NEE has strong credit ratings (NEE Investor Conference)

Additionally, NEE has an A- credit rating, bolstered by its 70/30 regulated business mix, long-term contracts, and the credit ratings of its customers. I don’t worry about NEE’s debt profile.

Lack Of Adequate Growth In Renewables

The main debt and credit risk would come from growth in renewables adoption falling short of expectations and not supporting the company’s investments. The return on NEE’s investments in growth is dependent on renewables adoption. As long as the growth in load demand occurs as expected, renewables appear to be a large factor in meeting that demand.

Conclusion

The pullback in the stock price might be a case of somewhat short-sighted thinking and should not overshadow the stock’s long-term potential. I think long-term investors should consider looking past medium-term projections and to the long-term outlook for NextEra. The sun may shine on investors who trust in the long-term objectives laid out by NextEra’s management during the investor conference. Demand for data centers, reshoring, electrification, and growth in Florida should provide NEE with plenty of room to maintain high-single-digit EPS growth and potentially even greater growth than that. For long-term shareholders, I consider the stock a buy, but perhaps not a screaming buy. Any significant pullback in share price might represent a strong buy opportunity

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NEE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I do not intend to add to my position in NextEra within the next 72 hours. I may do so at a later date if the price is right.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.