Summary:

- Amazon plans to invest $150 billion in data centers over the next 15 years to support the AI boom.

- NextEra Energy, a leading renewable energy utility, offers strong dividend growth and a promising outlook despite sector challenges.

- NEE has a track record of meeting or exceeding financial expectations and is positioned for significant growth in EPS and dividends.

Dilok Klaisataporn

Introduction

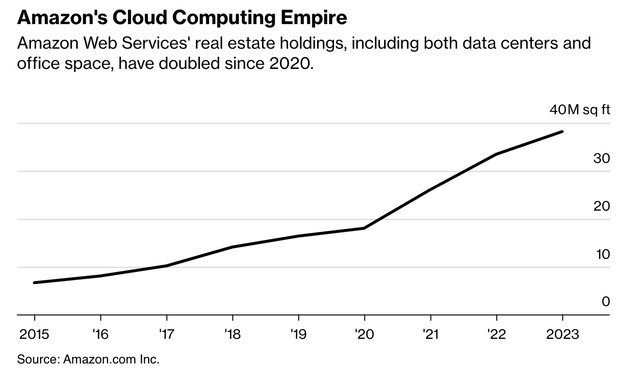

On March 28, I read a very interesting article about Amazon (AMZN) betting $150 billion on data centers needed to support the artificial intelligence (“AI”) boom.

According to Bloomberg, the company will spend this money over the next 15 years (roughly $10 billion per year!) to stay ahead of the competition and keep a tight grip on the cloud computing market, where it is the second-largest player.

Since 2020, the company’s real estate holdings, including data centers and office space, have doubled to roughly 40 million square feet.

I’m bringing this up for one major reason. This AI trend needs a lot of energy!

As reported by the Wall Street Journal (emphasis added):

The surge in AI-driven power demand comes as other factors converge to create new strain on the grid. A wave of manufacturing plants are being developed across the U.S., spurred by new tax policies under the Inflation Reduction Act, and many states are working to use more electric power for transportation, heat and heavy industry.

New data centers can be built faster than new power generation and there is already a supply crunch. Construction timelines for data centers have been extended by two to six years because of power-supply delays, according to commercial-real-estate services firm CBRE Group.

The same article mentioned that the Southern Company (SO), a major utility company in Georgia, revised its power outlook for 2030. It now expects 6,600 megawatts of demand growth. That’s 17 times higher than previously expected!

On top of that, tech giants want energy to be renewable, as it helps their ESG scores and prevents their hunger for power from resulting in an explosion of carbon emissions.

That’s where NextEra Energy (NYSE:NEE) comes in, one of the world’s largest utilities focused on renewable energy.

My most recent article on the stock was written on October 4, when I went with the title “Down 45%! I’m Buying The NextEra Energy Crash With Both Hands.”

Since then, NEE shares have returned more than 20%.

In light of changing energy needs and the general pressure on utilities from elevated rates and inflation, I’ll use this article to explain what to make of the long-term risk/reward for dividend investors after the recent surge.

After all, NEE is still trading more than 30% below its all-time high.

So, let’s get to it!

Utilities Are Cheap – For A Reason

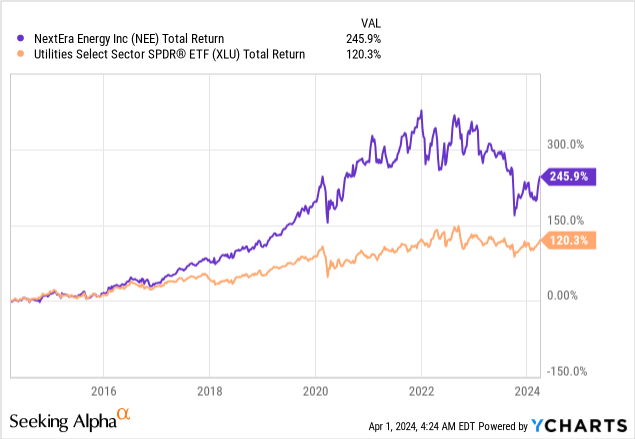

As we can see in the chart above, NEE shares are up 246% over the past ten years, including dividends. That is a mighty impressive performance. Not only is it more than 120 points above the return of the S&P 500, but it also includes a 30% drawdown from the company’s all-time high.

