Summary:

- Nike presents a compelling investment opportunity with a dominant market position, strong brand equity, and strategic initiatives for long-term growth.

- The company faces short-term challenges from increased competition and shifting consumer preferences, which weigh on financial results and affect stock performance.

- Strategic initiatives, including product range refreshes and robust advertising investments, are expected to drive a recovery in sales in the long term.

- NKE’s transparent cost structure and stable gross margins underscore its financial resilience. Despite potential macroeconomic risks, the company’s strong brand equity and market adaptability position it for sustained growth.

- With the current market valuation providing an attractive entry point, we rate Nike as a “Buy” with a target share price of $107.

Robert Way

Investment Thesis

Nike (NYSE:NKE) presents a compelling investment opportunity due to its dominant market position, strong brand equity, and strategic initiatives aimed at product innovation and market expansion. Despite short-term challenges from regional competition and fluctuating consumer demand, Nike’s transparent cost structure, robust gross margins, and significant advertising investments position it for long-term growth.

Business overview

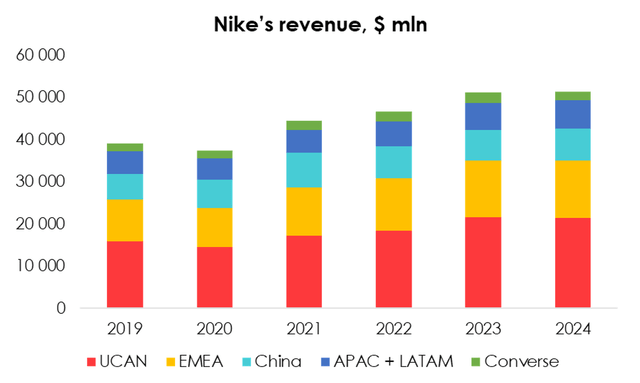

Nike is a fairly stable business in terms of product lineup and geography, as the company is present almost all over the world and in all sub-segments. Nike’s sales totaled $51.4 bln last year.

The main sales regions are North America, EMEA, mainland China, Latin America and Asia-Pacific. Converse files reports as a separate business unit.

North America continues to be the largest sales region, making up about 40% of the group’s total revenue. Stable consumer preferences and a loyal consumer audience allow the company to maintain its leading position in the home market.

In EMEA, Nike’s second-largest sales channel, the company’s share is much smaller (around 9% versus 15% in its home market), with sales in fiscal year 2024 representing 26.5% of Nike’s total revenue.

Nike’s penetration in China, Asia-Pacific and Latin America is much smaller, with combined revenue in the 3 regions making up about 28% of the group’s total sales.

Footwear dominates the product categories, with its sales making up more than 65% of the group’s total revenue.

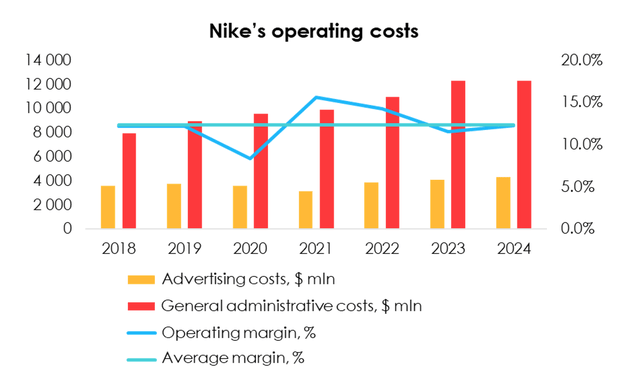

The company’s cost structure is very transparent. Gross costs include the cost of shoe production and logistics, while demand creation costs (advertising campaigns, consumer research, etc.) and general administrative costs (rent, hosting, salaries, etc.) are disclosed separately.

