Summary:

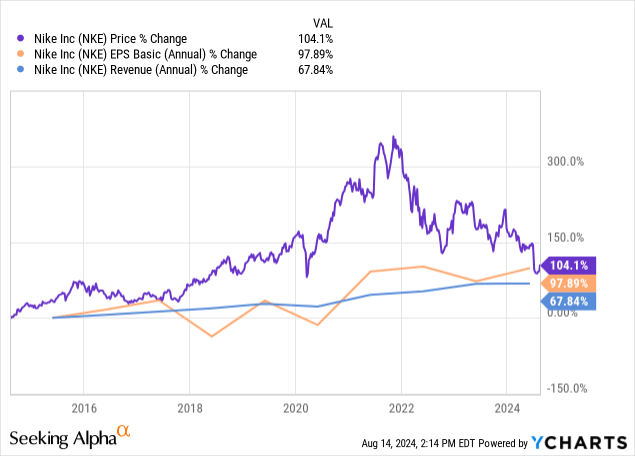

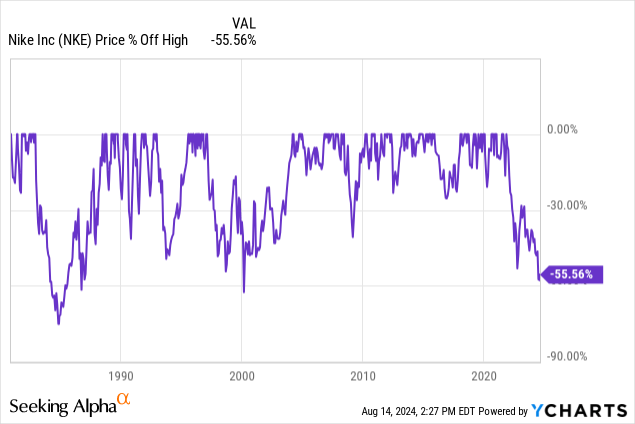

- Nike stock shows bullish signs with price growth meeting earnings growth, a rare scenario worth considering for a starter position in a portfolio.

- Competition from upstart brands like Hoka and On Running, as well as direct sales challenges, are impacting Nike’s growth.

- Valuation using Warren Buffett’s “Owner Earnings” discount model suggests Nike is a better bet than risk-free alternatives at its current price, with potential for future growth.

Robert Way

This hasn’t happened in a while

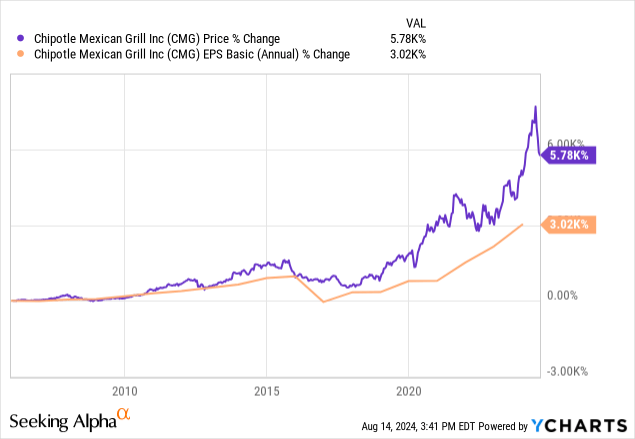

When I started writing this article for NIKE, Inc. (NYSE:NKE) a few weeks ago, the reflexive pattern was even better than it is now with 10-year price growth finally dipping below earnings growth. These are normally very bullish signs, especially when it comes to established brand names. While the stock has rebounded a bit, we still observe a convergence of the growth lines that really hasn’t occurred since 2017.

Although Nike stock is going through a rough patch of slow to no growth, I have faith that this is a rare scenario worthy of a starter position in my portfolio.