There are two problems here:

- Utilities are spending billions on the energy transition. This was no issue when rates were close to zero. However, with Fed fund rates above 5% and the 10-year yield north of 4%, this is becoming somewhat of an issue.

- Rising inflation makes it hard to protect operating income, as it is not always possible to aggressively hike rates for customers.

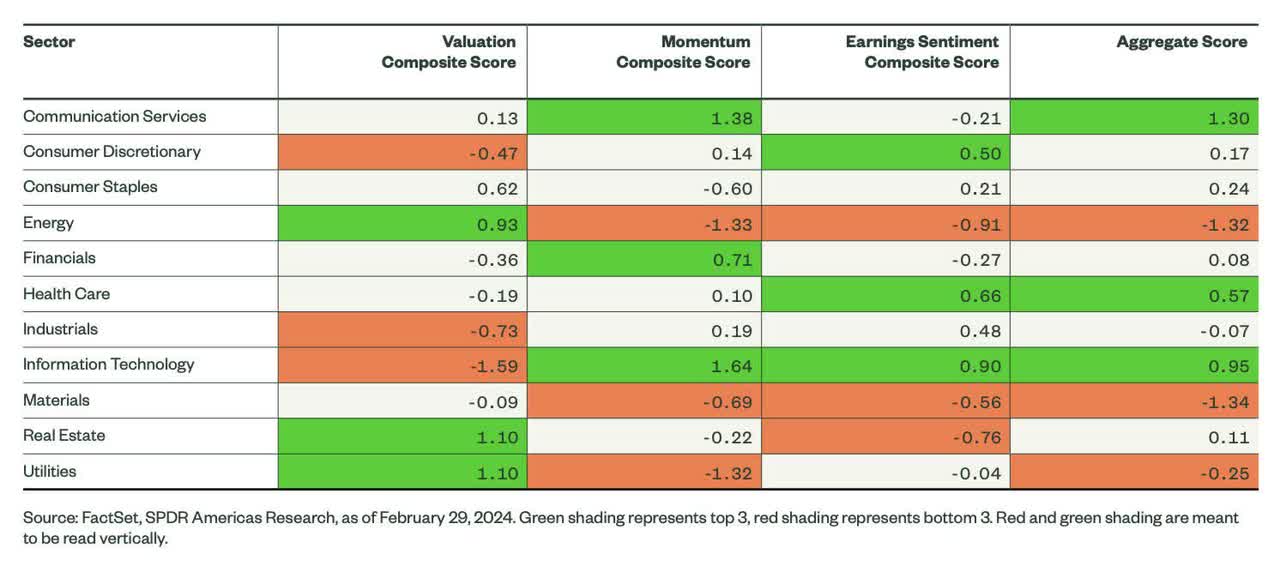

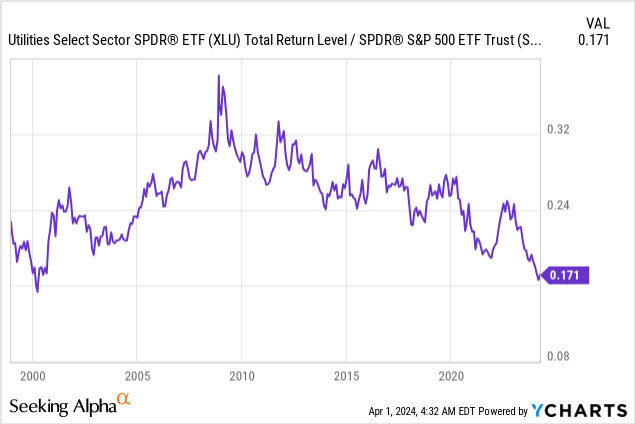

As a result, the utilities sector is one of the three cheapest sectors of the S&P 500, with a horrible momentum score.

