Summary:

- Nike has a safe and growing dividend, with a payout ratio well below the industry average.

- The company has been actively buying back shares, reducing the number of shares on the market and increasing EPS.

- Nike has a healthy balance sheet with manageable debt and strong cash flow coverage for its dividend.

- Due to its high-quality business model, NKE is the perfect dividend growth stock for investors looking to be defensively positioned against a looming recession.

- In the last six months, the stock is down double digits, and offers investors some nice upside to its price target.

code6d

Introduction

When it comes to brands, Nike (NYSE:NKE) is one of the most well-known. For as long as I can remember I’ve been wearing their shoes and they’re still my shoe brand of choice until this day. As a kid I remember going shopping and one of the first places I wanted to go was the Nike store. Now I don’t get as excited to go into any store and spend money. It’s funny how that changes as we age. You don’t put as much thought into owning things that are considered a liability. It’s also not your parents’ money you’re spending, but your own.

And paying $100+ for a pair of shoes doesn’t seem like a smart investment. But no matter how expensive things get, consumers continue to spend billions every year at NKE. Now as a dividend investor, instead of giving companies my money, I look for a way to make those same companies pay me. And one way to do that is by investing in strong, global brands like Nike that pay dividends. Like the saying goes “Offense wins games, defense wins championships.” In this article I list four reasons why NKE is a great stock to play defense with during the economic uncertainty.

#1 Safe & Growing Dividend

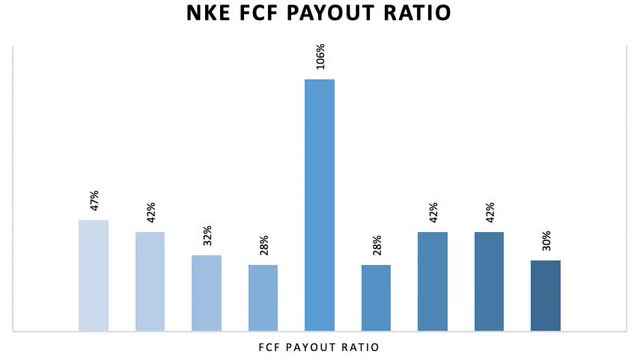

Since its last stock split in 2015, NKE has grown the dividend by roughly 113% from $0.16 to its current dividend of $0.34. The company has raised the dividend every year since then, even during the pandemic year where they raised the dividend by $0.03, from $0.2450 to $0.2750. And if history repeats itself, shareholders are in for another raise soon. During that period, free cash flow was elevated above 100%, dropping from $4.78 billion in the year prior to roughly $1.4 billion in 2020, a 70% decrease. But since then NKE has maintained a free cash flow payout ratio well below the 60% range, right where I like to my companies operate.

For me, it’s simple. A company can experience elevated cash flows, or suffer a temporary blow to its financials, but how or what they do to recover is what counts. I typically like to see companies with a long history that has been through tough economic downturns like the Great Financial Crisis and the recent pandemic to name a few. Below we see NKE’s free cash flow payout ratio has been well below what is considered a safe range. Unless you’re a BDC or REIT, investors typically like to see 60% or below. With the exception of 2020, NKE has averaged less than a 37% payout ratio, indicating the dividend in well covered by cash flows. And this is expected to drop to 30% over the next 12 months.

#2 Share Buybacks

Another way of knowing if a dividend is safe is if a company elects to do buybacks. The more cash a company retains, the more money it has to reinvest back into the business, and also repurchase shares. This in turn increases earnings per share over time. Buying back shares is one of my favorite things to see when looking to invest in a company.

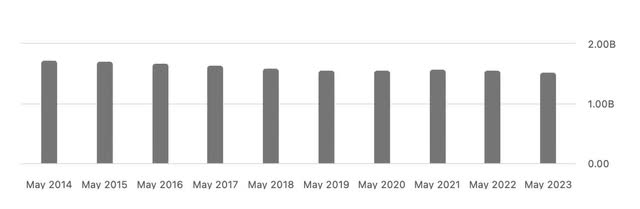

Taking a substantial amount of shares off the market while growing the dividend also returns significant amounts of cash to shareholders in the process. The less shares a company has on the market, the less of its free cash flow they have to pay to cover the dividend. When you have a company like Nike, who does both, you can’t ask for a better combination. Stocks like AutoZone (AZO) don’t pay a dividend, but returns ample amounts of cash to its shareholders via buybacks. Since the stock split, NKE has decreased its share count from nearly 1.7 billion shares outstanding to 1.52 billion at the end of Q1 ’23.

At the end of Q1 ’22 they had 1.567 billion shares outstanding and has retired more than 10.5 million shares since last year. I suspect when the company reports Q2 earnings in December month they will have repurchased additional shares. Especially since the stock experienced a decline in its share price to below $90 at the end of September, which I expect management took full advantage of it. In Q1 NKE returned a total of $1.7 billion to shareholders and had $12.1 billion remaining on the current repurchase plan of $18 billion, announced in June of 2022.

