Summary:

- Nike faces challenges due to weaker-than-expected China recovery and potential pressure on US consumer spending.

- The company’s valuation premium could be at risk if inventory issues return and China’s growth continues to stall.

- Despite these concerns, Nike’s strong brand presence and market share may help it weather the challenges.

- I outline key prices to monitor ahead of Nike’s Q4 earnings report Thursday night.

hapabapa/iStock Editorial via Getty Images

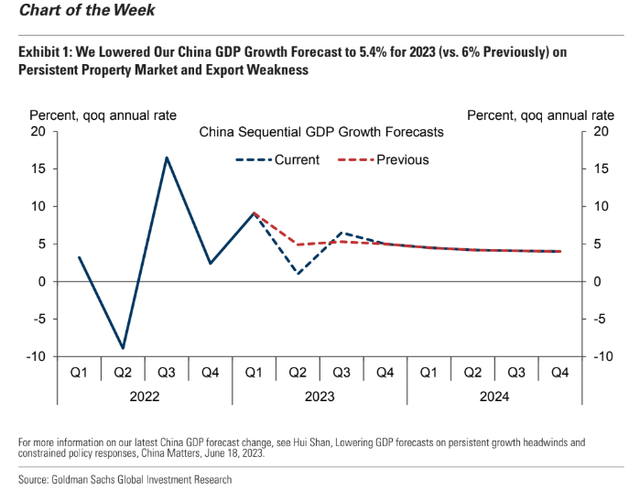

The China re-opening story is not going as planned, at least according to the bulls. Last week, Goldman Sachs reduced its 2023 real GDP growth forecast for the world’s second-largest economy. Firms exposed to the region face increased pressure to improve sales as the growth recovery story sputters. What’s more, the domestic consumer may be pressured as the student loan moratorium ends and some signs of an easing labor market appear.

I have a hold rating on Nike (NYSE:NKE) when weighing all the macro and micro risks. I assert its valuation premium is still warranted, but I would like to see a better margin story reported Thursday night.

China Growth Stalls Amid a Weaker-Than-Forecast Recovery

Goldman Sachs Investment Research

According to Bank of America Global Research, Nike is the premier global athletic footwear and apparel company with roughly 40% global athletic footwear market share. It also sells brands Jordan, Converse, and Nike golf shoes and athletic apparel. It produces through independent contracts and sourcing abroad. In addition, it sells a line of performance equipment and accessories comprising bags, socks, sports balls, eyewear, timepieces, digital devices, bats, gloves, protective equipment, and other equipment for sports activities.

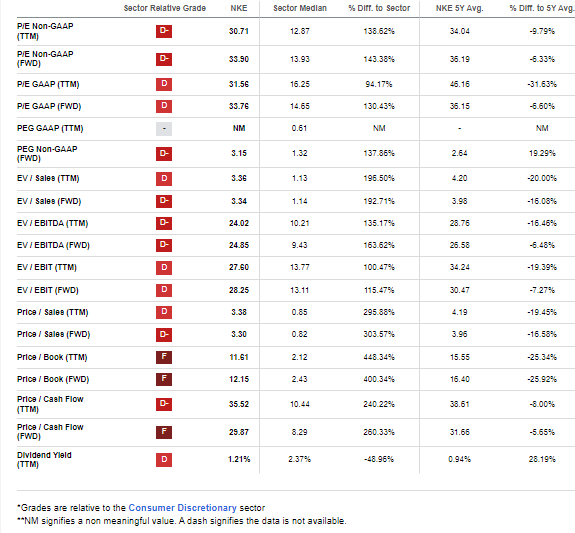

The Oregon-based $168 billion market cap Footwear industry company within the Consumer Discretionary sector trades at a high 31.6 trailing 12-month GAAP price-to-earnings ratio and pays a small 1.2% dividend yield, according to The Wall Street Journal. Ahead of earnings on Thursday, the stock has a low 1.25% short interest.