While this suggests that investors in utilities haven’t been doing so well lately, it also means that investors looking for exposure are buying a sector with a relatively attractive valuation.

In fact, the relative performance of utilities compared to the S&P 500 hasn’t been this bad since the year 2000!

That’s where NEE comes in.

The NEE Dividend Remains Strong

Generally speaking, NextEra Energy stands out for two reasons:

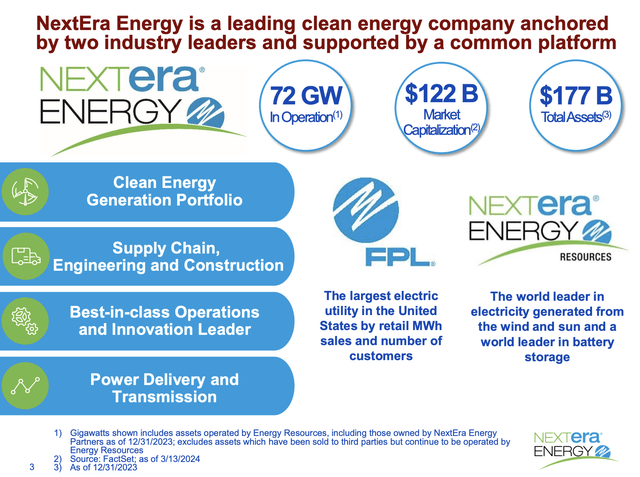

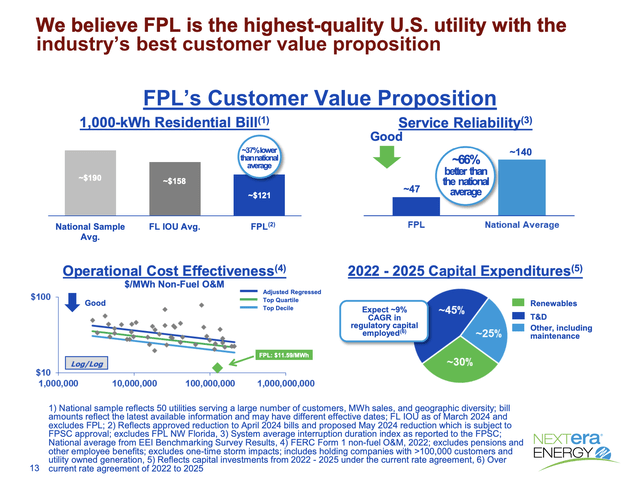

- It’s the leading clean energy utility, operating two giant corporations. This includes FPL, which is the largest electric utility in the United States, and NextEra Energy Resources, the global leader in electricity generated from wind and sun and battery storage.

