Summary:

- Nike is the leading company in the athletic footwear and athletic apparel markets.

- These markets are projected to grow up until at least 2029 – primarily driven by more women entering the space.

- Nike has a proven business model and they are in a position to dominate for years to come.

- The main risks are that Nike may suffer if they fail to innovate and keep up with competition, or that their attempt at cost efficiency to become more profitable over the next few years fails.

- I’ve calculated the fair value of Nike’s share price to be approximately $105.45 and believe this company is currently slightly undervalued.

NurPhoto/NurPhoto via Getty Images

Introduction

Nike (NYSE:NKE) is one of those rare companies that upon hearing their name, almost everyone (no matter how much investing experience they have) can understand who they are, what they do and how exactly they make money. This is because of the formidable brand reputation they have built up over years of operating to become the largest seller of sports footwear/clothes in the world – and the business of selling clothes isn’t inherently hard to understand.

What is hard to understand however, is where exactly Nike is headed in the long term and if their current valuation makes sense based on the current financial position they’re in. This is a company I’ve seen pop up a few times on X (formerly Twitter) saying it’s a good deal in the current price range. So after lacing up my financial analysis boots, I found out that Nike’s fundamentals should make it a slam dunk in the long term – however, the sneaky curveball here is that the valuation might just not be appealing at the current moment depending on your risk tolerance, making Nike a buy with certain conditions.

What’s Nike’s opportunity?

In a nutshell, Nike produces and sells athletic related items, such as footwear, clothes or accessories/equipment. They do this through their platform they call “NIKE direct operations” – which is a combination of their retail stores and e-commerce platforms. They use this platform to sell products wholesale or to other distributors.

Therefore, their business model has a few growth vectors they can leverage. Starting with the most obvious – the growing demand for athletic footwear. This is Nike’s bread and butter and makes up approximately 68% of their total revenue. At the end of 2022, the global athletic footwear market was estimated at $133 billion dollars and is expected to grow at a 4.9% CAGR to reach $196 billion by 2030. While this isn’t the highest growth rate in the world, it’s definitely enough to allow Nike to grow its revenue at a respectable rate each year. What we need to see most in this category however is innovation. Each year the shoes need to be improved upon in order for Nike to stay relevant, which to their credit they are doing very well on. In their Q3 conference call, they mentioned their success with their Ultrafly running shoe, their 3 football shoes (the Phantom Boot, the Tempo and the Mercurial) and the growth of their Jordan brand, which is now the number 2 brand in North America.

The next opportunity is with the global athletic clothing market, which makes up 28% of their revenue. This market has been estimated at $303 billion in 2021 and expected to grow at 5.8% CAGR to reach $450 billion by 2028.

Once again, this CAGR isn’t high enough to warrant an excited celebration, but it’s still strong enough to allow Nike to grow its revenue. What’s more exciting however, is Nike’s focus on the women’s side of their business. Nike has estimated that around $9 billion of their business is due to women’s products and that 40% of their members are women customers – a figure that is still growing and will most likely overtake the men at some point. Why is this so exciting? Firstly the women’s athletic footwear market is currently growing faster than the men’s market – but is actually predicted to overtake the men’s by 2030.

We see an even better situation with the women’s athletic clothing market, which is not only the larger market at 60% of global revenue, but it’s also estimated to grow at a significantly higher CAGR than the men’s side – a fact that Nike will be taking advantage of. The global women’s athletic clothing market is estimated to grow at a 6.4% CAGR from 2023 up until 2028, compared to the men’s which is only expected to grow at a 4.8% CAGR until 2028. Nike also stated in their latest conference call that their women’s business has grown high single digits on average over the past 3 years. In addition to this they also stated that their leggings, Zenvy, Go, and Universa, are now above the $100 price point, which they previously had not achieved. It’s clear that Nike understands their market extremely well and is taking steps to grow both the top and bottom line.

