Summary:

- NextEra Energy, Inc. has lost nearly 36% of its value since a bearish outlook was published in 2022.

- The company faces risk due to significant declines in the value of Next Era Energy Partners due to the impact of lower natural gas and higher interest rates.

- NextEra Energy’s focus on renewables will usually require a higher natural gas price. That said, the company is still largely gas-focused, giving it net positive exposure to lower cheap gas.

- NextEra Energy no longer trades at an unreasonable valuation premium to its peer group, with its two-year forward “P/E” being within the normal range.

- I believe NextEra’s most significant risk is a rise in bond yields associated with an inflation rebound. That said, the firm’s operational outlook seems likely to improve.

RyanJLane

Toward the end of 2022, I published “NextEra Energy: Tremendously Overvalued Based On All Fundamental Data,” detailing my bearish outlook on NextEra Energy, Inc. (NYSE:NEE). Most analysts and investors were bullish on NEE at that time due to its ample price appreciation over the preceding years. However, since that article was published, NEE has lost nearly 36% of its value.

My price target in 2022 was ~$42 per share. NEE currently trades at ~$55, potentially meaning it remains overvalued. Of course, much has changed for both the company and the economy since then. For the most part, utility stocks have lost value primarily due to the indirect impact of higher interest rates that have lowered their fair value. That said, like most of its peers, NextEra faces some risk due to labor shortages in the energy infrastructure industry.

Further, regarding NEE specifically, I had believed the company was overvalued due to an excess premium garnered due to its ESG focus. As NEE has lost value since then, it may no longer be overvalued based on its ESG focus. As we look into the rest of 2024, it appears likely that NEE will continue to experience ample volatility. That said, most of its directional volatility will likely depend on what occurs in the interest rate environment.

NextEra’s Fundamentals Remain Scattered

Fundamentally, NextEra is two companies with largely separate business models. One is Florida Power & Light, which accounted for $0.41 of its 2023 EPS. The other is Next Era Energy Resources, the world’s largest renewable power operator. NEER operates power projects that contract-sell electricity across the US. To a great extent, the infrastructure of those projects is owned by Next Era Energy Partners (NEP), in which NEE owns a controlling stake and which is operated by NextEra via NEER. Notably, the infrastructure company NextEra Energy Partners has lost nearly 70% of its value since 2022 as its EPS has collapsed, highlighting the issues in NEE’s renewable market.

Historically, investors love NEE because renewable energy is a growth opportunity. That said, renewable power is a growth opportunity mainly due to societal needs and governmental aims. Solar and wind account for around 14.5% of the U.S. power grid, while natural gas dominates at 43%. Coal is still a more significant power source than solar and wind at 16.2%. With natural gas worth only $1.84, renewable power is not very economical.

Indeed, an EIA study found that renewable power growth is not capital-efficient when natural gas is reasonably priced. Arguably, solar and wind are better long-term investments, as other analysis shows a lower overall electricity cost than gas; however, most of those data were found two years ago, when natural gas cost ~5X more than it does today. This is not to say that solar and wind are not the likeliest long-term power sources, benefiting NEE. Still, in the immediate term, natural gas is too cheap, and renewables are not as economical.

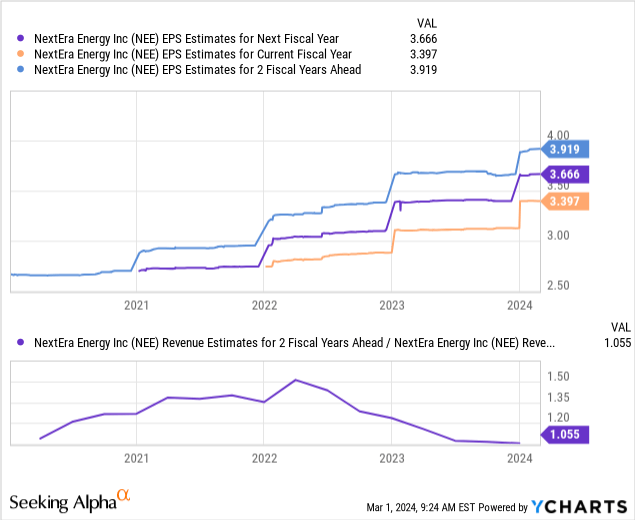

Still, most of NextEra’s power revenue from FPL comes from natural gas. The crash in natural gas prices improved NEE’s Q4 EPS by lowering power production costs, offsetting declines in NEP. The company’s EPS growth outlook remains decent, with ~8% growth expected over the coming fiscal year and 7% the year following. However, its sales growth outlook has slowed significantly. See below:

