Summary:

- Nike’s stock price has dropped by 17% since June 2023, underperforming the S&P 500 index.

- The company’s sluggish growth in China and market share loss to local players are key issues.

- Weak consumer confidence and increasing competition from local brands are impacting Nike’s growth in China.

code6d

Since I expressed my bearish view on Nike (NYSE:NKE) in June 2023, their stock price has dropped by 17%, significantly underperforming compared to 18% return of S&P 500 index during the same period. In my previous coverages, I pointed out their sluggish growth in China and the market share lose to local players. Nike has no growth over the past two quarters, and I think their key issues are the slowdown in China operations and increasing competitions from local players. I reiterate a ‘Sell’ rating with a one-year target price of $87 per share.

Losing Growth Engine from China Operation

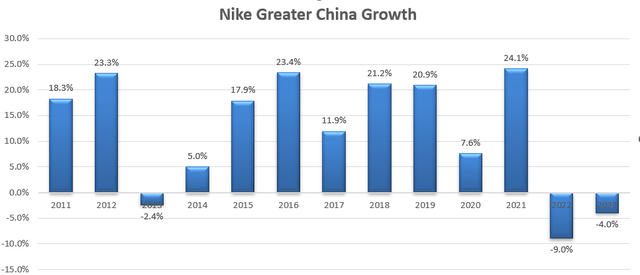

In FY21, the peak year for Nike, China accounted for more than 18% of group revenue and grew by 24.1% year-over-year. As such, China attributed more than 4.3% of total growth to Nike, which was quite remarkable. However, the business went down 9% in FY22 following by another 4% decline in FY23.

In my opinion, their weak China growth was caused by two main factors: weak China consumption growth and increasing competition from local players.

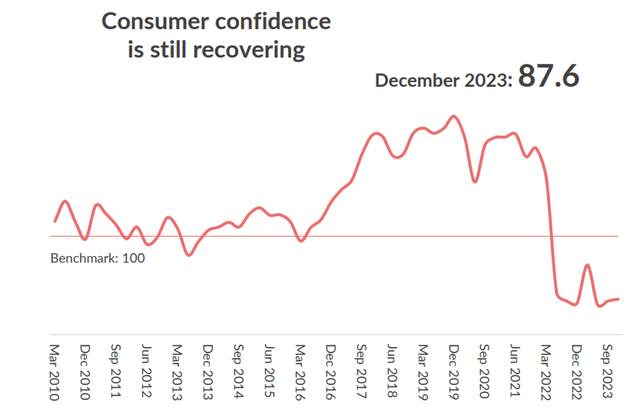

Because of falling property price and poor equity market performance, Chinese consumer confidence level have been declining following the global pandemic. As illustrated in the chart below, Chinese consumer confidence level was only 87.6 at the end of 2023. Nike’s products fall into the affordable luxury category in China, with the ASP much higher than that of local brands. As such, when consumers are financially constrained, they are more likely to switch from Nike brand to other cheaper brands.

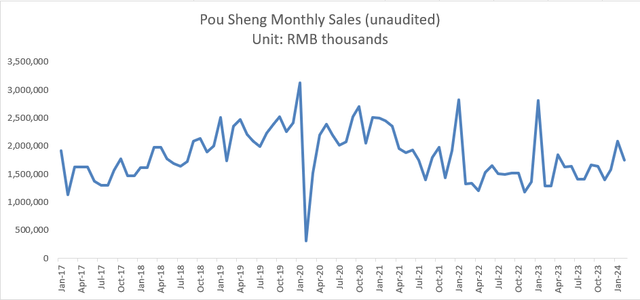

As indicated in my initiation report, 75% of Pou Sheng (OTCPK:PSHGY) revenues come from Nike and adidas’s (OTCQX:ADDYY) China wholesale businesses. The chart below shows the trend of Pou Sheng’s monthly revenue, and it is quite clear that the wholesale business has no growth in the post pandemic period.

