Summary:

- Renewable energy is a growth industry, but that does not mean that every company in this space is a buy.

- NEE and NEP are steady performers operationally.

- They are not equally attractive, however, due to large differences when it comes to yield, valuation, and growth.

24K-Production

Article Thesis

Renewable energy investments are in high demand by many investors, but many of these companies aren’t very profitable yet or are unattractive due to other fundamental issues. NextEra Energy (NYSE:NEE) and NextEra Energy Partners (NYSE:NEP) are outliers, however, as they are highly profitable while also providing a growing income stream for their owners. In this report, I’ll show why I believe that NextEra Energy Partners, LP is the significantly more attractive pick at current prices, relative to the mother entity NextEra Energy, Inc.

Investing In The Renewable Energy Industry

Renewable energy is in high demand around the world. Countries, corporations, and even individuals are spending heavily to increase the generation of electricity via hydro, solar, wind, geothermal energy, and so on. Many investors also want to invest in this macro megatrend, but not too many investment choices seem suitable for that. Many companies in this space are either not profitable or trading at very elevated valuations. Some have been clear bubble stocks in the past, along with many electric vehicle stocks that were also hyped up during the pandemic, which didn’t work out for investors.

Despite massive macro tailwinds for the renewable energy industry, the Global X Renewable Energy Producers ETF (RNRG) has delivered measly gains of just 8% over the last five years, massively underperforming the broad market’s 40% gain over the same time frame. Investing in renewable energy investments thus isn’t easy, despite the obvious fact that the industry enjoys long-term growth tailwinds.

Especially for income investors, there are not too many suitable choices. Brookfield Renewable Partners (BEP)(BEPC) is an outlier, and NextEra Energy, Inc. and its publicly traded daughter entity NextEra Energy Partners, LP are outliers as well — they are large, profitable, and offer reliable income to their shareholders.

NEE Versus NEP

In order to decide whether NEE or NEP is more attractive for investment today, we’ll look at a couple of factors that investors might want to consider when making an investment decision.

Renewable Energy Exposure

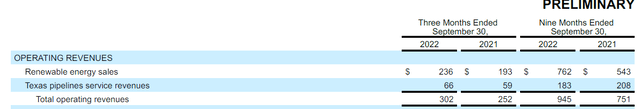

Both companies are marketed as renewable energy investments, but their actual exposure to renewable energy is very different. NextEra Energy Partners is highly exposed to renewable energy, as that industry contributes the vast majority of its revenue and profit:

The company reports that around 80% of its revenue were created with its renewable energy business, both in the most recent quarter and in the Q1-Q3 2022 time frame. By contrast, around 20% of NEP’s revenue was generated by its pipeline services, which could be called a hydrocarbon or “old energy” business.

NextEra Energy Inc., on the other hand, is not as heavily exposed to renewable energy. NEER, NEE’s renewable energy business unit, contributed just $1.6 billion of the company’s overall revenue of $6.7 billion during the most recent quarter, or 24%. The majority of NEE’s revenue is contributed by Florida Power & Lighting, a regulated electric utility. FPL has some renewable energy assets as well, but also uses non-renewable power assets for electricity generation on top of offering distribution etc. Overall, that makes NEE a less renewable-focused company relative to NEP. That does not have to be a bad thing per se, but for an investor that seeks to add renewable energy exposure, NEP with its ~80% exposure seems more suitable than NEE, which is more comparable to a typical regulated electric utility.

Growth

Both companies have enjoyed healthy growth in recent years. During the most recent quarter, NEP grew its EBITDA (earnings before interest, taxes, depreciation, and amortization) by 13% year over year, while CAFD (cash available for distributions) grew by an even better 17% year over year.

NEP continues to add new assets regularly, which drives its growth, although organic growth via rate increases and output optimization also plays a role. Overall, NEP isn’t very large yet, with a market capitalization of $7 billion. An acquisition worth a couple hundreds of millions of dollars is thus enough to move the needle — that’s not true for NEE, which is valued at around $170 billion. Only very large takeovers or new projects move the needle for NextEra Energy, Inc.

NEE forecasts that its earnings per share for 2022 will total $2.85 (final results have not been released yet), which would be up by 12% year over year. For a large electric utility, that’s still pretty strong, but it’s not as exciting as the growth that NEP has been delivering. Going forward, that should hold true as well. NEE is forecasting earnings per share growth of 7% for 2023, while EPS forecasts for 2024 and 2025 stand at 9% and 7%, respectively, using the midpoint of the EPS guidance range for each respective year.