Recent example

Seeking Alpha

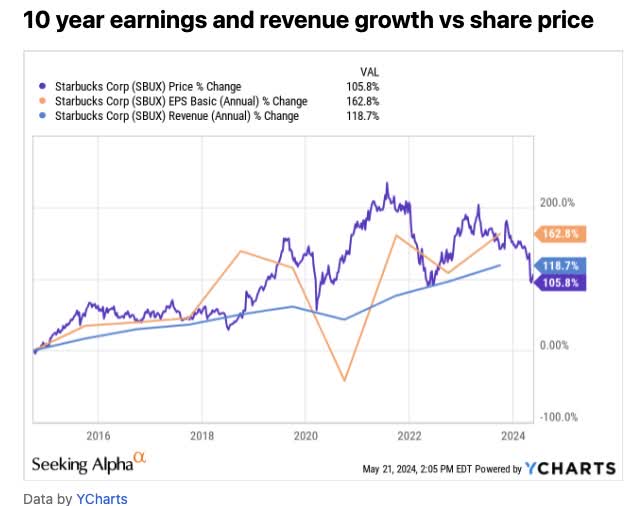

Here is an example from a recent buy article I wrote on Starbucks on May 22nd. The chart and pattern do not look like this currently, but it did at the time, again a rare occurrence that we last observed in 2019.

I again like to stress that starting any analysis with a reflexivity chart made famous by Peter Lynch’s books and George Soros, is a great comparison of subjective reality versus economic reality. When price growth gets too far ahead of earnings, that is oftentimes a subjective mistake. When fear hits and the reverse order happens, a stock is worthy of further analysis.

I can’t take even a smidgen of credit for the 20+% upswing in Starbucks Corporation (SBUX) since that article hit, as almost all the returns were based on poaching a CEO. However, these CEOs are pretty well-informed about these situations and know an easy hurdle rate from a difficult one. Below is an example of a difficult hurdle rate:

On a ten-year basis, this looks better, but a wide chasm between expectations [price] and reality [growth] is a tall task indeed unless you operate in software. Is this SAAS or Salsa? If I didn’t tell you the stock I’m sure you’d assume the prior.

Best teams, best players

Even with salary caps in sports, we still see many of the same teams in the NFL or NBA become champions or perennial playoff contenders. Players want to play for the most storied franchises, those with the most trophies, and the ones they grew up idolizing as a kid. Publicly traded companies share a lot of similarities. To my surprise, Starbucks Corporation (SBUX) was recently able to pull off the trade of the year nabbing Brian Niccol from Chipotle Mexican Grill, Inc. (CMG). This was like trading Tom Brady from the Patriots to the Buccaneers. I couldn’t believe it, but I should have expected it.

Going out on top and then taking over a situation where you at least don’t have to establish a brand is very attractive. I believe Nike also falls into this category and the board can certainly pull off a similar hire should they wish to pursue one. To be frank, pulling John Donahoe from ServiceNow, Inc. (NOW) was a great feat in itself but not one from a synergistic industry.

Let’s ask ourselves a question, if Nike approached the Hoka, On Running or Lulu Lemon CEO with a huge offer, do you think they would take it? I’ll let that question linger, but I bet they all have fond memories of Nike from their younger years.

The problems

This snippet from Sara Germano of FT sums up the current issues perfectly:

The age of social media has also allowed upstart brands to scale more effectively. Two newcomers in particular – Hoka and On Running – have benefited from stronger direct sales and strategic endorsements. They have also capitalised on the appetite from big retailers to reduce their reliance on Nike amid Donahoe’s emphasis on direct sales.

The company is losing Tiger Woods after 27 years. They still have Michael Jordan, but Tiger is arguably as big a blow. However, the Nike athlete endorsement list is still what I would consider the best in the world. Here are the top 10:

- Michael Jordan.

- Cristiano Ronaldo.

- Serena Williams.

- Tiger Woods [now gone].

- LeBron James.

- Naomi Osaka.

- Kevin Durant.

- Rafael Nadal.

- Megan Rapinoe.

- Russell Wilson.

The list is getting tired in the top echelon as several of these players have or will retire in the next few years. Attracting these athletes and major league deals that are team-wide across the globe is still something that I believe no newcomer will ever be able to compete in.

The biggest issue I see in Nike’s faltered growth is not social media or even the newcomers, but the direct sales.

I, for instance, used to buy a new pair of Nike shoes once a year from Costco. They no longer offer them and I simply get whatever other generic brand they are offering at $39.99. I understand the brand protection in direct sales, but these little sales add up. Even if you are just selling lower-end shoe lines at Target, Walmart, or Costco, Nike will edge out similar-priced competition and surely increase sales volume should that strategy return.

Let’s also not forget that there is a lot of new immigration happening in the US, both legal and not so much. Having legal immigrant in-laws, they only know Nike and exclusively want that brand. As going to a Nike store is not a possibility in some U.S. metros, a return to increased 3rd party sales across America is the first place I would start if I were the CEO.

