Summary:

- Nike’s direct-to-consumer strategy and loyal customer base acquired during the pandemic are expected to contribute to the company’s profitability.

- Q1 results showed mixed performance, with sales falling short in Greater China and Converse, but gross margin exceeded expectations.

- Nike is well-positioned for growth in China as Covid-19 restrictions ease, with the potential for accelerated revenue growth and improved margins.

Wirestock

Investment Thesis

NIKE, Inc. (NYSE:NKE) is the global leader in the athletic market, boasting diversification across product categories, geographical regions, and distribution channels. The company stands out with a compelling direct-to-consumer (DTC) strategy in the branded industry. A key aspect of this strategy is a heightened focus on the DTC channel, particularly through Nike Direct and strategic marketplace partnerships. The customers acquired during the pandemic, known for their loyalty, are expected to contribute positively to the company’s profitability. I believe that the strong momentum of NKE’s brand across the world is sustainable and will shield it from economic fluctuations, ensuring consistent high single to low double-digit revenue growth over several years. I am bullish on the company and assign a buy rating to the stock.

Q1 Review and Outlook

NKE’s result for the first quarter of fiscal year 2024 presented a mixed picture, offering points of interest for both optimistic and pessimistic viewpoints. Total sales slightly fell short of expectations, mainly due to weaker performance in Greater China and Converse, while Nike brand sales were on target. On the positive side, gross margin and selling, general, and administrative expenses exceeded expectations, aided by a shift in technology spending and a one-time tax benefit of $0.06, resulting in EPS of $0.94, surpassing the consensus estimates.

To rebalance supply and demand, NKE is carefully managing sales into the retail channel and restricting inventory access to ensure a healthy marketplace. Notably, end-channel sales remain above NKE’s expectations for a slightly increased revenue in the second quarter of fiscal year 2024. Regarding the direct-to-consumer market in North America, the liquidation activity from the previous year, especially in the apparel segment, is now being compared, resulting in a net positive impact on merchandise margins. Sales growth, however, is under pressure as lower-quality transactions are avoided. While debates around the bull and bear case may persist until there is greater clarity on wholesale recovery and macroeconomic conditions. Nike continues to maintain a dominant position as a footwear brand, both in North America and globally, and its inventory has been adjusted to align with faster-growing sales, while the wholesale destocking is expected to conclude by the end of the year.

In the upcoming second quarter, Nike foresees a slight increase in reported revenues. The company projects a gross profit margin improvement of approximately 100 basis points due to strategic pricing, better handling of markdowns, and reduced ocean freight costs. However, this gain will be partially offset by higher product input costs and around 50 basis points of adverse foreign exchange effects. The management also expects selling, general, and administrative expenses to rise in the mid-to-high single digits.

Looking at the full year, Nike has reiterated its outlook, anticipating revenues to increase in the mid-single digits. The management projects a gross profit margin increase of 140-160 basis points, which includes roughly 50 basis points of negative impact from foreign exchange fluctuations. SG&A expenses are expected to slightly outpace revenues, particularly at the upper end of the mid-single-digit range. It’s worth noting that the company anticipates only a “modest” improvement in markdowns for the rest of the year, suggesting there may be room for better-than-expected performance in this area.

