Summary:

- Recent industry events confirm the old adage that there is no such thing as risk-free growth, even in the utilities sector.

- NEE’s corporate units provide alternative investment opportunities with a combination of yield and potential upside/downside linked to the company’s shares.

- NextEra Energy’s unregulated segment poses risks, complicating its balance sheet and earnings, despite long-term power purchase agreements with fixed prices.

- NEER benefited from a decade of low interest rates, which abruptly came to an end. Today, interest rate costs are rising as they refinance debt at higher rates.

JLGutierrez/iStock via Getty Images

Investment Thesis

Do you ever get this feeling that, when it comes to NextEra Energy (NYSE:NEE), institutional investors always seem to know something that we don’t?

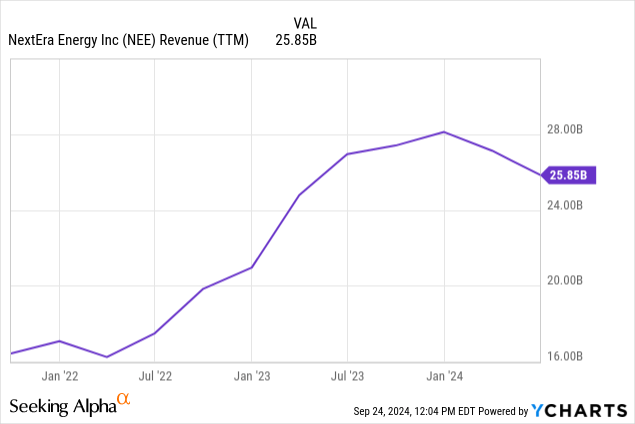

If you’re scratching your head over NEE’s latest earnings reports, you’re not alone. This year, revenue is down 19%, operating income is down 56%, net income declined by 35%, and EPS followed suit, dropping 28%. Dividend growth projections of NextEra Partners (NEP), which shares the assets of NEE’s fast-growing renewable energy segment, were halved earlier this year.

Yet, management Wall Street Analysts are celebrating as if they’ve struck gold.

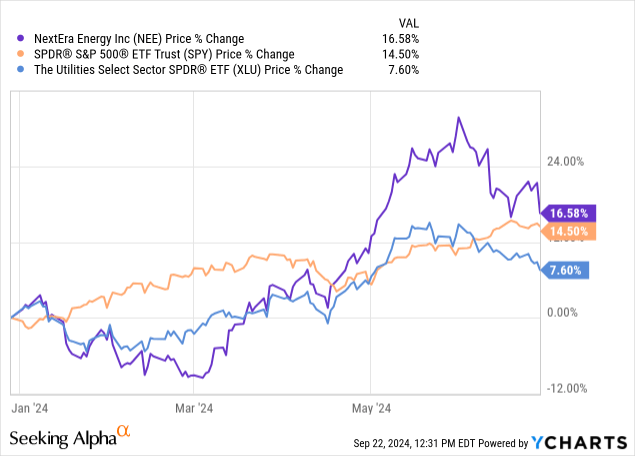

Why is the stock going up and outperforming peers and the broader index?

To Wall Street’s credit, there is more to the sales and EPS decline than meets the eye. It’s largely due to how NEE reports changes in the fair value of its derivatives.

NEE has one of the most complex and bizarre accounting methods I’ve seen in my career. Although the sales and net income GAAP declines don’t mirror the actual performance of core operations, they revealed the scale of NEE’s hedging operations and more importantly, the magnitude of risk that the company grapples with on a daily basis. This alone is sufficient to warrant a rating downgrade to ‘Hold’.

Since my last ‘Buy’ rating, NEE’s stock price increased by 28%, with dividends adding another 5% to the total return. However, adjusted EPS hasn’t kept pace. This casts a shadow over the substantial growth premium investors are currently paying for the ticker, as manifested in its 24x forward PE ratio.

The company doesn’t offer attractive options to fixed-income investors, either. The corporate units (NEE.PR.R) and (NYSE:NEEPRS), yielding 7.9% and 6.9% respectively, might seem tempting at first, but these units convert to NEE’s common stock at maturity, exposing income-oriented investors to volatile equity prices.