Speaking of the bottom line, I would expect this to improve by a decent margin in the future. This is due to their announced plan to save a cumulative $2 billion over the next 3 years, which I’ve decided to split into incremental $333 million compounding savings as a measure of simplicity. My expectations are that Nike’s margins begin to improve across the board from 2025 FY onwards.

Their final opportunity is with their e-commerce platform. It’s clear that the consumer is trending towards online shopping, with worldwide e-commerce revenue projected to grow at an 8.95% CAGR until 2028. Nike is currently taking advantage of this trend. Case in point, Nike Brand digital sales accounted for approximately 25% of their total revenue for their 2023 FY, and grew at a whopping 24% y/y. I would expect the digital sales for 2024 FY to be weaker due to the aforementioned tough comps in general, however from 2025 onwards we should be seeing healthy growth in this metric due to the expanding market.

One thing I really like about Nike is their ability to obtain athletic endorsements and partnerships. Just in the last quarter, Kelvin Kiptum attained the Marathon World Record and LeBron James led his team to the NBA tournament championship – both wearing Nike products and the famous Nike tick icon. These are the kind of sponsorships that are priceless and will of course boost revenue. On the opposite side to this however, is the bad publicity when a famous athlete decides to publicly part with Nike. A recent example of this was when Tiger Woods parted ways with Nike just a few weeks ago. While this parting was amicable, it certainly wouldn’t have done Nike any favors – especially to any hardcore Tiger Woods fans. Overall however, this upside of Nike capitalizing on this opportunity far outweighs the downside risk.

What about Nike’s management team?

Nike has a well-seasoned and loyal management team. John Donahoe has been the president and CEO of Nike since 2020 and has served on the board of directors since 2014. The previous CEO and president Mark Parker still serves on the board of directors and serves as the executive chairman. Speaking of the board of directors, there are some very big names such as Tim Cook – who most people would recognize as the CEO of Apple. Overall, the talent is definitely there to steer Nike in the right direction.

What about Nike’s financial position?

Nike’s financial position is good. For their 2023 FY, they’ve printed about $4.9 billion in FCF and $3.23 of GAAP EPS. I believe they should beat both these metrics this year, although by how much remains to be seen. I would expect the bottom line to increase around 10%, give or take a bit, for their 2024 FY. I do think revenue growth will be considerably weaker, due to the 9.65% top line growth last year being an incredibly difficult comp for them – considering this is larger than the CAGR of their market (as shown earlier).

The next quarter will also not be too hot, considering they’ve announced pre-tax restructuring charges of approximately $400 million to $450 million due to their plans to streamline their business – a smart move considering they’ll be saving $2 billion in the long term. However the short term will unfortunately take a hit. Their recent quarter however was definitely good as far as efficiency goes. They reported GAAP EPS of $1.03, an increase of 21% y/y. It was also great to see expansion of their gross margin by 170bps, showing they mean what they’ve said about becoming a more efficient business.

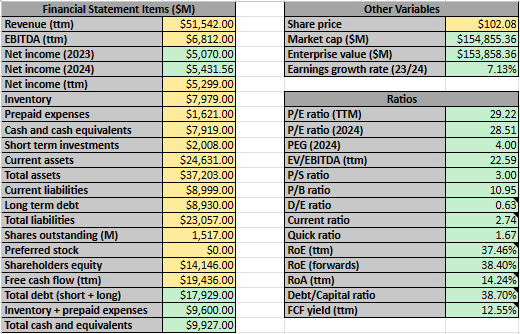

Nike’s balance sheet is also decent, with approximately $9.9 billion in cash and cash equivalents and $8.9 billion in long term debt. Regarding the financial ratios in the below screenshot, they are… interesting to say the least. Nike is producing some really good metrics, such as the excellent RoE, FCF yield, current/quick ratios and D/E yield. However there are some metrics that are actually not that great, such as the very high PEG and P/B ratios. It’s a mixed bag for sure, but overall there aren’t any glaring red flags – just some things to be aware of:

Author’s calculations

Looking at their trailing P/E ratio, this is currently sitting around fair value at 29.2. To put things in perspective, this typically trades between 25 and 35. This could be an attractive ratio at the moment considering the upcoming cost savings should improve Nike’s bottom line over the next few quarters.