Nike Sales Poised for Boost From China With Margin Set to Expand

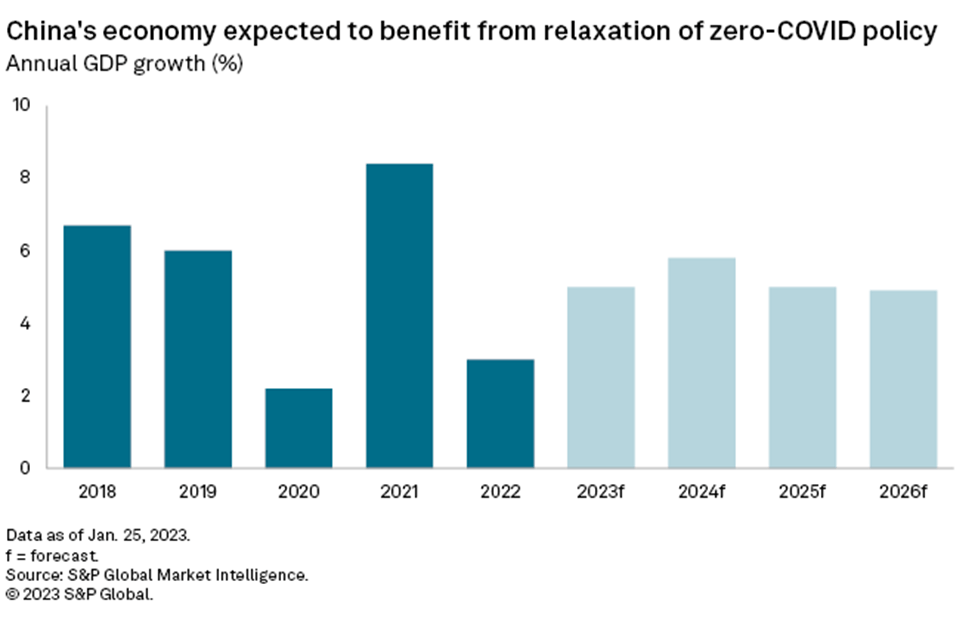

With 15% of its sales coming from China, Nike is in a good position to benefit from a rollback in COVID-19 restrictions in the region. The reopening may help growth continue to accelerate into 2024. The sales in China appear poised to keep surging as the country benefits from consumers returning to normal activities, going outside, and playing sports again. Currency-neutral revenue in China jumped 25% in fiscal 4Q ended May 31, but could accelerate significantly in the near term as demand ramps up and Nike launches hyper-local products, such as its Chinese New Year and Year of the Rabbit packs. Faster revenue growth may also benefit overall margins in my view, since China typically boasts the highest profitability, while inventories are relatively manageable. Nike has the highest footwear market share in China and is No. 2 in apparel. In 4Q, 15% of Nike Brand sales came from China.

Moreover, the contribution of China’s sports industry to GDP could rise this year as more residents resume outdoor activities after the end of Beijing’s Covid Zero policy. This would come after the contribution to GDP dipped to 1.06% in 2020 from 2019’s 1.14% and remained at 1.07% in 2021. Covid disrupted many sports-related businesses and activities, which resulted in an 8% fall in the manufacturing of athletic goods. Widespread virus outbreaks across mainland China likely also limited the rise in purchases of sporting goods last year. This might have offset sports-related sales gains driven by the Beijing Winter Olympics.

S&P Global Market

Sports Key to Brand Success

I believe Nike’s dominance in sports can continue to foster brand success, given its sponsorship of some highest-ranked teams and players at key sporting events. During NCAA basketball’s “March Madness” this year, Nike and its Jordan label sponsored 40 out of 68 teams. The brand also outfitted 13 of the 32 teams in the 2022 Men’s World Cup soccer tournament, with two of them making it to the final four. Nike also has 13 of the 32 teams in the 2023 Women’s World Cup, with seven of those ranked in the top 10, continuing to keep the brand in the spotlight. Nike also sponsors tennis players Aryna Sabalenka of Belarus, ranked No. 2 in women’s, and No.1- ranked men’s player Carlos Alcaraz of Spain, which helps the brand’s status for key tennis events like the just-completed Wimbledon and the upcoming US Open.