NEE Has Many Problems. Sales Decline Isn’t One

In the six months ended June 2024, NEE sales declined by 19%, a steep drop, especially for a utility company that is supposedly benefiting from increasing electricity demand. So, what’s the deal?

NEE stands out in its accounting methods. Fluctuations in the fair value of its hedging derivatives are included in revenue, likely because it trades electricity and gas futures.

Last year, sales were boosted by $1.9 billion in fair value mark-to-market unrealized gains. Without this boost this year, the year-over-year comparison was distorted, resulting in a 19% GAAP revenue decline posted on its SEC reports and financial data websites.

Adjusting for unrealized derivatives gains and losses, we see that NEE’s revenue has held relatively steady YoY.

| Millions $ | H1 2023 | H1 2024 |

| Operating Revenue | $14,065 | $11,801 |

| Non-qualifying Hedges (Gains) Losses | $ -1,953 | $217 |

| Adjusted Operating Revenue | $12,112 | $12,018 |

NEE operates in two segments:

- Florida Power & Light ‘FPL’, is a traditional, regulated utility company.

- NextEra Energy Resources ‘NEER’ is mostly an unregulated energy business selling electricity in competitive markets.

FPL’s profitability is protected by state regulators, who ensure FPL is compensated for its expenses via rate reviews on consumers’ utility bills. The small decline in NEE’s adjusted revenue this year is attributed to a decline in revenue from the FPL segment. This decline is due to Storm Ian and Nicole’s cost recoveries last year, which were absent this year.

| FPL (Millions $) | H1 2023 | H1 2024 | % decline |

| Operating Revenue | $8,693 | $8,224 | -5% |

NEE’s growth strategy is largely centered around NEER, its unregulated utility segment. NEER participates in the wholesale electricity supply market, selling energy to large industrial and commercial consumers under long-term contracts. Although these contracts have long-term duration, the prices aren’t always fixed, which is why NEER hedges a significant portion of its capacity.

| NEER (Millions $) | H1 2023 | H1 2024 | % decline |

| Adj. Operating Revenue | $3,419 | $3,848 | 13% |

Although demand for electricity has been rising and is expected to grow at a faster pace than in the last decade, the supply has also been accelerating. There are reports of periods when the price of electricity reached below zero (consumers getting paid for consumption). With little to no variable costs, and production-based government subsidies, solar and wind farms have no reason to stop supplying the grid with energy, even when prices are low.

Electricity That Costs Nothing – or Even Less? It’s Happening More and More. WSJ Article dated Sept. 22, 2024

The collapse of Algonquin Power (AQN) shares earlier this year serves as a cautionary tale to investors weighing exposure to untested, unregulated utility growth strategies. AQN’s business model, similar to NEE, centered around driving growth by expanding unregulated wind and solar energy farms. Despite low variable costs, AQN’s earnings from its wind and solar farms fell to a point where gains were no longer enough to cover the interest expense on the debt used to fund these very wind and solar farms.

NEE’s subsidiary NextEra Partners – which shares NEE’s solar and wind energy assets – also faced challenges this year, and has recently cut its growth forecast by half.

Unregulated utilities are price takers, as opposed to regulated utility companies, who, in consultation with state and federal regulators, are price setters.

How Profitable Are NEER’s Operations?

NEER’s Adjusted EBIT (adjusted for the $271 million non-qualifying hedges) stood at $451 million in the six months ended June 2024, or roughly $900 million when annualized. That’s about 9.4% operating return on assets, which is quite decent.

However, when including interest expense, returns are nearly halved, and it is getting worse each time NEE refinances a maturing debt it previously issued during the +10 years when interest rates were artificiality low.

For example, the weighted average interest rate on its non-recourse variable interest rate loans was 6.5% in 2022 but went up to 7.35% by 2023 year-end. Its fixed-rate debentures carried an interest rate of 3% in 2022, which rose to 4.06% as the company continued to refinance maturing debentures. These dynamics also extend to its international borrowing, such as Japanese fixed-rate debt, which saw rates jump from 0.73% to 2.6% between 2022 and 2023. The interest rate on fixed-rate debentures tied to NEER’s equity units rose from 2.3% to 4.6% in twelve months.

