Summary:

- Nike is a still an extremely popular brand as data from a teen survey illustrates.

- Nike has increased their dividend yield over the years while buying back shares.

- The company has a healthy balance sheet, an effective management team, and a great company culture.

Justin Sullivan/Getty Images News

I’ve been a long-term investor in Nike for nearly a decade now and in late September I added to my position.

Although the stock is up over 10% compared to the prior month I still think Nike is a great company for long-term investors to add to their portfolios.

Today I’d like to list five reasons why I believe NIKE, Inc (NYSE:NKE) is a good investment for long-term investors.

1. Nike is Still a Consumer Favorite

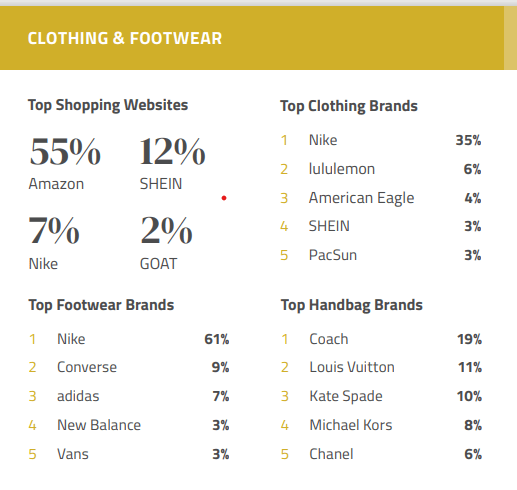

In a recent survey of American teens conducted by Piper Sandler, it was found that Nike was a popular brand amongst this demographic. As the below graphic illustrates, members of Gen Z said Nike was both their top footwear and clothing brand (by a large margin I might add). Additionally, it was one of the top shopping websites amongst teens as well.

Piper Sandler survey

Nike is also very popular with Gen X and millennials as well. As a member of this demographic I can attest that I personally wear Nike shoes and apparel as do many of my friends and family members.

Additionally, Nike represents some of the best athletes in the world. Current active athletes include Giannis Antetokounmpo, Rafael Nadal, Kevin Durant, and Jayson Tatum. Obviously you still have the historically popular big names athletes as well such as Kobe, Serena Williams, Tiger Woods, Lebron James and the one and only, Michael Jordan.

With such a strong brand presence and a group of world-class athletes promoting the company, it’s hard to see Nike falling from grace anytime soon.

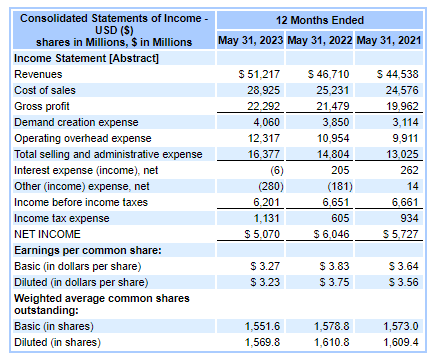

2. Solid Financials

Nike is in a great position from a financial perspective. The company has been growing revenues and gross profit over the years as can see from the below graphic:

SEC.gov

Net income did drop in the latest fiscal year as operating overhead expense grew compared to prior years.

In the most recent quarter, revenues came in at roughly $12.9 billion, which is a 2% increase compared to the prior year first quarter. Direct revenues came in at $5.4 billion, a 6% increase compared to prior year first quarter, and brand digital sales increased 2%. Similar to the 10K earnings, net income was lower in Q1 2024 compared to Q1 2023.

However, on the company’s latest earnings call, management did note several strategies which should help the bottom line move forwarding. These strategies include lower ocean freight rates as well as having more regional service centers to better serve consumer demand and make it a more sustainable practice (compared to shipping via airfare).