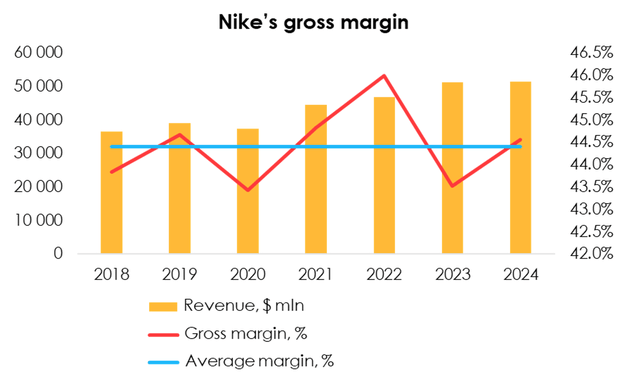

Nike’s gross margin remains stable due to the strong pricing position. The company promptly passes production inflation on to the consumer, even though seasonal discounts and inventory clearance sales remain an important part of its sales strategy. Fluctuations in the metric are mainly influenced by spikes in logistics costs, as well as the proportion of goods sold at clearance sales.

Nike’s production is spread out across 500+ factories around the world, but the company has no in-house production. All goods are made by third parties. Most of the factories for materials and finished shoes are located in Vietnam, Indonesia, and China due to lower labor costs, which keeps margins high and stable.

Advertising has made Nike a globally recognizable brand and continues to be a focus of the company. Nike spends more than $4 bln annually to create demand through multiple channels: contracts with sports leagues, athletes and other organizations; ads on television, billboards, online, etc. Nike’s advertising campaigns are known for their minimalism and memorable slogans, which has made the company world-famous.

Other operating costs, which mainly include labor costs and strategic investments in new product development, totaled $12.3 bln in 2024. Amid rising wages in 2023, Nike made limited staff cuts to keep margins stable.

From a business perspective, Nike is a large and stable player in the cyclical consumer sector. Revenue growth will be highly dependent on the overall spending of the population, as well as Nike’s ability to maintain its dominant position in the footwear and sporting goods market.

The company’s operating leverage is relatively small due to its high pricing power and gross margin levels, but changes in the product mix and inventory buildup could have an impressive impact on the group’s financial results. If inventory runs high, Nike will be forced to sell off a larger volume of products at a reduced cost, which could affect the group’s margins.

Competition, regional breakdown, and sales outlook

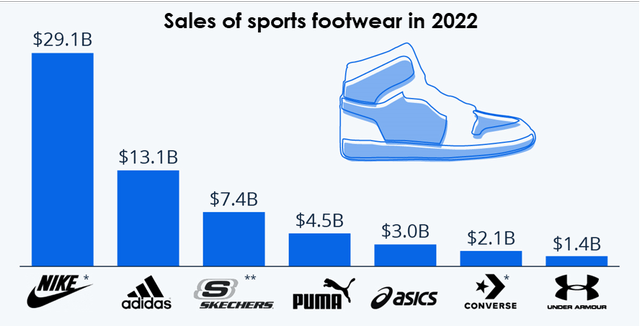

The German company Adidas continues to be Nike’s largest competition in the global market as the product range of the two brands and their target audiences are almost identical, but in each region there are niche brands that compete with Nike. According to Statista, Nike dominates the athletic footwear market by a wide margin.

The athletic footwear market has changed significantly as a huge proportion of purchases in the industry are now made for everyday wear rather than sports, so we will use a top-down approach across different regions to forecast sales.

The fashion industry is very dependent on short-term trends, so a particular brand can significantly outperform or underperform the market over a medium term.

At this time, we see Nike’s product range significantly losing out to regional competition (in the EU to Adidas, in China and Asia to local manufacturers like Hoka, and international manufacturers like New Balance), but we are guided by management’s strategic goals to change the product range in fiscal years 2025 and 2026 and restore sales growth.

Because industry trends are cyclical, we are confident that as the product range is refreshed and models from competition that are currently popular fall out of fashion, Nike will return to stable revenue growth by the end of fiscal year 2025 (1Q of calendar year 2025).