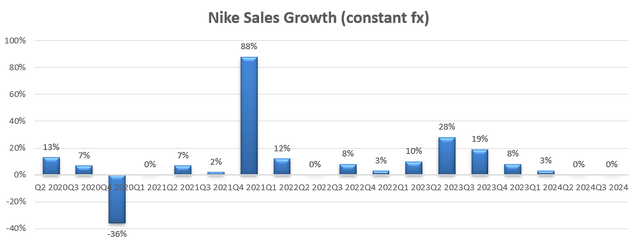

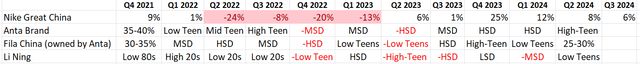

Other than the weak macro environment, Nike is also experiencing the increasing competition from local players such as ANTA (OTCPK:ANPDY) and Li Ning (OTCPK:LNNGF). As illustrated in the table below, during the period when Nike experienced negative growth from Q2 FY22 to Q1 FY23, Anta and Li Ning were growing at HSD-high teens. In my opinion, the combination of weak consumer confidence and rising competition of local brands explains Nike’s weak growth in China.

Nike, Anta, Li Ning Quarterly Earnings

As mentioned, China was attributing more than 4% organic growth to Nike in the past. Historically, Nike grew their revenue by HSD to low double digit organically. Therefore, without the growth contribution from China, Nike would become an MSD revenue growth company, as per my calculations.

North America and Europe Markets

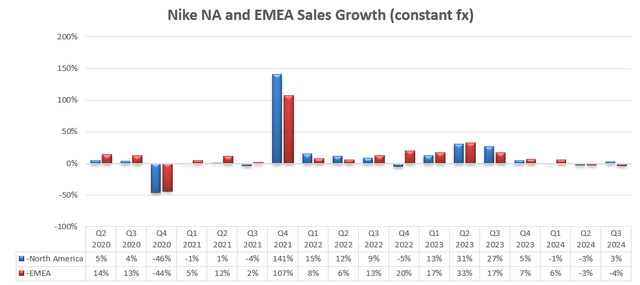

From Q3 FY23, Nike’s North America and EMEA growth began to decelerate. In Q3 FY24, North America only grew by 3% and EMEA declined by 4%.

Reasons behind the sluggish growth? First of all, Nike has been facing strong comparables from the same period last fiscal year. In Q3 FY23, North America grew by 31% and EMEA was up 33%, which explained the weak growth in Q3 FY24.

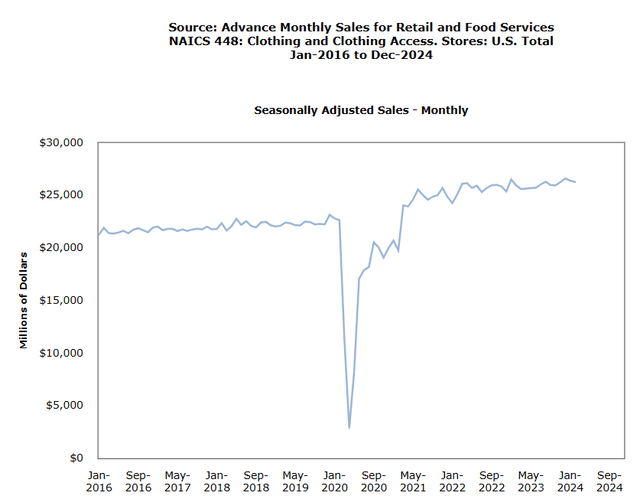

As depicted in the chart below, industry monthly sales for clothing have been quite stable in U.S. in the post pandemic period. The current high interest rate appears to have limited impact on U.S. consumer spending in cloth and related categories. As such, Nike’s growth fluctuation in the North America and EMEA markets is more likely to be caused by comparables.

Recent Result and FY25 Outlook

Nike released their Q3 FY24 result on March 21 with 0% revenue growth. As analyzed previously, the weak growth was caused by weak growth in North America, EMEA and China.

The company is in the middle of destocking their inventories, with inventory levels declining by 13% year-over-year. As mentioned in the earnings call, FY24 would be a transitional year for Nike, and in other words, investors should not expect any growth in FY24.

For the growth in FY25, I consider the following factors:

-North America and EMEA: I anticipate a normalization of revenue growth. As mentioned before, consumptions remain robust despite the current high-interest-rate environment. When the Fed begins to cut the interest rate, I would anticipate consumers having more discretionary money for consumption.