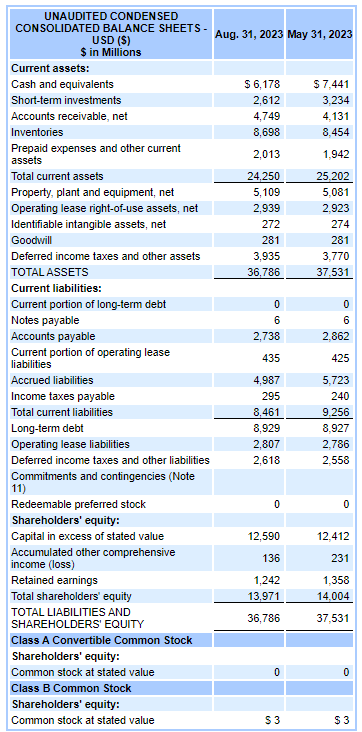

The company has a very healthy balance sheet. As of August 31, 2023 Nike has enough current assets to not only cover the company’s current liabilities but all outstanding liabilities as you can see below.

SEC.gov

When it comes to returns Nike has several impressive metrics such as ROA of 10.65%, ROE of over 40% and ROIC of over 27%. Nike’s management team clearly knows how to allocate and use capital effectively.

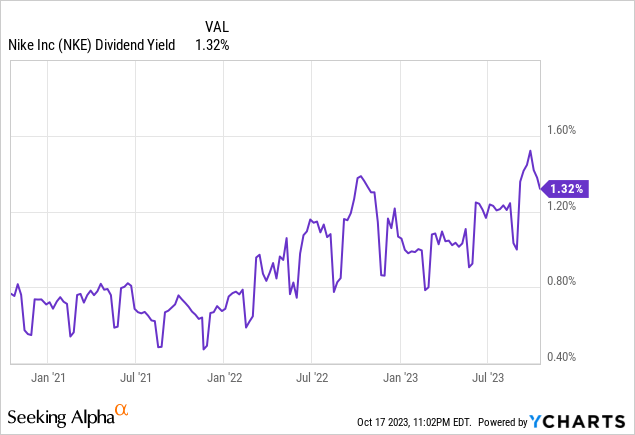

3. Growing Dividend

Nike’s dividend yield isn’t fantastic but it’s much better than most within the industry, as DECK, ONON, and SKX don’t even pay a dividend. Furthermore, as you can see from the graphic below, Nike has steadily been increasing its dividend yield over the last several years.

As stated on a recent 8K release, Nike has 21 consecutive years of increasing dividend payouts.

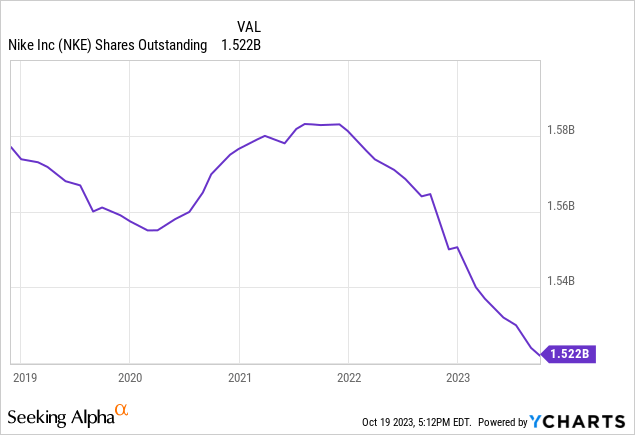

Nike continues to buy back stock as well reduce share count. In June 2022, Nike’s board of directors approved a four year share repurchase program worth $18 billion dollars. As of August 31, 2023 Nike has repurchased a total of 54 million shares under the program.

The graphic below is further evidence that Nike’s share count has dropped over the last five years.

This is certainly advantageous for investors and is an important piece of the company’s dividend growth strategy.

4. Valuation

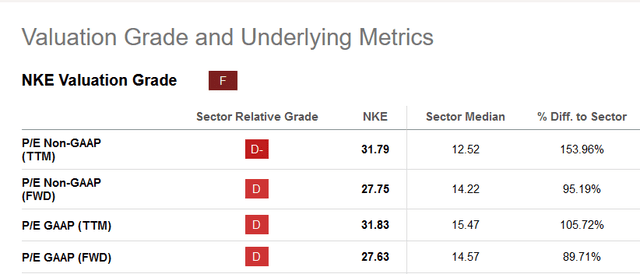

Seeking Alpha gives Nike a “F” valuation score as many of the P/E metrics you see below are greater than the median within this sector.