Competition comes and goes

A final note on competition and a prescient one from my youth. I remember a time even in the prime of the Michael Jordan era when Fila became the new hot kid on the block. Everyone wanted those and Cross Colors clothing. Both brands were very exclusive and expensive at the time. For those not familiar with Cross Colors, have a gander:

These are now vintage 1990s history, but trust me, at the time everyone wanted to get their hands on the clothing. It lasted for a few years and then poof! I expect the current competition to come and go as well. Possibly, they’ll wind up being bought by a South Korean conglomerate like the once-Italian Fila was.

Valuation

In the case of slow growth established by Stalwarts, I like to use the Warren Buffett “Owner Earnings” discount model as a preference.

From Hagstrom’s books on Warren Buffett, net income is first adjusted to add back in depreciation and amortization, which is different from EBITDA, this still accounts for interest and taxes, two very real expenses to a business. Then you subtract capital expenditures. If capex is huge in comparison to D&A, the business will pencil out less valuable, if equal or close to it, then you have an efficiently run business.

Hagstrom also points out that Buffett did not believe in the CAPM required rate of return that incorporates market risk. If the business still has good earnings after adding in D&A and subtracting out capex, then the 10-year treasury risk-free rate is all that was needed.

All numbers in millions courtesy of Seeking Alpha

- TTM net income: $5,700.

- TTM Depreciation and Amortization:$844.

- TTM CAPEX: $812.

- Equals owner earnings: ($5,700+$844)-$812= $5,732.

- Discounted by risk-free rate 4%= $143,300.

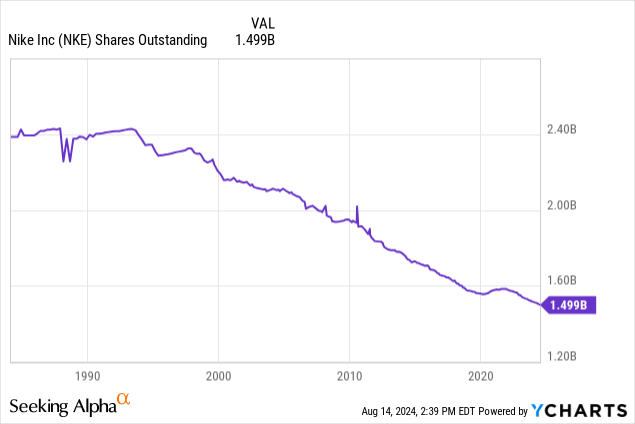

- Divided by shares outstanding=$143,300/1499.4= $95.57/share.

Discounting this 20% more to get a buffer for risk equals $76 a share which is where we are roughly at.

The 10-year treasury “risk-free rate”, is actually trending downward at this time and will continue to do so as investors anticipate a rate cut and start lengthening their fixed income durations. While Warren Buffett was known to add a point or two to the risk-free rate when rates were historically low, Nike in my mind gets the benefit of the doubt that the company is a better bet than risk-free alternatives at this price with the ability to grow owner earnings in the future.

Be it through better management and earnings growth from margin improvement or better top-line numbers, I can’t imagine Nike being down for the count. Not only that, but the company has a nice propensity to buy back shares. Hopefully, they are buying back more currently at these prices.

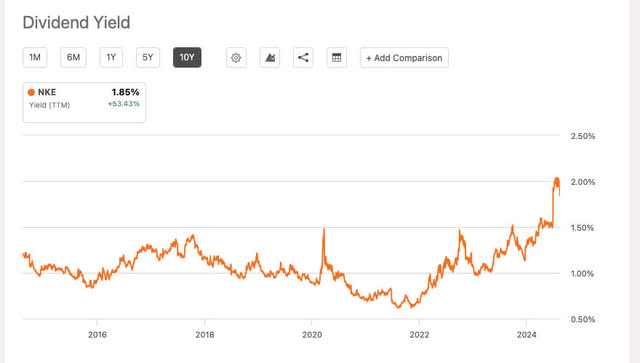

The dividend

While the dividend is not huge, it is at decade-high levels. With $4.36 in free cash flow per share and a forward dividend per share of only $1.48, that is a payout ratio of only 33.9%.

