Summary:

- Nike is rated as a hold due to unclear visibility of its long-term business model.

- CEO Donahoe’s strategy of digitalization and DTC approach has not delivered expected results, leading to declining sales.

- Nike’s brand may not be as strong as perceived, with competitors taking advantage of its strategy missteps.

Robert Way

I rate Nike (NYSE:NKE) as a hold as there are certain factors that do not contribute to having a clear visibility of Nike’s business model as a long-term investment. It seems like the strategy launched by CEO John Donahoe three years ago of accelerating digitalization and its direct-to-consumer approach (DTC) have put Nike in a hard position now. Some people might think that Nike’s competitive advantages are associated with its well-renown brand, but that’s wrong, as the apparel and footwear industry is extraordinarily competitive, where design, comfortability, performance, and fashion can play a more important role than the brand itself. I will elaborate on this important factor, as, in my particular view, a company whose competitive advantages cannot be easily identified is one with an unpredictable business model for the long haul. Maybe Nike could be attractive for investors who like to hold the stock for months or a year, but for those who like to hold it for more than 5 years, it’s very important to know the dynamics of the competitive advantages, which are difficult to identify for a company like Nike. These difficulties let the CEOs have a low margin of error in the design of the company’s strategy, which can be the case with Nike.

Context

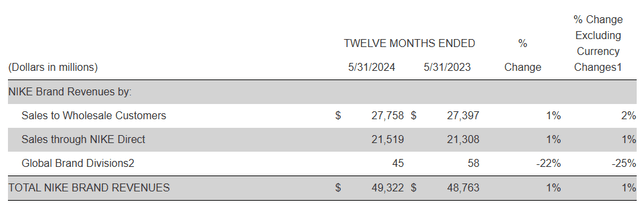

Nike’s revenue growth was 1% in FY 2024 YoY on a currency-neutral basis and only 0.23% when counting the effect of the currency. Net income grew 12.43% YoY and operating income grew 6.69% YoY in the same period.

Consolidated Financial Statements FY 2024

Excluding Converse, we can see that wholesale customers and Nike Direct were not almost growing. In the last quarter, total revenues dropped 2% YoY, explained basically by the drop in Nike Direct of 8% YoY, whereas wholesale revenues were up 5% YoY. However, what truly concerned investors was the guidance, which is down to the to the mid-single digits for the full fiscal year.

There are three things that explain this poor guidance, according to the management: i) a FX effect; ii) slowdown growth in China; and iii) the aggressive actions taken on Nike’s key franchises across the total market place. The third point is what really matters since it shows that the management took the wrong approach at the beginning of the pandemic, thinking that his strategy could be held over the years, even after the pandemic.

CEO Donahoe’s strategy in the middle of the pandemic: the onset of the problems

In 2020, Nike announced that John Donahoe would take over as CEO to replace Mark Parker. Donahoe’s background experience included the leadership of tech companies like eBay, PayPal, and ServiceNow. It was clear that his predecessor, Mark Parker, was seeking a CEO who would lead the digital transformation of Nike to turn it into a tech company more directly connected with its customers through its own apps, collecting valuable data from shoppers.

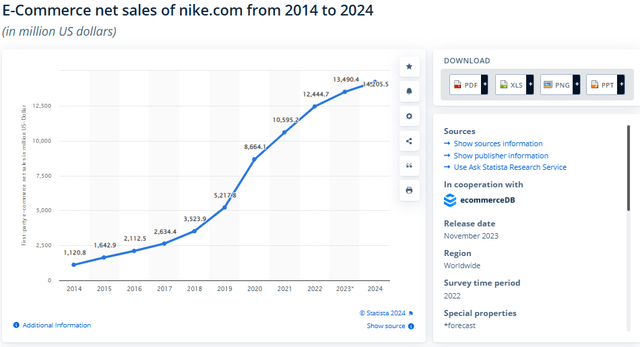

Statista

The e-commerce industry was performing well in the first years of Donahoe’s tenure, as we can see in the chart above. In the COVID scenario, between 2020 and 2022, it was understandable to reinforce the digital business by launching new apps such as Nike, Nike Training Club, Nike SNKRS, and Nike Run Club.