Back in March, Nike reported an earnings beat but a lower gross margin was concerning. The good news is that the retailer managed to improve its inventory level and a rebound in its China market appeared positive, though the comp was very easy in that region. The management team issued mixed guidance; it now expects 2023 sales growth to be in the high single-digits, a slight uptick from the prior outlook, but Nike reduces its gross margin forecast.

The big question going into earnings this week is regarding its valuation premium given what is by all accounts a weaker-than-expected China recovery. Its 30-plus P/E could be lofty if inventory issues return, and analysts at Morgan Stanley question the improvement story told in the March quarterly report. A new risk is the resumption of student loan repayments which could further pressure U.S. consumer spending.

More mixed signals are seen among other sports equipment retailers. Foot Locker had a terrible quarter as reported in May while Dick’s Sporting Goods had generally rosy things to say about consumer spending trends given the macroeconomic backdrop. I will be watching NKE’s gross margin outlook and any changes to its FY 2024 outlook Thursday night.

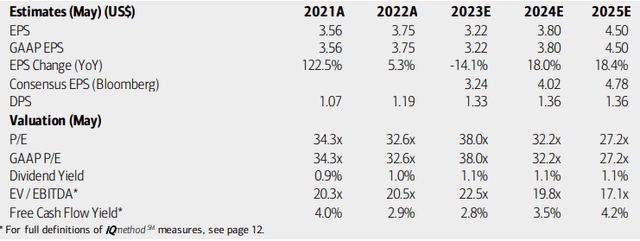

On valuation, analysts at BofA see earnings having fallen sharply this year, though its FY 2023 has already wrapped up. Now that we are in FY 24, per-share profits are expected to snap back in a big way with further strong earnings gains in the out year. The Bloomberg consensus forecast is more upbeat compared to BofA’s outlook. Dividends, meanwhile, are expected to creep higher over the coming quarters.

With P/E ratios north of 30, the stock appears expensive but we must acknowledge that Nike appears to be near the trough of its current earnings cycle, so a high earnings multiple is not as bad as it might seem. The firm’s EV/EBITDA ratio is likewise stretched at nearly twice that of the S&P 500. Its free cash flow yield is modest, too, though profitability rightly earns an “A” quant rating from Seeking Alpha, in my opinion.

Nike: Earnings, Valuation, Dividend, Free Cash Flow Forecasts

Looking closer at the valuation situation, if we assume $4 of next-12-month earnings and use Nike’s 5-year average forward operating P/E of 36.2, then the stock should be near $145, leaving the stock undervalued. But with higher interest rates today and heightened unease in China, not to mention a pressured American consumer, I assert a 20% discount to that valuation is appropriate and prudent. Thus, I would value shares near $116 right now. Just $7 above Friday’s closing price, I have a hold rating on valuation.

NKE: A Valuation Premium Remains Earned, But the Earnings Recovery Must Show Itself

Seeking Alpha

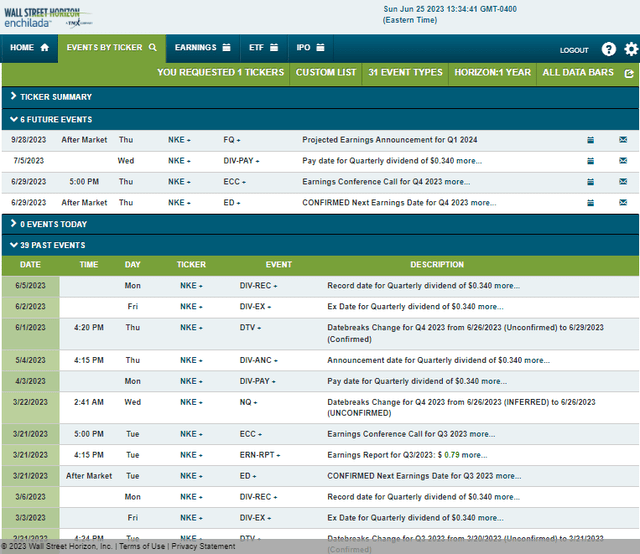

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q4 2023 earnings date of Thursday, June 29 AMC with a conference call immediately after the numbers hit the tape. You can listen live here. The calendar is light on volatility catalysts aside from the reporting date.

