Summary:

- NEE is expected to report its 2024 Q2 earnings next week.

- I expect it to either reaffirm the full-year guidance or even up it from the range announced in Q1.

- My optimism stems from the new developments in the past quarter.

- The top ones are Florida’s strong economy, NEE’s expansion projects, and the new interest rate outlook.

Abstract Aerial Art

NEE stock: Q1 recap and Q2 preview

I last wrote on NextEra Energy, Inc. (NYSE:NEE) about three months ago. As you can see from the screenshot below, that article was titled “NextEra Energy: Still Looking For Direction” and was published on April 19, 2024, on Seeking Alpha. In that article, I rated the stock as a HOLD due to the following mixed signals:

- NextEra Energy’s current dividend yield is way above its historical average, usually a sign of undervaluation.

- But a consideration of its growth potential also shows it’s close to fair valuation and offers no obvious margin of safety.

- The uncertain interest rate outlook further clouds its return potential.

Seeking Alpha

Since that writing, there have been new developments in pretty much every aspect examined in my earlier article. Notably, the company has reported its 2024 Q1 earnings (on April 23, 2024) and the new CPI data has drastically shifted the outlook for interest rates. These changes motivate an updated assessment of the stock. Also, NEE is scheduled to report its Q2 earnings next week (on July 24, 2024, before the market opens). Therefore, this updated assessment also serves as a preview of its Q2 earnings report.

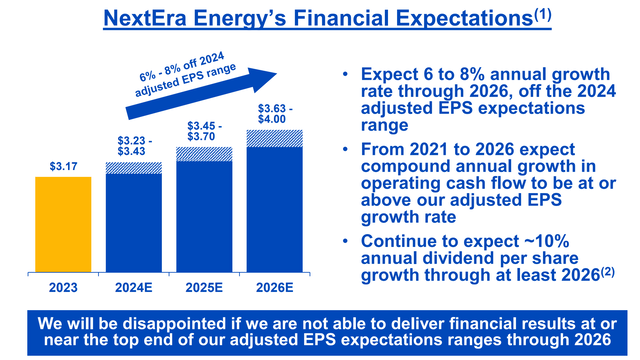

In the remainder of this article, I will explain why this updated assessment resulted in a rating upgrade to BUY from my earlier HOLD rating, and I will highlight a few earning catalysts that I expect from the Q2 report. To provide background, NEE is off to an excellent start in 2024 in my view judging by the numbers it reported in Q1. Its reported EPS beat the market consensus by a sizable margin of $0.11 per share. Management also provided their full-year earnings guidance in the range of $3.23 to $3.43 a share (see the next chart below). Furthermore, management expects the growth of operating cash flow to be at least as robust as the EPS growth rate, allowing dividend payouts to grow at faster rates (around ~10%) in the next few years.

Against this backdrop, I will next explain why I expect NEE to reach the high end of this range or even see an upward shift of the guidance range in its Q2 report.

NEE Q1 Earnings Report

NEE stock: EPS outlook

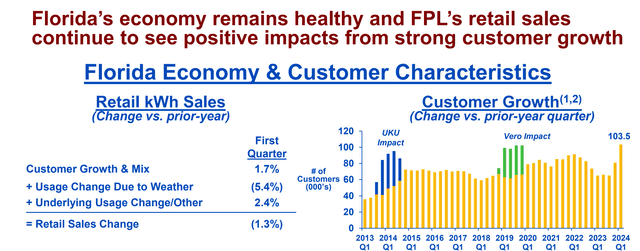

The top reasons for my optimism – which are also areas I look forward to updated information in Q2 – are Florida’s strong economy and NEE’s expansion projects. I expect NEE’s utility subsidiary, Florida Power & Light, to keep reporting strong growth driven by their capital investments. The utility had enjoyed its strongest quarter of customer growth in over 15 years with the count up by about 100,000 from the first quarter of 2023 (see the chart below).

NEE Q1 Earnings Report

In the meantime, NEE’s renewable energy subsidiary was also off to a strong start in 2024 and I expect the progress to continue or even accelerate in Q2. As a background, NEE grew its backlog of expansion projects from year-end 2023 by 2,765 megawatts (MW) to 21,500 MW. The updated backlog level is net of 1,165 MW of projects placed in service during the first three months of the year.