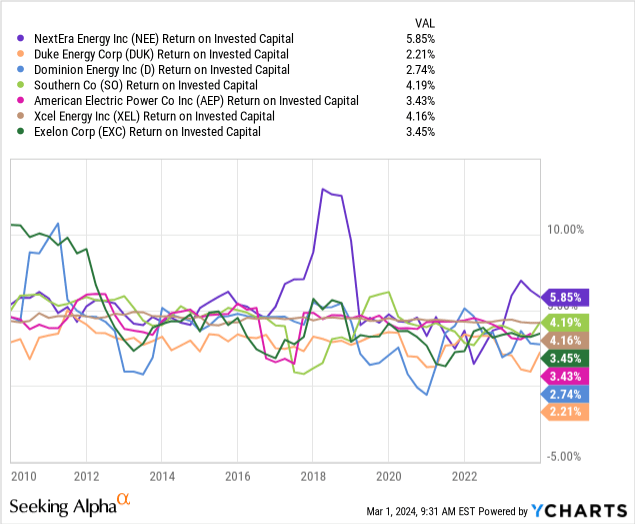

Overall, NextEra focuses more on improving its profit margins than on continuing growth in its renewables business. Fundamentally, the likelihood comes from the higher interest rate costs that are making solar and wind investments have lower returns on investment. On that note, NextEra does have a higher ROIC than its peers, potentially indicating the superiority of its focus on renewables. Its ROIC is typically more volatile than its peers and was the lowest in 2022. See below:

Overall, I believe that NEE should be valued similarly to other utility firms. Its focus on renewables is interesting and notable, but it is unclear if that will result in shareholder value. These renewable investments have high costs, as do all electricity investments, usually resulting in external financing that largely offsets any “growth” benefit for shareholders. Indeed, before its recent inflation-driven revenue growth, NEE had negative revenue-per-share growth for most of the 2010s, with its high overall sales increases more than offset by external financing.

What is NEE Worth Today?

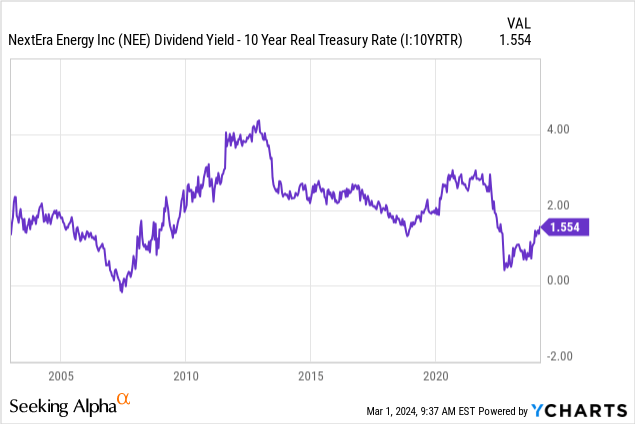

There are fundamentally two key ways we can value NextEra Energy. One is its dividend or income compared to real interest rates. For the most part, we should expect NEE’s yield to be tied to real interest rates, as both are inflation-hedged. Real interest rates are much higher today than in 2021, likely the most significant negative headwind facing NEE and most other utilities, as bonds become a higher risk-reward tradeoff than utility stocks. Historically, NEE’s dividend is usually around 2% above the 10-year real interest rate but ranges from 0% to 4%. See below:

Compared to real interest rates, NEE’s dividend is slightly low today. I believe NEE’s yield should be at least ~45 bps higher to make it fairly valued to real interest rates. With its forward yield at ~3.75% today, an increase to 4.2% would require a ~11% price decline for NEE to ~$48 to $49. However, while I disagree, many believe real rates will inevitably decline soon, potentially justifying the small historical premium to inflation-indexed bonds.