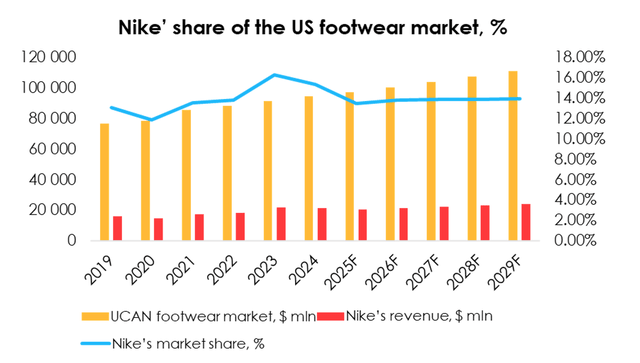

North America

Nike’s revenue in North America in fiscal year 2024 totaled $21,396 mln (-1% y/y). The company noted lower sales in the casual footwear segment, as well as deteriorating consumer demand for the Jordan line of shoes. Based on estimates, Nike’s market share declined from 16.3% of the total footwear market in 2023 to 15.4% in 2024. We assume that amid refreshments in the product range and declines in shipments by vendors, Nike’s market share will decline to 13.5% of the North American market in fiscal year 2025, before recovering to 14.0%, which is the average level over the past 6 years.

Statista, company data, Invest Heroes calculations

In its home market, the company has established itself as the most popular footwear manufacturer, and we believe consumer preferences in the region will remain stable going forward, as Nike is a homegrown manufacturer with a broad product range. Short-term market share decline is mitigated by the release of new models as well as updates to popular older silhouettes, which will help maintain steady product sales in the future.

We expect Nike’s revenue in North America will total $20 390 mln (-4.7% y/y) in 2025 and $21 512 mln (+5.5% y/y) in 2026.

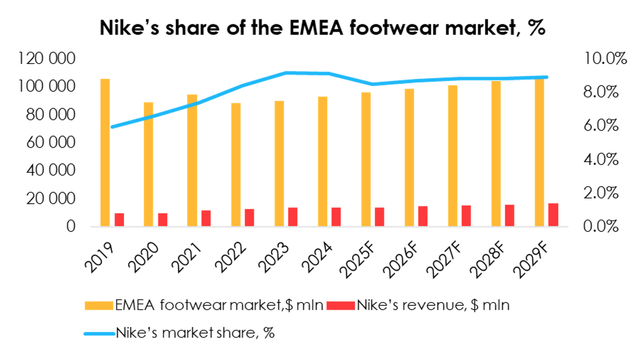

EMEA

Nike is less popular in Europe and the Middle East, due to the wider presence of Adidas, as well as the availability of a large number of local manufacturers. According to Statista, Nike’s market share in the EMEA market is around 9%, much less than in its home market. Competition from Adidas has been particularly felt in the last year, as Nike’s EMEA sales in 4Q FY 2024 fell by 2% y/y, while Adidas’ sales jumped by 15% y/y in the same period.

We assume this is due to the growing popularity of the updated classic models from Adidas. The pressure on Nike’s sales will continue over the next 6-12 months. We assume Nike’s market share will decline to 8.5% (-0.6 pp y/y) in 2025, before recovering to 8.9% by 2029. We believe it will be hard for the company to significantly increase market share in the long term due to differences in consumer preferences and the presence of many regional players.

Statista, company data, Invest Heroes calculations

Therefore, we assume that Nike’s revenue in the region will total $13 513 mln (-1% y/y) in 2025 and $14 522 mln (+7% y/y) in 2026. The decline in market share will be mitigated by accelerating expenses on footwear and apparel in developing regions due to pro-inflationary environment and faster growth in consumer spending.

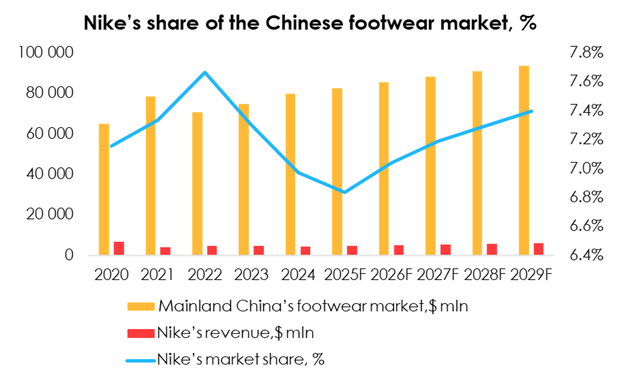

Mainland China

The Chinese market delivered strong revenue growth to Nike in 2020 and 2021 on the back of the development of the DTC platform, but the growth has since slowed significantly amid moderate consumer activity in the region. In addition to the passive consumer, the presence of a large number of regional brands, as well as the commercial success of New Balance (models 2002, 1906) in the region have significantly impacted Nike’s results. The company’s market share declined from 7.7% in fiscal year 2022 to 7.0% in 2024.