Corporate Event Risk Calendar

The Options Angle

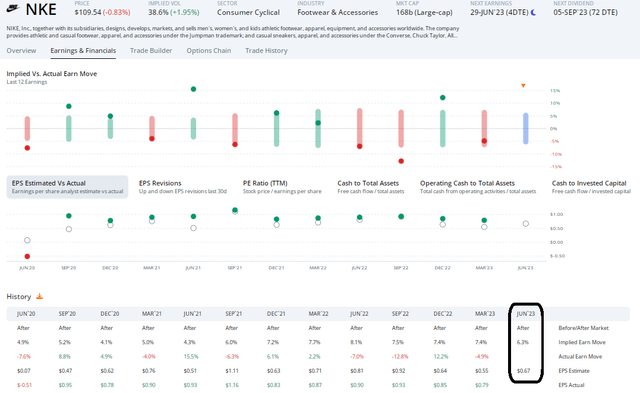

Digging into the upcoming earnings report, data from Option Research & Technology Services (ORATS) show a consensus EPS forecast of $0.67 which would be a 26% decline from $0.90 of per-share profits earned in the same period a year ago. A bottom-line beat should be expected given Nike’s historical string of topping estimates. The stock has traded lower post earnings in 3 of the last 4 instances, though.

This time around, the options market has priced in a somewhat tame 6.3% earnings-related stock price swing when analyzing the at-the-money straddle expiring soonest after Thursday night. That is the smallest premium percentage since the September 2021 report. That makes sense given overall lower volatility writ large across the market. With the stock trending sideways, I am inclined to sell that straddle. Let’s look to the chart to find some key price levels (strikes) to monitor.

NKE: Expected an Earnings Beat, A 6% Straddle Priced In

The Technical Take

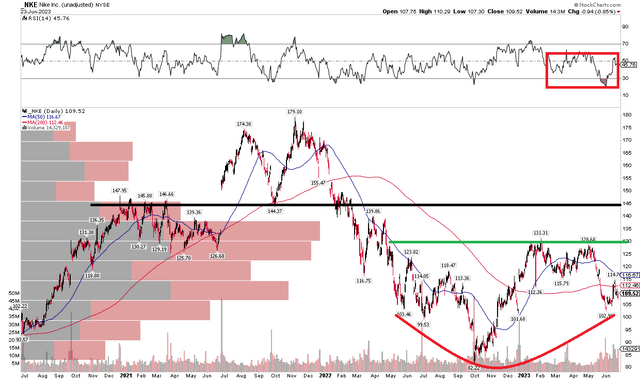

NKE does not look strong on the chart. Notice in the graph below that the stock failed to make a new high during a rally attempt from March through mid-May. $131 is thus resistance and there appears to be developing selling pressure at $115 (near my fair fundamental value). With a flat 200-day moving average, there is no clear trend at the moment.

The bears had been in control of NKE from late 2021 through last September, but a more than 50% recovery to its February 2023 high halted that bearish move. I see a bullish rounded bottom forming, but it’s key that the $99 to $103 level hold as support. If we lose that, then a retest of the $82 appears likely. With RSI in bearish territory, the onus is on the bulls to get a revival going.

Overall, it is a neutral to slightly bearish chart, and selling calls at the $115 strike and perhaps writing a $100 put could work right now.

NKE: Sputtering Bearish to Bullish Reversal Pattern, $116 & $131 Resistance

The Bottom Line

I have a hold rating on NKE. Shares are near what I assert is fair value while the trend favors neither the bulls nor the bears right now. With elevated global risks and a soft consumer, Nike’s strong brand presence is being challenged.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.