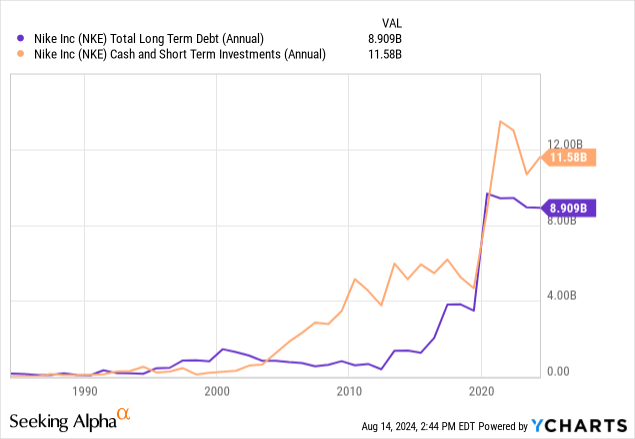

Balance sheet

An ultra-strong balance sheet with cash and short-term investments above long-term debt. I have no complaints here and the company has the cash or leverage capability to change directions once a plan is made.

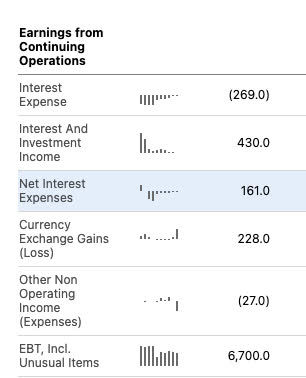

Ongoing interest expense

Seeking Alpha

Again, another rarity in the stock market where the balance sheet actually yields interest income versus having an interest expense. I couldn’t ask for more.

Catalysts

The street is expecting negative earnings growth going forward. Most of us following the stock know about the bad guidance on the last earnings call. I also don’t expect any surprise top or bottom-line growth to be a catalyst.

Rather, a clear plan for the coming earnings call of a big pivot and or a change in management similar to Starbucks would be a coiled spring waiting to happen.

Risks & Summary

The risks here are all in headline and execution risk. I don’t see any balance sheet or liquidity risks. Continued drops in revenue will be attributed to a loss in market share whereas it may just be an overall weakening of the consumer. I was recently in the Nike outlet in my town [which was packed] for back-to-school shopping.

I did notice some deep discounts on higher-end shoes, particularly the Jordan 2 retro “Italy” sneaker which was marked down from $175 to $59! I don’t typically buy those, but I would have if they had my size. The overkill in the Jordan segment of their shoe line is very apparent when scuttle-butting. In my youth, the release of a new Jordan line created wrap-around lines at Foot Locker and some unfortunate individuals would get robbed and have to walk home barefoot after. It was a huge deal.

Now, they’re shoving too many Jordan shoes down our throats to swallow. I imagine we’ll see very weak margins in their Jordan lines until they blow out all the old ones and hopefully pare down future offerings.

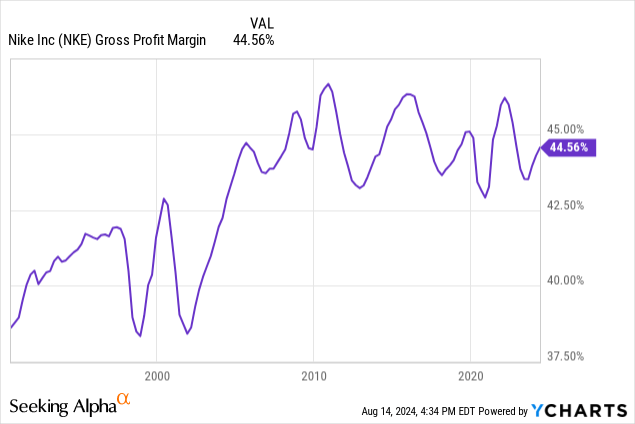

I could certainly imagine a retreat from 45% gross margins if massive markdowns in high-end shoe lines persist.

Be it as it may, I am adding Nike here and believe that the new trend that Starbucks started will either get big brand CEOs on their toes or exit stage left. Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NKE, SBUX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information provided in this article is for general informational purposes only and should not be considered as financial advice. The author is not a licensed financial advisor, Certified Public Accountant (CPA), or any other financial professional. The content presented in this article is based on the author's personal opinions, research, and experiences, and it may not be suitable for your specific financial situation or needs.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.