In the long term, we assume that Nike will have a tough time capturing the market due to the improving product quality of local players, so its market share will reach 7.4% by 2029. However, consumer preferences in China are still very much aligned with those of Western and developed Asian countries, so any Nike’s successful releases could dramatically change the situation in the region.

Statista, company data, Invest Heroes calculations

We estimate that Nike’s revenue in China will total $7 748 mln (+3% y/y) in 2025 and $8 205 mln (+6% y/y) in 2026. The market share decline will be mitigated by a recovery in consumer activity in China, as we are already seeing economic recovery after a long stagnation.

Developing markets and Converse

When it comes to developing markets (Asia, the Pacific Rim and Latin America), data on total sales is disparate. In our revenue forecast, we will be guided by the general state of the global economy, as well as sales dynamics relative to developed markets.

According to recent reports from Mastercard and Visa, consumers in Latin America are trying to reduce discretionary spending, which is likely to put pressure on sales of cyclical goods. We expect total regional sales to be $6 093 mln (-9% y/y) in 2024 and $6 509 mln (+7% y/y) in 2025, which will follow 4 years of growth.

Revenue from Converse declined by 14% y/y in 2024, and we assume that the decline will continue due to the low popularity of classic sneakers. Given the brand’s rich history and loyal audience, we assume that after a 2-year sales decline, revenue will stabilize and expand at 2.3% y/y, which is in line with the industry’s long-term sales growth forecast.

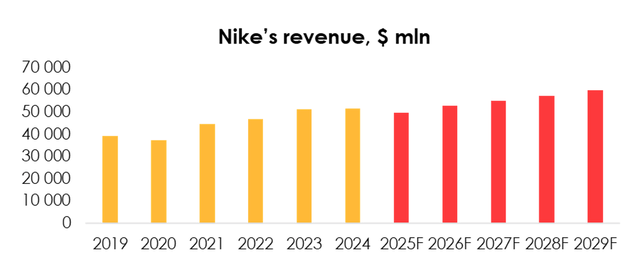

Therefore, we are forecasting that Nike will earn a total revenue of $49 613 mln (-3.4% y/y) in 2025, and $52 657 mln (+6.1% y/y) in 2026. We assume that most of the sales decline will fall in the first half of the year.

Company data, Invest Heroes calculations

Nike’s management expects revenue to decline by mid-single digits (4% – 6% y/y) next year, which is slightly more negative than we forecast. With the consumer confidence remaining strong in most regions, Nike’s actual sales could be above guidance and consensus expectations. We believe the company could deliver revenue growth in the second half of the fiscal year on the back of the lower base of the comparable period and a refreshed product range.