#3 Healthy Balance Sheet

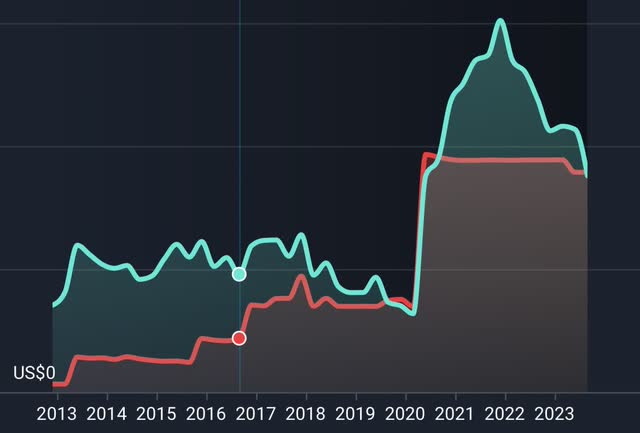

A large risk all companies face, and especially now during the current macro environment, is how well they can manage/utilize their debt. Most of us know debt is used as a tool to help businesses grow, but taking on too much debt can be detrimental if they are incapable of paying it off in a reasonable amount of time, or use it to their advantage. At the end of Q1, the company had a debt balance of almost $9 billion with $6.1 billion in cash & cash equivalents.

This debt increased from $2.0 billion in August of 2016. So in 6 years, NKE’s debt has increased almost $7 billion to $8.93 billion, roughly $1 billion a year. They’ve also managed to increase their cash from $3.13 billion at the end of FY16 to a reported $6.1 billion at the end of Q1 this year. Over the last 12 months, NKE’s net debt to EBITDA was just 0.45x, and this is expected to be lower at 0.39x over the next year. So investors should have no worries when it comes to NKE’s debt load.

#4 Valuation

Over the past 6 months NKE’s share price has fallen from $127 on May 1st 2023 to its current price of $100.46 at the time of writing. One reason I believe for this is the stock’s low yield. As treasury rates have surged along with the rise in interest rates, investors have elected to go the safer route, placing their money into CD’s and money market accounts yielding upwards of 6%.

I’ll admit 2023 hasn’t been a very green year for dividend investors, unless you’ve been solely invested in business development companies who’ve held up well during the rapid rise of interest rates. But that’s due to their business models, floating rate portfolios, and higher historical yields. REITs have especially been brutalized, and consumer discretionary stocks haven’t been spared either. Especially those with low dividend yields like NKE.

Seeking Alpha currently gives NKE a valuation grade of F. I’m assuming this is because their P/E of 31.41x is double that of the sector median. But with a forward P/E of 26x, this is less than their 5-year average of almost 32x. So investors with a long-term outlook, I think now is a good time to invest as the stock offers 21% upside to its price target. Seeking Alpha currently has an average price target of $121 and 15 analysts rating it a strong buy, 8 a buy, and 10 a hold.

If you look at NKE’s dividend growth over the last 5 years, you’ll see they have an average dividend growth rate of 10.3%. For my valuation I use the Dividend Discount Model (DDM) and an expected rate of return of 8%. Because of the expected slowdown next year I decided to go with a growth rate of 7% to account for this. Using SA’s dividend estimates for 2024 of $1.41, this gives me a price target of $141. Investors may feel like this is being too optimistic, but a stock of NKE’s quality, you can never count them out.

Risks

A risk I think the company faces in the near term is interest rates continuing to rise. At the time of writing, the FED decided to hold rates at 5.25-5.50% for the second straight time, but left the door open for further hikes down the line. Of course this is all data dependent but this could push the stock price lower as they have a historical low yield of less than 2%. Especially if treasuries surge again in the future. As I mentioned earlier, a lot of lower-yielding consumer discretionary stocks are all down by significant percentages.

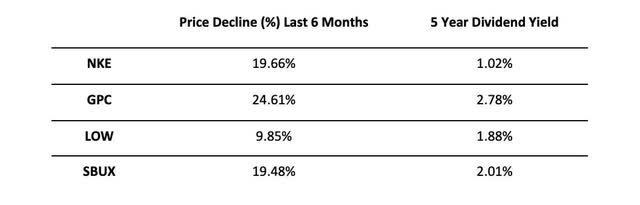

As more investors rotate out of the market into safer, fixed-rate alternatives, I see NKE showing some additional share price weakness because of this. Below you can see some of the most popular, lower-yielding consumer discretionary stocks that are down in the last six months. Genuine Parts Company (GPC) is down by the largest amount at nearly 25%. Coffee giant Starbucks (SBUX) & NKE are both down nearly 20% while Lowe’s (LOW) is down less, roughly 10%.

Another risk NKE faces in the near to medium term is if we enter into a recession. With mounting credit card debt, inflation, and a recession looming, the company will likely face a decline in sales, which would in turn affect revenue and net income for the foreseeable future. A recession would likely cause consumers to spend their cash more discreetly. Furthermore, they could also see gross margins continue to decline as it did in Q1 by 10 basis points to 44.2%. This was driven by higher product costs, and net foreign currency exchange rates. So investors should keep a close eye on this going forward as this could also continue to be a headwind.

Conclusion

Nike has experienced some share price weakness over the last six months like other low-yielding stocks. The company is a global brand that has a great track record of increasing its dividends. Furthermore, NKE has continued to grow its free cash flows by repurchasing its shares, returning cash to its shareholders. They also have a healthy balance sheet and a very low net debt to EBITDA, so investors worried about the higher for longer environment should sleep well at night as NKE’s balance sheet remains healthy.

Additionally, they offer a double-digit upside to their price target of $121, so one could get some capital appreciation along with a growing dividend. Investors with a long-term outlook, or buy-and-hold mentality may be getting this stock at a great bargain right now as they are down double-digits in the last six months. Although they will continue to face headwinds in the near-term as the FED battles inflation with interest rates on top of an expected recession, NKE is the perfect stock for dividend growth & price appreciation. Additionally, they are the perfect stock to play defense with due to its high-quality business model, and for that reason I rate the stock a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.