It’s a similar story with their EV/EBITDA ratio, which is currently at 22.6. This is at the lower end of the historical range which Nike tends to trade at – between 20 and 30, however the upcoming cost savings means this could be a bit lower once the upcoming quarters begin to print.

What’s Nike’s intrinsic value?

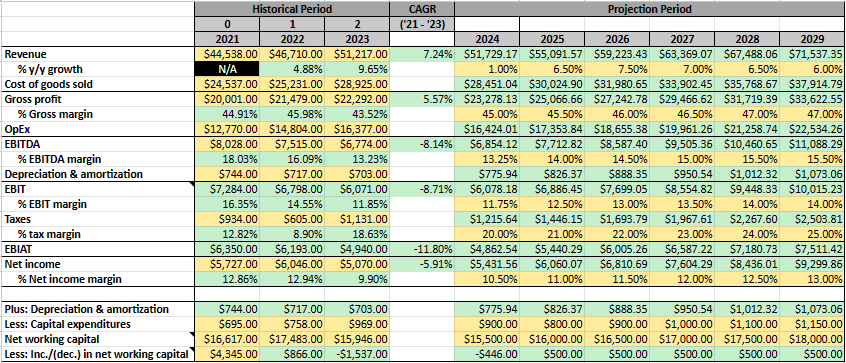

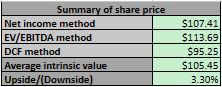

As usual, I’ve decided to undertake 3 different approaches to determine the fair value per share of Nike’s stock: A net income analysis, a EV/EBITDA analysis and a DCF analysis. But firstly, please see the below financial projections, which I’ll provide a brief discussion on:

Historical financials and projections

Author’s calculations

As stated earlier, I expect revenue growth to be wear for 2024 FY, but then reaccelerate heading into 2025 FY. I believe this will start to slow down towards the end of the decade to be more in line with the CAGR of their market. I also think we should see continual margin expansion as the cost savings measures start to take effect over the next few years. Nike has guided for $2 billion in cumulative savings, so I’ve decided to break this down into $333 million blocks that accumulate each year – as a matter of simplicity. Either way however, Nike has historically hit a 13% margin on the bottom line, but has trouble maintaining this consistently and has never had 2 consecutive quarters in the 14% range. Therefore, while their efficiency mission could bring about historical profitability, I think it would be a mistake to forecast it without proof first.

CapEx will most likely decline/remain stagnant over the next few years as part of Nike’s plan to reduce costs, but will pick up again soon after. I also think we should see a steady increase in net working capital as Nike increases their cash on hand.

Net income analysis

I’ve put together the below net income analysis based on the above projections:

Author’s calculations

Based on the research I’ve done, Nike should have a base case forward P/E ratio of around 30. Although this is within the 25 to 35 range I stated earlier, I believe this is definitely a premium valuation – but there are a couple reasons for this. Firstly, Nike will most definitely improve its bottom line over the next few years due to its increased efficiency and secondly, companies that have proven they can operate well tend to trade at a premium.

The rest of their 2024 FY will be a bit rocky as stated earlier, but they’ll most likely hit around $5.4 billion or so, meaning the fair price for this year will be $107.41 – a 5.23% upside from the current price.

In addition, if my projections are correct, a 30 P/E will allow the stock price to reach $183.91 by 2029 – implying a 80.17% return in 5 years.