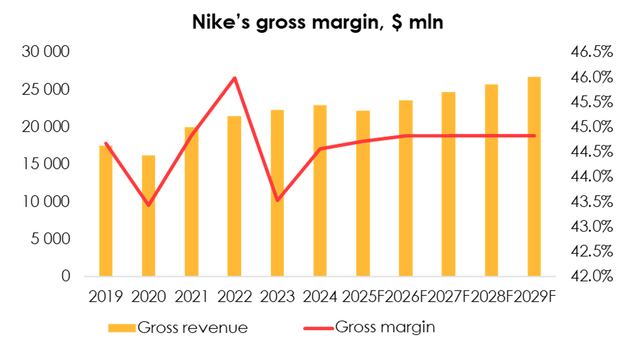

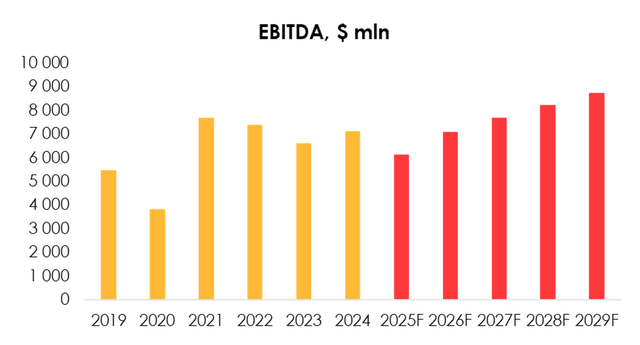

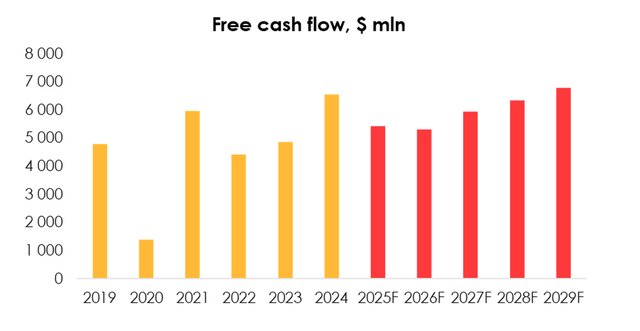

Bottom-line forecasts, EBITDA & FCF estimation

As was mentioned before, Nike does not have its own factories to produce shoes, and all products are made by third parties. The gross margin reached 44.6% in 2024, which was roughly in line with the average margin of the last 7 years. Over the next 2 years, we expect a conservative expansion of gross margin (by 10 bps per year) due to refreshment of the product range and a smaller share of sales at discounted prices. Afterward, we are projecting a stable gross margin of 44.8%.

Company data, Invest Heroes calculations

Potential risks to the company’s gross margin could come from spikes in supply chain costs, but given that the number of available merchant vessels is expected to increase globally, we do not believe this will put any pressure on Nike’s margins in the base-case scenario.

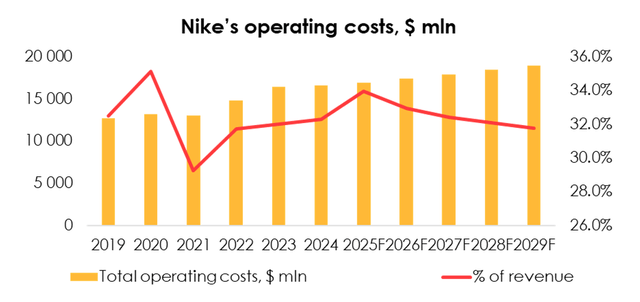

When it comes to advertising costs, the growth of this expense item has been fairly stable at Nike. In 2024, these expenses totaled $4 285 mln (+5.5% y/y) and the average growth rate for the period from 2018-2024 was 3.1% y/y. Nike has long been a mature business and broadcasts advertising in a multichannel mode, so we do not expect an increase in the number of customer engagement channels or a solid expansion of the advertising budget.

Amid expectations of a dip in demand, we anticipate that the advertising budget will not rise in 2025, totaling $4 272 mln (-0.3% y/y), and will climb to $4 417 mln (+3.4% y/y) in 2026.

General administrative costs totaled $12 291 mln (-0.2% y/y) in 2024. The ongoing increase in salaries was mitigated by some staff cuts, but we do not expect any further initiatives to raise efficiency. We expect the metric to total $12 574 mln (+2.3% y/y) in 2024 and $12 926 mln (+2.8% y/y) in 2025.

Therefore, we assume that Nike’s total operating costs will $16 846 mln (+1.6% y/y) in 2025 and $17 343 mln (+3.0% y/y) in 2026. The expected decline in revenue will take a toll on Nike’s operating margin within one year, but that effect will then be mitigated by rebounding sales.

Company data, Invest Heroes calculations

Therefore, we are forecasting EBITDA to total $6 123 mln (-14% y/y) in 2025 and $7 073 mln (+15.5% y/y) in 2026.

Company data, Invest Heroes calculations

In terms of cash flow generation, Nike remains a fairly stable business, with an average EBITDA to operating cash flow conversion rate of around 90%. We expect free cash flow to be supported by lower inventory buildup next year, but starting from 2026, turnover will return to its average levels and working capital investments will range from 0.5% to 1% of revenue.

