Summary:

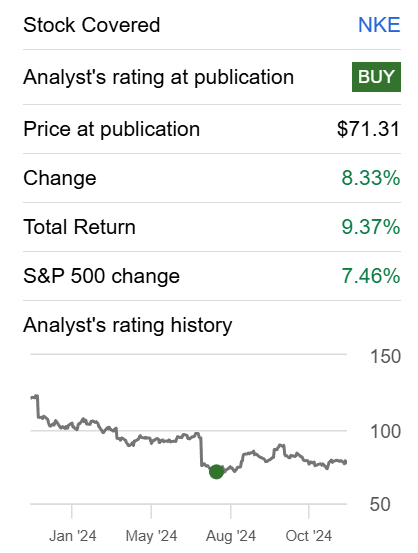

- Nike is up slightly, outperforming 9.4% following a Buy rating issued in early summer.

- The Company is scheduled to report earnings this week, with consensus expectations set relatively low.

- The increasing global popularity of American Football, coupled with an extended NFL contract, potentially adds a wildcard element for Nike.

- NKE still needs to demonstrate its ability to maintain and defend its significant margin in market leadership.

- With moderate payout ratios, market leader Nike positions itself as an income investment for a long-term dividend marathon.

Diy13

After having left premium valuations behind earlier this year, NIKE, Inc. (NYSE:NKE) made its way back onto watchlists of value-seekers for the first time in years. Moreover, in my initial Seeking Alpha coverage this summer, the company made it to a personal Buy rating – whereupon I acted accordingly. Since then, a total return of 9.4% has been recorded.

Seeking Alpha

Ahead of earnings this week, let us once again break down the challenges that Nike inevitably faces and weigh them against the current opportunities in the market. This article’s conclusion will be that Nike remains a counter-cyclical income idea, or in other words, a dividend play.

Market Leader Under Pressure

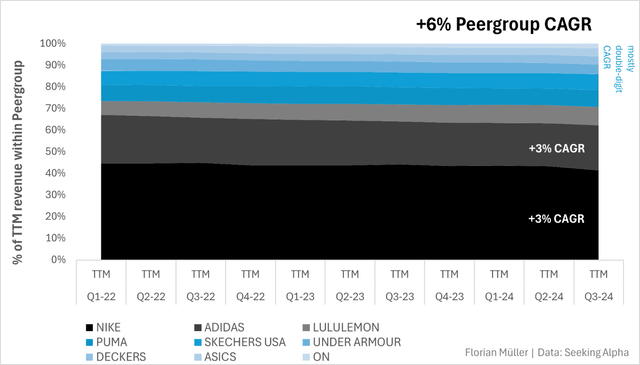

Below is a self-conducted study among a peer group of nine major global sports apparel companies, based on revenue data from Seeking Alpha. While this does not represent a comprehensive market share analysis, it highlights the main trends in market composition within the industry. The study displays the relative trailing twelve months (TTM) revenues of these companies within the peer group on a quarterly basis.

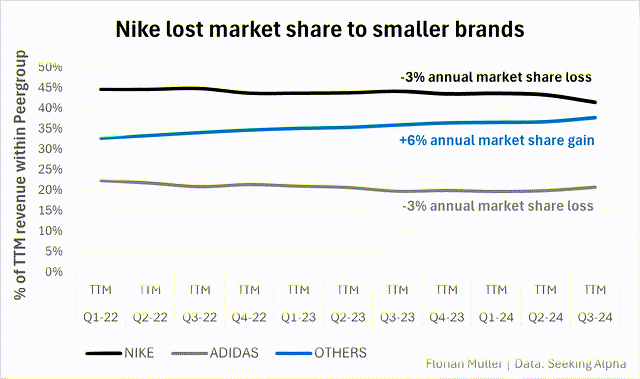

Over the observed 2.5-year period, the peer group’s combined revenues grew at an annual rate of 6%, driven primarily by the rise of smaller competitors, many of which demonstrated double-digit growth rates. In contrast, market leaders Nike and Adidas lagged behind, achieving only a 3% compound annual growth rate (CAGR).

The resulting relative market share losses for Nike and Adidas amounted to 3% annually (not percentage points), while the combined smaller peers increased their market share by 6% annually. To clarify the math: Nike’s below-average overall revenue CAGR of +3% is the result of a +6% market CAGR offset by a -3% annual market share loss (not percentage points).

