Summary:

- NextEra Energy excels in renewable energy and storage, poised for substantial growth in clean energy markets.

- With a robust financial foundation, NEE delivers consistent dividends and invests billions in expanding solar and battery capacities.

- Despite high valuation and regulatory risks, NEE’s operational efficiency and strategic focus make it a compelling choice in the utility sector.

s-cphoto

Introduction

Companies like NVIDIA (NVDA) have become the obvious winners of the current AI boom.

Do you know who the secret winners are?

The companies expected to power it.

In recent months, we have increasingly discussed non-tech AI opportunities. This included hardware and power.

After all, AI is very power-hungry.

According to The Brussels Times, AI searches require up to 25x more energy than a simple Google search.

However, ChatGPT consumes a lot of energy in the process, up to 25 times more than a Google search. Additionally, a lot of water is also used in cooling for the servers that run all that software. Per conversation of about 20 to 50 queries, half a litre of water evaporates – a small bottle, in other words. – The Brussels Times

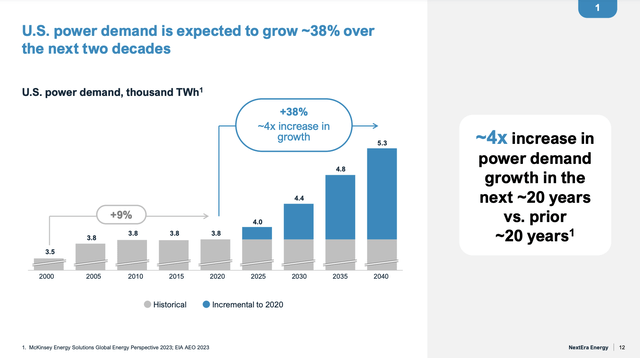

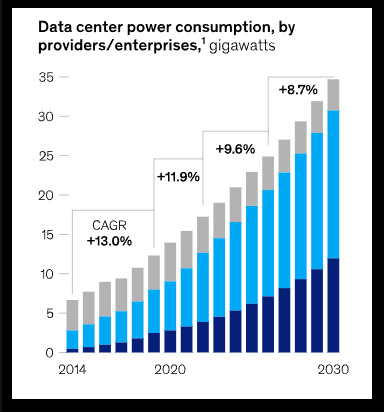

Using the McKinsey data below, total energy demand for data centers is expected to rise by high single digits through 2030, potentially resulting in a demand of roughly 35 gigawatts by 2030.

McKinsey

This comes with another major problem: emissions.

Big tech companies do not want to ruin their ESG footprint by causing rising demand for coal to fuel their data centers.

That’s where clean-energy utilities come in.

Access to renewable power sources also is an advantage. Aaron Dunn, co-head of value equity and portfolio manager at Morgan Stanley Investment Management, likes NextEra Energy Inc. because it builds renewable generation for its own utility unit and develops renewables for others.

“We believe renewables and storage are a key enabler to help meet this increased demand” NextEra CEO John Ketchum said during the company’s first-quarter earnings call on Tuesday. “The U.S. renewables and storage market opportunity has the potential to be 3x bigger over the next seven years compared to the last seven.” – Bloomberg (emphasis added)

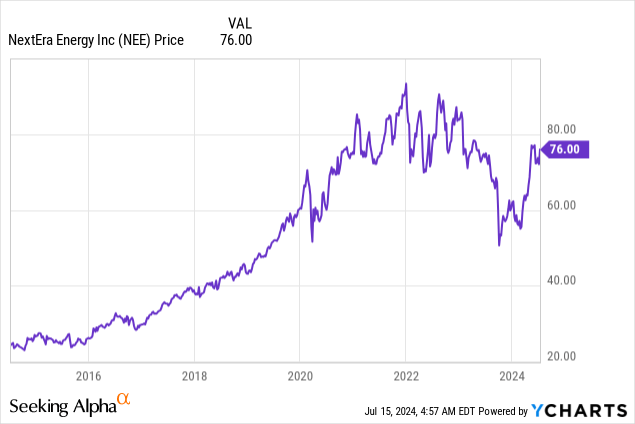

This brings me to NextEra Energy (NYSE:NEE), a company I started to pound the table on during last year’s stock price crash. Since then, shares have risen by 45%, including dividends, beating the 33% return of the S&P 500.

