Summary:

- Nike’s slogan is to “Just Do It,” but in this article, I argue that shouldn’t apply to buying Nike’s stock.

- I’ll dig into pressing questions like “How fast can Nike grow?” And, “Is Nike’s capital allocation deteriorating?”.

- Nike’s direct-to-consumer business is great for consumers. But for shareholders, it’s a costly endeavor.

- There’s a real possibility we look back in 10 years and find that Nike’s stock has gone nowhere. But why? Let’s dive in.

Chris McGrath

The Thesis

In this article, we’ll look at Nike’s strategy, capital allocation, growth prospects, and moat. In summary, I’ve grown bearish on NIKE, Inc. (NYSE:NKE). In the decade ahead, I estimate returns of just 2% per annum.

CEO John Donahoe And Nike’s Outlook

Nike’s new CEO as of 2020 is John Donahoe. He inherited the reins to a wonderful business, one that has been compounding and earning high returns on capital for decades.

I recently read Nike’s 2022 letter to shareholders, written by CEO Donahoe, and I have a few concerns. When you have such a wonderful business model, the most important thing to do is not mess with it. Yet, Nike’s company direction has been changing in recent years.

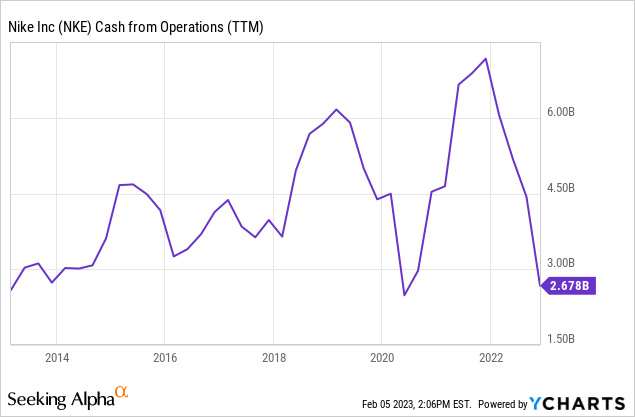

In recent years, Nike has built out its e-commerce offerings. Nike’s direct-to-consumer business offers free shipping to members in the United States. While this is great for consumers, free shipping is a large expense for Nike. You see, it’s far more efficient to deliver shoes in bulk than to deliver to individual households. Alongside other e-commerce players like Amazon (AMZN), Nike’s cash flows have fallen off a cliff:

Nike is also operating physical retail stores, and has reduced its reliance on 3rd party retailers like Foot Locker (FL). In operating physical stores and an e-commerce business, Nike is taking on a lot of risk (As evidenced by the company’s volatile cash flows). I preferred the approach of focusing solely on being a branded product owner. At the same time, I can see why Nike wants to build these online and offline relationships with its customers. Nike has also been cutting ties with the likes of Amazon and Urban Outfitters (URBN) according to Forbes:

“[Nike] discontinued selling directly on the online giant [Amazon], although Nike products are still available on the marketplace through third parties.

Since it began cutting back third-party selling, it [Nike] has dropped a number of big national retailers, including DSW, Zappos, Dillard’s, Urban Outfitters and Shoe Show.”

Nike’s Capital Allocation

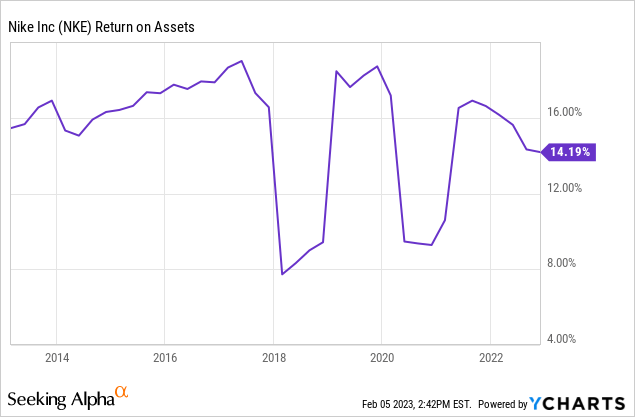

From a capital allocation standpoint, Nike’s returns on assets (ROA) have been in a downward slide since 2017:

Nike has taken an equity ownership position in the WNBA (Women’s National Basketball Association) and has also invested in sustainability initiatives like “Space Hippie.” Yes, even building an inclusive brand comes with a price.

The investments in direct-to-consumer may be the other side of the coin in Nike’s declining ROA. It is yet to be seen if these investments will yield returns to shareholders. Since the beginning of 2017, Nike’s net income has grown at just 6% per annum, pretty slow.