Nike Remains US-Teens’ Top Clothing Brand

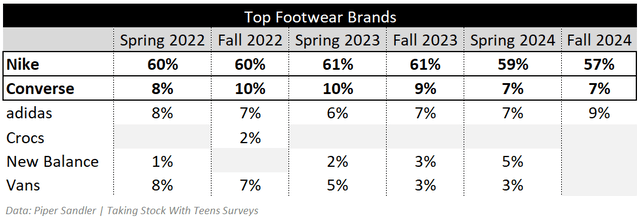

Initially, sentiment among U.S. teenagers averaging 16 years old toward Nike as their top footwear brand is also declining, reaching a 2.5-year low at 57% according to Piper Sandler data. Nevertheless, Nike remains the leading footwear brand by a significant margin. While momentum is not in Nike’s favor, this underscores the brand’s resilience at the top, despite facing challenges from rising competitors on all fronts. Converse, another brand under Nike’s umbrella, has seen an even more noticeable drop in popularity, although it recently still held third place. Meanwhile, Adidas is making a comeback.

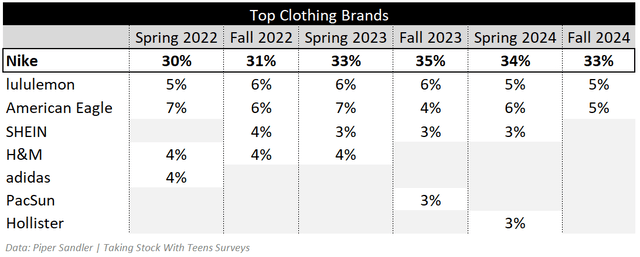

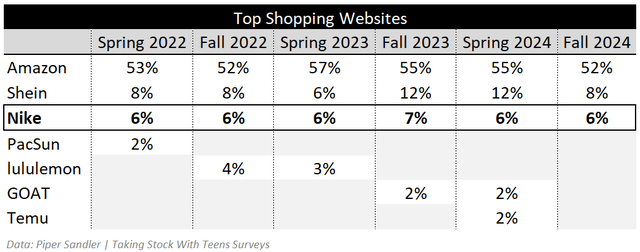

Popularity for Nike as the top clothing brand remains strong among U.S. teenagers, holding steady at around one-third, despite a slight decline. Nike continues to resiliently maintain its position at the top in this category as well. Interestingly, Nike has consistently maintained its third-place ranking among U.S. teens’ top shopping websites, trailing only Amazon and Shein.

Author | Data: Piper Sandler Author | Data: Piper Sandler

Riding Up The Globalization Of American Football

Nike has been partnering with the National Football League (NFL) since 2012 and recently extended their contract through 2038, which was originally set to expire in 2027. Among other things, this ensures that Nike remains the exclusive apparel provider for all 32 NFL teams. This contract extension is a ‘crucial catch’, given the enduring popularity of American football, which continues to grow not only in the United States but also globally. The Nike-NFL partnership aims for nothing less than to further expand the sport’s worldwide reach.

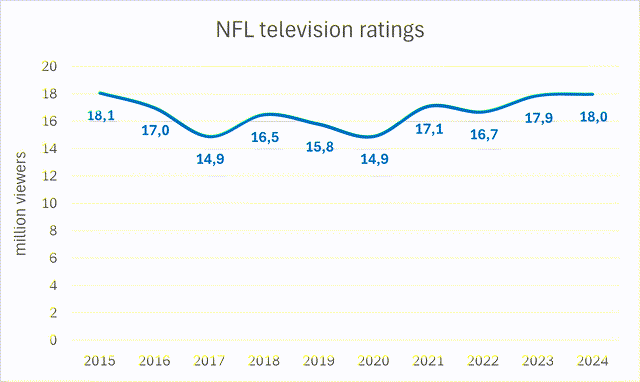

See below how average NFL viewership is trending upward, reaching a nine-year high in the current season. Internationally, Super Bowl LVIII in early 2024 experienced a 10% increase in viewership outside the U.S., with double-digit growth in most countries. Viewership of NFL Game Pass on DAZN, which facilitates international access to NFL games, surged by 61% during the week of the last Super Bowl. Securing the NFL partnership for another decade was therefore a crucial move in defending Nike’s market leadership and potentially regaining international market share.

