Summary:

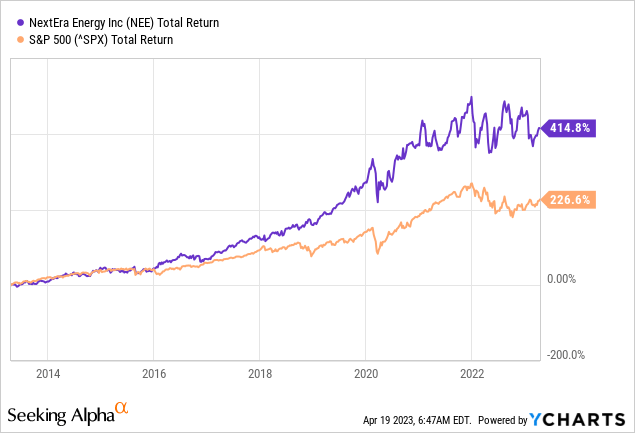

- NextEra Energy is a top performer in the energy sector and has even overtaken the S&P 500 in terms of total return.

- The company is performing well because of its clean energy initiatives and the Inflation Reduction Act is helping to further encourage clean energy investments.

- NextEra Energy expects earnings growth of 6% to 8% per share over the next few years but this is accompanied by a large increase in their net debt.

- The total amount of net debt has increased from $37 billion in 2018 to $63 billion currently.

- This means NextEra Energy will have to dramatically increase its electricity prices. I find this a disappointing development.

pidjoe

Introduction

NextEra Energy (NYSE:NEE) distributes electric energy from wind, solar, nuclear, coal and natural gas as energy sources to consumers and businesses in North America. It also develops and builds renewable generation facilities, battery storage projects and electric transmission facilities.

Investors in NextEra Energy have done well over the past 10 years. In fact, it is one of the best-performing stocks in the sector, even beating the S&P500 by a wide margin. With the sharply higher share price, people are wondering if it still makes sense to get in, in this article I make it clear that NEE stock is overvalued and the company has too much debt.

Strong Growth Ahead

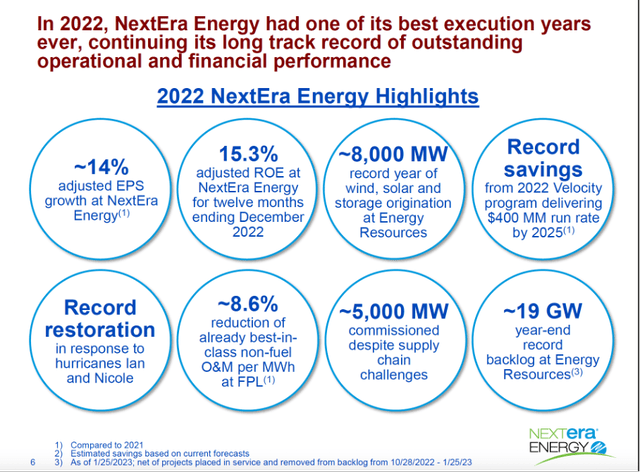

NextEra Energy will announce its first-quarter earnings on April 25. Figures for the fourth quarter and full year came out well with EPS growth of 14% for the full year 2022 compared to 2021. It is one of the largest clean energy companies in the United States and is also Florida’s largest electricity supplier. The company is investing heavily in solar & wind projects and added about 450 MW of new cost-effective rate base solar projects for FPL. The Inflation Reduction Act is a strong catalyst for NextEra Energy because of its clean energy incentives. Consequently, NextEra Energy expects annual EPS growth of 6% to 8% through 2026.

2022 Energy Highlights (NextEra Energy 4Q22 Investor Presentation)

Dividends and Share Repurchases

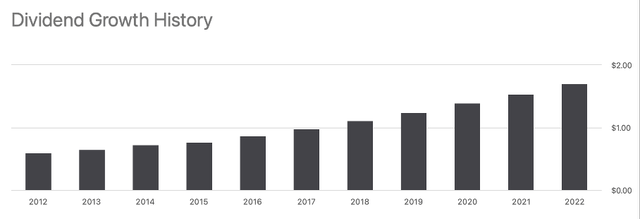

Over the past 5 years, the dividend has increased by an average of 11.6% annually, and 12 analysts forecast an increase of 9.6% in 2024. The dividend yield is 2.4%, and projections for 2024 put it at 2.6%. Comparing NextEra’s dividend yield to 10-year Treasury bonds for 2024, Treasury bonds look more favorable. NextEra looks like a more valuable investment if dividends continue to rise in the coming years.

Dividend Growth History (NEE Ticker Page on Seeking Alpha)

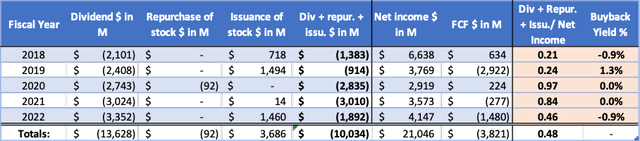

The dividend distribution increased annually, however, the company also issued shares which dilutes its shares outstanding. NextEra does not repurchase its shares. Overall, the total return to shareholders is about 50% of earnings. But due to fluctuating free cash flows, its cash decreased and debt has increased strongly. The company’s net debt increased from $37 billion in 2018 to $63 billion today, of which $9.7 billion is short-term debt. Due to rising interest rates, interest expense on this debt is increasing. NextEra’s net income of $4.1 billion is a pittance compared to the total debt. When the long-term debt matures, it must be refinanced at higher interest rates. Interest coverage is only 3.7 and it will continue to decline as the debt is refinanced. Therefore, I expect electricity rates to increase substantially in the coming years.