NEP, meanwhile, will likely deliver double-digit growth going forward, at least if management is correct. The company forecasts that its cash available for distribution run rate will be around $820 million at the end of 2023, which would be up from $730 million in 2022, which makes for a 12% increase. While management has not given out guidance numbers for 2024 and beyond, the higher growth in 2023, coupled with the fact that driving meaningful inorganic growth is easier as smaller acquisitions can have a larger impact, make me believe that NEP has a good chance of growing faster than NEE in 2024 and 2025 as well. That also impacts the dividend growth rate, which gets us to the next point.

Dividend

NEE offers a pretty slim yield both in absolute terms and relative to the yield of many other electric utilities. Based on current prices, the $1.70 per year dividend translates into a dividend yield of just 2.0%. Meanwhile, NEP offers a dividend yield of 4.1%, which is more than twice NEE’s dividend yield. Investors thus need to put in less than half the amount of money into NEP, relative to what would be needed for an investment in NEE, in order to generate a similarly-sized income stream.

And yet, NEP also offers the better dividend growth rate. It has grown its dividend by 15% a year over the last five years, versus a 12% annual growth rate by NEE over the same time frame. The combination of a higher starting yield and faster dividend growth makes NEP look favorable from a dividend growth investor’s point of view. NEP has also been offering quarterly dividend increases in the recent past, while NEE only increases its dividend once per year.

Going forward, NEE forecasts ~10% dividend growth per share, while NEP has forecasted dividend growth of 12%-15% a year going forward. It thus looks like dividend growth will decelerate slightly for both companies, but NEP should continue to offer more pronounced income growth on top of offering the way higher starting yield today.

Valuation

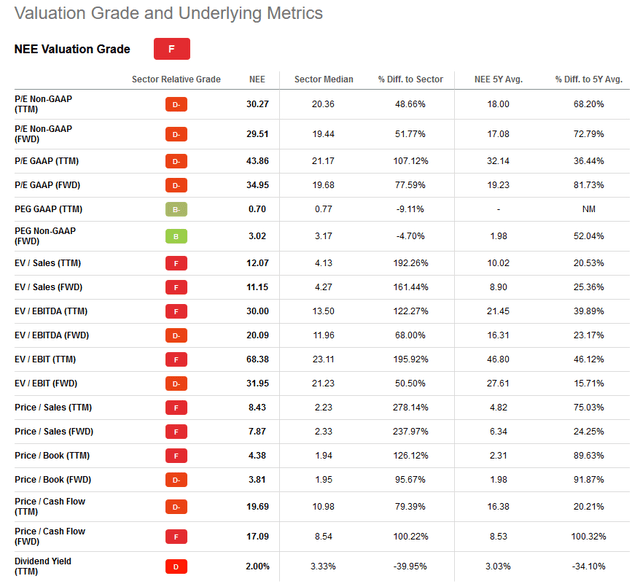

A stock’s valuation should always be considered when making investment decisions. Today, NEE trades at 28x this year’s expected net profits, using the midpoint of management’s guidance range. That’s a pretty high valuation for an electric utility, and explains why NEE only receives a Valuation Score of F:

Meanwhile, NEP is trading at just 8x CAFD today, which translates into a cash flow yield of 12.5% (versus an earnings yield of less than 4% for NEE). Not surprisingly, NEP has a way better Valuation Score of C+. NEP’s valuation is thus not perfect, either, but easily outclasses the valuation NEE trades at. For those that prefer to look at net profit for both companies, although one can argue that cash flow is more telling for an LP like NEP, NEP looks way cheaper than NEE, as NEP’s forward earnings multiple is 13.5 — less than half as much compared to the valuation NEE trades at, despite NEP’s better growth.

Takeaway

Renewable energy is a growth industry for sure, but that does not automatically result in strong equity returns. Many names in this space, including industry ETFs, have delivered sub-par returns in recent years. NEE and NEP seem like outliers, as they are consistently profitable and since they offer reliable and growing income streams.

When we compare the two against each other, NEP looks way more attractive, however. Not only is it offering a dividend yield that is more than twice as high as that of NEE, but NEP is also growing faster, trades at a hefty discount, and has the more pronounced renewable energy exposure for those that seek it.

Disclosure: I/we have a beneficial long position in the shares of BEP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!