Therefore, we are forecasting the company’s free cash flow to reach $5 436 mln (-17% y/y) in 2025 and $5 307 mln (-2% y/y) in 2026.

Given the low debt burden, we assume Nike will continue to raise its dividend payout and buy back its shares from the market, even as sales decline.

We expect that the annual dividend will total $1.51 (+4.1% y/y) in 2025 and $1.58 (+4.6% y/y) in 2026, while the value of repurchased shares will be $3 000 mln and $4 000 mln respectively.

Company data, Invest Heroes calculations

Potential risks

Being a consumer cyclical company, Nike remains a subject to several risks that may significantly affect further financial results and stock performance:

- Consumer activity and cyclical spending could slow more than expected due to deteriorating macroeconomic conditions;

- Failure of the team to bring new models to market and extended loss of competitiveness.

- Trade tensions between the US and China may complicate the company’s activity in this particular market (both on the production & distribution sides)

Valuation

Nike is a mature and steady business in a hyper-competitive industry. In this environment, it will be hard for the company to boost sales by much, so revenue and EBITDA growth will roughly match the pace of the rest of the sector.

However, the decline in the share price, which came as a result of slower growth and increased competition in the international market, creates an attractive entry point, as the value of Nike’s business is now below 2018-2019 levels, even though the volume of the business has expanded significantly since then.

We view the medium-term decline in financial performance as a cyclical shift in trends in the volatile apparel and footwear market, and believe Nike will return to a steady growth in financial results as it refreshes its product range and consumer preferences go through their regular changes

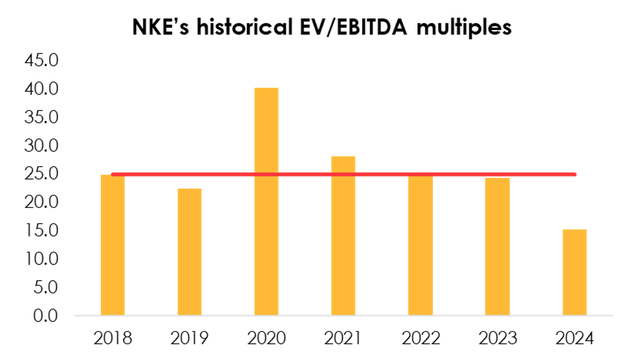

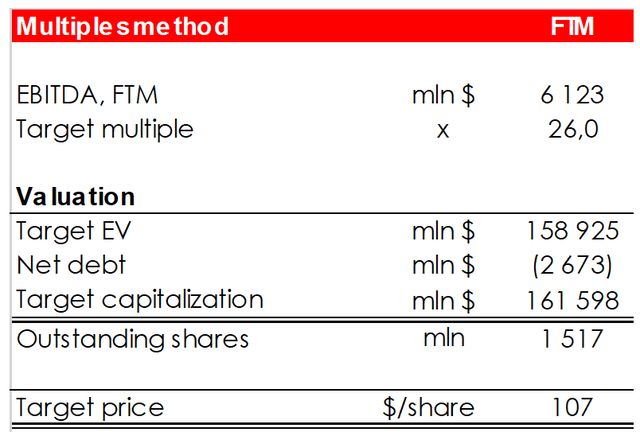

We’re evaluating NKE target share price based on FTM EV/EBITDA multiple.

We set the target price of the shares at $107/share, using a 24.9x target multiple (which is a 7 years average for NKE), multiplied for further compound annual EBITDA growth rate of about 5%.

Based on our assumptions, we set the rating for the company at BUY.

Conclusion

Investors should consider the cyclical nature of the fashion and athletic footwear industry, understanding that short-term fluctuations may give way to long-term growth as trends evolve. With a stable gross margin and disciplined cost management, Nike is poised to navigate these challenges effectively.

Given the current market valuation and the expected rebound in financial performance, we rate Nike as a “BUY” with a target share price of $107. This reflects the company’s strong fundamentals, strategic growth initiatives, and potential for long-term value creation.

To manage your position, we suggest keeping an eye on Nike’s and its competitors (Adidas, Skechers, etc.) financial statements and industry research articles.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.