In addition, Donahoe wanted to reinforce its DTC segment not only through the apps and websites but also through new physical stores while cutting its relationships with important retailers such as Durham’s Sports, Shoe Show, Zappos.com, Olympia Sports, Big 5 Sporting Goods, and reducing its presence in Foot Locker, Macys, and DSW.

CEO Donahoe said in the call for FY2021 results:

Today, we are the clear leaders in our industry, and we continue to see digital as our leading channel for growth in fiscal ‘22. The combination of owned and partner digital revenue is now nearly 35% of our total business, more than 3 years ahead of our prior plan. And we see no sign of this shift slowing. In fact, we believe we will achieve 50% digital mix of business across owned and partnered in fiscal ‘25.

Donahoe was expecting in 2021 that the digital business would represent around 50% of the total sales in 2025; so, it was clear that Donahoe thought that his strategy of reinforcing more of the DTC segment through investments in more Nike’s physical stores and more apps that connect directly with its customers was the right move even after the COVID scenario.

The DTC approach and digitalization would enable Nike to have better margins, as the company would have the chance to charge higher prices in its own stores.

The DTC approach would not achieve goals

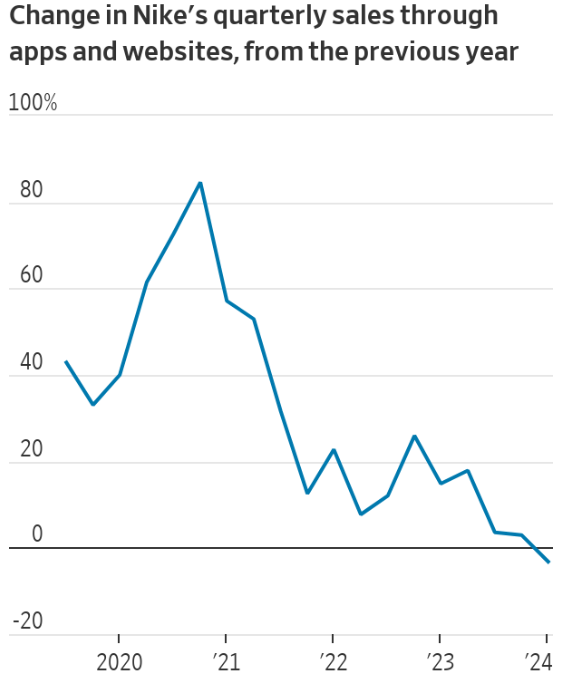

Although Donahoe’s strategy seemed successful at first, pushing up the number of members on the digital platforms to 160 million in 2022, growth in Nike’s quarterly sales through apps and websites started declining since the last quarter of 2021, showing a downward trend until FY 2024.

Kanebridge News

Nike Direct, which includes the sales of Nike’s stores and its digital platforms, represented 41.9% of total revenues in FY 2024, 41.6% in FY 2023, and 40% in FY 2022. Now the goal set by CEO Donahoe was that this segment reach 50% of the total revenues by FY 2025; apparently, that goal will not be achieved.

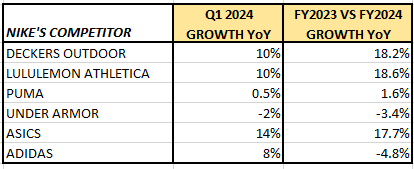

As the pandemic was receding, customers wanted to visit stores more frequently, not necessarily Nike’s stores but the wholesale stores where they could find a lot of variety and several brands. In case you are thinking that Nike’s decline in sales is explained by lower demand in the whole sector, I want to show you this:

Author

In the table above, we can see how other brands in the sector, except Under Armor, were performing well in the last quarter and in the last year. As such, it’s clear that it’s a problem only associated with Nike.