My most recent article on the stock was written on April 3, when I went with the title “Forget Tech Stocks And Boost Your Portfolio: NextEra Energy’s AI-Fueled Dividends.”

Since then, shares are up 22%.

In this article, I will update my thesis using the latest developments, including its 2024 Investor/Analyst Day, which revealed a lot about its potential.

So, let’s dive into the details!

NextEra Makes The Case For A Bright Future

NextEra is in the right place at the right time.

As the Bloomberg quote above showed, the company has clean energy and highly favorable demand markets.

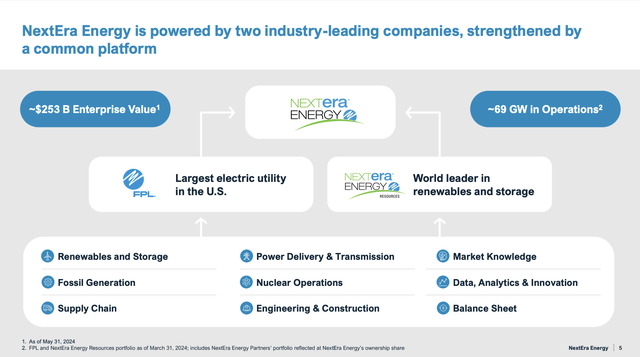

The company operates through two businesses: Florida Power & Light (“FPL”), which is the largest rate-regulated utility in the United States, and Energy Resources, the global leader in renewable energy and storage.

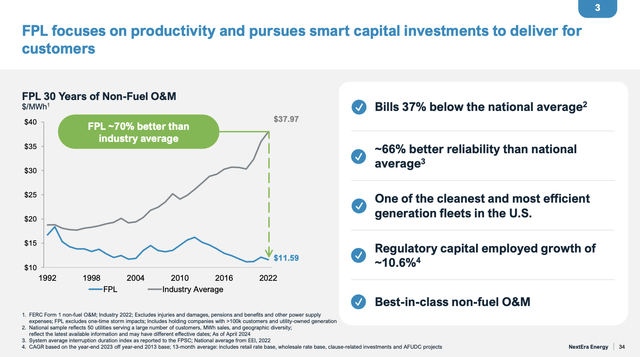

FPL isn’t just large, according to NEE, but it also has average electricity bills that are 37% below the national average, with one of the best reliability rates in the industry.

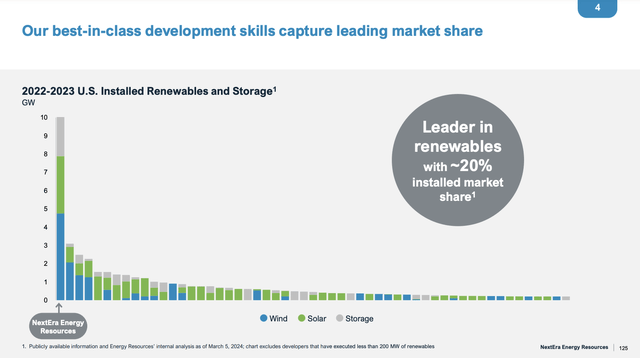

Meanwhile, Energy Resources has a 20% market share in renewables and storage.

This scale is a huge advantage, as it has allowed the company to build capabilities in sitting, developing, building, operating, and financing renewable projects in and outside of Florida. When adding its supply chain and technological advantages, it is hard to compete with NEE.

Even better, the company has consistently delivered elevated returns.

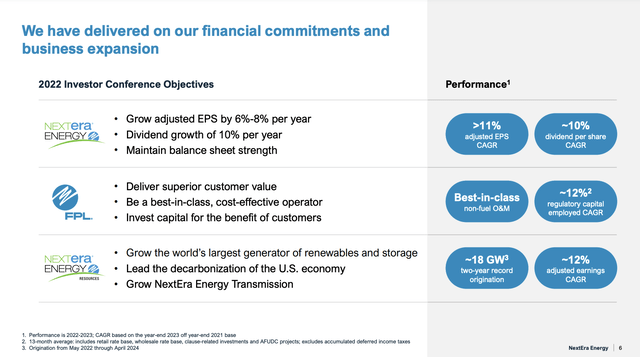

Over the past two years, NEE has achieved an adjusted earnings per share growth of more than 11% and maintained a dividend growth rate of 10%.

