Summary:

- In 1Q25, Nike generated revenues of $11.58 billion, declining by 10.43% and 8.07% year-on-year and quarter-on-quarter, respectively.

- Despite an improvement in gross margin, operating margin deteriorated due to higher SG&A spending to capture demand.

- Although the company has multiple initiatives to restore growth, consumer sentiment will continue to weigh on NKE’s sales.

- In China, domestic competitors have outperformed, and the Company must figure out a way to generate growth amidst poor macroeconomic conditions and changing consumer patterns.

- Valuation analysis suggests that NKE’s valuation does not reflect a deterioration of the company and does not provide any margin of safety.

ozgurdonmaz/iStock Unreleased via Getty Images

Introduction

Nike (NYSE:NKE) (NEOE:NKE:CA) is one of the world’s most renowned brands and engage in the development and sale of athletics products including footwear, apparel, equipment, and accessories. Since November 2021, the company’s share price has fallen more than 50% due to deteriorating sales.

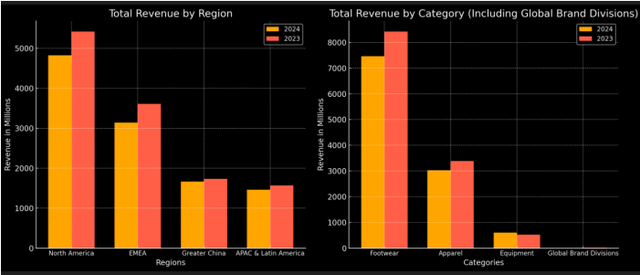

Revenue Breakdown of Nike (Company Filings, Author’s Illustration)

Unfortunately, based on my analysis, NKE’s performance is likely to continue deteriorating. Currently, NKE has two big challenges: (1) how to increase sales amidst the backdrop of a poor consumer sentiment and (2) how to win the uphill battle in China. In this report, I will demonstrate why NKE’s performance is likely to continue deteriorating. For those who already have positions in NKE, it will be wise to take profits now.

Latest Developments

In 1Q25, NKE generated a total revenue of $11.58 billion, representing a year-on-year and quarter-on-quarter decline of 10.43% and 8.07% respectively. Revenue deterioration is attributable to weaker sales across all regions and categories, except for the equipment category. Equipment sales surged by 14%; however, remains only a small contributor to overall revenues.

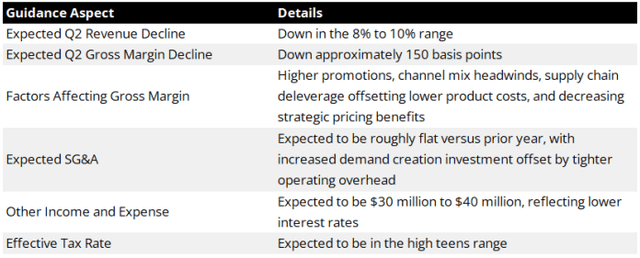

Nike’s Guidance (1Q25 Earnings Call )

Gross margin for the period have improved from 44.21% the same period last year to 45.36%; gross margin improvement is due to lower logistic related costs. However, operating margin have deteriorated close to 200 bps from 12.40% to 10.43%. Operating margin deterioration can be attributable to higher SG&A spending. SG&A as % of sales increased from 31.8% the same period last year to 34.93%.

Looking forward, John Donahoe will retire as President and CEO of Nike, while Elliott Hill will take over as the new President and CEO of Nike on 14 October 2024. NKE stated that as a result of the leadership transition, the company will be withdrawing full-year guidance. That being said, NKE expects revenue to continue to decline by 8 to 10% for 2Q25. Gross margin is also expected to deteriorate by 150 bps, while SG&A spending to be similar as per last year.

Nike’s Topline Likely To Continue Struggling Due to Poor Consumer Confidence

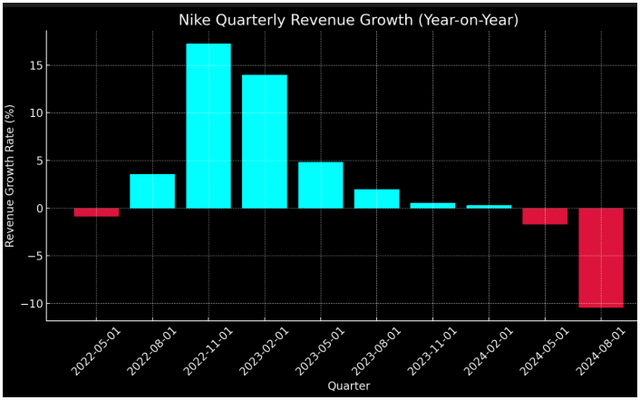

Over the past couple of quarters, NKE has failed to stop its deterioration in revenues effectively. Since 2022, when NKE’s revenue growth reached a peak of 17.24% year-on-year, the company’s sales have deteriorated significantly. For the past two quarters, NKE had an average revenue growth of -6.07% year-on-year.

