Summary:

- NextEra Energy’s valuation has normalized, making it a more attractive investment option.

- The company’s fundamentals and portfolio make it appealing despite not offering a high yield.

- NextEra Energy’s subsidiaries, FPL and NEECH, contribute to its strong performance and growth in the utility industry. I view NEE as a “BUY” here, and give the company a target.

pidjoe

Dear subscribers,

I haven’t exactly been a vocal proponent of NextEra Energy (NYSE:NEE) or its L.P. at any point in time previously.

Why?

The reason is simple.

Why on earth would I pay top-dollar multiples for a utility company when I can get larger utilities trading at more than 5x the yield at a significant discount in Europe?

Utilities that, by the way, have an equally or close to equally attractive portfolio.

If you, like some I know, bought NEE for the promise of growing renewable attraction at any time in the past 5 years now, you may still be in the positive, but anyone who bought during or after 2019 is now dangerously likely to be negative, and even if you bought during the worst of COVID-19 dip, you’re now at a meager 4% annualized RoR.

Why is that?

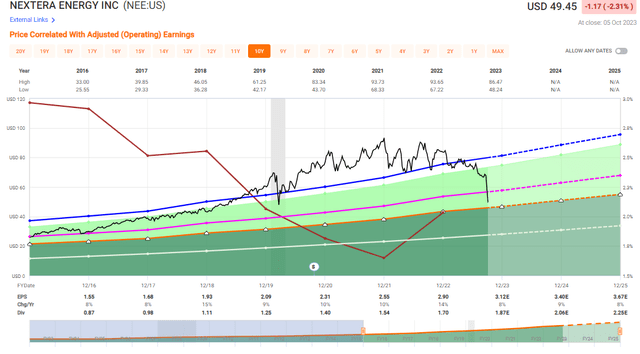

Because in less than a month, the valuation for this utility has in fact almost “normalized”.

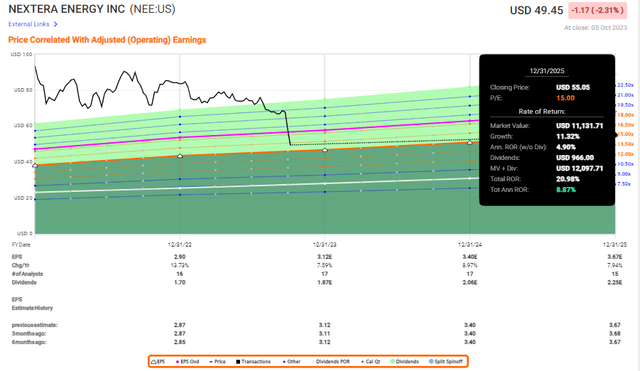

NEE valuation (F.A.S.T Graphs)

Not much attracted me to NEE for the past 4-5 years. That is now different. I will be providing you with my first coverage article for NEE, and my first positive stance. This company does not match the yield of any of the better/higher utilities I invest in, but it makes somewhat up for this with its fundamentals and portfolio, which we’ll be looking at here.

So, let’s dig in and let’s see why I haven’t been interested before, but why I am interested now.

NextEra Energy – The upside could be significant based on incredibly appealing fundamentals

To be clear, this to me isn’t a go-gaga sort of table-pounding, screaming “BUY” that others seem to consider it at. My own view on utilities has always been moderated by what I “use” them for – usually yield and safety. While NEE has certainly been “safe”, it hasn’t offered a yield as such, not a high one. It also, during the worst time, traded at 37x P/E.

And the day that I’m buying a utility at 37x P/E, is the day that I start selling snowballs to Swedes living above the polar circle, to put it mildly.

Just “no”.

Investors that bought the company back in the Fall of last year, when everything seemingly dropped except stocks like this one, have lost around 40%+ of their investment at this point (unrealized losses of course). This shows you some of the issues with buying something like this at a high price. The company also, at the time had nearly $180B of market cap. Today it’s around $100B, and likely, if the recent few weeks are any indication, to go even lower.

NextEra Energy requires a bit of understanding. The company is essentially not reporting financial results under NEE – reporting comes from the FPL and NEECH Businesses. FPL, or Florida Light & power, is the largest vertically integrated utility in the US, measured on the basis of MWh sales. Not a bad start.

NEECH meanwhile, owned fully by NEE, provides funding for its operating subsidiaries other than FPL, such as NEP, an affiliate of NEE that works on clean energy projects with supposed long-term stable cash flows – it’s been a high-yield favorite of many an investor I’ve spoken to here.

The feather in the company’s cap really is FPL – it’s one of the better utility franchises in the US, with almost 6 million accounts, spread out in the following area.

