Summary:

- NextEra Energy is a defensive growth play on renewable energy with strong competitive positions in the FPL and Energy Resources divisions.

- There is accelerating structural growth in the clean energy industry, with forecasts projecting increased power demand and renewables share.

- NextEra Energy has a history of outperformance, undemanding valuation, and potential for positive surprises in adjusted EPS growth.

Frederick Doerschem

NextEra Energy, Inc. (NYSE:NEE) is an attractive defensive growth play on the renewable energy theme. Improving structural growth in clean energy coupled with a strong competitive position for both the FPL and NextEra Energy Resources divisions should allow NEE to ride secular trends in the industry and maintain healthy cash flow and EPS CAGR for the next decade.

Recent weakness following the Investor Day and an undemanding valuation might offer an entry point for a position in the stock.

Accelerating Structural Growth

Power demand has been flat for decades but is expected to increase in the US. EIA projected power demand will rise to 4,103 billion kilowatt-hours (kWh) in 2024 and 4,159 billion kWh in 2025 compared with 4,000 billion kWh in 2023. Over a longer time frame, US power demand is expected to grow ~38% over the next twenty years, which is a 4x higher growth rate than seen in the last two decades. Growth is expected to be driven by trends such as industrial electrification, manufacturing onshoring (~4x increase in US manufacturing construction spend since 2022), and data center demand (expected to grow at ~15% CAGR), among others.

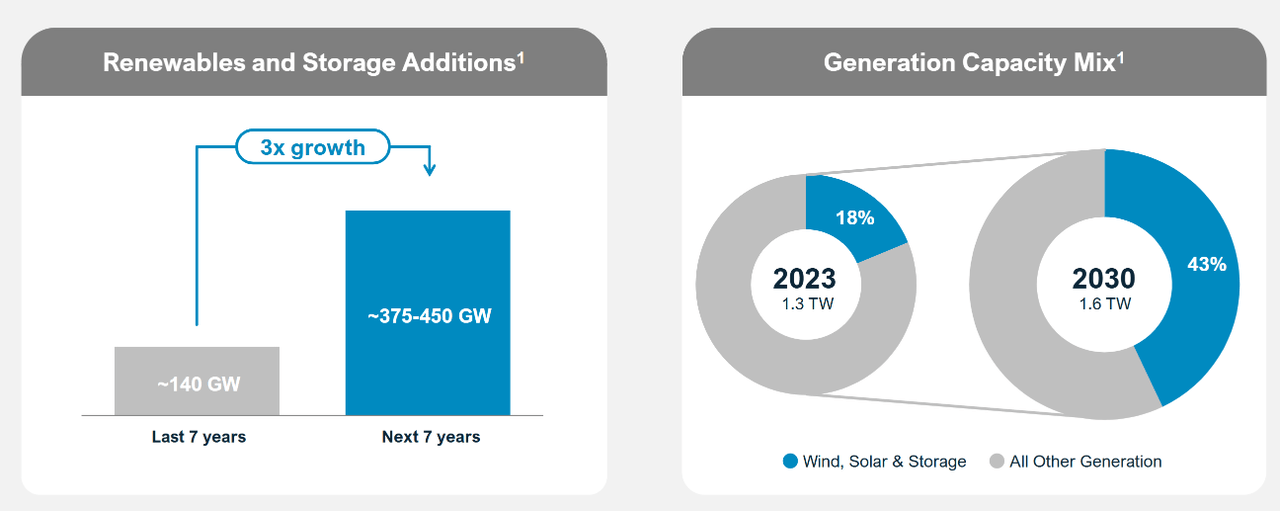

For renewables, forecasts are projecting a tripling in renewables growth over the next seven years compared to the past seven. Renewables remain a clean, fast-to-deploy, and potentially low-cost energy source, especially when coupled with battery storage. Wind, Solar & Storage combined are expected to increase to 43% of the generation mix.

The storage part of the market is expected to grow by between 3x and 6x in the next seven years, from 15GW to 50-85GW, and NextEra seems to be positioned very well with the largest owned and operated storage portfolio in the US, as well as 34G gigawatts of stand-alone interconnected queue positions ready to be used for storage technology.

NextEra’s portfolio is quite diversified across technologies with a tilt towards renewables that helps give the business exposure to structural growth trends. The Wind, Solar, and Storage portfolio totals 37GW, compared with 6 GW in nuclear and 27 GW in fossil fuels.