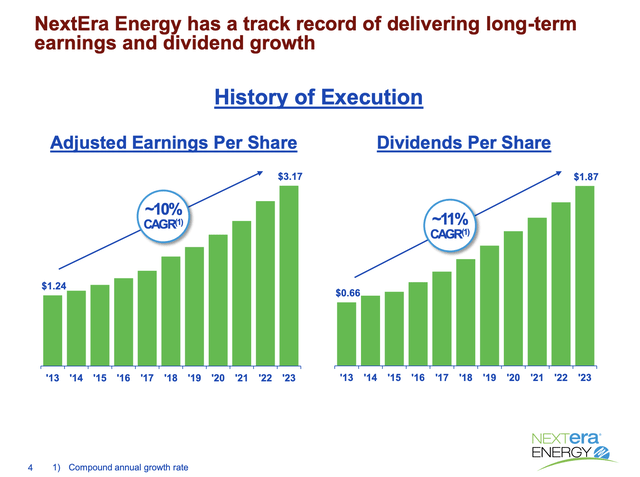

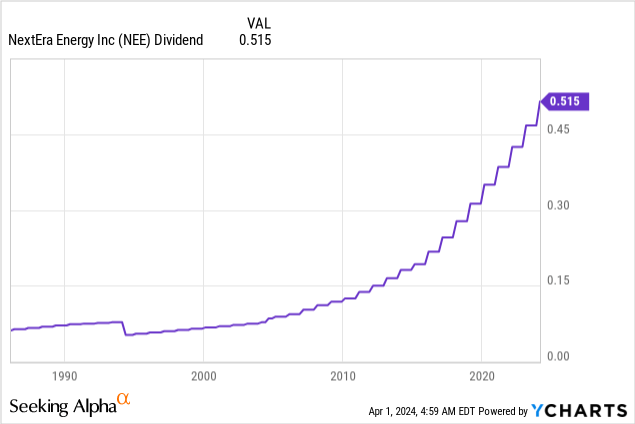

- It’s a standout in a very “boring” sector that tends to come with subdued dividend growth and poor total returns (as we saw in the prior segment of this article). Since 2013, NEE has grown its dividends per share by 11% per year, supported by 10% annual earnings growth during this period.

After hiking its dividend by 10.2% on February 16, the company currently yields 3.2%. This dividend is protected by a sub-60% payout ratio.

The five-year dividend CAGR is 10.9%. The sector median is just 5.3%, using Seeking Alpha data. While the median sector yield is roughly 80 basis points higher, I believe these numbers clearly favor NextEra Energy.

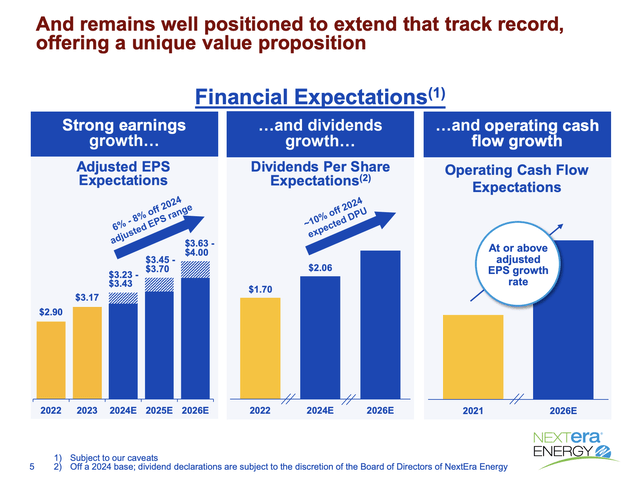

Even better, the company expects growing dividends per share at roughly 10% per year through at least 2024, based on a 2022 base.

With that said, the company is doing well – especially in light of some of the challenges I mentioned in this article.

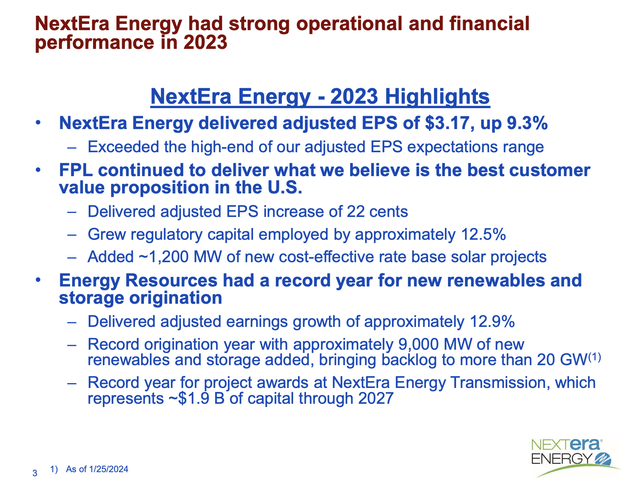

For example, in 2023, the company grew its adjusted EPS to $3.16, which marks a 9.3% year-over-year increase.

This number exceeded the high end of the company’s adjusted EPS expectations range.

Moreover, despite challenges like disruptions in the solar supply chain, the company achieved a CAGR of adjusted EPS of roughly 11.5% since 2021.