NEE IR (NEE IR)

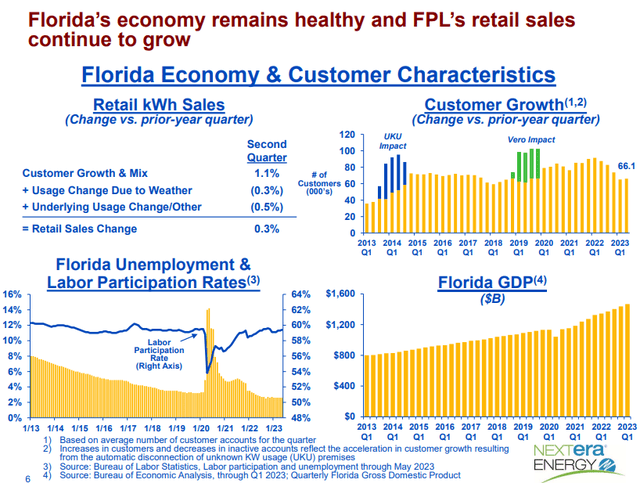

You also have very solid recent results from FPL, as of the 2Q23 results, which show continued growth in retail sales at a relatively favorable mix, and good labor participation rates. (Source: NEE 2Q23)

The same trends, by the way, are true for the company’s Energy resource subsidiary, which is one of the leading businesses in electricity from wind and solar.

This is one of the primary arguments that bulls have when it comes to NextEra Energy. The company is really a world leader in these fields of renewables – and there is a legitimate argument to be made that some of the stated climate goals won’t be possible to be met unless players like NEE work with renewable sources.

However, that’s not the same as this being investable.

Many people think that just because something is necessary or a good business idea, equates it to being an investable idea. That’s not the case. Take airlines for instance. I’m hardly the only investor who doesn’t invest in airlines, but I fly plenty with several different airlines. Renewables is a good example of another industry that might not be as good as you think, at least not at any price.

NextEra does more than just wind and solar though – thankfully. If it was just that, I probably wouldn’t be interested. Hydrogen is another thing the company is working with and pushing for. All of the company’s mix makes it into the cleanest energy utility in North America.

That’s probably part of the reason the company has seen so much exuberance over the past few years.

I won’t argue that NEE isn’t a good investment. Because it is. The numbers prove that it is. If you invested many years ago, over 20, the company is at a decent RoR. However, people holding this stock as sacred have been talking about 15-18% long-term rates of return.

That is no longer the case.

On a 20-year basis, you’re now “down” to 10.96%. It’s still good, still market-beating, but frankly, portfolio positions that I have are better in terms of annualized RoR.

It all comes down to recognizing overvaluation when it happens, and when not to “BUY”, or when to “SELL”.

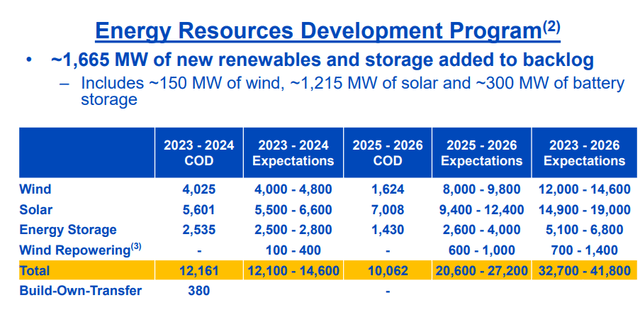

So, again – I won’t argue this isn’t a good company. Because it is. Just look at the backlog for some of these subsidiaries.

That’s over 20 GW worth of backlog, with predominantly solar – which I like above wind. And the company keeps increasing EPS as well, much like my own European utility investments. Frankly, a utility that saw declining earnings here would have me extremely worried – so rising EPS isn’t an advantage, it needs to be a “Given” for this sort of investment.

The company also argues it can continue to grow its dividend, to which I respond that “you better!”. Because, the company at its ~3% yield, is one of the lower-yielding utilities out there.

Let me quote the company’s earnings material here.

We will be disappointed if we are not able to deliver financial results at or near the top end of our adjusted EPS expectations ranges through 2026

(Source: NEE 2Q23)

So, for those of us living under a rock, what exactly happened to the company which is the largest electric utility company in the US?

Well, simple. The company came out with a surprising bout of realism in early October and late September. A confirmation that it won’t be doing an asset dropdown, subsidiaries cutting expectations for unit growth. The serious portion of this story is that the company claimed/reiterated its growth prospects at 12-15% as late as July 2023, until at least 2026. That’s what the comment came from that I showed you – the fact that the company management themselves said they would be disappointed if they didn’t reach this estimate.

