Summary:

- NextEra Energy and NextEra Energy Partners recently published excellent results continuing their strong track record of execution.

- The share price of NEP has tumbled for several reasons post results, including disappointment around IDR elimination and confusion around the CEPF structures.

- The now 6% yield growing at three times the inflation rate is just too tempting, and I suggest you consider using this opportunity to buy or add.

- With the backing of an investment grade parent that happens to be the largest electric and solar utility in the USA with an enormous pipeline long-term investors shouldn’t go wrong here.

- Reiterate my strong buy and $79.10 target price.

pidjoe

What’s the news

On the 25th of April 2023 NextEra Energy Partners (NYSE:NEP) and NextEra Energy (NYSE:NEE) released Q1 results and the numbers were excellent. Both businesses maintained their incredible winning streak.

NextEra Energy

NEE keeps delivering. Adjusted earnings per share grew by 13.5% year on year made up as follows…

Florida Power is the largest electric utility in the USA and now after this quarter is the largest ‘Solar utility’ in the USA too. It grew earnings by 20% when compared to the same quarter last year, in dollar terms that amounted to a tidy sum of $195m in net income. Continued reinvestment in the business resulted in an additional 970MW of new solar coming on board and taking the total owned and operated solar capacity to just shy of 4600MW. There is massive demand for green projects in their space. Florida is officially the fastest growing state in America and investment dollars are flowing. The company reckons that Solar is the most affordable energy option for the state too, but it accounts for just 5% of their delivered energy (Hint as to why so much investment is going into Solar, the demand and returns are there). This growth was solidified by the company filing a 10-year site plan which includes around 20 000 MW of new solar. This keeps the anchor in the NEE stable delivering like clockwork. The company is doing its bit to give back too, by adding solar to the grid they reduce customer costs, which keeps bills down. They’ve also decided to use projected 2023 fuel savings to reduce unbilled fuel costs from 2022 customer bills. By doing this they’re making money and keeping customers from spending more than they need to. This should help relieve energy burdens for consumers.

Energy Resources is firing too the world leader in renewables and battery storage delivered adjusted earnings growth of 16% driven primarily by new investments. Renewable and storage backlogs keep growing too (another 2020MW added during the period). Deals have also been done with CF Industries to create a green hydrogen solution for ammonia production for the world’s largest ammonia producer and the acquisition of an operating landfill gas to electric portfolio was closed too providing a foundation for growth for the renewable natural gas [RNG] business.

On top of this the California ISO recently recommended a $400m sum for transmission and substation upgrades for the transmission business.

Overall, it was just another day at the office for NEE. One thing is for sure though, they aren’t standing still. There is a lot happening and a plethora of opportunity out there. NEE’s credit rating remains investment grade of course and on top of this S&P considered the strength of the business and its cash flows and decided to reduce its downgrade threshold for its funds from operations (FFO) to 18% from 20% on the back of lower business risk following the passing of the Inflation Reduction Act (IRA). This and other changes effectively added 50bps or so of additional headroom to the downgrade threshold which adds an extra layer of comfort to NEE investors and more flexibility to the company to help keep its growth engines firing.

To sum it up we have a company that can buy, build, and operate at a high level. This along with an investment grade balance sheet and a strong tailwind of investment opportunities backed by the IRA make it a reliable growth pick for investors wanting to take advantage of all the action in the green energy space with the comfort of knowing you have ‘Utility’ risk to consider.

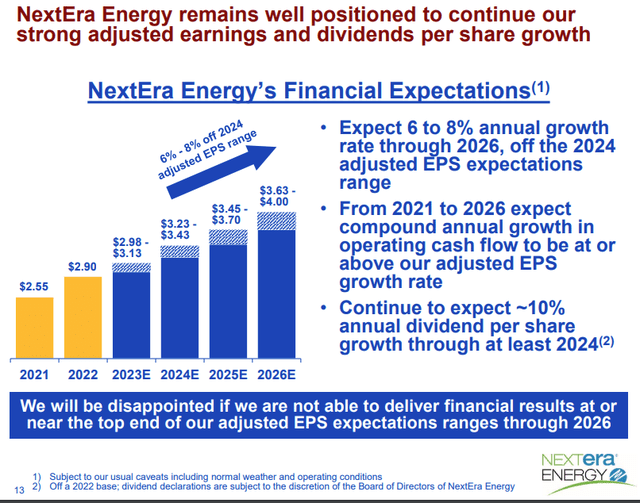

It’s clear that there is a reason they have been voted number 1 in their sector on the fortunes list of ‘Worlds Most Admired Companies’ for sixteen of the last 17 years. With that record of accomplishment, their achievements are no fluke. NEE reiterated their growth and dividend expectations through 2026.