FPL has reduced its operations and maintenance (O&M) costs, which led to a 12% growth in rate-regulated capital employed. Meanwhile, as we can see below, Energy Resources has generated 12% earnings growth, marked by two consecutive record years of renewable production.

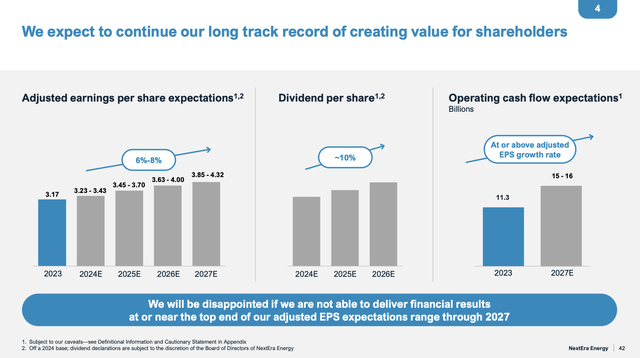

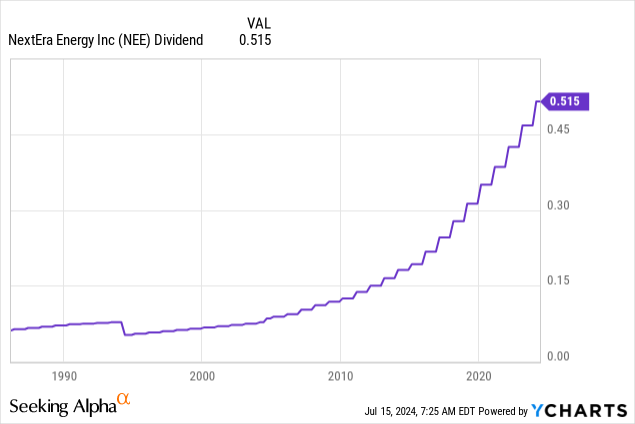

With regard to its dividend, NEE currently yields 2.7%. This dividend has a 59% payout ratio and a five-year CAGR of 10.7%. It also comes with 28 consecutive annual dividend hikes.

The company expects to grow this dividend by 10% annually through at least 2026, supported by 6-8% annual EPS growth and potentially outperforming operating cash flow growth through 2027.

The reason why NEE is so upbeat about its ability to grow is elevated demand.

As we just discussed, demand is rapidly rising.

According to the company, U.S. power demand is expected to grow by 38% over the next two decades. That rate would be four times higher than in the past two decades!

Not only is AI great for power demand, but it also allows NEE to operate more efficiently.

During its Investor Day, the company noted it has more than 100 AI projects launched and even proprietary AI applications in use.

Essentially, the integration of advanced digital platforms and generative AI tools allows the company to optimize site selection, development, and operations.

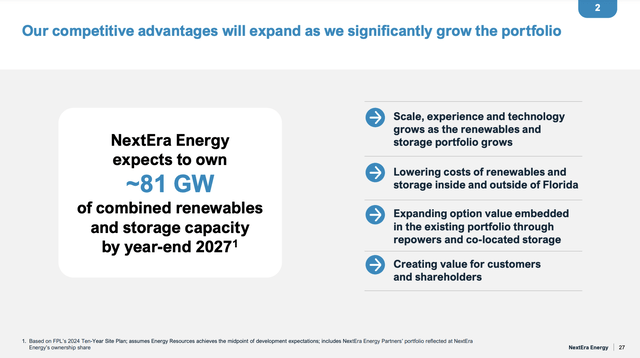

Even better, the company’s footprint in battery storage, with more than 50 gigawatts in its operating portfolio and 34 gigawatts of standalone interconnection queue spots, allows it to address increasing demand.

This is important, as the company expects a 20% compound annual growth rate in installed renewables over the next decade. I added emphasis to the quote below:

Our competitive advantages apply across our development platform. We are expecting a 20% compound annual growth rate in installed renewables over the next 10 years. So while Energy Resources is growing, FPL is growing at the same time. And with FPL, the renewables today are roughly 5% of our capacity. That’s expected to grow to 38% and in the next 10 years. Why? Because solar and storage are by far the lowest cost option for customers, driving bills lower every day. And scale, experience in technology, it grows as our portfolio grows. We’re expecting an 81 gigawatt combined renewable generation portfolio by the end of 2027. – NEE 2024 Analyst/Investor Day

It also helps that the company has a super healthy balance sheet. In general, this is important to support multi-billion CapEx plans. However, especially in an environment of elevated rates, financial health is key.

