Summary:

- NextEra Energy investors experienced a remarkable revival after the panic selling in NEE reached selling exhaustion in October 2023.

- NEE is still not overvalued relative to its historical averages, notwithstanding its recovery of nearly 30% from its recent lows.

- NextEra Energy is well-positioned to lead the transition from fossil fuels to renewable power generation and storage with its market leadership, robust balance sheet, and massive scale.

- I argue why investors looking to add more exposure are still early, as the NEE rally is just getting started.

pidjoe

NextEra Energy (NYSE:NEE) investors have enjoyed a revival of fortunes since it endured the worst selling in three years, reaching lows last seen in March 2020. In an early October update, I urged investors to ignore the heightened fears that led to its sharp decline as NEE bottomed out resoundingly in October.

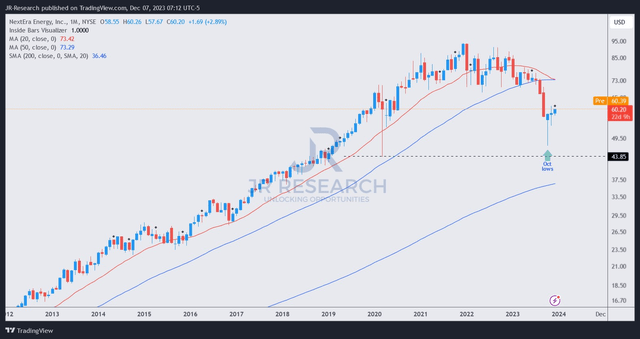

In other words, NEE buyers returned with conviction, helping the leading renewable energy leader form a robust bottom on its long-term chart and demonstrating confident buying sentiment. It coincided with a significant normalization of NEE’s valuation, reaching below its 10Y average, indicating significant pessimism.

Notwithstanding the nearly 28% recovery from the $47 level in October, I believe NEE remains early in its long-term recovery from its battering. NEE’s forward EBITDA multiple of 14x is slightly above its 10Y average of 13.7x as it recovered from its battering.

I already have a full position in NEE, capitalizing on its recent slump to add aggressively. However, I’m looking to reallocate capital and increase my exposure. NextEra is well-primed to lead its peers as we transition from fossil fuels to renewable power generation.

Investors should recall that NextEra’s business comprises its regulated utility in Florida Power & Light or FPL (>70% of NextEra’s business) and NextEra Energy Resources or NER. FPL is reported as “America’s largest electric utility,” while NER is a significant market share leader in a diversified renewable energy and storage portfolio.

FPL remains the company’s critical near-term earnings driver, benefiting from its market-leading position and competitive pricing. Management stressed that FPL has “a well-established capital plan agreed upon through 2025,” corroborating the earnings stability for NEE investors.

In addition, NER holds “over 20% of the renewable origination market share,” demonstrating its scale and credibility with large customers. The company has continued to gain traction in Q3, adding 3.2 gigawatts to its backlog, up markedly from the 1.7 gigawatts added in Q2. As a result, it has lifted its backlog to more than 21 gigawatts, providing clear growth visibility for investors looking to invest in NEE’s long-term growth potential. Accordingly, the company remains confident about reaching a backlog of between 32.7 and 41.8 gigawatts by 2026.

I believe it’s clear to renewable energy investors that NEE is well-positioned to maintain its leadership in a market environment where interest rates are expected to remain high. The company’s robust balance sheet and earnings visibility are critical underpinnings to support robust investor sentiment over smaller developers with fewer resources. As a result, I view NEE’s “B+” growth grade as high quality, given the company’s confidence in its adjusted EPS growth outlook.

Accordingly, NextEra Energy expects an adjusted EPS range of between $3.63 and $4 by 2026, indicating a midpoint CAGR of 7% from 2024’s estimates. In addition, management stressed that NextEra benefits from its ability to “enter into effective interest rate hedges, providing a significant competitive advantage.” As a result, it provides confidence for investors in the visibility of its EPS growth profile, helping to de-risk the company’s short- and medium-term outlook. Therefore, investors shouldn’t understate the substantial advantages proffered by NextEra Energy’s cost of capital and massive scale.

NEE price chart (monthly) (TradingView)

NEE’s October 2023 bottom at the $47 level likely stunned panic sellers into bailing out at the worst possible moment as it bottomed out.

The buying sentiment over the past two months has continued to improve, although I don’t expect a rapid recovery. Despite that, I expect inward sector rotation from less attractive/overheated sectors as investors look for well-battered and high-quality plays emerging from their malaise.

I believe NEE is one of those turnaround opportunities that long-term renewable energy investors should consider capitalizing on, as it remains well below its all-time highs.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NEE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!