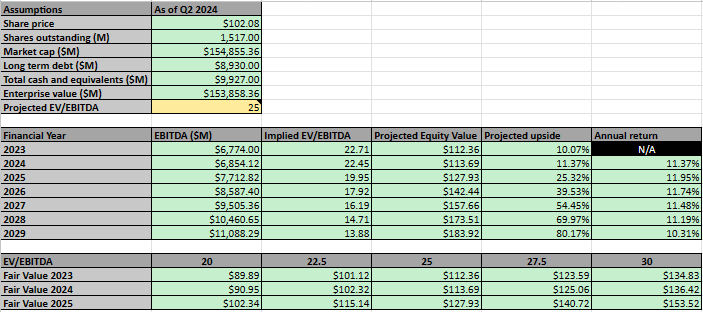

EV/EBITDA analysis

I’ve put together the below EV/EBITDA analysis based on the earlier projections:

Author’s calculations

I’ve decided that an EV/EBITDA of 25 should be fair for Nike. This is right in the middle of the 20 to 30 range I stated earlier. Once again, I believe this is trading at a premium for a reason – you’re purchasing a solid company that will continue to perform into the future.

As such, the fair value for Nike should be around $113.69 per share based on the projected EBITDA for 2024. I’ve also conducted a mini-sensitivity analysis for the EV/EBITDA, which I think would be reasonable to use if you think this should be closer to 20. Personally I would find it hard to justify going closer to 30 unless you’re expecting a massive ramp up in profitability.

Furthermore, assuming my projections are correct, there is an implication the stock price will reach $183.92 by 2029, which is nearly identical to the 2029 number I’ve forecast in my previous net income analysis.

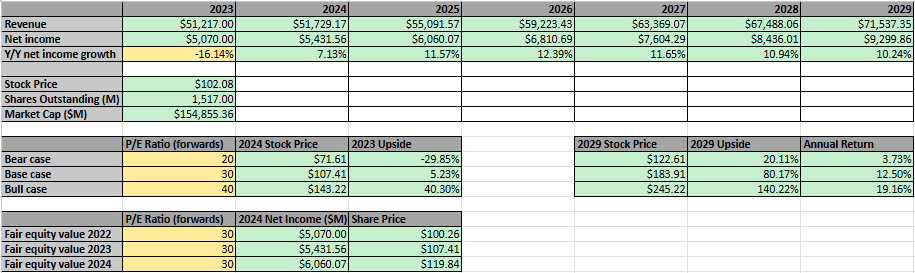

DCF analysis

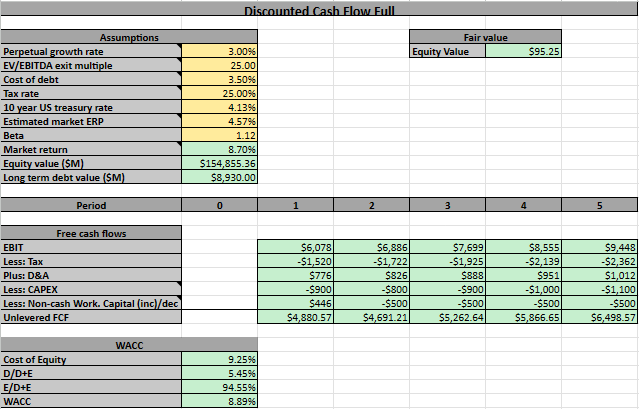

I’ve put together the below DCF analysis based on the earlier projections. Please note that I’ve calculate the terminal value using the average of the EV/EBITDA exit multiple method and WACC method:

Author’s calculations Author’s calculations

I’ve decided to use a 3% perpetual growth rate for Nike – which is between the average inflation rate and GDP growth rate of 2.9% and 3.2%. I also believe a 25 EV/EBITDA exit multiple is appropriate, based primarily on the same reasoning I stated in my EV/EBITDA analysis. I calculated the cost of debt from Nike’s latest 10-K and then added an approximate 0.5% margin of safety, due to the 2 extra quarters. I used an effective tax rate of 25% as a conservative assumption and chose the 10 year US treasury rate as the risk free rate, which was 4.13% at the time of writing.

