Summary:

- NextEra Energy experienced a significant rally after hitting a 52-week low in 2023, with potential for long-term growth.

- NEE’s strong position in the energy market, particularly in data center markets, makes it a compelling investment amidst the A.I. renaissance.

- Despite risks such as high debt and competition, NEE’s dividend growth potential and expected EPS and revenue growth make it an attractive long-term play.

PM Images

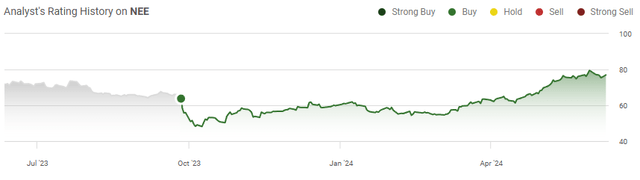

It’s been a wild ride for NextEra Energy (NYSE:NEE) over the past year as shares dropped to a 52-week low of $47.15 in October of 2023 before staging a strong rally that exceeded $80 on May 31st, 2024. NEE caught a massive bid coming out of the pandemic as shares propelled to their all-time highs at the end of 2021, and at one point, NEE was a larger company by market cap than Exxon Mobil (XOM). Despite the impact on NextEra Energy Partners (NEP) after cutting its growth guidance in 2023 and NEE deciding to hold off on the asset dropdown, NEE has continued raising the dividend while The Street expects YoY growth in EPS and revenue significantly increasing in 2024. NEE is currently retracing after hitting $80.47 the prior week, and shares could remain in a downtrend for a while, but I believe NEE is a strong long-term play on the growing energy demand from the Artificial Intelligence ((A.I.)) renaissance we’re experiencing. The amount of power required for the growing demand for chips is expected to expand, and NEE has a footprint that is critical to many of the major data center markets across the country. I am not currently a shareholder, but once this downward trend has established a bottom line, I plan on starting a position as I believe utilities are undervalued and that NEE will continue to be an earnings and dividend growth machine.

Following up on my previous article on NextEra Energy

I wrote my last article on NEE on September 26th, 2023, right before shares sold off on the news regarding NEP (can be read here). Since then, shares of NEE have rebounded and gained 7.51%, which has underperformed the return of the S&P 500 by 24.51%. When NEE’s dividend is accounted for, its total return over this period is 10.08%. In that article, I discussed why I felt NEE was a compelling dividend growth stock and why I was keeping a close eye on it. I am writing this article to update my investment thesis as I believe NEE will be a strong beneficiary from the growing A.I. boom we are experiencing. I think that NEE will generate enticing capital appreciation and dividend growth in the years to come as the demand for energy increases.

The risks to investing in NextEra Energy

There are two main risks that I can see when considering starting an investment in NEE, and they both play off each other. NEE has a massive debt load with $65.87 billion in long-term debt on its balance sheet. The amount of debt needed to fund its growth has expanded YoY since 2018. NEE has produced $15.31 billion of EBITDA over the trailing twelve months (TTM), placing their debt to EBITDA ratio at 4.30x. If the Fed keeps rates higher for longer, then NEE will see higher capital costs on future borrowings, and older debt that is maturing may end up being refinanced at higher levels, which could also increase expenses. The next risk is competition and companies driving the price per kilowatt hour lower. If breakthroughs in energy production continue and the price per kilowatt hours declines, it could impact utility companies across the board as they will face pressure to lower the prices they charge for the supply of energy. If solar panels and battery storage become cheaper while interest rates start to decline, it could have a negative impact on utility companies. As technology becomes cheaper, the barrio to entry decreases, and it becomes more affordable for the general population. The last thing that utility companies want is more homes that are independent energy producers, as this will certainly cut into its top and bottom lines. NEE has been strong for dividend growth and capital appreciation over the years, but just because its past performance looks enticing, that doesn’t mean NEE will replicate the results going forward. Investors should consider the macroeconomic environment and the emphasis being placed on disruption in the energy industry prior to making an investment into NEE.

I am upgrading my long-term thesis on NextEra Energy because of the A.I. renaissance we’re experiencing

In their last fiscal year, NVIDIA Corporation (NVDA) grew the amount of revenue it generated by 125.85% YoY from $26.97 billion to $60.92 billion. In the trailing twelve months (TTM) its revenue has jumped to $79.77 billion as its Q1 results shattered all of its previous quarters, generating $26.04 billion in revenue. There are some projections that NVDA will ship 1.5 million A.I. server units per year by 2027, and NVDA announced during their Q1 earnings that they will be introducing the Blackwell product line, which is expected to be purchased by many companies, including the rest of the Magnificent Seven. The A.I. boom is real, and an unprecedented amount of capital is being spent to advance the future of computing.