NEE earnings and div forecasts (Company Presentation)

Pivoting to NEP

Turning to NextEra Energy Partners then, with NEE flying like it is how did NEP do? In short very well. Following up on my deeper dive article that was published around a month ago we can turn to the NEP earnings and see how things are progressing along. Now I covered NEE above and let’s not forget that NEP is the primary acquirer of NEE assets for growth. The latter has a large stake in the company, and it earns IDR fees worth approximately $157m a year from NEP, based on the relationship between the two it literally ‘pays’ both parties to be successful. From a pipeline perspective NEE, via Energy Resources alone has around 58GW of renewable and storage assets potentially for sale to NEP. On top of that NEP has the option to also acquire outside of this relationship and reinvest in its own assets to help boost organic growth. This growth can be financed via debt, equity a combination of the two or a variety of other structures, one of which is Convertible Equity Portfolio Financing (CEPF) which I’ll get into in a bit. These opportunities are being added to the portfolio on a regular basis and earnings and dividends are growing rapidly.

This quarter they announced the acquisition of 690MW of operating wind and solar projects from Energy Resources for $708m as an example. Cash available for distribution [CAFD] (the figure used to calculate the dividend) will be boosted by up to $72m on the back of this. Adjusted EBITDA will rise by at least $110m. This is an amazing deal for NEP, who just invested their money at a CAFD yield of around 9%. It’s immediately accretive to income and dividends and will be funded by a combination of new project debt and the corporate revolver. So, no dilution to shareholders here.

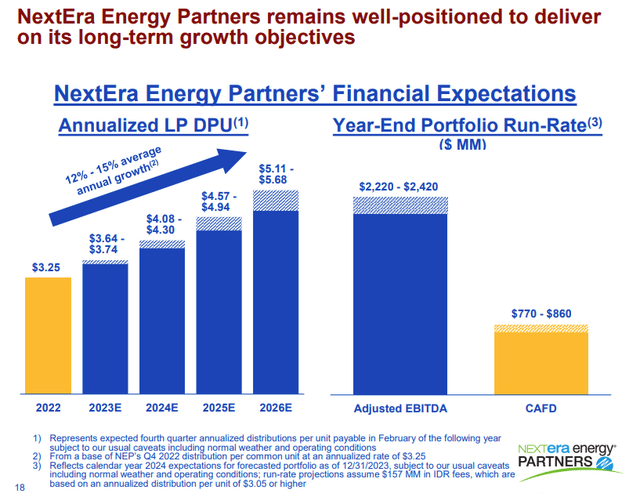

The Energy Resources pipeline is so strong and potentially profitable that management stated during the earnings call their entire forecast for growth and dividends through 2026 could be met solely by acquiring assets from NEE. Here is that forecast.

NEP dividend forecasts (Company Presentation)

This earnings release and the deal done prompted a dividend bump to $0.8425 per quarter or $3.37 per annum which is already 3.6% higher than the last dividend and keeps the company on track to reach its target range of $3.64-$3.74 for 2023.

So then why has NEP fallen by over 8% since earnings?

The obvious question is therefore why has NEP fallen 8% since earnings have come out? And particularly when earnings were good, the outlook reiterated and the dividend raised once again. I reached out to management and asked a few questions of them, and this is what I’ve come back with.

You might recall that in mid-2022 the companies (NEE and NEP) came to an agreement where the IDR fees would be ‘frozen’ at around $157m a year.

‘Beginning in the third quarter of 2022, NextEra Energy will receive a fixed fee of approximately $157 million, with no incremental IDRs on distribution per unit growth above an annualized rate of $3.05 per common unit. The approximately $157 million fee is predicated on NextEra Energy Partners delivering limited partner distributions at an annualized rate of at least $3.05 per common unit to all unitholders. If annualized limited partner distributions are below $3.05 per common unit, then the existing fee structure shall apply.’

There seems to have been a view or ‘hope’ in the market that the IDR program with NEE would be amended further or perhaps even eliminated with this earnings call. This of course never happened. At no point have management ever alluded to the fact that it could happen either, but it seems as if there was a piece of the market that may have been expecting this and then came away disappointed. Personally, I asked about the IDR’s and why this structure still exists, it’s all but been eliminated in the MLP universe as the world changed and the market soured on this type of incentive structure. I’d prefer it was scrapped, eliminated or a deal done to end this chapter for the companies however on the call no specific mention was made around this potentially happening. I will say however that unlike other IDR structures in the past, NEE is not ‘milking’ NEP. Over the years they have capped and limited payments and as we see now with it being frozen at $157m per annum they clearly are ensuring more cash is left at NEP to fund the massive growth opportunities out there. This of course makes perfect sense as NEE is the largest shareholder in NEP, it earns dividends from those shares and of course will see the value of their investment rise as NEP delivers value to shareholders over time. I did however point out that if some market participants sold off the stock on the back of a failure to remove the IDR structure there is potential for a re-rating to occur should they do that at some point.

The other thing that seems to have shaken the market is the company Convertible Equity Portfolio Financing (CEPF) structures that are in place. These have come under some scrutiny too, especially since the announcement that $420m of new equity might be issued over the next few months to buy out the remaining 50% of the STX Midstream CEPF and 15% of the NEP Renewables II CEPF. These structures can be confusing, so I’ll point you to the 2020 ‘Teach Presentation’ that the company published to help investors come to grips with them.