Nike’s current agreed beta is 1.12 according to various financial services and I used a market return of 8.7%, which is a combination of the risk free rate and market ERP (currently around 4.57%)

Using these numbers, I’ve calculated a fair share price of approximately $95.25. I think this is reasonable and doesn’t seem out of the ordinary – albeit it does imply a downside from the current price.

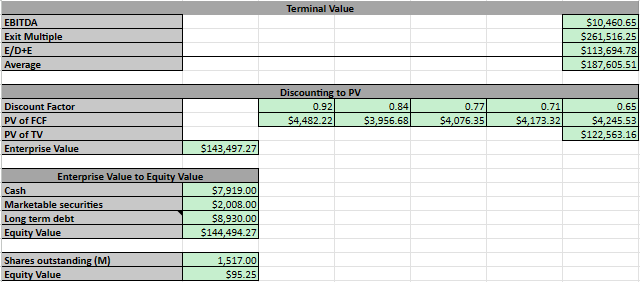

I’ve also conducted the below sensitivity analysis if you want to move the numbers a bit, however I’m happy keeping things as they are:

Author’s calculations

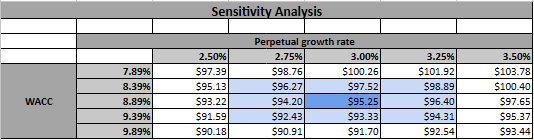

Average share price

As per the below screenshot, the average of these 3 methods gives us a fair share price of $105.45 – marking a 3.30% upside from the current share price. This therefore implies that Nike is slightly undervalued and is therefore a buy.

Author’s calculations

What are the risks?

The most obvious risk is Nike’s efficiency costs not working as planned. They’ve promised us $2 billion in savings over the next 3 years, if they fail to deliver on this or worse – don’t deliver on any efficiency efforts, then the stock will not perform as predicted.

The next main risk is Nike not innovating and losing ground to competition. I find this a bit hard to believe as Nike has already proven across the past few decades they do know how to innovate and stay relevant.

The other most obvious risk is due to my analysis – the 3.3% upside has no margin of safety. Typically I like stocks to have a minimum 10% upside to mitigate against any unforeseen circumstances – anything greater than 30% is really when I start to get interested. 3.3% on the other hand really doesn’t leave much room for error. If Nike drops the ball on just a few numbers, that upside could easily turn into a downside.

Conclusion

This one was tricky to decide a rating on. I was deciding between hold and buy, but eventually the buy rating won the battle. The main reasons for this decision is that Nike has a solid business model and a history of being a reliable company. They also pay a dividend, so if you’re looking for a dividend play that won’t see any extreme drops in your capital, then Nike is definitely an option due to the valuation not being too extreme. All of this is even more true if you have a long term outlook and aren’t worried about short term fluctuations.

Nike should be worth around $105.45, however you like a margin of safety in your stocks or just want some upside potential, I’d recommend waiting a little bit – but only if you’re comfortable doing so. For example, I don’t own any Nike, but if we see any meaningful pullback close to the low 90’s, I’ll consider picking some shares up. However, if we don’t see that pullback and Nike’s stock only goes up from here – I’m also okay with that. In other words, if you’re okay with possibly not owning the stock, then waiting for a possible retracement may be the wise decision here.

The main risk to Nike’s business model is that they fail to remain innovative and lose market share to competitors. As stated in the risks section, I do think this is unlikely. Nike have shown use they can be trusted to operate and perform well over time. I don’t see why the future would be any different right now.

If you’re looking for a place to park your money and earn some dividends over the coming years – Nike is a good place to start looking. They’ve been increasing their dividend payment each year since 2004 and I think it’s unlikely they would want to break this streak and harm their reputation as a solid dividend payer going forward. As for me, I’ll be watching this one closely and seeing if a decent entry point arises for me to “just do it” and start playing ball with Nike.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.