Does Nike Have A Moat?

The short answer is yes, Nike has a brand moat and benefits from share of mind. Nike’s developed this moat over decades, partnering with key athletes like Michael Jordan. In 2021, Nike’s five highest paid athletes were Michael Jordan, Cristiano Ronaldo, Lebron James, Tiger Woods, and Rory McIlroy. Individually, Nike paid these athletes between $25 million and $100 million in 2021.

How Fast Can Nike Grow?

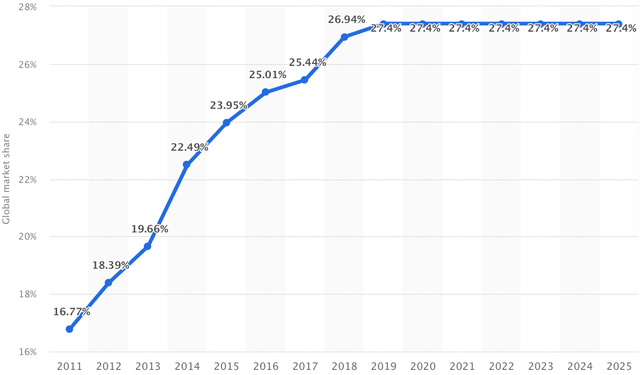

According to Grand View Research, the global footwear market is projected to grow at 4.3% per annum through to 2030. Another source (Fortune Business Insights) estimated the sports footwear market will grow at 4.8% through to 2028. This is by no means a fast growing market, and while Nike’s been gaining share over the past decade, the company’s 27% market share in athletic shoes is projected to be capped out:

Nike’s Market Share – Athletic Footwear (Statista)

Looking at the landscape of the footwear industry, it’s only reasonable to expect that Nike’s market share will one day reach a peak. The company accounts for almost 1/3rd of the athletic footwear industry. I think it’s prudent to assume that Nike’s market share will stabilize around 27-30%. This takes into account the risk of market share loss, as well as the possibility of further gain.

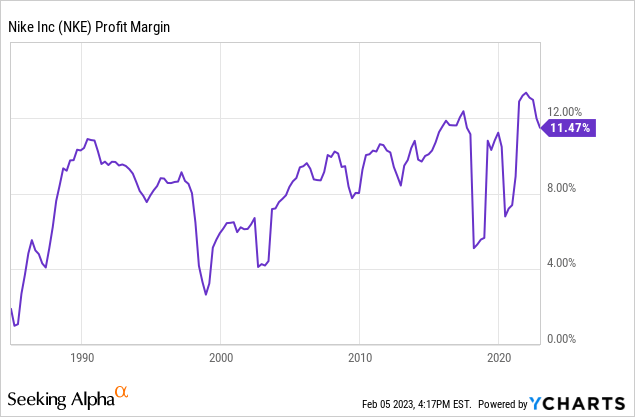

While some reference Nike’s emerging market tailwinds, there may also be developed market headwinds. Currently, 41% of Nike’s revenue comes from North America. The unemployment rate in the United States and Canada has been exceptionally low of late, and there’s always the risk that changes. There’s currently a disconnect between Nike’s high net income and low free cash flow (FCF). Nike’s profit margins could have further downside as they appear to be at somewhat of a peak, especially compared to the company’s lackluster cash generation.

As for the disconnect between cash flow and net income, this is an industry-wide phenomenon. Nike’s inventories have built up over the past 12 months. I expect cash generation will eventually resume, closing the gap.

The other driver of Nike’s growth is its buybacks, but at such high valuations (PE of 36), these buybacks have very little effect. You could even argue they’re blown capital.

So what do I expect? Well, I expect Nike to benefit from the organic growth of its industry. I also expect Nike to maintain its terrific market share over the next ten years. Factor in the muted effect of buybacks and other investments, and I think the company can grow its earnings per share at 7.5% per annum.

Long-term Returns

Using economic projections, I estimate long-term returns using base-case scenarios. My 2033 price target for Nike is $128 per share which, if correct, implies investors wouldn’t earn much more than the dividend rate.

- This is the result of growing Nike’s $3.55 of earnings per share at 7.5% per annum, reaching $7.30 by 2033 (Effectively doubling of EPS). I’ve applied a terminal multiple of 17.5x (A halving of Nike’s PE multiple).