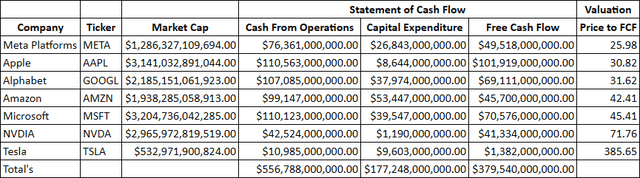

Over the TTM, the Magnificent Seven have spent $177.25 billion on CapEx, and NVDA has been a strong beneficiary of how they are allocating capital. It’s not just one company; everyone is taking A.I. seriously, and these companies are working to embed A.I. throughout their products and services. Amazon (AMZN) is planning on building 2 data center complexes in Mississippi with an estimated cost of $10 billion while launching new infrastructure regions in Saudi Arabia and Mexico through more than $5 billion of invested capital. Microsoft (MSFT) discussed how their CapEx in Q1 of 2024 amounted to $14 billion to support its cloud demand and scaling its A.I. infrastructure. Mark Zuckerberg was early on GPU’s with the Metaverse, but recently, on the Meta Platforms (META) earnings call discussed that they will continue to scale the amount of capital allocated to CapEx to compete in the age of A.I. The Magnificent Seven have generated a combined $556.79 billion in cash from operations and $379.54 billion in free cash flow [FCF] over the TTM and can spend as much as they need on building out infrastructure to support their future growth.

Steven Fiorillo, Seeking Alpha

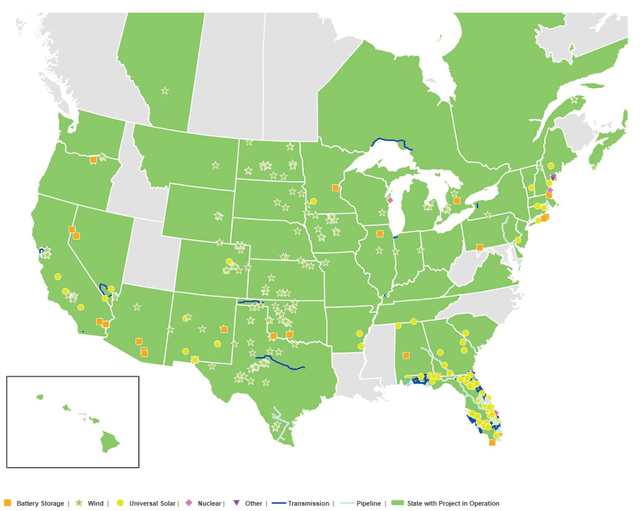

In a recent Forbs article (can be read here), they indicated that data centers that power A.I. have the same energy requirements as a small city. Data centers account for 1.5% of the electricity produced on a global scale, and the amount of electricity needed to facilitate future needs continues to expand. There are estimates that 21% of the electricity produced globally will be allocated toward computing and communications technology by 2030. I looked at where the most data centers are across the United States, and the top-10 markets in a country with more than 2,700 data centers are Northern Virginia, Dallas, Texas, Silicon Valley, California, Los Angeles, California, Tri-State Area New York, Chicago, Illinois, Washing D.C., Atlanta Georga, Miami Florida, and Phoenix Arizona. I then looked at where NEE operates, and they are active in each of these markets, and have a presence that extends to 49 states outside of the asset map below.

