Summary:

- NextEra Energy investors who added while it was significantly overvalued late last year have underperformed the S&P 500 by a considerable margin. I cautioned investors to be cautious then.

- NextEra is a high-quality renewable energy play. But, NEE is not immune to overvaluation prospects, given the buying fervor.

- Despite that, NEE’s solid fundamentals remain intact. Management’s confidence in its earnings trajectory should attract dip buyers to return at the appropriate valuation.

- I assessed that the moment had arrived for me to turn more bullish on NEE. With interest rates likely peaking, yield-driven headwinds are not expected to worsen.

- I make the case why I’m ready to start buying on the renewable energy leader and ride out the near-term volatility. Comment and let me know whether you concur with my upgrade.

pidjoe

NextEra Energy, Inc. (NYSE:NEE) investors who added late last year bore the brunt of its significant underperformance relative to the S&P 500 (SPX) (SPY) since then. I cautioned investors in September 2022 that NEE was overvalued and they needed to be very careful.

While NEE is a high-quality regulated utility and renewable energy leader, it’s not immune to over-optimism and overvaluation challenges. Earlier holders in NEE could point out that it outperformed SPX over the last 10 years on total returns. Accordingly, NEE delivered a 10Y total return CAGR of 15.2% despite the pullback from last year’s highs.

As a result, NEE’s overvaluation has normalized, even though it’s still not cheap, with Seeking Alpha Quant assigning it a “D” valuation grade. Despite that, I gleaned that the underlying fundamentals for NextEra Energy have not deviated. Management’s update at its second-quarter or FQ2 earnings call corroborates my conviction that NextEra is a high-quality leader in the renewable energy space.

Its regulated business continues to gain traction, given the “more than 12% year-over-year increase in regulatory capital employed.” In addition, the demand/supply dynamics in the solar energy market have also improved, as the company stressed that it’s “now witnessing an increase in capacity both in the US and other markets, enabling NextEra to leverage its buying power.”

As such, I assessed that the improved industry dynamics and more constructive macroeconomic conditions should give investors more confidence about NextEra’s energy medium- to long-term growth trajectory. In addition, the company is expected to commit more resources to developing its solar energy business while improving “the transmission and distribution system while keeping customer bills affordable.” As such, management accentuated that it has “more than half of its planned renewable energy growth until 2026 dedicated to solar and energy storage projects.”

It’s also important to note that the company is still early in its nascent push to develop a sustainable clean hydrogen segment. However, management’s commentary suggests that traction is not likely in the near term, with more constructive momentum likely toward the end of the decade. Given NextEra’s market leadership, I have confidence that the company is well-positioned to lead in clean hydrogen, given its significant resources and favorable cost of capital advantages against smaller peers.

As such, I believe NEE holders must recognize that I’m not a perma-bear in NEE at the appropriate valuation. While NEE remains priced at a premium, I believe the current valuation is reasonable for its growth potential, with Seeking Alpha Quant assigning NEE with an “A-” growth grade.

Accordingly, NEE’s forward EBITDA multiple has dropped to 15.5x, still above its 10Y average of 13.6x. However, it’s also important to note that the market is likely pricing NEE for medium- to long-term growth, as its valuation bottomed out last year at the 14.2x level.

With management reiterating its robust earnings guidance through 2026, I don’t expect NEE to trade consistently below its 10Y average. Moreover, with macroeconomic conditions unlikely to head into a hard landing, downstream dynamics are expected to remain robust, strengthening NextEra Energy’s revenue and earnings visibility.

While the current high-interest rates are likely affecting the appeal of its relatively low forward dividend yields (2.85%), I anticipate interest rates are likely peaking, suggesting yield-driven headwinds are not expected to worsen further.

With that in mind, I believe it’s appropriate to assess whether the more constructive risk/reward levels are in sync with NEE’s buying sentiments, suggesting dip buyers have returned.

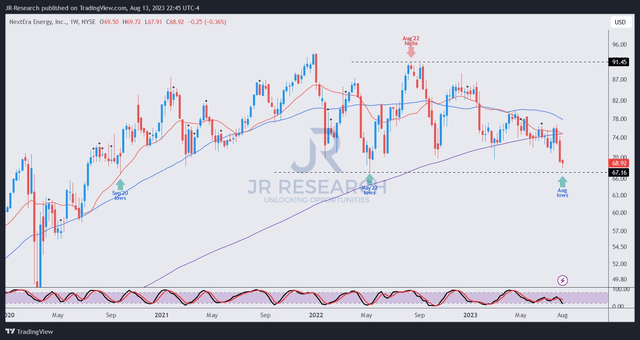

NEE price chart (weekly) (TradingView)

To be clear, I didn’t glean robust buying sentiments supporting the recent pullback yet, even though there were glimpses of it last week, as seen above. Zooming out to its long-term chart, NEE remains in a considerable consolidation zone that started in September 2020.

As such, the contention between buyers and sellers has not been decisively resolved, suggesting a further breakdown in upward momentum could continue, giving more impetus for selling pressure to intensify.

However, I believe NEE’s dip buyers should support its critical support zone identified at the $67 level. Based on my observation, buyers did not give up this level when tested previously, suggesting high conviction. Could it be the same this time? It’s still too early to tell. However, I believe the conditions leading to more dip buyers returning to defend the $67 level are increasingly constructive, as discussed earlier.

Therefore, I’m ready to turn bullish on NEE at the current levels and encourage holders to add more exposure.

Rating: Upgraded to Buy. Please note that a Buy rating is equivalent to a Bullish or Market Outperform rating.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in NEE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!