- Now that Nike’s no longer gaining share and growing at a rapid rate, I think its multiple will contract. The average S&P 500 company’s grown earnings at 5.5% annually dating back 100 years – this growth has garnered a median PE multiple of 15x.

- Nike should be able to grow its dividend at 7.5% per annum.

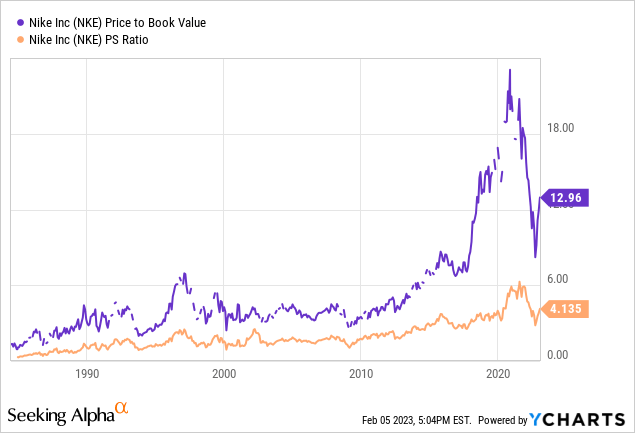

To corroborated this gloomy forecast, I’d say Nike has gotten markedly more expensive over the years:

Nike should instead be getting cheaper over the years because its growth runaway is no longer as large.

In Conclusion

Nike is a wonderful brand, with terrific share-of-mind. However, looking at the fundamentals, I expect the company’s growth to slow in the decade ahead. Since 2017, Nike has grown profits at just 6% per annum. The company’s capital allocation has been questionable of late, from low return investments, to high valuation buybacks. In light of this, one could argue Nike’s valuation is full of air, much like its Air Jordan shoes.

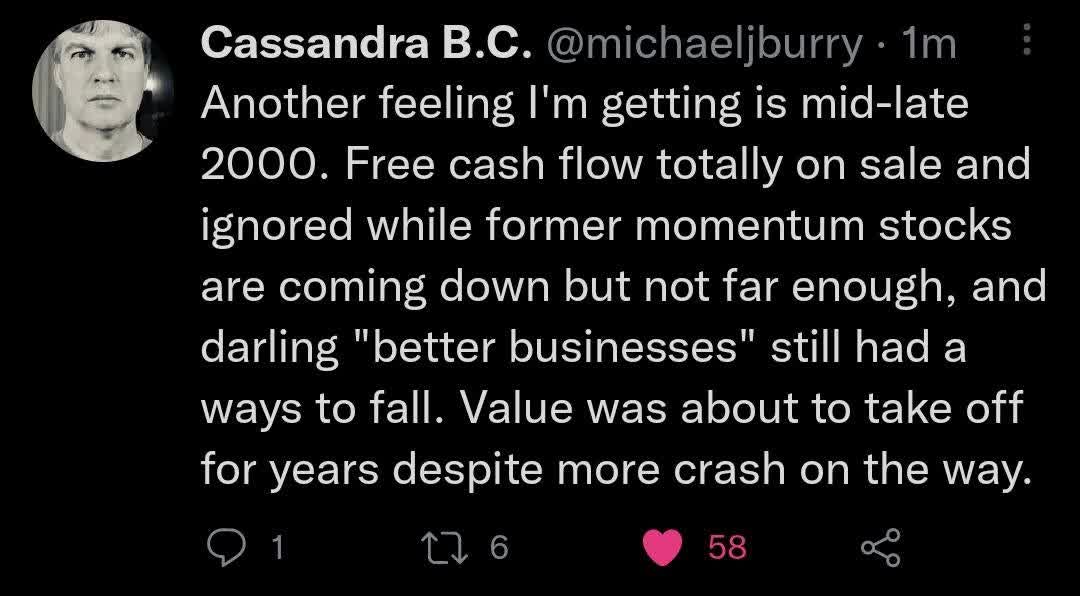

“The Big Short’s,” Michael Burry recently called out that market darlings are overpriced:

Michael Burry Tweet October 1, 2022 (Reddit)

Darling better businesses got overpriced in the nifty fifty bubble of 1972 and the dot com bubble of 2000; I believe this is happening again today.

With the prospect of Nike shares delivering little more than its dividend yield, I have a “strong sell” rating on the stock. While bearish articles are rarely well received, I hope my analysis of Nike’s growth prospects and capital allocation proves helpful.

Until next time, happy investing!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article includes base-case scenario estimates, using known facts and economic projections. The future is uncertain, and investors must draw their own conclusions.