NextEra has large-scale and significant expertise in developing and siting projects with 34 GW of capacity (~70% higher than the number two operator). It also has large amounts of data that are leveraged to pick and operate the best sites. This combination arguably gives NextEra a good edge versus many competitors.

Good Prospects For Both FLP and NextEra Energy Resources

NextEra Energy has a total of 69GW of operations powered by a platform that combines two leading businesses. FPL, the largest rate-regulated utility in the United States and Energy Resources, the world leader in renewables and storage.

FPL has a track record of being an efficient and reliable low-cost operator, with bills 37% lower than the national average, ~23% lower than the average investor-owned utilities in Florida, and 66% better reliability than the national average based on system average interruption duration index as reported to the FPSC. FPL’s O&M costs are ~70% lower than the industry average, and it has ~41% better non-fuel O&M cost performance than the next best utility. The strong track record in keeping operational costs down has helped FPL keep electricity bills growing at a limited ~1.8% CAGR in the past ten years.

Good underlying tailwinds include favorable demographic and economic trends in the home market of Florida, which is one of the fastest-growing states by population and is expected to expand GDP by 44% by 2040.

Growth prospects in terms of energy consumption and renewable growth mean the business will invest significant resources in the next four years. FLP has a rate-regulated return on capital invested, so the main drivers of net income growth are the level of capital employed and the share of equity to debt. Projected capex for FLP in the 2024-2027 period indicates a range of $8.0 to $8.8bn for both 2024 and 2025 and an increase to an average of $8.8bn to $9.8bn for 2026 and 2027. FPL plans to invest ~$12bn in solar in 2024-2027 and expects solar & storage to increase to ~38% of the generation mix by 2033 compared to 6% in 2023. On the battery front, capacity is expected to increase by nearly tenfold at a ~25% CAGR, from 469 MW in 2023 to 4,491MW in 2033. Overall Regulatory capital employed is expected to expand to the $83-86bn range by 2027E, compared to $66bn in Q1’24, implying a ~9% CAGR.

NextEra Energy Resources is a leader in renewables with ~20% installed market share and is the number one wind, solar, and storage developer in the world. It has ~34GW of operational capacity in generation and storage, a ~21.5 GW backlog, and a ~300 GW pipeline of renewables and storage, with 150GW in the transmission queue. While exposed to even stronger structural trends in renewable energy than FLP, the track record of NextEra energy resources has been strong, with a 15% adj. EPS CAGR in the past twenty years on the back of a ~14% EBITDA CAGR.

NextEra Energy Resources has good exposure to technology customers with over 3GW in the operating portfolio and over 3GW in the backlog, plus a big pipeline of future projects. It’s a business that has shown a strong culture and track record of operational improvements, which in the past ten years, resulted in the total cost of operations declining at a CAGR of 4% in Wind, 6% in Solar, and 2% in Nuclear.

A key asset and potential driver of growth opportunities for NextEra Energy Resources is the large unutilized interconnection capacity in wind and solar amounting to 15GW (growing to ~32GW in 2027) and available for fast deployment (typically one or two years, possibly less). As timelines for interconnection expand and are currently between four and seven years or beyond, having the surplus capacity to deliver new battery storage projects four years faster than a greenfield project is potentially a great competitive advantage, supporting strong pricing power that can drive high-margin revenue growth.

Adjusted EPS is expected to grow at ~13% CAGR in the 2023-2027 period, but the business is capital intensive and the high growth capex means there is significant cash burn expected meanwhile. AEBITDA for NextEra Energy Resources is expected to grow at a 16% CAGR from 2023 and 2027, outpacing growth in capex but not enough to significantly reduce the cash burn in terms of EBITDA – Capex, expected to remain in the area of a negative ~$7bn per year between 2024 and 2027.

Confidence and History of Outperformance

The business managed to beat the 2022 investor conference adjusted EPS target of 6-8% per year, generating an 11%+ CAGR. Management also stated that they always work to exceed expectations. While this is a statement to be taken with caution and is not necessarily always a positive, there is indeed a history of strong outperformance of NextEra versus the utility sector. Since 2015, shares of NextEra Energy appreciated by ~170%, outperforming the SPDR Utilities ETF (XLU) by ~120%. Over twenty years, NextEra generated a total shareholder return of 1739% compared to 543% for the S&P Utilities, a performance backed by a 9% adjusted EPS CAGR, 10% CAGR in dividend per share, ~8% CAGR in operating cash flows, which allowed them to become the largest global utility by market capitalization. This is also ~3x the performance of the S&P 500 with half the beta.

