Summary:

- Nike raised its full-year outlook at its FQ2’23 earnings release. Management believes that the worst of its inventory digestion is likely over.

- However, before anyone goes FOMO over its nearly 15% pre-earnings surge, it’s essential to consider whether the margin of safety is appropriate at those levels.

- Also, Nike’s revenue and profitability growth could face further headwinds if the macro outlook worsens, given its global footprint.

Joe Raedle

NIKE, Inc.’s (NYSE:NKE) stock is up nearly 15% in pre-market trading after reporting its FQ2’23 earnings release. But, before anyone goes FOMO over a better-than-expected FY23 outlook and better execution in FQ2, please consider its valuation carefully.

Nike remains a work in progress, but its valuation remains well above its peers and industry. Moreover, even though the company has made solid progress in FQ2, it was predicated against last year’s much easier comps, where it faced significant production disruptions in Vietnam. Recall that the company posted revenue growth of 1% in FQ2’22 (the previous year), with an EBIT change of -8%.

Hence, last quarter’s 17% revenue growth and an EBIT growth of 9% is a good but unspectacular performance. In addition, the company continues to face significant inventory writedown pressure, even though Nike emphasized it has abated from FQ1.

As such, Nike posted an EBIT margin of 11.9%, worse than FQ1’s 13.4%, suggesting that its revenue growth needs to be reflected in the proper context, given its inventory discounting.

The impact is undoubtedly seen in its gross margins, with Nike reporting FQ2’s gross margins of 42.9%, down from FQ1’s 45.9%. Despite that, Nike emphasized that the worst of the writedowns are likely behind the company, as CEO John Donahoe accentuated:

We believe the inventory peak is behind us as [the] actions we’re taking in the marketplace are working. So overall, our Q2 results give us confidence that we will deliver the year, and we remain on a path toward our long-term goals as well. Our current headwinds, such as foreign exchange and inventory challenges, are transitory, but our tailwinds are structural, like the expanding definition of sports, the consumers’ move toward digital, and the cultural shifts toward comfort and health and wellness. (Nike FQ2’23 earnings call)

Nike’s FY23 outlook does suggest that the worst of its gross margin compression is likely in FQ2. Accordingly, the company guided for “gross margin to decline between 200 to 250 basis points versus the prior year, reflecting ongoing liquidation actions in the second half.”

Hence, it suggests management anticipates full-year gross margins of 43.75% (midpoint), indicating that we should also see accretion in the second half of fiscal’23. However, Nike’s full-year revenue guidance of $49.5B for FY23 suggests a significant slowdown in the second half. Accordingly, the consensus estimates (in line with management’s outlook) indicate just 3.2% and 3.3% revenue growth in FQ3 and FQ4, respectively.

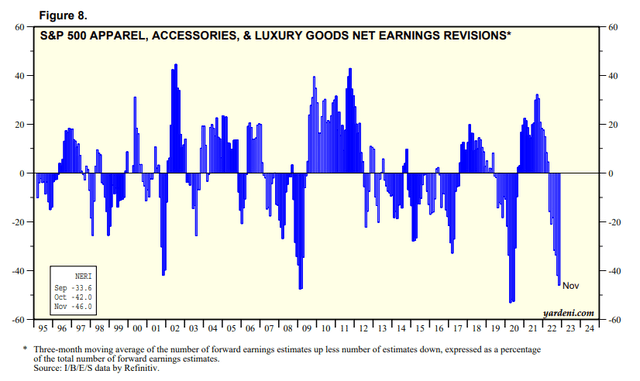

S&P 500 Apparel, Accessories, & Luxury goods industry net earnings revisions % (Yardeni Research, Refinitiv)

Notwithstanding, we believe management’s outlook is likely conservative, and analysts have likely also penciled in highly pessimistic estimates. As seen above, the downward revisions on Nike and its peers accelerated in November as the macro headwinds worsened.

Moreover, given Nike’s global footprint, a worsening global macroeconomic outlook is not conducive for a material re-rating. Hence, some investors could argue that NKE’s valuation might not have contemplated sufficient pessimism yet, despite the writedowns.

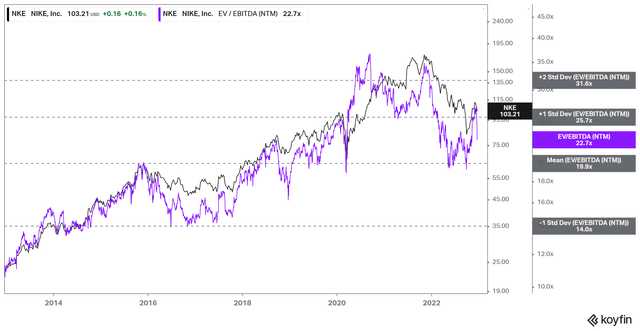

NKE NTM EBITDA multiples valuation trend (koyfin)

NKE last traded at an NTM EBITDA multiple of 22.7x, above its 10Y average of 20x. Note that NKE has been supported above its 10Y average at its COVID and recent October lows.

Therefore, we postulate long-term buyers remain confident in the company’s competitive moat against its peers, suggesting NKE deserves its premium rating.

Despite that, we also urge investors to be wary about expecting NKE to surge toward its unsustainable highs seen in 2021/22. Therefore, it’s critical to reflect a more considerable margin of safety. But, with the pre-earnings surge, it has likely weakened that buffer further.

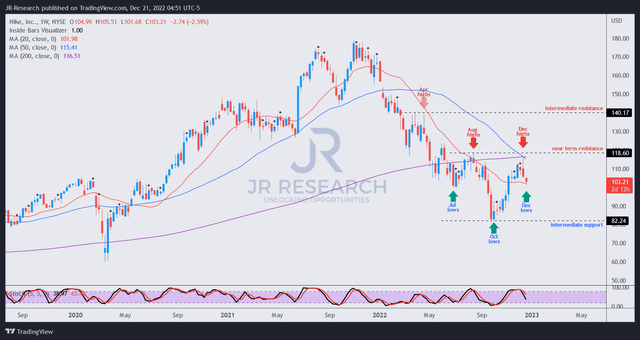

NKE price chart (weekly) (TradingView)

NKE remains in a medium-term downtrend, with its August highs as a significant resistance hampering its recovery.

The pre-earnings surge has brought NKE back toward those levels. Therefore, we assessed that it could attract sellers to return to digest some of that momentum, given NKE’s premium.

With that in mind, we encourage investors to consider a much deeper pullback before contemplating adding NKE.

Maintain Hold.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Do you want to buy only at the right entry points for your growth stocks?

We help you to pick lower-risk entry points, ensuring you are able to capitalize on them with a higher probability of success and profit on their next wave up. Your membership also includes:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!