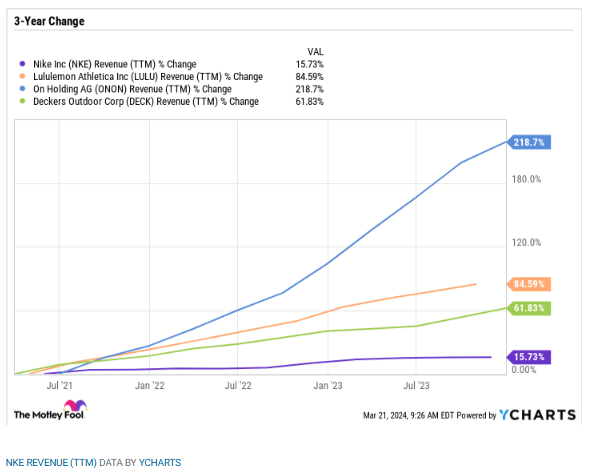

Motley Fool

As Nike was reducing its presence in the retailer’s spaces, competitors were taking advantage of the spaces left by the company. In 2022, companies like Adidas (ETR: ADS) signed a long-term partnership with Foot Locker that included the development and expansion of the women, kids, and apparel segments. Another retailer, DSW, started highlighting other brands, such as New Balance, Skechers, and Brooks.

In general, Nike’s move of reducing its presence from retailers to reinforce its own stores and direct connection with its customers was taken advantage of by Nike’s competitors; in the last 3 years, Nike’s growth was only 15%, whereas competitors such as Lululemon, On, and Deckers had a growth of 84%, 218%, and 61%, respectively.

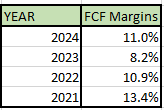

In addition, when Nike started its new strategy in 2020, the company had to manage more inventory as it was managing its own stores, more fixed costs, and more employees. As a result, we can see how the FCF margins have declined since 2021, given the costs associated with inventories and fixed costs.

Author

Nike is trying to reverse its strategy

In June 2023, there was some news about the retailer DSW announcing that it was re-entering a partnership with Nike. So, DSW is selling a wide variety of Nike products across its physical and digital channels. The same happened with Macy’s and Footlocker as Nike re-established the partnerships, given the importance of retailers as part of Nike’s long-term strategy.

All these events made me think that Nike’s brand is not as powerful as we might think since its strategy to reinforce its direct connection with customers did not deliver the expected results. Nike’s brand does not have enough force to attract more customers to its own stores; most of them prefer going to retailers’ stores. As such, CEO Donahoe might have overestimated the brand’s force in its customers.

Nike’s moat is not as strong as you might think

It seems like the board and CEO Donahoe thought that Nike’s brand was similar to Apple’s brand, a well-known worldwide brand, needing to take advantage of its own brand by opening its own stores, which would attract more customers.

The assumption that Nike’s brand had the same power as a brand like Apple was wrong in the end. This made me ask myself why Warren Buffett never considered Nike as a potential incorporation into his portfolio. He was asked in several shareholder meetings about it, and he always answered, saying that even when he recognized Nike’s past achievements, he did not understand Nike’s competitive dynamics.

For instance, Apple has its own stores, and it does not need to sell its products and devices through retailers. The power of the brand is so great that it attracts, by itself, so many customers to its own stores to see the new upgrades or new products in those Apple stores. Nike could not do the same with its own stores since customers were not coming to Nike’s stores as frequently as they do to retailers’ stores.

On the other hand, we will never see Apple paying athletes of different sports or any other celebrity big sums of money to use the brand through contracts, simply because Apple does not need to do it. If a company like Nike has a strong brand, it would not need to do these expensive marketing campaigns to promote its products. I am not saying that Nike is a weak brand; all I am saying is that a brand in the footwear and apparel industry is not as strong as we could expect given the fierce competition in the sector and the nature of the products.

Some might think that the Jordan line, which is a very profitable segment of Nike, could be seen as an excellent example of Nike’s pricing power. Nevertheless, those sneakers barely represent around 13% of the total sales, and they cannot be massively manufactured in order to avoid future price reductions, as the hype for them might deflate.

Nike’s strategy of innovation to make a turnaround

One of the positive things is that not all is lost for Nike, as the company can take advantage of its worldwide presence – a market share of 38% – and its renown brand in footwear and apparel to boost its revenues through more innovation to catch up with its main competitors.

Now, the company is focusing more on cutting-edge footwear for athletes as a way to recover its revenue growth; however, I feel that Nike should also be focused on quality, as I read in several comments about the brand that its main competitor, Adidas, delivers products with better quality and design. As such, I am not sure if the management’s approach of only focusing on innovation would be sufficient to attract more customers.

