Summary:

- NextEra Energy stock has experienced a significant decline, reaching levels last seen in April 2020. Investors capitulated following NEP’s growth downgrade.

- NEE holders are likely anticipating higher execution risks for NextEra Energy as they assess the impact of the higher cost of capital challenges.

- Despite the challenges, the risk/reward for NEE is leaning towards upside risks rather than downside caution at current levels. Also, NEE could be close to peak pessimism.

- I explain why I’m even more bullish at the current levels, as I added more recently, taking advantage of the fear.

pidjoe

I was previously cautious about NextEra Energy, Inc. (NYSE:NEE) stock, even as the S&P 500 (SPX) (SPY) bottomed out last year. I urged investors to mind the overvaluations in NEE, notwithstanding its market leadership. Notably, NEE remains the largest Utilities sector (XLU) constituent, which was also battered recently.

Notwithstanding my caution, I upgraded NEE in August 2023, as I anticipated more constructive opportunities. However, that upgrade proved premature, as NEE fell further this week, reaching levels last seen in April 2020. It has been a remarkable roundtrip for investors who added at NEE’s COVID lows, as it has plunged nearly 50% in price-performance terms since it topped out in late 2021. For a solidly profitable market leader like NextEra, I believe it likely stunned even the “diamond hands” NEE holders into submission as they looked to protect their gains. NEE’s price action corroborates my view that the recent plunge seems to be a capitulation that saw rapid selling intensity.

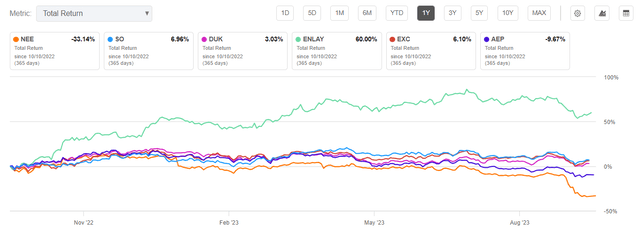

NEE Vs. peers (1Y total return %) (Seeking Alpha)

However, I believe investors shouldn’t jump to a premature conclusion that NEE’s malaise is indicative of sentiments across its sector peers. Clearly, NEE’s underperformance is unusual, as it delivered a total return of -33% over the past year, as seen above, underperforming its peers significantly.

Keen investors should recall the hammering that NextEra Energy Partners (NEP) unitholders received in late September as management downgraded its medium-term growth outlook. As such, investors have likely reflected increased execution risks on NEE. Does it make sense? Yes, I believe it does.

The elevated cost of capital could impact the company’s ability to meet its adjusted EPS CAGR of 6% to 8% through 2026 for NEE. Accordingly, management didn’t envisage the need to revise its outlook, corroborating the robustness of its balance sheet, interest rate hedges, and dividend payout.

However, NEP’s significant growth downgrade suggests a substantial loss of confidence in a management team that has executed well consistently. Seeking Alpha Quant’s “B” earnings revisions grade corroborates my thesis about NextEra’s execution, which should continue to keep dip buyers onside.

Notwithstanding my optimism, a higher-for-longer Fed is a clear and present danger that NextEra Energy investors need to navigate cautiously. Given the decision to revise NEP’s growth outlook downward, its ability to drop down assets to NextEra Energy has also been impacted. As a result, NextEra Energy needs to seek project finance opportunities or other non-strategic asset sales to drive capital recycling efforts and sustain its ability to meet its adjusted EPS growth targets.

With that in mind, the market is correct, as it hammered NEE holders into submission. The critical question facing investors thinking about adding now is whether NEE is close to peak pessimism after its steep plunge?

NEE price chart (weekly) (TradingView)

NEE’s price action is reminiscent of a massive capitulation. I gleaned that the selling intensity seems to have subsided this week, but it’s still too early to assess whether it could bottom out. In other words, an entry now should be considered aggressive without a price action thesis.

Fundamentally, NEE is a solid stock. If you think NEE was attractive three months ago, the steep plunge should have made it even more attractive now.

However, as a price action investor, I would have preferred for NEE to fall even steeper to re-test its March 2020 lows, take out those dip buyers before forming a bear trap (false downside breakdown), and complete the roundtrip.

Notwithstanding my price action caution, I’m confident that market operators have already attempted to price in significant challenges, given the growth downgrade at NEP. Hence, the risk/reward is leaning toward upside risks rather than downside caution at the current levels, in my opinion.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NEE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!