Summary:

- Utility stocks have been weak in 2023 due to a strong bull market and sensitivity to interest rates.

- NextEra Energy, Inc. has rebounded and may continue rallying, supported by momentum indicators and the inverse correlation with interest rates.

- NextEra has a history of consistent earnings and dividend growth, with expectations of continued growth in the future, making it an attractive investment for income investors.

pidjoe

Utility stocks have been extremely weak in 2023, partly because we’ve seen a tremendous bull market, but also because they’re highly sensitive to interest rates. We know that defensive sectors like utilities underperform when equity markets are doing well, and that has been the case again in 2023. But what I see as changing for utilities is interest rates, and indeed, we’ve already seen a lot of progress on that front in recent months.

NextEra Energy, Inc. (NYSE:NEE) is one of the biggest players in the space, with a traditional utility and a large renewables business. The stock was destroyed in September but has since rebounded massively, and to my eye, it looks like the rally is likely just getting started. I’m starting NextEra with a strong buy rating; let’s dig in.

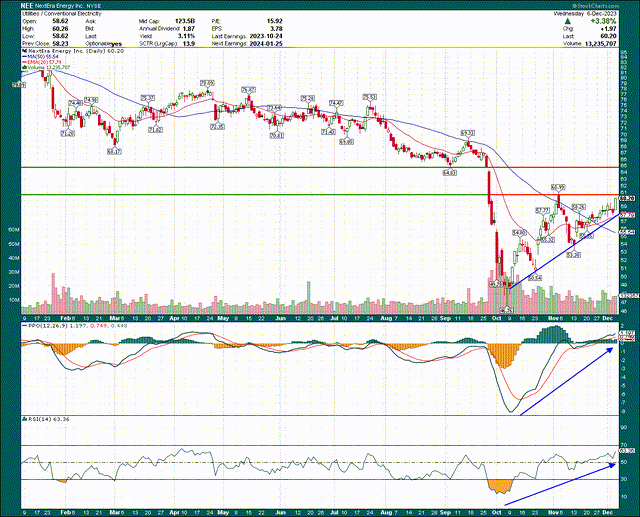

An impressive rally, but more room to run

NextEra quickly recovered from the waterfall decline it posted in September, after losing support at $65. The ultimate bottom was all the way down at $46, and the stock closed yesterday at $60. For a $120 billion utility stock, that’s a massive move.

I’ve noted resistance levels on the chart, which I’ve plotted at $61 and $65, with those levels being the relative high from November and that prior $65 level from September. I believe NextEra will take those out; it’s a matter of whether it does so quickly or not.

The PPO is rising sharply and is in positive territory, and the same can be said for the 14-day RSI. From a momentum perspective, NextEra looks very supportive of sustaining this bull run. On the downside, the rising 20-day exponential moving average and trendline support are in the same area, so if the stock loses those, it’s probably going to result in a longer consolidation. However, long-term investors won’t care about that, and I think risk is skewed to the upside into 2024.

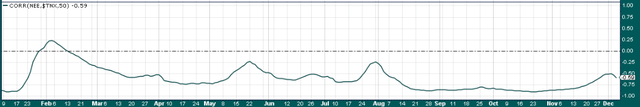

I mentioned interest rates above, and we know that in recent weeks, rates have plunged. Below is the correlation between the 10-year Treasury yield (US10Y) and NextEra’s share price, and we can see they are extremely inverse to each other.

The correlation on a 50-day basis is -0.59, which in plain terms just means that if rates go down, NextEra goes up. You can make your own determination about the direction of rates, but as long as rates don’t move back towards their highs, it’s open season for utility stock bulls.

Fundamentals support more gains ahead

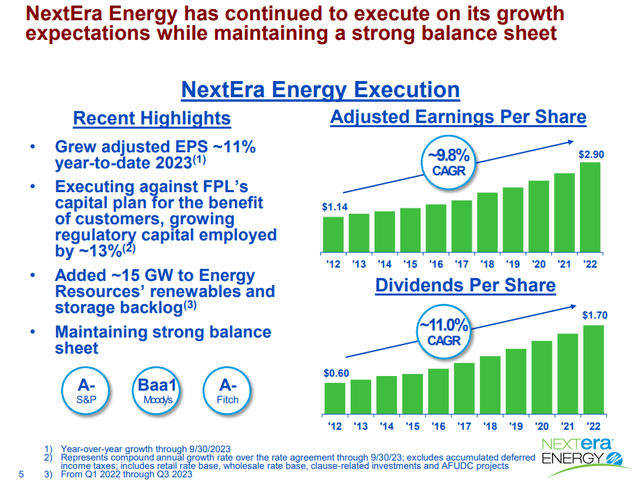

NextEra is one of the better performing utilities over time, so it’s certainly no accident it has one of the larger market caps in the space. The company’s ability to grow earnings consistently has been impressive, and as far as management is concerned, the good times are set to continue for years to come.