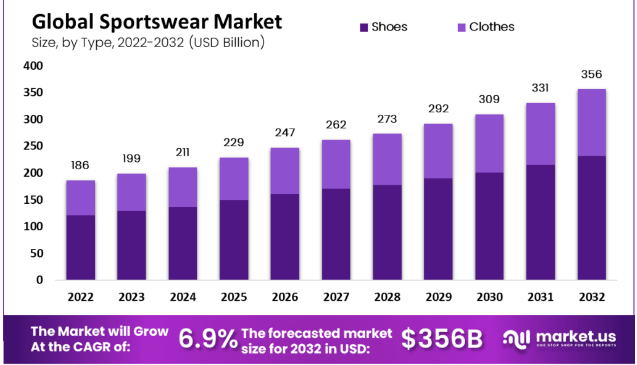

market.us

Even when the global sportswear market is expected to grow in the next few years, where the main brands, Nike and Adidas, have the opportunity to take advantage of their size, new brands are emerging to take advantage of these prospects in the industry too.

With all this information, I understand why Buffett does not like brands in the footwear and apparel industries, as their brand recognition is not sufficient to charge higher prices as the competition is fierce and loyalty to one particular brand is not guaranteed over the long haul. Companies like Nike and Adidas need to invest between 8 and 13% of their total revenues in marketing expenses to maintain their market positions over time.

In my view, there is not much room to keep innovating in footwear, and they might experience a time when more new innovations do not contribute to generating more revenue growth unless the company is thinking about manufacturing footwear that helps you levitate. When a company needs more innovation to protect its market position, it means more money to reinvest in the business, money that could have been used for more repurchases and dividends to reward long-term investors.

Valuation

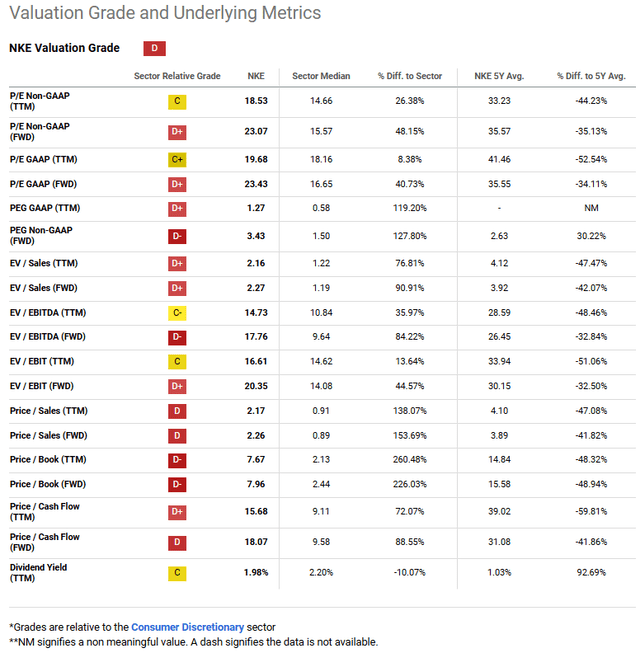

According to SA, all the multiples for valuation indicate that NKE is expensive compared to its peers:

SA

According to the different multiples, the stock is not cheap at all; nevertheless, I will use other methods that enable me to have better control over different variables.

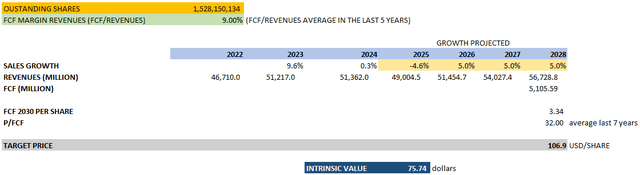

First, I will need to make certain assumptions:

- Outstanding shares: 1,528,150,134 (as of May 2024)

- FCF Margins: 9% (average of the last 5 years)

- I assume that Nike is held until 2028.

- Revenue growth for 2025: according to consensus

- Revenue growth beyond 2025: I assume 5% annual revenue growth, as I estimate that Nike will be able to make a turnaround in 2026.