-Greater China: I don’t expect Nike will achieve 20%+ of revenue growth as they achieved in the past. Nike would lose the powerful growth engine from China if they cannot stop local players from taking their shares. Considering the weak consumer sentiment and increasing competition from local players, I only forecast Nike to achieve MSD growth in China.

Historically, North America and EMEA have been growing at 7% annually, and I don’t anticipate any change in the competitive landscape in these developed markets. Therefore, I assume North America and EMEA will grow by 7% and China will grow by 5% in FY25. The combined revenue growth is estimated to be 6.5% in FY25, as per my calculation.

Model Update

Basically, I forecast Nike will lose the growth engine from China operation going forward, and the revenue growth is estimated to be 6.5% as discussed above.

To estimate the margin, I consider the followings:

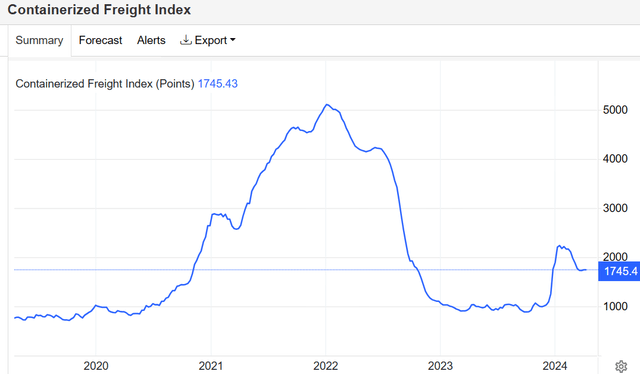

-Freight cost: The latest freight index shows the freight costs experienced a slight spike at the beginning of 2024, and on a year-over-year basis, the freight costs are more likely to have a YoY increase from Jan-Mar 2024.

-Nike Direct: Nike has been working on their Direct-to-Consumer initiatives, aiming to achieve 60% Direct revenue mix in the future. As the DTC channel carries much higher margin, the increasing mix towards Direct would improve the corporate margin profile over time.

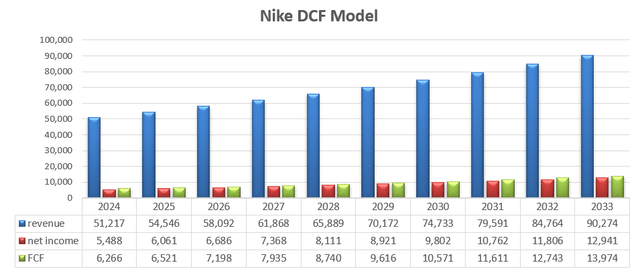

The total operating expenses are forecasted to grow by 5.8% annually in the model, driven by 20 bps margin improvement from COGS and 30bps leverage from overhead expenses. The revenue, income and FCF over the next 10 years can be found below:

Nike DCF – Author’s Calculation

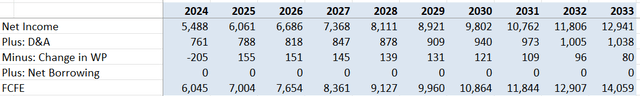

The free cash flow from equity is derived from net income adjusting depreciation/amortization, net change in working capital and net borrowings.

Nike DCF – Author’s Calculation

The cost of equity is calculated to be 12.1% assuming: risk free rate 4.2% ((US 10Y Treasury Yield)); beta 1.13 ((SA’s DATA)); equity risk premium 7%.

After discounting all the future FCFE, the one-year target price for Nike is calculated to be $87 per share, as per my estimate.

Key Risks

Converse: The brand accounts for around 5% of group revenue and has been only growing at an average rate of 4% over the past eight years. The brand has been losing market share due to lack of product innovations in my view. The acquisition of Converse back to 2003 appeared to be a mistake with hindsight. It would be a smart move if Nike divests the brand sometime in the future.

China Nationalism: Due to the Xinjiang cotton issue, several foreign brands including Nike faced a backlash in China after they expressed concerns about the use of forced labour in 2021. Nike has suffered weak growth in several quarters due to the boycott. In my view, Nike needs to have a better government relationship with China if they want to accelerate their business there.

End Note

In short, I think China will no longer be a growth powerhouse for Nike due to the weak macro and increasing competition from local players. As such, Nike is unlikely to sustain their double-digit revenue growth in the future, in my view. I reiterate a ‘Sell’ rating with a one-year target price of $87 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.