It’s another form of funding where they sell parts of a project or asset to an investor for cash upfront in exchange for a fixed coupon. The asset is then purchased back at NEP’s discretion at some point in the future as per the predetermined agreement, in cash or units or a combination of the two. It gives NEP cash to invest in other projects whilst improving their credit rating and avoids IDR fees and dividends on shares that would have otherwise been issued during an ATM program at the time the cash was raised. It makes sense to me when I think about them but the messaging to the market needs to be improved.

I will say that all these CEPF structures have been considered when the company put its forecasts for CAFD and dividends out to the market. This of course takes the potential dilution caused by issuing shares into account too. The details are worked on the returns generated relative to the share price at the time the CEPF is done. So, it may make sense to issue units at ‘todays price’ if its higher than the price at deal date. It’s about the return on a ‘per deal’ basis is my takeaway. However, with the share plumbing 52 week lows the news of a dilution equivalent to almost 10% of your current market cap doesn’t go down well with shareholders. And as a shareholder myself I shared that sentiment.

The response was as follows; the company doesn’t need to issue stock right now to fund that purchase. As per CEPF agreements, they can be delayed or staggered; in fact, this deal has time until December before a decision needs to made on the way forward. NEP does have options here. First of course is the issuing of stock to generate cash to pay for the repurchase of the assets. The second option is to take on debt. This debt can come from various sources too such as the underlying asset in question, other assets on the balance sheet that are under levered, current facilities already in place or new debt altogether. As a last option they don’t need to do anything. The current owner of the stake can be granted ownership and the CEPF ‘closed’. I’d consider this an option only if NEP really didn’t want to retain 100% of the asset which doesn’t seem to be the case here but nonetheless it’s an option, we as shareholders need to be aware of.

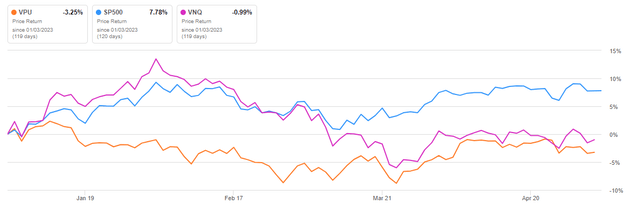

So, with the IDR issue and the CEPF issue covered, what else is there? Markets as a whole haven’t look great this year, especially in those parts of the market that involve companies taking on debt to grow. This includes things like REITS and Utilities of course. The Vanguard Utilities Index Fund ETF (VPU) is down 3.25% YTD versus the S&P500 gain of almost 8%. REITs as measured by the Vanguard Real Estate Index Fund ETF (VNQ) is down 1% so far in 2023. Both sectors have lagged considerably as markets fret about the higher cost of interest these companies need to bear to fund their debt burdens.

S&P500 vs Utilities vs REITs YTD (Seeking Alpha)

For NEP this is not an issue at present. Just 1% of their debt is floating rate. On top of this they have over $6bn of interest rate swaps at their disposal which need to be used by 2028 (lots of water can flow under the interest rate bridge then before we need to worry too much about higher rates here.) My understanding during the chat was that the swaps were purchased in 2018 and 2020 with rates varying from 3%-5%. So as existing debt is renewed, or new debt acquired protection exists to mitigate the impact of higher rates for quite some time. My friend Samuel Smith – himself a bull on NEP, also suggested I ask about threats made by Senator Joe Manchin to support the repeal of the IRA. Naturally, the company can’t make any specific comments about that save to say that the green energy revolution is not something you’d want to get on the wrong side of. Should the IRA get repealed, this would pose a threat to the potential growth rate of any company exposed to green energy from suppliers and manufacturers to utilities. It also runs the risk of setting the USA back considerably when it comes to their clean energy goals. My view is that this doesn’t necessarily have legs and may just be ‘politicking’ ahead of things like elections and debt ceiling debates.

Conclusion

The real issue here I think to NEP is that the longer the share price remains under pressure the greater the risk that using equity as a source of funding becomes uneconomical. This would be a problem much like a REIT that issues equity to grow, NEP does the same thing, raising cash to buy assets from NEE or perhaps anyone else that’s selling something that is attractive to them in their wheelhouse. My sense is they have a few levers to pull to right the ship, they can cancel the IDR structure or buy themselves out of it. That alone could help boost the share price so some degree. They could also go on a roadshow to the market and explain the use of the CEPF structures so that analysts out there understand them properly and don’t confuse stock issues to correlated to them as conventional ATM issues, as they are based on deal terms done a few years prior. The recent KeyBanc downgrade post results talks exactly to this point.

For further risks please see my last note on the company but in conclusion I’m buying more down here and phasing my purchases in so that NEP becomes my largest holding. With a 6% yield growing at almost three times the rate of current high inflation backed by an investment grade rated parent with a massive pipeline for growth that is has line of site of. I can’t imagine the stock not recovering from here. It can of course languish for some time but the really high and fast-growing income stream sets me at ease. This is a proper business and I’d expect the prudent management team to keep doing their thing and that the share price resolves itself over time.

I reiterate my strong buy rating and target price of $79.10 details of which can be found here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NEP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.