Financial Outlook and Valuation

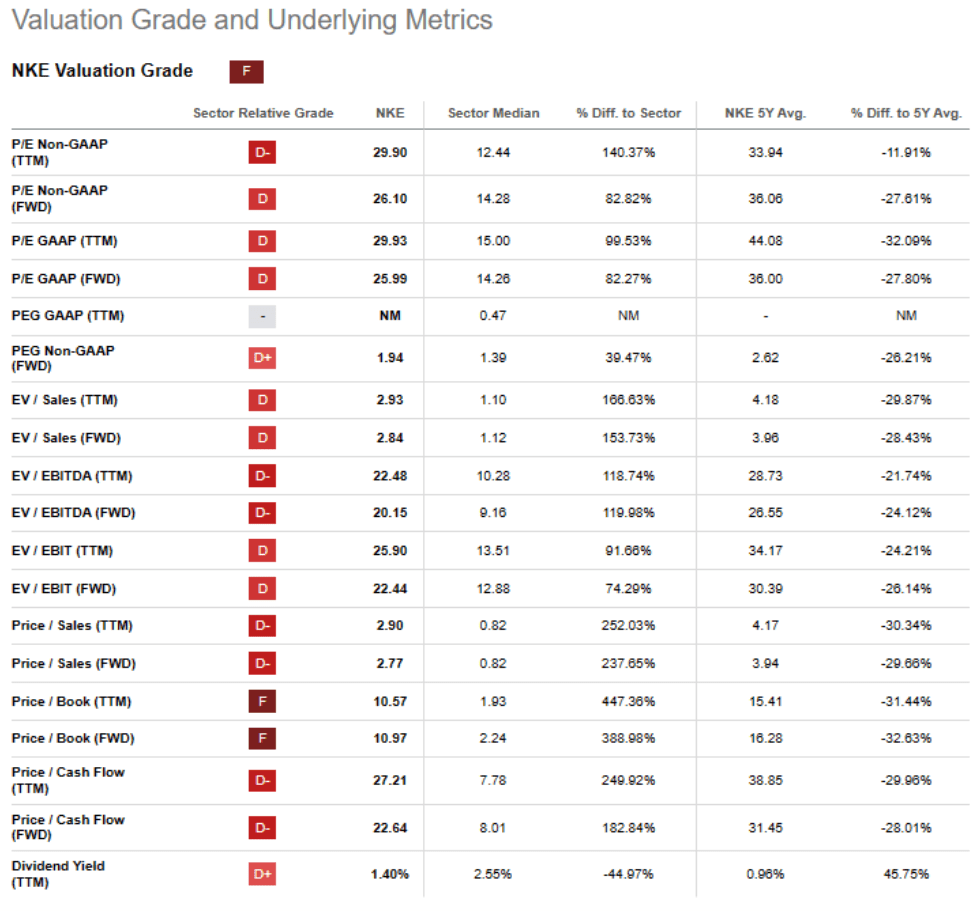

Nike is actively working to reduce its inventories, which may lead to continued margin pressure due to increased discounts. Nike has already managed to bring down its previously high inventory levels, with growth remaining flat at the end of fiscal year 2023 compared to the previous year. Nike has integrated personalized product recommendations into its e-commerce app to boost the sell-through of available inventory. Nike is trading at 26x forward PE, which is in line with the company’s historical three-year average but represents a premium compared to global peers, which typically have lower P/E ratios ranging from low double-digits to mid-teens. The premium reflects the high-quality nature of Nike’s business, its leading position in the appealing athletic category, margin-enhancing strategies (despite recent margin challenges), and a robust balance sheet. I believe that Nike continues to be a top-tier company with strong market positioning in both apparel and footwear, further bolstered by its strong digital capabilities. Moreover, Nike’s deep connection with customers sets it apart from competitors, especially as consumers increasingly prefer brands that offer a unique experience in both physical stores and online. Hence, I remain bullish on the stock and assign a buy rating to the company.

Seeking Alpha

Investment Risks

I see the biggest risk to a NKE recovery to be the weakening macro backdrop and potential for recession. Even in such a backdrop, I continue to see NKE as a relative brand and market share winner. While NKE would not be immune to a weaker demand backdrop, I believe a strong balance sheet, highly sought after products driving brand equity, and company-specific operational initiatives could still drive margin expansion from current levels. Moreover, competition has risen due to the industry’s shift toward performance-oriented products, which has lowered barriers for new entrants, which may threaten the company’s market share.

Conclusion

Nike, Inc. is an established player in the global athletic market and is well-positioned for growth. The reopening in China is expected to drive continued sales growth as consumers return to normal activities, engage in outdoor sports, and drive demand for Nike products. Additionally, Nike’s sponsorship of top teams and players in key sporting events further enhances its brand’s success and visibility in the sports world. The company’s direct-to-consumer strategy in the branded industry is particularly impressive. This strategy places a strong emphasis on the DTC channel, primarily through Nike Direct and strategic partnerships with marketplaces. The loyal customer base acquired during the pandemic is expected to make a positive impact on the company’s profitability. Hence, I am bullish on the company and assign a buy rating to the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.