The company has a balance sheet rating of A-. Although the company is expected to see a net debt surge from $70.5 billion in 2023 to more than $94 billion by 2026, it is expected to keep its net leverage ratio below 5.0x EBITDA. In 2022, the leverage ratio was 7.4x EBITDA.

A healthy balance sheet with favorable rates is one of the reasons why it can pass on low rates to customers. The other is its “operational excellence,” as the company’s FPL operations have O&M costs that are 70% lower than average utility, creating $3 billion in annual savings for customers.

It also has 482 power purchase agreements across 194 counterparties, which further supports its stable and predictable cash flow.

Over the past decade, FPL has expanded so rapidly that it has added enough gigawatt hours to match 50% of one of California’s largest utilities, 40% of a major Southeast utility, and 100% of Ohio’s largest utility.

Although the company did not mention the names of these peers, these are impressive numbers nonetheless.

The company even makes the case that no utility in the U.S. has invested more in new generation and grid technology over the past 20 years than FPL.

This aggressive capital deployment has allowed the company to build a “brand new utility,” integrating more solar and storage capacity than any other operator in Florida.

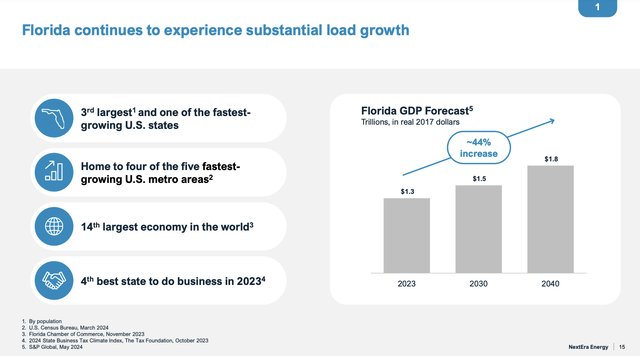

Speaking of Florida, especially after the pandemic, the state has become an economic hotspot in the United States, attracting people and businesses.

It is currently the 14th-largest economy in the world, the 4th-best state to do business in (according to S&P Global), and the third-fastest growing state, with a GDP forecast of $1.8 trillion for 2040 – 44% above 2023 levels!

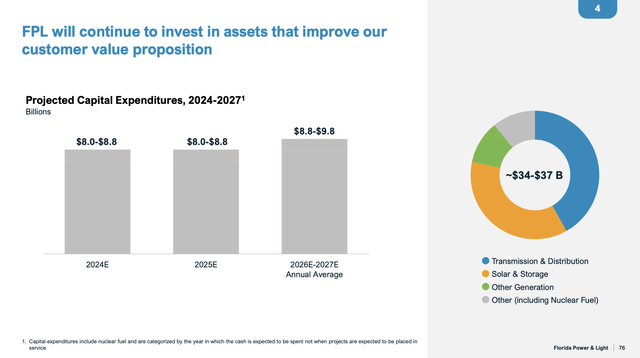

Going forward, NextEra Energy is poised for substantial growth, with an expected investment of $34 billion to $37 billion over the next four years (see the chart below).

This investment is primarily aimed at improving the company’s regulatory capital employed, which is expected to grow at a compound annual growth rate of roughly 9% through 2027.

Moreover, the company plans to invest $12 billion in solar energy over the coming years, aiming to add 20 gigawatts of solar capacity over the next decade.

Interestingly, the company makes the case that solar installations have a capital revenue requirement, which is offset by fuel savings and production tax credits, making solar power nearly zero cost over its 35-year lifecycle when discounted to today’s dollars.

In other words, initial costs are high. Total costs are very low.

This is one of the reasons why NEE believes it can continue to deliver attractive prices for customers.

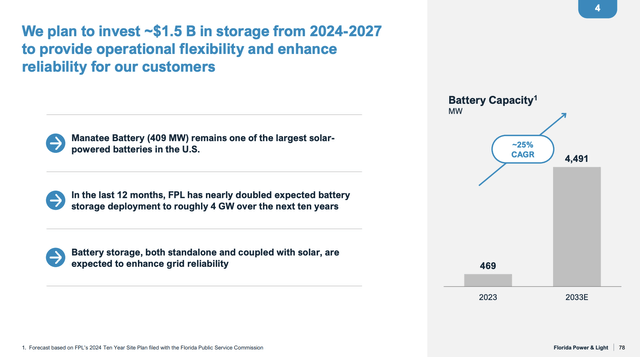

Meanwhile, the company is doubling its battery storage capacity from 2 GW to 4 GW over the next ten years, with a $1.5 billion investment in battery storage planned for the next four years. Total battery capacity is expected to grow by 25% per year through 2033.

