Summary:

- NextEra Energy is a top-performing utility stock that has consistently outperformed its peers over the last decade.

- The company is well-positioned to benefit from long-term growth in renewable energy sources and federal/state subsidies.

- NextEra Energy stock is undervalued based on various metrics and is projected to increase earnings by nearly 50% over the next 4 years.

pidjoe

Timing is often everything. While finding good management teams and well-run companies is obviously very important, no business can completely control the operating environment a corporation functions in. Sometimes macro events can be more important than the specific fundamentals of an individual corporation.

The Utility industry has become one of the more preferred sectors for people to invest in for multiple reasons over the last decade. With interest rates at historically low levels for most of the last ten years, these stocks have gotten a lot of demand from income and dividend investors. One of the best-performing large-cap utility stocks in this industry is NextEra Energy (NYSE:NEE).

NextEra Energy is a $131.17 billion company that operates in both traditional power sectors such as nuclear and natural gas, as well as renewable energy areas such as wind, solar, and other clean energy sources. The utility operator’s current yield is 3.22%.

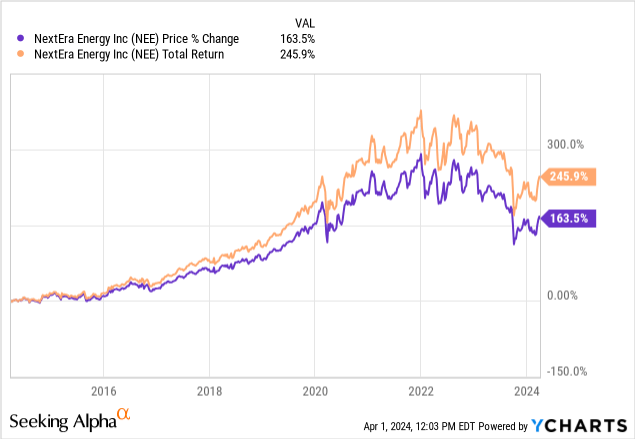

NEE has offered investors total returns of nearly 246% since 2014, while the S&P 500 has offered investors nearly identical total returns of 245% during the same time period. NextEra Energy has still consistently and significantly outperformed most of the company’s peers during the last decade.

I am rating NextEra Energy a buy today. The company is ideally positioned to take advantage of what is likely to be strong long-term growth in a number of a number of sources of renewable energy. NEE should benefit significantly from both federal and state subsidies as well as the provisions within the newly passed Inflation Reduction Act Well. The company also looks undervalued using multiple metrics as well.

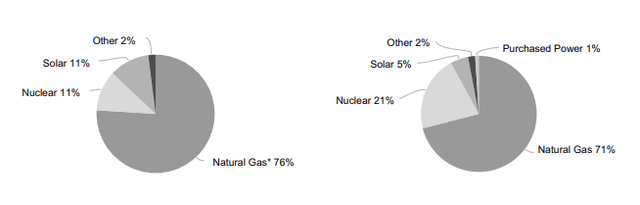

NEE has traditionally gotten nearly 90% of the company’s revenues from the Florida Power and Light Company, and less than 10% of the company’s revenues is come direct from investments in alternative and renewable energy. The company customers as 11% commercial and 89% residential. FPL’s energy sources are 71% natural gas, 21% Nuclear, 5% solar, 2% other, and 1% purchased power. NEE’s revenues coming directly from renewable energy, or NEER, are 61% wind, 14% solar, and 8% nuclear. The remaining amount comes mostly from natural gas. NEE’s most recent revenue growth has come almost entirely from the NEER portfolio, which saw revenues grow from $1.63 billion to $7 billion over the last 3 years.

A Grid of NEE’s Power Sources (NEE Investor Conference Presentation)

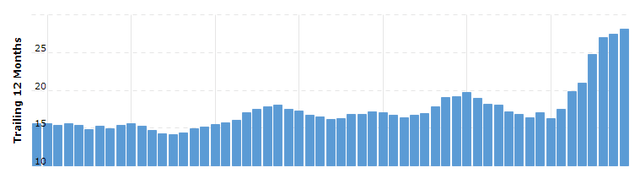

The company’s revenue growth has accelerated significantly in recent years, and exceeded the industry average of 5.4%, with NEE’s recent revenue growth per year averaging 8.4%.

A Chart of NEE’s Revenues (Macrotrends)

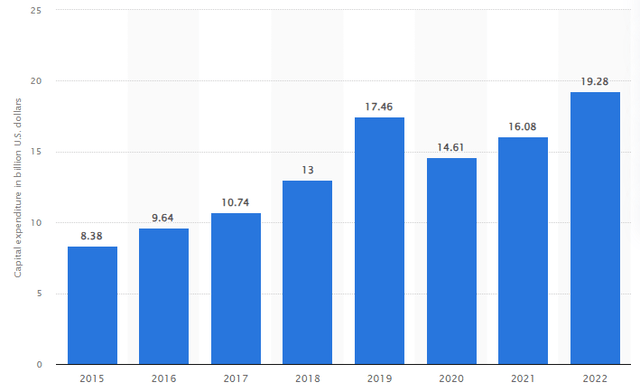

The company’s cap ex has been rising, and management has outlined aggressive spending plans moving forward as well, but the company has already raised significant debt the tax credits and rebates in the IRA should offset a lot of these costs as well. Management plans to spend nearly $32 billion over the next 4 years. This spending is being done with a manageable debt of $73.21 billion. NEE’s EBITDA ratio of 4.3x and the company, and the company’s EBIT covers the interest expense by 3x. The utility provider’s payout ratio is also a conservative 52%, well below the average payout ratio in the sector of 62.8%. NEE has also raised the dividend at a rate of nearly 11% a year over the last 10 years.

NEE capex per year from 2015 to 2022 (Statista)

NextEra Energy is also well positioned to benefit from both Federal and State subsidies as well as the IRA over the next several years for multiple reasons. In addition to the Florida state tax credits for renewable energy forms such as solar energy, NEE should benefit from the infrastructure build-out and tax credits in the IRA in multiple ways.

The Inflation Reduction Act includes significant tax breaks for both the production and investment in renewable energy forms such as wind and solar. This includes an up to 30% corporate tax credit even for large corporations such as NEE investing in bigger projects if they meet certain labor requirements. The credit can be carried forward as well. The IRA also provides grants and tax rebates that are designed to help metro areas and cities upgrade the power grid by working with companies such a NEE.

This is why NextEra Energy looks undervalued using several metrics. The company currently trades at 19x expected forward GAAP earnings, 13.85x predicted forward EBITDA, and 2.38x projected forward book value. NEE’s average five-year valuation is 23x expected forward GAAP earnings, 17x projected forward EBITDA, and 1.51x predicted forward book value. Analysts are also projecting that NEE will be able to grow earnings by nearly 50% over the next 4 years, and the company’s core business is fairly recession-resistant.

Even though renewable energy has become a political issue, the IRA is not going to be repealed, and younger more progressive voters who think what they refer to as climate change is a major issue are a very important part of the Democratic Base. These tax rebates and incentives also create jobs in red states as well, neither party is likely to try to repeal these provisions regardless of the outcome of the 2024 or future elections. With the federal government committed to building out and modernizing our country’s infrastructure, NextEra Energy should be well-positioned for years to come.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.