NextEra Energy’s cash flow highlights (Annual Reports and analyst’ own calculations)

Valuation Is Too Expensive

Many valuation indicators point to an overvaluation of NextEra Energy. Take cash and debt into the valuation picture and we see that the enterprise value to EBIT ratio has increased from about 15 in 2015 and before that to 47 currently, very pricey.

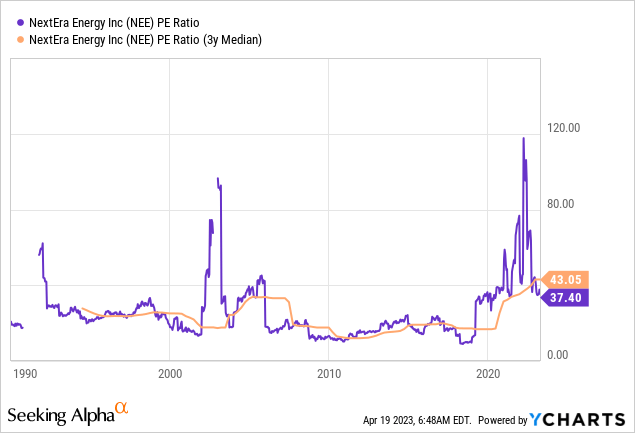

If we take cash and debt out of the equation, we also see with the P/E ratio that the valuation is huge with a ratio of 37 relative to its historical figures but also overall. However, YCharts shows only the GAAP P/E ratio.

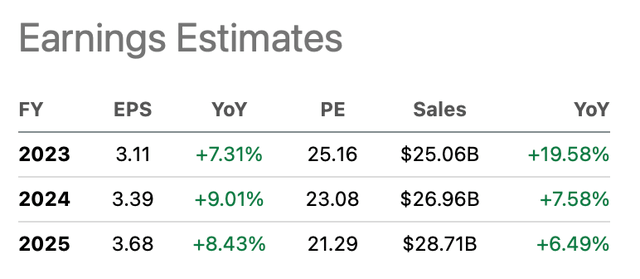

The earnings estimates from Seeking Alpha show the non-GAAP P/E ratio. We see that the non-GAAP P/E ratio is only 25 compared to 37 for the GAAP P/E ratio. 17 analysts expect high single-digit earnings per share growth, bringing the forward P/E ratio for 2025 to 21. Pretty cheap you might say, but remember that the PE ratio does not include the huge amount of debt. Earnings fall if interest expenses rise. 6 analysts have revised their earnings estimates upward and 4 downward. This paints an uncertain picture of the future.

Earnings Estimates (NEE Ticker Page on Seeking Alpha)

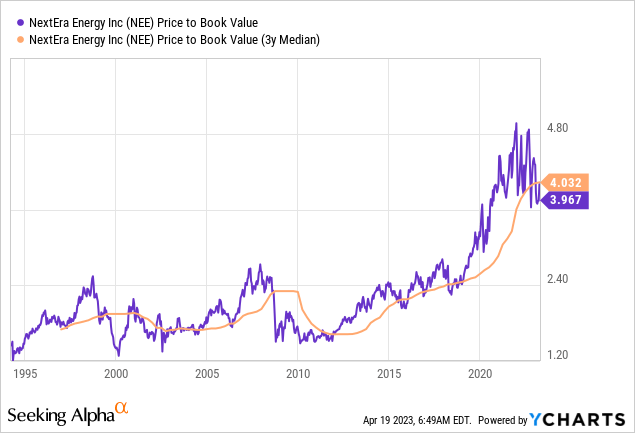

Finally, I provide insight into book value using the following YCharts chart. Book value is also important, of course, because utilities eventually have to repair or replace their assets. A lower book value means that cash flows are needed to refurbish the assets, and that obviously comes at the expense of profits.

The book value per share has risen evenly in recent years, but the share price has risen much faster. The P/B comes out at 3.9, and a cursory glance at the chart lets us conclude that NextEra Energy is once again overvalued.

Conclusion

NextEra Energy is a top performer in the energy sector and has even overtaken the S&P500 in terms of total return. The company is performing well because of its clean energy initiatives and the Inflation Reduction Act is helping to further encourage clean energy investments. NextEra Energy expects earnings growth of 6% to 8% per share over the next few years but this is accompanied by a large increase in their net debt. The total amount of net debt has increased from $37 billion in 2018 to $63 billion currently. It has a large amount of debt in comparison to its net income of around $4 billion. NextEra Energy has been able to benefit greatly from low interest rates, yet its interest coverage is only 3.7. Short-term debt of $9.7 billion will be refinanced at the sharply increased interest rates, bringing interest coverage into critical territory. Over time, the large amount of debt will also be refinanced at higher interest rates. This means NextEra Energy will have to dramatically increase its electricity prices. I find this a disappointing development. The stock is vastly overvalued based on various valuation metrics, which is why I give it a “hold rating.”

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.