Part of the problem is the company’s complex structure. It probably wouldn’t be as severe in terms of drops if it was more traditional – but with a structure that pays out almost 100% of available cash for distribution, the success of NEP, for one thing, is extremely tied to its ability to raise capital and work with very favorable debt terms.

Well, that’s no longer the case – not for NEP, and not as much for NEE either. Cost of debt and rate cases are a core part of the thesis for a utility.

I view this as “reality” coming back to NEE. Some of these analyst downgrades are almost laughable, with their 30-50% cuts, which just goes to show you how incredibly inflated some of those targets really were.

Fundamentally, the company uses plenty of hedges for its interest rates to offset risks – but if you dig down into filings, you find close to $19B worth of swaps that are due between 2023-2025 – an impact of this alone is upwards of $0.15/share headwind potentially – and for a company that on a per-share basis manages adjusted $2.9/share for its last year, that alone is a 5% impact.

So, here’s what I “know” – because I’ve been trading the tail end of the utility sector and renewables for about a year now, as they’ve grown cheaper. But the core problem is that the way renewables have been estimating their returns, their upsides, and their overall estimates are based on very low interest rates, not the current realistic rates. That’s why the largest wind power company in the world, Orsted (DNNGF), fell like a rock.

It’s also why I picked it up at 350 DKK/share – because it’s a great business – just not at a premium.

The same is true for NEE.

I’m saying that NEE is a good business. You’ve just been seeing the exuberance for over 3 years at this point, so this reality check is painful if you’re “in it”.

But now NEE is actually, slowly, getting interesting.

And this is worth highlighting.

The problem with NEE is as with any renewable-focused utility.

The cost of capital/amount of capital required for investing in renewables at this stage is still comparatively high. This has been excused during times when debt is cheap, when energy has been expensive, and things like the Russian/Ukraine war have come in between, but this is normalizing. Because the cost of investment is so high for renewables, that means that renewable companies rely more on debt.

This sort of debt reliance is not a positive in a rising interest rate environment.

This, in addition to other factors, is what is driving the decline. Because when you rely on debt to finance projects, and the costs for financing increase, you don’t get your returns.

And while NEE looks okay, things in terms of debt are actually, from some perspectives, looking less than perfect. The cost of debt is up triple digits since 2019 (Source: Seeking Alpha, NEE debt), while other companies including European ones, have seen increases in debt servicing costs of perhaps 15-35%. Not even close.

Yes, company earnings are up as well – more in fact than its peers – but not even close to the relationship between debt cost increases. If your competitors are increasing EBITDA by 21% in 3-4 years for debt cost increases of 25%, and your EBITDA is up 46% for a 121% debt cost increase, that does not speak in your favor.

Also, risk number two.

Florida.

Forget the inflationary pressure, which is high in the state. Florida remains and is one of the heaviest-impacted states in terms of weather effects out of all of the USA. You’re talking extreme heat, extreme drought, wildfires as well as both inland flooding and coastal flooding (Source: SafeHome).

If choosing specific geographies to invest in for utilities, I wouldn’t necessarily rush towards Florida – just as I wouldn’t rush towards California for insurance investments.

So, that’s a lot of challenges, but the point here is for me saying:

This is why I haven’t invested at a premium.

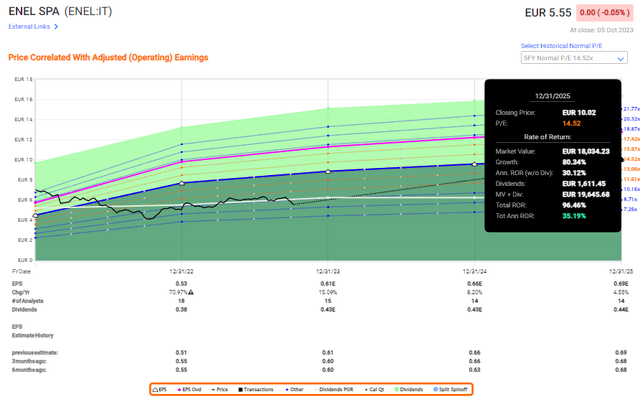

I’m not saying it’s not a good company worth your money, because it actually is – but I’m saying this company hasn’t been as attractive as Enel (OTCPK:ENLAY), where I’m still up 30% this year, or other utility companies.

Now, for the positives.

The positives for NextEra Energy – why I am now looking at “getting in”

It shouldn’t be a surprise to you that the reason I’m probably getting into the company next week is because of valuation. I’m known for being very valuation-focused.

The only reason I haven’t gone in yet is because market action has not convinced me that the “drop” is over.

As I am writing this article, the company is dropping even more. We’re down to around $48-$54/share, which is the lowest level for around 3 years.