Essentially, NEE makes the case that it is able to do so well because it has worked on building a competitive edge in renewables for 25 years.

These advantages include supply chain capabilities, strong customer relationships, access to capital, and a data-driven development playbook.

In fact, the company has a track record of either meeting or exceeding financial expectations for 14 consecutive years.

There’s Plenty Of Growth Potential

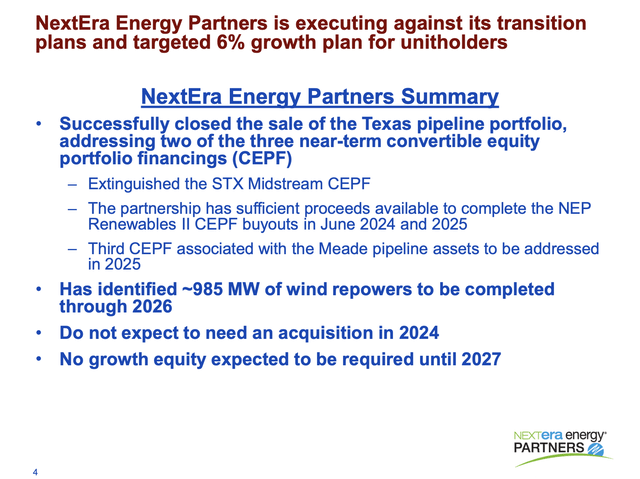

In order to protect its balance sheet, the company is “recycling” assets. For example, NextEra Energy Partners (NEP) sold its Texas pipeline portfolio for net proceeds of $1.4 billion. These proceeds were used for other growth plans, including its strategy to repower existing assets.

The partnership plans to repower roughly 1.3 gigawatts of wind projects through 2026 to improve the performance and longevity of these assets.

Looking ahead, NextEra Energy Partners expects continued growth in distributions per unit through at least 2026.

The partnership’s payout ratio is expected to remain in the mid-90s through 2026, which indicates its ability to generate sufficient cash flow to support its distributions.

Speaking of expectations, NextEra Energy expects significant growth opportunities in its Florida Power & Light and Energy Resources segments.

For FPL, the company aims to increase its solar generation capacity substantially by 2032, with plans to add over 15,000 incremental megawatts. This expansion would raise FPL’s solar generation from 5% of its total generation to approximately 35%.

Even better, FPL’s capital plan under the current rate agreement ranges from $32 to $34 billion. These investments are expected to support the company’s goal of maintaining customer bills of roughly 30% below the national average while supporting grid infrastructure modernization!

The company also benefits from the fact that Florida remains one of the hottest destinations for movers, paving the road for above-average growth.

Looking at the company’s latest expectations, we see that it expects to grow adjusted EPS by 6-8% per year through 2026.

This is what the company said with regard to data centers during its earnings call:

First on the data centers, clearly, there’s an enormous amount of demand being driven across the U.S. economy by the growth in data centers driven by a lot of things, of course, but specifically generative AI. And that growth is pretty explosive at this point. – NEE 4Q23 Earnings Call

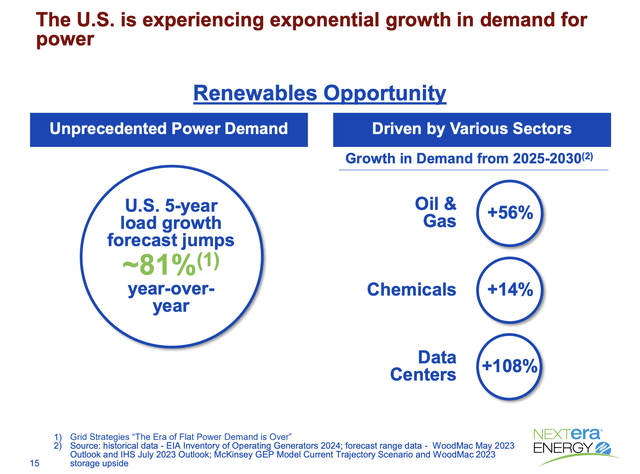

According to the company, the U.S. 5-year load growth forecast is up 81% year-over-year, driven by data centers, oil & gas, and data centers.

