Summary:

- Rising interest rates and changing energy fuel prices have slowed down demand for renewable power in the utilities sector.

- NextEra Energy, Inc., the largest U.S. utility stock, has seen its share price rebound after experiencing losses earlier this year.

- NextEra Energy’s focus on renewable power is not vastly different from its peers, but it is transitioning, with a significant portion of its capital expenditure going towards solar and wind.

- NextEra Energy’s valuation premium to its peers is difficult to justify, even if we account for its higher EPS growth outlook.

- Overall, utility stocks appear overvalued compared to inflation-indexed bonds, with NextEra’s premium being particularly excessive.

Justin Paget

The utilities and renewable power industries have experienced increased volatility recently, as rising interest rates and changing energy fuel prices pressure the electricity market. For the most part, we’ve seen a slowdown in demand for renewable power stemming from higher capital investment costs. This change has negatively impacted major utility-scale renewable companies like NextEra Energy Partners, LP (NEP). It has arguably led to draw-downs for Dominion Energy (D) and others. The utility sector, seen in The Utilities Select Sector SPDR® Fund ETF (XLU), was the worst-performing sector, with losses led by NextEra Energy, Inc. (NYSE:NEE).

In 2021, I published a bearish outlook on NEE, citing overvaluation and anticipating a growth slowdown. After losing 36% of its value by March of this year, I upgraded my view to neutral, believing NEE was fairly valued. Since March, it has skyrocketed by 40%. Thus, although little time has passed, I believe NEE’s immense short-term performance warrants an updated outlook.

NextEra Energy and the Future of Renewables

The utility sector has been the top performer over the past three months, with a ~15% return. NextEra Energy is the largest holding in the utilities ETF XLU at 14.7%, nearly twice as high as the second-largest, The Southern Company (SO) at 8%. This stems both from the valuation premium on NEE and its scale.

NextEra Energy differs from the other major utility giants due to its focus on renewable power. That said, I feel there is often a great deal of emphasis on its investor marketing surrounding renewable energy, but not necessarily the facts of its business. For example, most of its power comes from natural gas at 45% of the total. Nuclear accounts for 22%. Roughly 26% comes from wind, but only 6% from solar. Thus, in reality, its mix is not vastly different from its peers, particularly as Duke, Dominion, and others plan their own renewables projects. It is undoubtedly a leader, but it is becoming less unique as time passes. Still, NextEra is focused on transitioning, with ~37% of its NEER CapEx (its renewables business – see 10-Q pg. 33) going to solar and ~26% to wind.

I believe this transition will only occur so long as it is economically feasible. Further, investors should not expect to benefit from these investments unless that is true. Theoretically, the ROI of renewables can be better than that of fossil fuels and nuclear. Onshore wind has the lowest levelized cost of power estimate, at a mid-range of $89/MWh (including storage). Solar’s is $135/MWh (with storage). Nuclear’s is $182/MWh, while natural gas’s is lowest at $76. That said, solar and wind are more affordable if the storage issue is not accounted for, with onshore wind having an absolute minimum cost of $27/MWh without storage.

Of course, we can look at these data points in different ways. Across the board, the primary difference between fuel-generated power and renewables is the more significant storage needs for renewables and higher labor needs for fuel-generated power. Coal and gas have comparatively lower upfront costs and high overhead. Nuclear has extremely high labor overhead. Solar and wind have exceptionally high upfront costs but very low labor overhead. For this reason, high interest rates discourage renewable investments, causing a disproportionate increase in capital financing costs. However, general wage inflation benefits renewables, owing to the rising labor shortages in the traditional utilities industry.

Still, with financing costs much higher today and natural gas prices so low, likely, natural gas investments are likely more profitable than wind and solar. However, I believe it remains possible that the long-term ROI of wind and solar will be superior due to the likelihood of a continued rise in labor and commodity costs. As I pointed out regarding NEE’s Limited Partnership company, NextEra Energy Partners, higher solar and wind financing costs are offset by a ~50% decline in solar panel prices, stemming from stagnant US demand and immense overproduction from China.