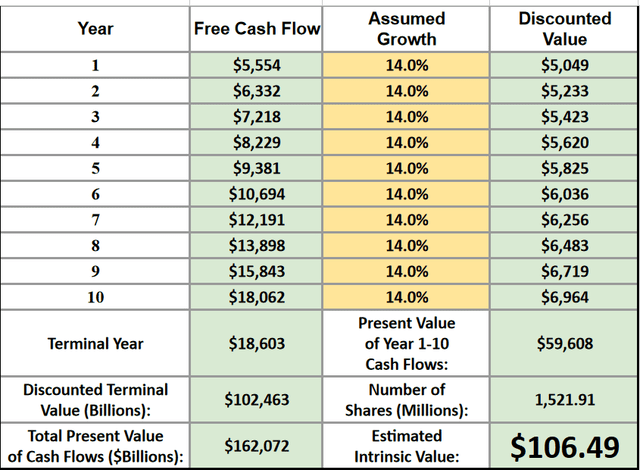

However, I think this company is actually near fair value. Using a reverse discounted cash flow model with a discounted rate of 10% and a terminal rate of 3% and assumed growth of 14% I come to estimated intrinsic value of roughly $106 a share.

I think 14% is a reasonable growth rate as you see these estimated growth rates from Seeking Alpha are in that same ballpark:

As a long-term investor, I think Nike could be bought at these current prices given it’s down roughly 11% YTD and seems reasonable priced.

5. Company Culture

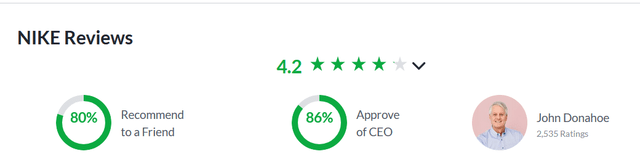

Just as Nike as viewed as a top brand for consumers, it is a top employer as well. You can see from the Glassdoor reviews Nike is viewed as an excellent place to work and the majority of employees approve of current CEO, John Donahoe.

Since 2009, Nike has been rated as one of the best places to work, according to Glassdoor, eight times.

I believe non-quantitative factors such as management and culture company are often overlooked by investors. These factors are critical, especially for long-term investors. If a company can attract talent and retain key personnel while creating a positive working culture then I believe the company is far more likely to succeed.

Risks

Nike lists numerous risks to the business which investors can location on the company’s recent 10K filing within risk factors.

In my opinion, two of the top risks the business faces are competition and brand reputation. New shoe companies such as On (ONON) and Allbirds (BIRD) have risen in popularity over the years. Regarding apparel, Lululemon (LULU) has certainly grown in popularity over the years as well (as it suggests in the teen survey coming in at number two).

Brand reputation is certainly important as well and social media plays a vital role in maintaining brand reputation. A brand mishap such as the recent issues Target (TGT) and Bud Light have experienced can negatively impact a business and creating unnecessary problems.

In my mind, Nike does have a competitive advantage over rivals given its brand recognition and star power. The teen survey clearly illustrates Nike has popular brand consumers love and it is not just teens who feel this way about Nike.

Regarding brand reputation, I think Nike can deal with those situations because they have dealt with similar situations in the past, for example the Kyrie Irving situation. It is a given more Nike athletes will find themselves in hot water over an insensitive tweet or a rude post, however Nike has successfully dealt with those situations and will continue to do so in the future.

Conclusion

Nike is a wonderful business for long-term investors looking to add a high-quality business to their portfolios. The company has a strong brand with excellent products and a collection of world class athletes to showcase their products.

The company is financially sound and provides investors with a dividend. A dividend which has continuously increased over the years as the share count has declined.

The company has created a wonderful culture which has been rated as one of the best companies to work for numerous times over the last decade.

Finally, I believe Nike has a reasonable valuation considering the company’s future growth estimates.

This is company investors can hold and sleep easy at night. This is a business I believe in and one I’ll continue to invest in over the next decade.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NKE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.