Author | Data: ministryofsport.com

Earnings Ahead

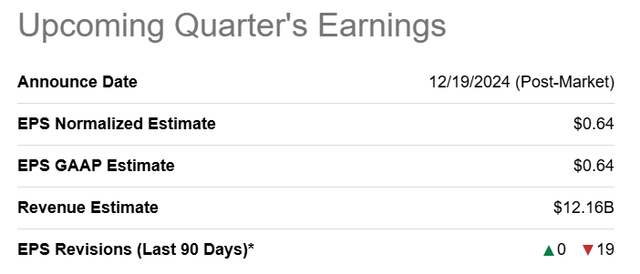

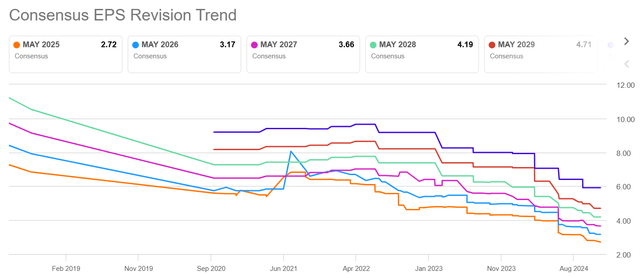

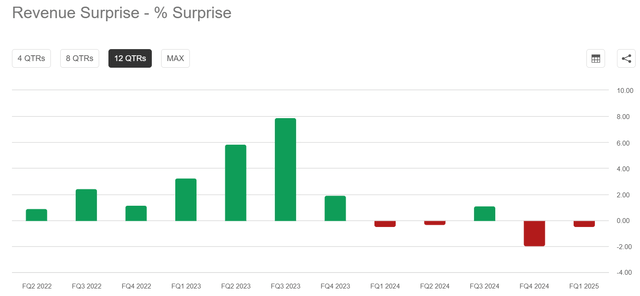

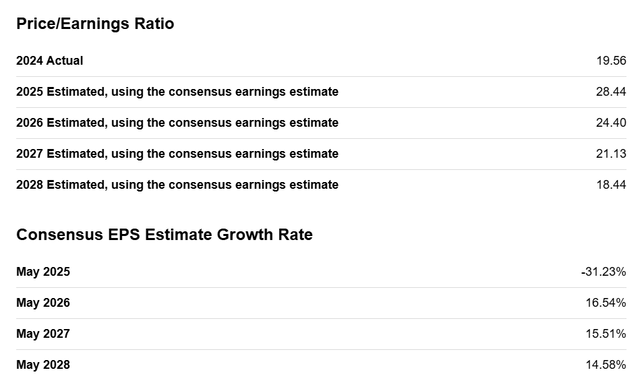

Despite once again missing revenue expectations in Q1 2025, and with analysts across the board revising EPS estimates for the upcoming quarter downward, the stock managed to hold its ground. Earnings estimates for FY 2025 through FY 2027 are now approximately 20-25% lower than they were during my initial Nike coverage in early summer. Reported revenues were down 9% overall, with above-average declines in the direct-to-consumer segment and Converse, partially offset by smaller declines in the wholesale segment.

Given the sharp downward revisions and the fact that the revenue miss was not as severe last quarter, combined with the stock holding steady despite the challenges, it seems we may have reached the bottom. This suggests that current estimates are highly pessimistic, which could set the stage for positive surprises. In a tech-driven market, where companies like Nvidia are experiencing the opposite trend of ever-increasing expectations that are becoming harder to surpass – and where lately there appears to be an upper ceiling for the stock price even when expectations are exceeded – I believe Nike has great potential for positive surprises. This makes it a more attractive risk-reward opportunity compared to some highly valued tech companies, in which I am invested as well, to avoid misunderstandings.

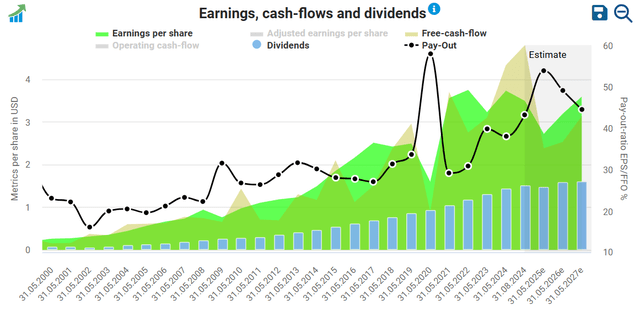

Dividends And Valuation

Although payout ratios have increased over time, it is expected to remain around a healthy 50%. Hence, despite all challenges, Nike remains a reliable dividend play. Valuation multiples around 20 for the next few years correspond to a 5% earnings yield, which I also deem fair for a market leader that I expect to find back to a growth path alongside the overall market. Nike, at its superior size and market position, is not expected to outperform competitors in terms of growth, but delivers stable shareholder returns at a fair valuation. Elevated forward P/Es over the next fiscal year are due to expected earnings contraction that might be too pessimistic, as argued earlier.

dividendstocks.cash Seeking Alpha

Ready To Run This Marathon

In summary, Nike may have been mistakenly valued as a high-growth stock in recent years. However, expecting dynamic growth from a market-leading position that is twice the size of its nearest competitors was unrealistic from the outset. As a result, Nike did not catch my attention in recent years until its valuation dropped to its current levels.

Nike’s primary objective should be to defend its leading position and pay out returns to its shareholders. This forms the foundation of the long-term investment case for Nike as an income-oriented play. Beyond that, the brand’s premium might eventually be reflected again in valuation multiples over the long run, potentially leading to relevant price gains as well. But as the company’s management themselves acknowledge, proofing the brand premium is a marathon, not a sprint.

On the risk side, it is worth noting that I have caught myself potentially being overly bullish or biased. For instance, if the NFL were expected to significantly contribute to a turnaround, why is Nike still in its current position despite American football’s growing popularity over the years? Thus far, the operating turnaround is yet to be proven.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NKE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.