That doesn’t necessarily mean it’s “cheap”.

Cheap is what I will call a utility below 10x P/E.

NEE is now at ~16x. Enel is currently at 9.4x. This is my conservative upside for Enel based on a forward P/E of 14.5x. Enel is BBB+ rated, over €50B in market cap, and also comes with a very well-covered yield of over 7%.

But, this is on NextEra. So the upside for NextEra based on a forward P/E of 15x looks something like this.

NextEra Upside (F.A.S.T graphs)

Of course, this is sans a premium. And the largest utility in the US with a solid set of renewables, does deserve a premium.

But how much?

At 17.1x P/E, the upside is around 15% per year until 2025E based on the current growth rate of close to double digits. Or, on a 20x P/E basis 22% per year – still not as much as Enel, but it’s getting there, and it obviously does have some fundamental advantages.

S&P Global targets obviously haven’t been able to fully adjust their targets.

So, let’s look at 12 months ago. We’re talking about a low target of $78/share and a high of $120/share. The average back in September of 2022, was a nice $97/share (Source: S&P Global), at which point 16 out of 19 analysts were at a “BUY” or equivalent when the company traded at around $80/share.

Now we’re at $48/share. The targets begin at $53/share, go up to $102/share, and 20 analysts are at an average of $80/share. 11 analysts are now at a “BUY” rating.

Plenty of analysts have called for “buying the company” and going in very deeply. They take a bullish view of the industry’s tendencies, agreeing with the sentiment that the drop is failing to take into account its fundamentals, balance sheet capacities, tax credits, or potential asset sales.

I say I’d rather err on the side of safety here.

The dividend is safe – but it’s less than 4%. So there’s not much to crow about there. Also, the company is expected to end 2024E with over $75B worth of debt, which isn’t technically above 5x net debt/EBITDA, but there are utilities with better leverage – far better, in fact.

My main worry is that I don’t want to go into NEE before I believe it’s really “cheap enough”. At below $50/share, I do believe we see a compelling argument for the company’s above-quality, A-rated portfolio, and balance sheet, even with its plethora of subsidiary issues, but I’d be more comfortable buying it below $40-$45/share. Of course, we might not get there. I believe there’s only so far a drop like this can go.

That’s why I take a careful approach here and buy slowly.

There’s no shortage of quality utilities out there – especially not if you broaden your scope internationally.

What I want you to do is to completely forget the 25x P/E+ valuation trends. Those were a product of ZIRP and renewable mania. We’re now going back down to earth. The company is better-valued at a range of 15-18x P/E, even if the 20-year normalized P/E comes to around 19x. I wouldn’t go to 19x here, I don’t see the justification for it.

At 17x P/E the upside is 15% per year, and implies a long-term price target of around $62/share.

I give the company a discounted price target of 15.5x 2023E P/E of $50/share, to account for some of the risk.

It’s below S&P Global.

It’s below most of my colleagues here.

But it’s what I believe the company is worth, because not only do I invest in utilities with far better return rates for the past 24 months, but with better leverage, better yield, and equal or similar credit rating.

NEE feels to me like a company that too many people have “fallen in love with”. I’m guilty of the same flaw at times.

I will not do so here.

My thesis for the company is as follows.

Thesis

- NextEra is an interesting company. It has a superb credit rating and a solid business with one of the more interesting portfolios out there. Everything I said in this article notwithstanding, I believe the company to be one of the best utilities out there.

- This does not excuse excessive overvaluation, however, which NEE has been seeing for at least 3 years at this point. NEE has been uninteresting for me to invest in for a very long time – but it recently got interesting.

- The company is now a “BUY”, with an initial PT of $55/share which gives it a small upside. I may initiate a position in the business within the next 14 days.

- I’m also looking at options, and various strikes for the company to see if a cash-secured put could be attractive here.

Remember, I’m all about :1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

NextEra Energy is not cheap, but aside from this, I can say “BUY”. My cost basis is below $50/share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ENLAY, NEE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment. Short-term trading, options trading/investment and futures trading are potentially extremely risky investment styles. They generally are not appropriate for someone with limited capital, limited investment experience, or a lack of understanding for the necessary risk tolerance involved.

I own the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in my articles. I own the Canadian tickers of all Canadian stocks I write about.

Please note that investing in European/Non-US stocks comes with withholding tax risks specific to the company's domicile as well as your personal situation. Investors should always consult a tax professional as to the overall impact of dividend withholding taxes and ways to mitigate these.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

The company discussed in this article is only one potential investment in the sector. Members of iREIT on Alpha get access to investment ideas with upsides that I view as significantly higher/better than this one. Consider subscribing and learning more here.