Nike’s Quarterly YoY Growth (Company’s Filings, Author’s Illustration)

It is important to note that NKE is not sitting around and just letting the company languish. Based on the latest earnings call, NKE has multiple plans and initiatives to turnaround its situation. NKE is working on leveraging its momentum in its running section. Consumers will be expecting a new running model that combines the ZoomX and Zoom Air, more performance related apparels, and women-led designs. NKE will continue to scale its marketing efforts through major events and partnership with strategic partners. For example, the company had previously worked with DICKS and Foot Locker to promote women’s fitness and basketball, respectively.

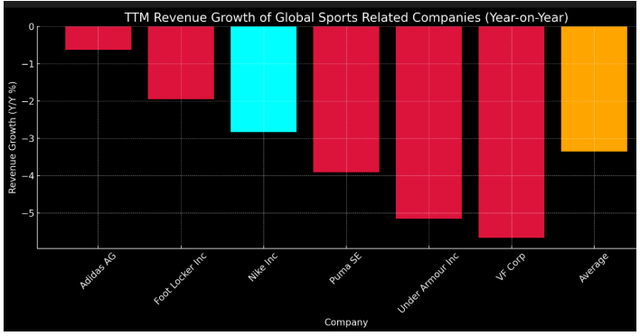

TTM Growth of Sports Related Companies (Company Filings, Author’s Illustration)

Despite these efforts, the company’s management continue to expect poor sales for the next quarter. It is important to note that NKE is not facing an idiosyncratic situation. Other global sports related companies are also facing a similar situation. Companies such as Puma, Under Armor, Adidas, and VF Corp are all seeing depressed TTM revenue growth.

The weakness in sales can be attributable to poor consumer confidence. Ever since 2021, consumer’s confidence has plunged and remained significantly below pre-Covid levels. Scarred by Covid-19 and the subsequent stubborn years of high inflation, it will take considerable time to restore consumer’s confidence. According to a recent consumer spending survey, many consumers believe that the economy is worse than before. 58% of the survey responded indicated that they have reduced spending based on their perception, and 89% stated that they have relied more on coupons and promotions.

Nike’s Challenges In China Are Bigger Than It Would Like to Admit

China is an important market to NKE; as of 1Q25, revenue contribution from China represents 31.2% of NKE’s total sales. In the latest quarter, the company’s sales from China have declined by 4%. Although NKE remains aggressive in China, the company is facing an uphill battle in the region. Unfortunately, there are multiple indicators and factors that suggest NKE’s sales in China will remain weak.

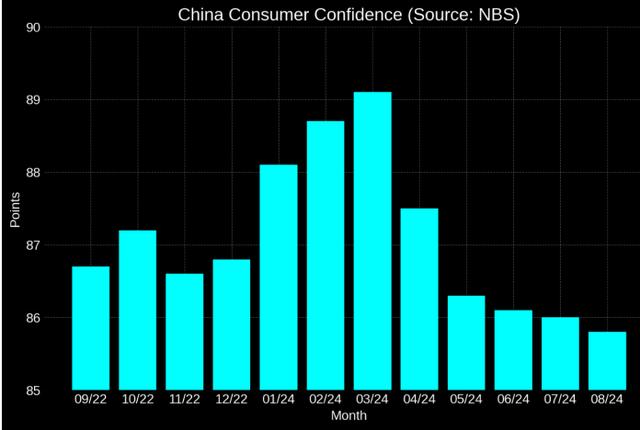

China’s Deteriorating Consumer Confidence (National Bureau of Statistics of China, Author’s Illustration)

Macroeconomic conditions remain soft in China and will continue to weigh on consumer’s spending ability. Although the country has implemented multiple fiscal initiatives and there is a rebound in retail sales and industrial production, overall consumer confidence remains severely depressed. Moreover, jobless rates for youth further surged to a staggering 18.80%. It will take a considerable amount of time before we see the macroeconomic conditions improve.