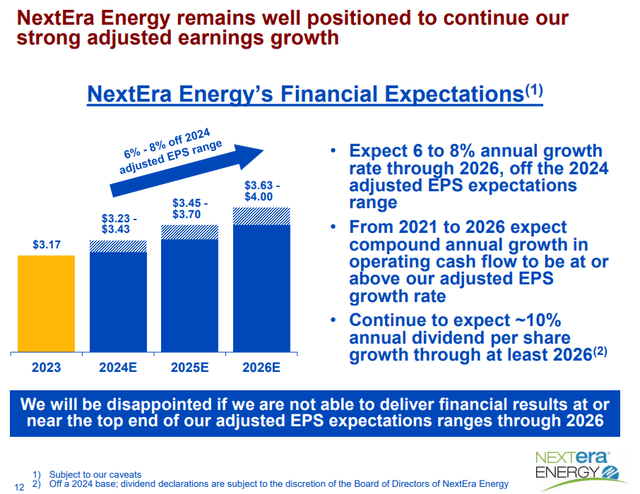

As companies continue to spend tens of billions on infrastructure, the amount of power needed to facilitate the future energy demand needs to increase. In Q1 NEE added roughly 2,765 megawatts of new renewables and storage into its backlog, which was its 2nd largest quarter of originations to date. Florida Power & Light, which is owned by NEE, also placed 1,640 megawatts of solar into service during Q1. NEE is currently operating 74 gigawatts of energy throughout its entire portfolio, and this is expected to grow to over 100 gigawatts over the next 3 years. Senior leadership has reiterated that their forward EPS projections remain unchanged, and investors can expect 6-8% annualized EPS growth through 2026. As more data centers are built and the demand for energy increases, NEE is in a position to potentially exceed its expectations in the short term and continue its EPS growth post-2026, as it brings more projects online from its backlog and enters into new project agreements.

The Street is expecting NEE to grow its EPS and Revenue over the next several years which should continue fueling its dividend growth

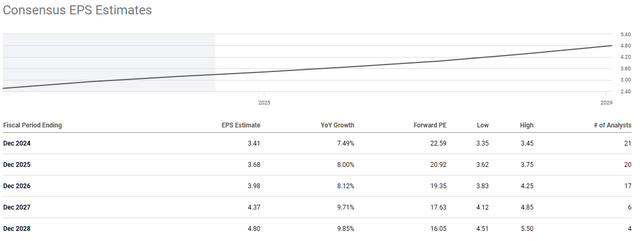

The analyst community has their consensus estimates tied to the ranges that NEE provided for their earnings growth through 2026. Post-2026 there are 6 analysts that believe NEE will generate $4.37 of EPS in 2027 and 4 analysts that believe NEE will generate $4.80 in EPS for the 2028 fiscal year. For the next 5-years, the consensus estimates have NEE’s EPS growing in the high single-digits YoY while their revenue is expected to grow by 33.12% from $27.87 billion to $37.1 billion. I think there is value to be unlocked as NEE is trading at 22.59 times 2024 earnings and 19.35 times 2026 earnings. There is potential for NEE to exceed expectations, and if a rotation into income-producing assets occurs, NEE could catch a bid as it’s been a strong dividend growth player for decades.

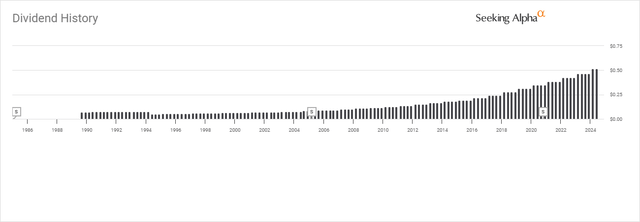

NEE has paid a dividend for 34 consecutive years and is a Dividend Aristocrat, having increased its dividend for the past 28 years. While the yield on its $2.06 dividend per share is 2.68%, NEE is a dividend growth play as its 5-year dividend growth rate is 10.74%. In 2023, NEE increased the annualized dividend by 9.3% from $1.72 to $1.88, and in 2024, shareholders got a 10.64% increase as NEE took the dividend to $2.08 per share. NEE has a payout ratio of 61% based on the consensus estimates for 2024 earnings, which leaves a lot of room for future increases. In the Q1 2024 press release, management indicated that they expect to increase the dividend by around 10% annually through 2026, which would put the dividend at $2.29 in 2025 and $2.52 in 2026. Based on the current trajectory for earnings, NEE could be in a position to continue this dividend growth trajectory well beyond 2026.

Conclusion

I think that utilities are undervalued, and we could see investors pay more attention to them if we experience a sector rotation out of tech or if the Fed starts cutting rates. NEE is one of the most interesting plays in the utility sector because of where its assets are, how much capacity it’s bringing online and adding to its backlog, and its earnings growth projections. As more capital gets allocated toward cloud and A.I. infrastructure, the number of data centers will increase, and the utilization rates for electricity will expand. I think that the utility sector is an indirect beneficiary of the CapEx allocation happening throughout the technology sector, and NEE is one of the most enticing investments in the space. NEE trades at less than 20 times its 2026 earnings, is expected to grow its EPS and revenue by high single-digits YoY, and increase its dividend by around 10% annually through 2026. I am more bullish than before on NEE, and once it looks as if a bottom is being established I plan on starting a position in this Dividend Aristocrat.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, AAPL, META, GOOGL, TSLA, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.