Summary:

- Nike has seen continual margin compression since early 2022 because of increased competition abroad and rising costs.

- The company still has no plan to deal with the recent success local competitors are having in China, in my view.

- The Stock Looks overvalued using several metrics.

Joe Raedle

Finding top brands at what looks like a discount is almost always appealing. Good investments don’t often stay undervalued for long and the best run companies are often usually the top performing stocks, and premium at a discount is hard to find.

The most well-known shoe brand in the US and most countries worldwide is Nike (NYSE:NKE). This leading shoe brand is a $167 billion dollar company that sells in 170 countries. In addition to selling shoes, Nike also sells apparel and accessories. Nike also sells under other brand names such as Converse, Chuck Taylor, All-Star, One Star, Star Chevron, and Jack Purcell.

Nike had been one of the better performing stocks in the market for some time, but the company has significantly underperformed the S&P 500 (SPY) and most of the broader indexes over the last three years.

Today, I believe Nike is a sell. The company doesn’t seem to have a plan in China where local brands continue to take market share, and costs and expenses continue to cause margin compression as well. The stock also still trades at a growth multiple even though analysts are forecasting significant earnings losses this year.

Nike’s third quarter earnings report highlighted the problems that the company has continued to have for some time in the US and international markets. Even though Nike reported revenues were up 14% adjusted for currency issues, and 19% on currency neutral basis, net income was down $1.2 billion, or 11% year-over-year. Earnings per share were down $.79 or 9% year-over-year. The company’s margins also continued to fall, with gross margins declining 330 basis points year-over-year. Overall revenue growth in China ex-currency was also up just 1% year-over-year.

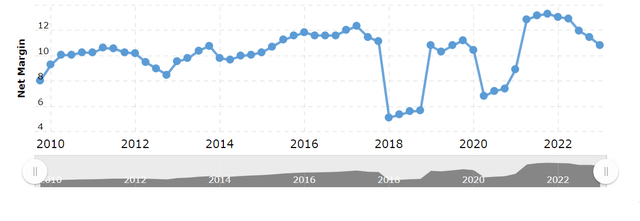

Nike has been struggling with margin compression for over a year now, and the company’s earnings growth was negative even though revenues increased by double-digits on a year-to-year basis. Nike’s net margins have fallen every quarter since the end of 2021, and the company has seen net margins fall from 13.3% to 10.8% during this time frame. Management has also recently guided to margins falling another 2.5 basis points for the full year.

A Chart of Nike’s Net Margins Since 2010 (macrotrends)

Management has not been able to raise prices to offset the labor shortage and supply chain issues that have cause wages and costs to consistently increase over the last two and a half years. Nike saw overall overhead expenses up 17% year-over-year.

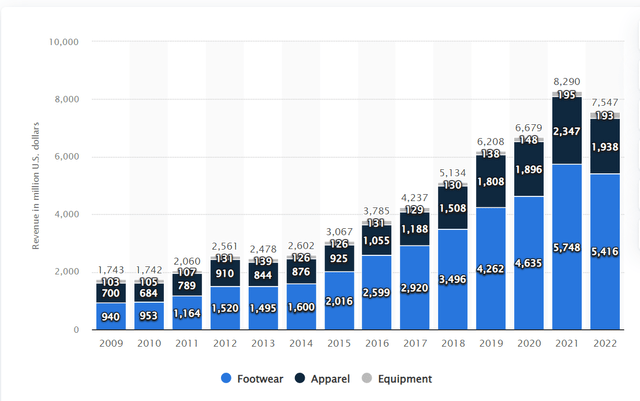

The company also still has no plan to turn around continued market share losses in China in my opinion. Nike’s revenues from China in 2022 were $5.42 billion. The company gets nearly 18% of overall revenues from world’s second largest economy.

A Chart of Nike’s revenues in the Asia-Pacific Region (statista)

Chinese consumers have been increasingly turned to cheap but still high-quality local brands such as Anta Sports and Li-Ning. Anta Sports recently announced the company is raising an additional $1.5 billion after this Chinese shoe company recently saw revenues hit $7.8 billion. Li-Ning’s revenues recently increased to $3.7 billion after growing by 14% just this past year. The Chinese Government has been encouraging consumers to purchase local brands, and Nike’s positions on Hong Kong’s independence and the Chinese Communist Party’s treatment of Uyghur Muslims have hurt the company in this market. Local competition has hurt it in multiple ways, since the company has both lost market share and been forced to offer more discounted pricing. This is part of the reason why Nike’s margins continue to fall for over 2 years now.

Nike also looks overvalued using several metrics. The company currently trades at 33x forward earnings and 29x expected forward cash flow even though analysts are expecting this leading retailer to see earnings per share fall by 16% this year, and the macro environment remains challenging. Nike also faces a number of significant company specific issues as well. While some analysts are forecasting Nike to grow earnings by between by 24% in 2024 and 18% in 2025, those more optimistic expectations seem too high with growing signs of a global slowdown and the continued challenges Nike is having in the US and overseas. The industry average is also 14.44x expected earnings and 8.75x projected forward cash flow. Nike is unlikely to trade at more than 20x forward earnings if the company cannot sustain a double-digit growth rate in my view, and the current company is operating in a very difficult environment right now.

Still, Nike has obviously been a successful and well-run company for a long time, and if management can develop a better plan to handle local competition in China, the company should be able to limit further margin compression and market share losses in this key market. Nike’s margins have fallen as rising inventory levels have forced the leading retailer to discount merchandise, and China and most of the Asian-Pacific region opening up could relieve some of the supply chain pressures that are negatively impacting the company right now. Nike is also sensitive to currency moves, and the Fed changing course in raising interest rates would also likely lead to the dollar weakening against most major currencies. A strong dollar has hurt Nike significantly over the last several years.

Nike was one of the best performing stocks in the market for some time, but the company has no plan right now to stop the continued market share losses in China that I can see, and management has not been able to offset rising costs and expense with price increases. While inflation has impacted all companies in some ways, Nike’s margins have taken a bigger hit than most. Even though China opening up should relieve some supply chain issues the company faces this year, Nike will still likely continue to face significant challenges moving forward.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.