Essentially, this move makes sure that solar energy can be stored and used effectively even when the sun is not shining, which is one of the biggest issues solar energy is struggling with (reliability).

Valuation

So far, we have discussed a lot of bullish developments.

The company has a cost advantage, a healthy balance sheet capable of absorbing elevated future capital investments, strong demand, and a focus on dividends.

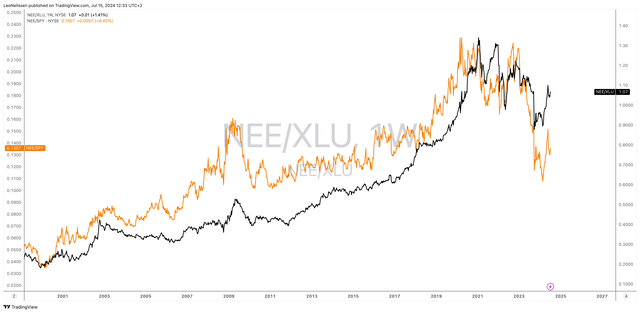

As such, the chart below shows that the company has consistently beaten both the Utilities ETF (XLU) and the S&P 500, as the NEE/XLU (black) and NEE/S&P 500 (orange) ratios below show.

TradingView (NEE/XLU, NEE/SPY)

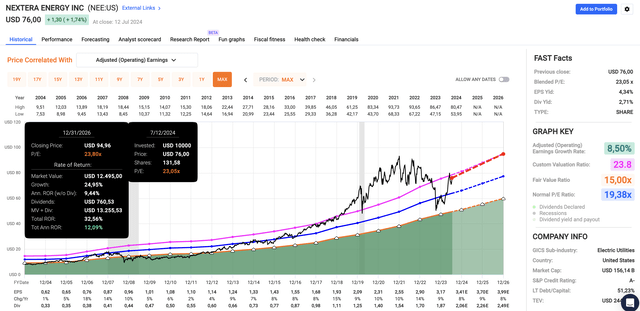

Valuation-wise, NEE stock trades at a blended P/E multiple of 23.1x.

The company’s 20-year normalized P/E ratio is 19.4x. The 10-year P/E ratio is 23.8x, slightly above the current valuation. Using the FactSet data in the chart below, EPS is expected to grow by 8-9% per year through at least 2026.

If the Fed is able to find a way to lower rates, I believe its 23.8x multiple continue to be warranted, which would imply a fair stock price of $95, 25% above the current price.

It would imply a theoretical annual return of 10-12%.

Since 2004, NEE has returned 12.6% annually, which is a truly impressive return.

The only reason I don’t own it anymore is my focus on more volatile dividend stocks in the energy space. I currently do not own any utilities. That’s simply based on my risk profile, not because I don’t believe any of the bullish things I wrote in this article.

Takeaway

NextEra Energy emerges as a powerhouse in the rapidly evolving landscape of AI and clean energy demand as it capitalizes on its massive portfolio in renewables and storage.

With a track record of strong financials and strategic growth initiatives, including significant investments in solar and battery storage, NEE is in a great spot to meet escalating energy demands while delivering consistent shareholder value through dividends and potential capital appreciation.

As the utility sector adapts to new challenges, I believe NEE stands out for its operational excellence and its competitive edge over many of its peers.

Pros & Cons

Pros:

- Strong Growth in Clean Energy: NEE is a leading player in renewables and storage, poised for significant growth.

- Financial Stability: The company has a healthy balance sheet, strong cash flow, and consistent dividend growth.

- Operational Efficiency: Lower costs and reliable service enhance competitive edge.

Cons:

- Sector Challenges: Utilities face pressures from rising inflation and energy transition costs, impacting profitability and growth potential.

- Debt and Leverage: Although the company has a stellar balance sheet, the impact of potentially prolonged elevated interest rates could hurt its future growth plans.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.