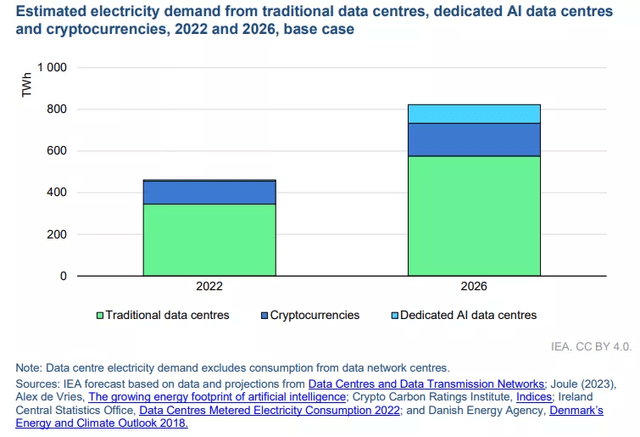

From a broader context, I expect these expansion projects (a good portion involve renewable energy sources) to benefit from a secular tailwind as we fully embrace our digital future. As argued earlier,

Our digital future will largely be driven by power-hungry technologies such as AI, cryptocurrency, intelligent manufacturing, etc. (see the next chart below). The demand for electricity in the U.S. has been growing rapidly over the past few decades. The reindustrialization of America (again, led by AI and other digital technologies) requires enormous amounts of electricity, and my view is that the country has been underinvesting in its power-generating capacity for years if not decades.

IEA

NEE stock: Interest rate outlook

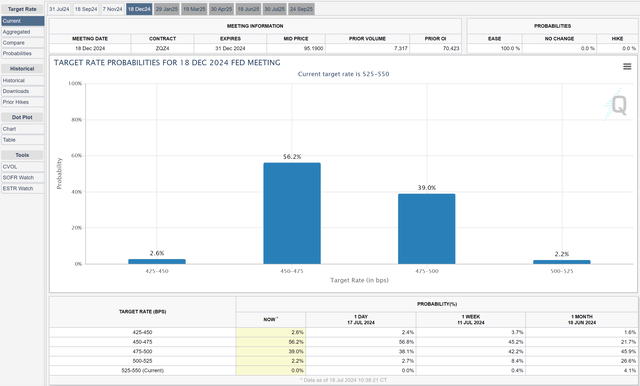

Another factor behind my optimism is the updated interest rate outlook. As aforementioned, a key concern expressed in my previous article is the higher-for-longer interest rate environment (10-year treasury rates were around 4.7% at that time vs. about 4.2% now). Moreover, since my last article, the newly released CPI data has drastically shifted the interest rate outlook. More specifically, the CME Group FedWatch Tool below compares the current probability to that before the release of the CPI data. As seen, the current data suggest a 2.2% probability for interest rates to remain unchanged by the end of this year (i.e., remain in the current range of 5% to 5.25%) and a 39% probability for one interest cut. This means the current federal funds’ futures contracts imply a dominant probability for at least two rate cuts – a 58.8% probability (100% – 2.2% – 39%).

Utility stocks, given their heavy reliance on debt financing and quasi-bond nature, tend to respond more directly and sensitively to interest changes than other segments. Historical data have shown a strong negative correlation between interest rates and their valuation multiples. The current interest rates thus could better support NEE’s valuation (in other words, its stock prices can move higher with its yield still remaining attractive to treasury bond rates) and also reduce its future interest rate expenses.

CME group

Other risks and final thoughts

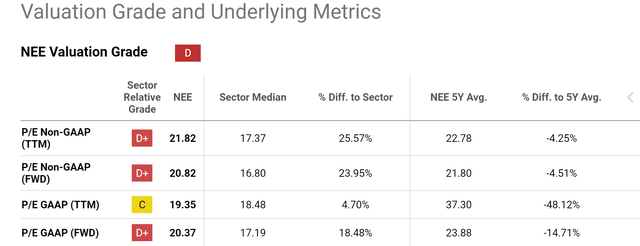

In terms of downside risks, NEE faces the same set of common risks as other utility companies. These risks include interest rate changes (as analyzed above) and regulatory changes that could impact its ability to generate electricity or raise prices. However, NEE also entails some more unique risks. NEE’s significant investment in clean energy positions it well for the future as argued earlier. However, these investments bear higher risks than those in traditional energy sources considering the possibility of project delays, technology maturity, and also heavy CAPEX requirements. Finally, NEE is currently trading at a sizable valuation premium over the sector. More specifically, the chart below shows NEE stock’s valuation grade. As seen, NEE’s P/E ratios are slightly below its 5-year averages (on a non-GAAP basis), but they are substantially higher than the sector median. For example, its TTM P/E (again, on a non-GAAP basis) ratio is 21.82, while the sector median is only 17.37. This translates to a 25.57% difference.

All told, I think these risks are well compensated for by NEE’s strengths and the positive catalysts mentioned above. Thus, I expect to hear good news in its incoming Q2 earnings report. I expect NEE to either reaffirm the full-year guidance in Q2 or even further shift it towards the high end of the range it announced in Q1 considering the new developments in the past quarter. To recap, the top developments in my view are Florida’s robust economy, NEE’s expansion projects, and the new interest rate outlook.

Seeking Alpha

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.