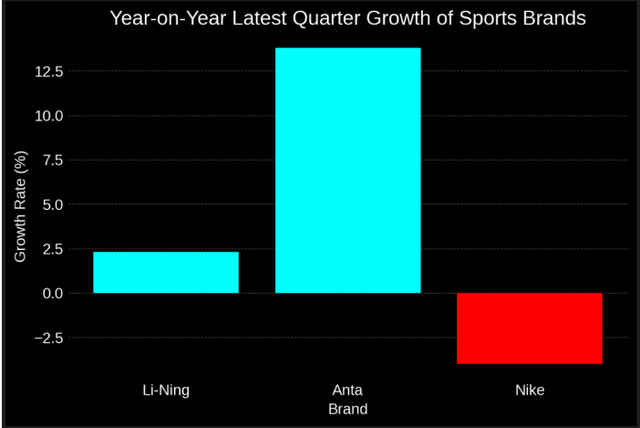

Nike’s Competitor Analysis in China (Company Filings, Author’s Illustration)

Despite poor macroeconomic conditions, NKE’s performance in China relative to its domestic competitors have severely underperformed, indicating a change in consumption patterns and suggesting a bigger issue at play here. The shift in consumer behavior in recent years can be attributable to a rise in nationalism; this phenomenon is also known as guochao where consumers choose China related products over global renowned brands. In fact, most of the global companies in China are already affected and dethroned by its domestic competitors. For NKE to win its domestic competitors, relying on innovation and Kobe Bryant’s legacy will not be enough.

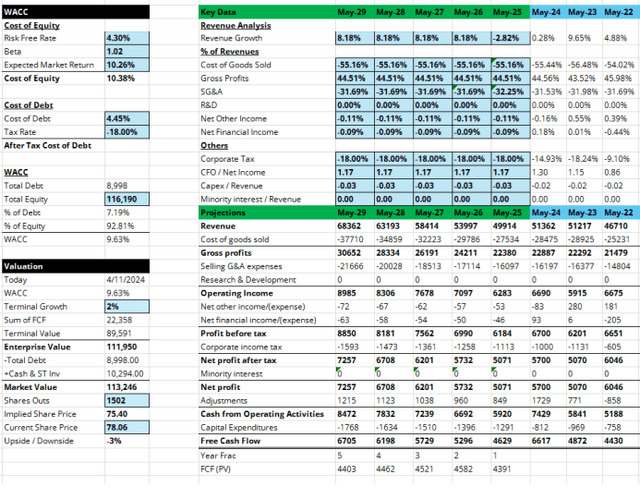

Nike’s Valuation Does Not Reflect The Deterioration of the Company

Despite falling more than 50% from its high, NKE’s current valuation does not truly reflect the deterioration of the company. Based on the following assumptions: (1) a revenue growth of -2.82% for FY2025 and 8.18% through FY2026 to FY2029, (2) NKE to maintain its margins similar to the average of the past four quarters, (3) a terminal growth of 2% and a WACC of 9.63%, the DCF valuation model suggests an implied share price of $75.40, representing a potential downside of -3%.

Valuation Analysis (Author’s Projection)

However, it is important to note that these are fairly optimistic estimates. The company’s latest revenue has already declined by 10.43% year-on-year, and NKE’s management expects next quarter to fall by another 8% to 10%. If we assume that NKE sales deteriorate by 5% for FY2025 and achieves a CAGR of 6% (still outperforming its average sales growth between FY2022 and FY2024), NKE’s implied share price will be $68.59, representing a potential decline of 12%. Clearly, there is no margin of safety for investors to come in at this price.

Closing Remarks

Overall, NKE is facing multiple challenges to maintain its leadership. Apart from facing macroeconomic challenges, the company will also have to figure out a way to beat its domestic competitors in China. Unfortunately, at this stage, inventory levels remain high, consumer’s confidence remains poor, and NKE will face an uphill battle in China.

Looking forward, investors should keep a close on NKE’s plans and strategies in China. China will continue to remain as an important market for NKE. If NKE is able to show evidence that their initiatives in China succeed in helping the company outperform its competitors, there is a strong likelihood that NKE will return to growth. Unfortunately, based on current developments, it is likely that we will see continued deterioration in its performance.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.