Moreover, NEE maintains a stellar balance sheet with an investment-grade rating of A-.

While the company is expected to grow net debt to $86 billion in 2026 (up from $70.5 billion in 2023), it is also expected to lower its net leverage ratio to 4.7x EBITDA again, after an expected surge to 5.4x EBITDA by 2025.

In 2022, that ratio was 7.4x EBITDA.

So, what does all of this mean for its valuation?

Valuation

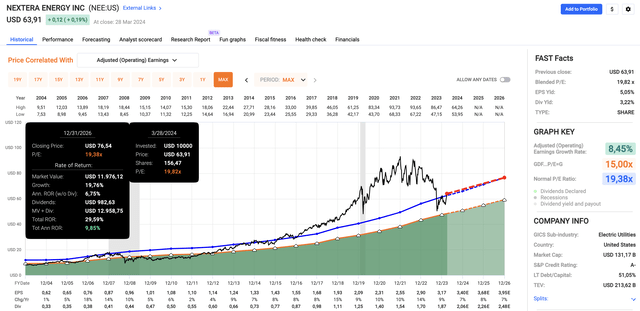

Since January 2004, NEE has returned 12.0% per year. Going forward, I expect that number to be slightly lower.

As we can see below, the company trades at a blended P/E ratio of 19.8x, which is slightly above its long-term normalized P/E ratio of 19.4x.

The good news is that analysts agree with the company’s own outlook, as they expect between 7-8% in annual EPS growth through 2026.

When combining a 19.4x normalized EPS multiple with its expected EPS growth and 3% dividend, we get an annual return outlook of roughly 9.7%.

This number can change depending on EPS growth volatility and changes in its valuation multiple.

While the stock has traded well above its normalized valuation before inflation became an issue, I’ll stick to a 19.4x multiple, as I do not believe that inflation will fade soon.

However, if inflation were to fade soon, allowing the Fed to cut rates aggressively, I expect NEE to enjoy a much higher multiple, paving the road for >10% annual returns.

All things considered, I remain bullish on NEE. I believe NEE is one of the best stocks in a sector that is currently undervalued,

However, I sold my NEE position after I bought some shares for my trading account after last year’s stock price crash. This is solely based on my decision to shift money almost exclusively to my dividend growth portfolio.

I also decided to mainly buy more volatile energy stocks, which fit my personal strategy a bit better. In the years ahead, I will likely buy NEE again. For now, I’ll stick to more aggressive inflation protection in energy, industrial, and basic materials.

Please note that both energy and utilities are undervalued S&P 500 sectors right now. I am opting for the riskier sector.

Takeaway

As the demand for artificial intelligence continues to surge, energy consumption, particularly in data centers, is poised to skyrocket.

NextEra Energy stands out as a leading player in renewable energy, offering strong dividend growth backed by a fantastic business model.

Despite challenges like rising inflation and energy transition costs, NEE maintains a promising outlook, with expectations of significant growth in EPS and dividends.

While I’ve opted to reallocate my investments for now, NEE remains a top pick in an undervalued sector, offering long-term potential for investors seeking sustainable returns.

Pros & Cons

Pros:

- Leading in Renewable Energy: NextEra Energy dominates the clean energy sector, owning the largest electric utility in the U.S.

- Strong Dividend Growth: With a history of 11% annual dividend growth since 2013 and a current yield of 3.2%, NEE offers attractive returns for income-focused investors.

- Robust Financial Performance: Despite challenges, NEE consistently meets or exceeds financial expectations, with a track record of 14 years of steady growth.

Cons:

- Sector Challenges: Utilities face pressures from rising inflation and energy transition costs, impacting profitability and growth potential.

- Debt and Leverage: Although the company has a stellar balance sheet, the impact of potentially prolonged elevated interest rates could hurt its future growth plans.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.