This is a view into the past for NextEra, and we’re looking at roughly 10% annualized EPS growth in addition to 11% annualized dividend growth. If you’re an income investor, this is about as good as it gets; high rate of growth in EPS and the dividend, and pretty steady as well. We don’t see 25% gains one year and a 10% retracement the next year, we just see a well-managed business. It helps, of course, that utilities operate what are essentially monopolies in their service areas, but that’s why income investors love utilities, right?

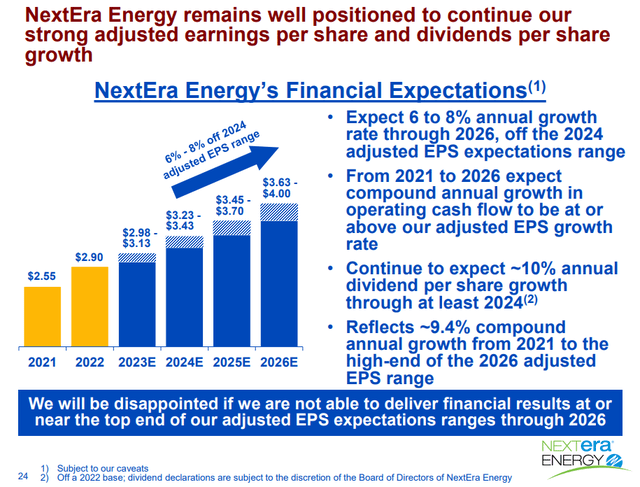

Looking forward, we see the next few years are expected to see 6% to 8% growth in EPS, so slightly off of historical levels, but still quite strong for a utility.

The company is looking at $3.63 to $4.00 in adjusted EPS for 2026, and analysts are firmly at the upper end of that range with current expectations of $3.92. In addition, the dividend is expected to grow at 10% annually, so for dividend investors, NextEra offers a strong current yield and terrific dividend growth potential; what’s not to like?

The beautiful thing about a utility business is that results are largely predictable, meaning earnings volatility and earnings risk are minimal compared to most other businesses. There’s some risk of operating costs being higher than expected, or unforeseen regulatory actions, but over time as we saw above, this is a very predictable business. Investors pay premiums for that predictability, but right now NextEra is cheap.

Cheap no matter how you slice it

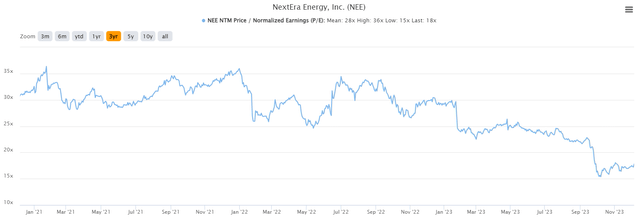

Let’s kick off the valuation discussion with a look at the stock’s forward P/E ratio for the past three years, which is showing a very long runway for shares if it can recover former valuation levels.

Shares are trading today at 18X forward earnings, which is a ~35% discount to its average valuation in the past three years. Said another way, the stock would need to rise by more than half in order to get to its average valuation of the past three years, all else equal. I’m not suggesting the stock is going to rise by half overnight, but what I am suggesting is that the risk is very firmly to the upside here, not the other way around. That limits your downside risk as a buyer and increases the chances you see price appreciation.

Another way to value a dividend stock is through the yield, as yields fall when a stock is overvalued and rise when it is cheap.

NextEra’s yield is very near the top of its 5-year range right now, having been higher only after the September plunge earlier this year. At a 3.1% yield and a 10% dividend growth rate, NextEra is dividend royalty at the moment.

If we take all of this together, I see a business with extremely predictable earnings, strong dividend growth, a well above average yield, and an attractive valuation. It is my opinion we’ve already seen the lows, and that Next Era is going a lot higher in 2024. If you’re looking for a value-oriented income stock, NextEra may just be the one for you.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in NEE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you liked this idea, sign up for a no-obligation free trial of my Seeking Alpha Marketplace service, Timely Trader! I sift through various asset classes to find the best places for your capital, helping you maximize your returns. Timely Trader seeks to find winners before they become winners, and keep you out of losers. In addition, you get access to our community via chat, direct access to me, real-time price alerts, a model portfolio, and more.