Thus, I would not argue that NextEra Energy is necessarily at a competitive disadvantage due to its significant solar and wind investment spending today. That said, unlike many, I do not believe NEE is necessarily at a competitive advantage either, as natural gas investments likely have a superior payoff, and that may remain the case for years to come, given natural gas is so cheap today, and its financing costs are lower.

What is NextEra Energy Worth Today?

Given this, I do not believe NEE should trade at a premium to its peers, which are also making wind and solar investments. Further, the utility sector should not trade a significant premium to bonds, given they’re income-oriented investments with minimal organic growth potential.

In addition, utilities, including NEE, are exposed to political risk amid allegations of misconduct regarding its former managers and the ongoing backlash against electricity rate hikes for Florida Power and Light (NEE’s subsidiary) from the state’s electricity regulators. Utilities earn a monopoly profit, largely determined by politicians’ willingness to allow them to increase rates. Recently, more utility regulators have pushed back against rate increases as voters become concerned regarding rising electricity prices.

This issue has faded over the past year as electricity inflation stagnated amid lower natural gas prices. Still, it will likely return, given utility infrastructure investment needs stemming from the aging energy grid, exacerbated by higher labor and capital costs. In other words, virtually all US utilities need to invest more significantly into their infrastructure investments but cannot do so without losing profits or increasing rates. Regulators, facing pressure from voters struggling with inflation, are not allowing rate increases as much as in the past. This has been a back-and-forth issue for NEE’s FPL, again bringing it into a state supreme court case.

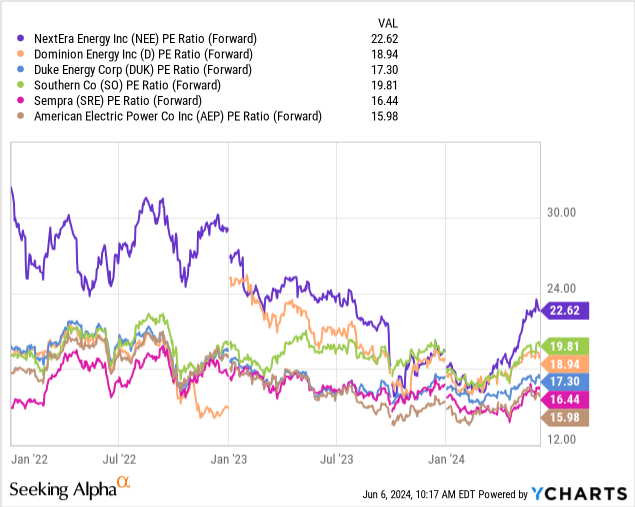

From a valuation standpoint, NEE is significantly more expensive than its peers. Its forward “P/E” ratio is 22.6X, compared to its peer median of 17.3X, giving it a 30% premium. This premium was much lower when I published my neutral outlook on the firm months ago, but is now much larger. See below:

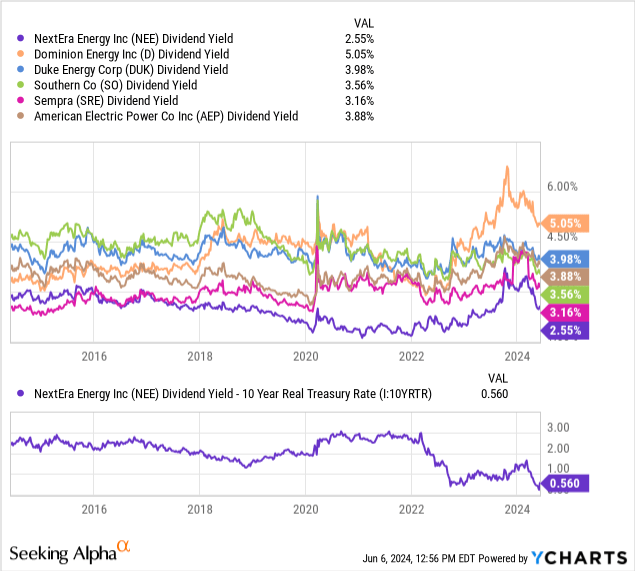

This premium is also realized in its dividend yield, which is just 2.55% compared to a peer median of 3.56%. NEE consistently has a lower yield than its peers, stemming from expectations of higher earnings growth. That said, we must remember the potential that renewables will not deliver the same ROI they had in years past or that their peers will continue to develop similar projects. Crucially, NEE’s dividend yield compared to real interest rates is extremely low, indicating it is also at a high premium to bonds. See below:

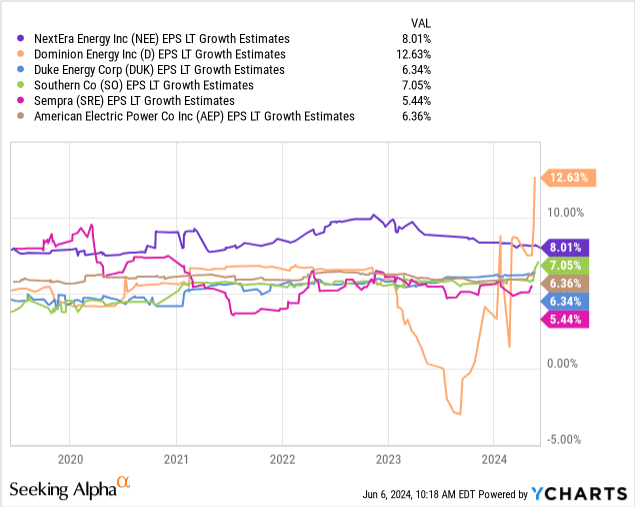

I compare utility dividend yields to real interest rates, as both will likely see their payments rise proportionally to inflation over time. Before 2022, there was a relatively consistent premium among most utilities to real Treasury bond rates. However, as real rates have risen, we have not seen a proportional rise in utility dividend yields. To me, that is one indication that utilities are generally overvalued, particularly when political pressures may halter their ability to raise their dividends as fast as inflation. However, most analysts expect utilities to increase their income faster than inflation in the coming years. See their EPS growth expectations below:

This metric allows us to adjust forward “P/E” valuations for growth expectations. Higher EPS growth allows for larger valuation multiples. For example, assuming NextEra will indeed grow its EPS at an 8.1% pace for the next three years, we can extrapolate a 26.3% three-year ahead EPS level. Thus, its forward “P/E” based on three-year expected EPS would be about 17.6X (or 22.6/1.263).

Using the same math, we get an adjusted three-year ahead forward “P/E” of 16.1X for Southern (22.6% expected growth), 16.5X for AEP (20% growth), 14.4X for Duke (20% growth), 14X for Sempra (17% growth), and 13.2X for Dominion (43% growth). Thus, even adjusting for expected growth, NextEra has a ~19% premium to its peers, with a three-year growth-adjusted average forward “P/E” mean estimate of ~14.8X.

The Bottom Line

Of course, we can look at the company’s relative valuation in different ways. However, if we compare it to real interest rates or its peers, NextEra appears overvalued today following its sharp rally lately. Put simply, utilities are “supposed” to be low-volatility investments. We might expect the largest of the bunch to be remarkably calm. However, abnormal volatility in the positive direction can quickly turn into the opposite. In my opinion, NEE has become overvalued due to the excessive investor exuberance surrounding it and renewables.

That is not to say renewable power is not the future, only that investors should account for its high capital costs and not assume significant EPS growth will occur so quickly. Indeed, given the state of the market, I doubt NEE will earn the 8% EPS growth rate that the analyst consensus expects. Further, beyond that, I expect its peers will see faster-than-expected EPS growth as they’re shifting more aggressively toward renewable power capital investments today.

Overall, I believe NEE is now materially overvalued and is likely best avoided. Although its LP, NEP, may carry more risks owing to its business model, I am bullish on NEP and believe it is a much better renewable power investment from a risk-reward perspective. However, I am again bearish on NEE and would generally avoid the major utility stocks due to their abnormally low premiums to Treasury bonds.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.