NextEra’s expectations for the 2024-2027 period reflect an adj. EPS CAGR of 6% to 8%. However, management said getting to the high end of the guidance range is de-risked given the underlying trends, and the business has a history of using conservative assumptions in initial investment decisions and beating expectations.

I believe a few potential benefits are also excluded from the guidance. For NextEra Energy Resources, for example, management commentary at the investor day suggests potential benefits from solar repowering could lead to better results.

A ~10% adj. EPS CAGR for NEE in the next ten years is not unreasonable, in my view, given the strong structural trends in renewable transition, the company’s track record, and management’s tendency to issue conservative guidance. Moreover, I believe there is further positive surprise potential in an environment of declining interest rates. NextEra Energy’s interest rate sensitivity at the adjusted EPS level is ~$0.04 per 50bps interest rate increase. Although small, a 50-100bps decline in interest rates can easily add a few percentage points to NEE’s adjusted EPS.

NextEra’s FCF remains negative due to growth and the high-capex nature of the business. As long as resources are found to meet capex without stretching the balance sheet, this is generally not a problem. At the group level, NextEra Energy expects ~$97 to $107bn of capex in the 2024 -2027 period. Around $44 to $48bn are expected to be financed by tax equity and project finance, while 99% of the remaining capex needs are expected to be financed by cash from operations, meaning no stretch on the balance sheet other conditions held equal.

Valuation Appears Undemanding

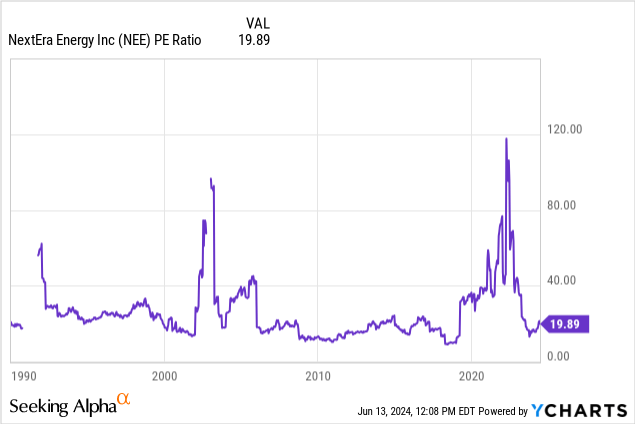

The recent Investor Day was not met with much enthusiasm from the market as the stock declined over 5% on the day. The stock currently trades at ~20x EPS which is towards the low end of the long-term range and more or less in line with the normalized multiples if we exclude the 2020-2023 period.

Structural trends in energy transition make NEE a high-duration growth play, and ~10% adjusted EPS growth for five years with 3% terminal growth and an 8% discount rate that considers the defensive nature of the business would translate into a fair multiple of ~28x P/E. Even a very conservative estimate of 7% CAGR with a more neutral discount rate of 9% would make the current multiple of ~20x fair, and potentially leaving upside potential from multiple re-rating if results don’t disappoint.

Risks

- Execution should be monitored. Successfully delivering on NextEra’s ambitious growth plans and maintaining cost efficiencies will be important for the investment case. Delays or unforeseen cost increases could impact profitability.

- The regulatory environment for utilities and renewable energy is subject to change. Unfavorable regulatory shifts could impact profitability or growth opportunities.

- The renewable energy market could become more competitive and put pressure on NextEra’s market share and pricing power.

- NextEra’s high capex needs make it somewhat sensitive to interest rate fluctuations. Rising interest rates could increase borrowing costs and impact cash flow.

Conclusion

I think NEE remains a good play on the structural theme of clean energy growth. Valuation appears potentially undemanding considering the defensive nature of the revenue streams, the company’s track record and efficiency, and the secular growth prospects in the industry.

In a stock market running into all-time highs but with potential macro weakness emerging (such as weak labor data this week), playing defense with a high-quality defensive name in clean energy looks increasingly attractive as well.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.