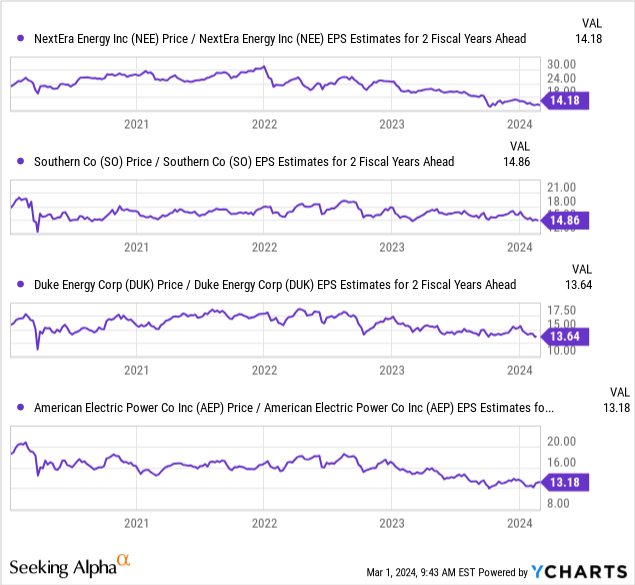

NextEra’s “P/E” based on two years ahead EPS estimates is much more reasonable today compared to 2022. Currently, that ratio is a fair 14.18X, which is well within the normal range for its peers. See below:

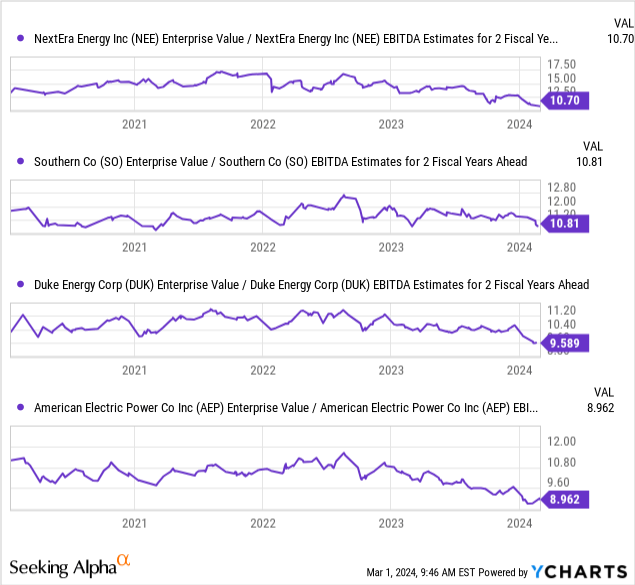

Further, we can see all of the major utilities have seen significant valuation declines since 2022, largely driven by the rise in real interest rates that naturally lower utilities’ value. Accounting for debt, NEE’s valuation is on the higher end compared to the other giants. See below:

NextEra Energy’s two-year ahead “EV/EBITDA,” although higher than its peers, is not problematically higher than the others. This small premium is reasonable, given NextEra’s long-term growth potential is likely superior to its less renewable-focused peers. This is not to say NEE should trade at a considerable premium, but a 10% to 20% valuation premium appears sensible given its long-term growth edge.

The Bottom Line

Overall, I believe NextEra Energy, Inc. stock is essentially fairly valued today. My earlier price target is due to a slight upgrade to a $50 fair-value target based on real interest rates. Most importantly, NEE is no longer overvalued relative to its peer group, trading at a massive premium in 2022. Thus, to me, the utilities sector remains slightly overvalued compared to bonds, and NEE itself is not overvalued to utilities.

My outlook for NEE is upgraded to neutral. For the most part, I do not expect NEE to break below its ~$50 support level unless we see a spike in bond market interest rates, which is possible if we assume inflation is rising again. Thus, NEE’s most significant risk largely depends on changes in how its cash flows are discounted, while the company appears stronger than when I covered it last.

I do not believe NextEra Energy, Inc. is undervalued. However, if it falls below $45, it would likely be a solid long-term discount opportunity.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.