As of December 2023, the weighted average interest rate on NEER’s debt was 5.2%, and it is rising, as more of the low-cost debt accumulated in the past decade reaches maturity and is refinanced in a higher interest rate environment. So, yes, the 9.4% operating return on assets is great, but when we account for the rising interest rate, the allure of this business model dims.

Valuation And Growth Premium

Currently, investors are paying 24x NEE’s forward EPS, a premium above the sector’s 18x average. This premium reflects the 6% – 8% EPS annual growth expectations through 2027. I don’t believe that this 6%-8% growth is really worth this premium, especially considering the risks of the untried, unregulated utility growth strategies that are increasingly proven not to be solid enough to stand trial, as mirrored in the sector’s recent events discussed above.

FPL’s net income stood at $2.4 billion in the six months ended June 2024. Earnings from this segment are stable and protected by state regulators, who ensure (in most cases) that investors get a fair return on their investment. Using the average industry PE ratio of 18x, I believe FPL’s value is about $86 billion, based on an annual EPS of $2.34.

Thus, the residual market value of NEER is about $87 billion (NEE’s consolidated market cap is $173 billion minus FPL’s fair value of $86 billion).

This values NEER at a significant premium, given that its forward earnings this year are roughly $900 billion. This translates to a PE ratio of 95x.

For this reason, I think that the market is overpricing the NEER segment.

A Better Alternative In NEE’s Fixed Income Securities? Not Too Fast

Given the market’s overvaluation of NEER, and by extension NEE’s common stock, some may consider the company’s corporate units, trading on the NYSE under the symbol ((NEE.PR.R)), a better alternative. That’s not necessarily the case.

The units mature in September 2025, with annualized interest and dividend income yield of 7.9%. This might appear an attractive and relatively safe path to gain exposure to NEE. But the protection is limited and disappears if NEE’s share price trades below $79, given the conversion feature of the units (based on current NEE.PR.R prices.)

At maturity, the unitholders receive NEE stock in return for their $50 principal. The units are trading at $48 per unit, constituting a discount of 4%. The stock conversion is flexible, based on NEE’s share price level at the time of maturity (Sept 2025).

If NEE’s share price was $88.88 or less, the unitholders receive 0.5640 of NEE shares at maturity, on top of the 7.9% annual yield. The current NEE’s share price is $84.3; thus, if prices remain at this level through Sept 2025, investors should expect 0.564 shares valued at $47.5 (0.564 shares * current price of $84.3) plus $3.46 in dividends (five quarters through Sept 2025). Given that today, investors will be buying the units for $48, the net yield on invested capital would stand at 6.1%.

If NEE’s price was $111.1 or above, unitholders receive 0.4512 of NEE shares, plus a 7.9% annual yield, making it an attractive proposition for those bullish on the ticker. If, for example, NEE’s share price rises to $120 per share in the next twelve months, unitholders will receive 0.4512 NEE shares valued at $54 (0.4512 shares * $120 price forecast) plus $3.46 in dividends. This translates to a 19% yield.

The break-even price of the units is $79 per NEE share based on the current price of the convertible units of $48 per unit, giving some, but not infinite, protection of capital.

Summary

NEE’s financial report is one of the most complex I’ve stumbled upon. This is enough to warrant caution, especially given the company’s venture into the untested, albeit burgeoning unregulated utility market. We are seeing an increasing number of companies that have aggressively ventured into this emerging market being burned by their pursuit of growth. The market is competitive, and while NEE’s management asserts that their projects are covered by long-term power purchase agreements with established consumers, the pricing mechanisms of these contracts in many cases are set by competitive forces. AQN, the Canadian utility behemoth, was recently forced to sell its assets when earnings from its solar and wind power farms failed to cover the cost of debt used to fund these power farms. NEE itself was impacted when its subsidiary cut its EPS and dividend growth forecast by half.

The corporate units traded under the symbol NEE.PR.R perhaps offer a better risk-reward opportunity. However, investors should be mindful that these securities are convertible to NEE shares at maturity at a pre-determined formula as discussed above. This means that the unitholders while enjoying some relative safety from the quarterly dividend, are still exposed to NEE common equity price movements.

Finally, when it comes to valuation, NEE is not cheap. Investors are paying a hefty price for 6%-8% EPS growth. This growth rate might be enticing in the utility realm, but in no way does it reach the par on the growth trader’s radar.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.