- P/FCF 2030: 32x (average of the last 7 years)

- Discounted rate: 9%

author

Based on our assumptions, I make a projection of revenue growth of -4.6% for 2025 and finally 5% for 2026 and beyond. So, I take the revenues projected for 2028, and then I multiply those revenues by the FCF margins of 9%. As a result, I get an approximate FCF of 5,105.59 million euros for 2028.

Now, I take that FCF of 5,105.59 million to be divided by the outstanding number of shares of 1,528 million to get a FCF per share for 2028, getting 3.34. In this sense, I take the FCF per share of 3.34 and multiply it by 32, which is Nike’s average P/FCF of the last 7 years. Then, I get a target price of 106.9 euros per share in 2028, so I calculate the present value to bring it back to 2024.

Thus, finding the intrinsic value:

Intrinsic value = 106.9 /(1+discounted rate)^4

Finally, I get an approximate intrinsic value of 75.74 euros per share, which would not leave us with any margin of safety as the stock price is trading at around 73 euros per share currently. I should notice that this intrinsic value is under the assumption that Nike will substantially improve its revenue growth from 2026 on.

So, investors who are willing to pay the current price are confident that the management will make a successful turnaround, surpassing the assumption of a revenue growth of 5% YoY for the next few years. So, the investor would need to evaluate if he feels comfortable with this intrinsic value given the assumptions behind it. In the rest of the year, if the market feels that Nike will not be able to achieve a revenue growth of at least 5% in 2026, the price might drop even further.

As such, having explained different qualitative aspects about the company previously, I would demand a way lower price to give me incentives to buy shares of this company, something between $50 and $60 per share; even in that scenario, I would not hold the stock for the long haul due to the fierce competition in the sector and my lack of confidence in the management to make a real turnaround.

Risks

A risk of my thesis is that CEO Donahoe achieves a successful turnaround for FY 2025 through more innovation while improving the quality of its products. Furthermore, if the management decides to take some measures to reinforce Nike’s brand over the long haul, I might consider the stock a buy even at the current levels.

For instance, measures related to social responsibility, such as methods and manufacturing in a more environmentally friendly way, or other measures that might contribute to associating the brand with status. In my particular view, I think it would be interesting that the management had a long-term vision of building a collection of intangibles associated with the brand that enables the company to reinforce its moat over the long haul in order to avoid only competing through more innovation.

Unfortunately, I do not see any of these aforementioned factors, at least not mentioned explicitly, as part of the management’s long-term strategy currently. In this sense, the management wants to reinvest more in innovation, expecting that strategy would put Nike ahead of its competitors as the company has the size and the resources to recover its revenue growth.

In my view, competing only through innovation is a risk in the footwear and apparel industry, as other competitors are doing exactly the same, so that would encourage all the players to reinvest more and more money in the “innovation race” only to keep their respective market positions. I think that there should be other factors as part of the strategy beyond innovation to gain more intangibles over the years in order to reinforce the brand while gaining more pricing power and competitive advantages.

Final Thoughts

In this article, I wanted to review Nike’s strategy since CEO Donahoe took over in 2020. In my particular view, reviewing the CEO’s strategy of reinforcing its DTC segment and digital e-commerce enabled us to understand how strong the brand of the company is in the footwear and apparel industry. Even when the brand Nike is located in position 13 on the last Forbes list of the most valuable brands worldwide, I think that the brand is not strong enough, as was demonstrated when Nike reduced its presence in retailers’ stores to sell its products in its own stores.

The management seems to focus on the development of more innovation as the only way to achieve positive revenue growth in the next few years. Warren Buffett was right when he said that he would not invest in companies like Nike or Adidas, as it’s very difficult to understand their competitive dynamics. I wanted to emphasize these qualitative aspects since those factors help me determine the weight that a stock deserves in my portfolio in case I wanted to invest in it; as you might infer, I would only overweight companies with a very strong moat that are easy to understand while finding them at competitive prices.

Now, I can’t deny that the management can surpass all my expectations and make a successful turnaround in the next quarters, but I seriously think that I would not consider Nike as a long-term investment, in my own view, given the different factors that might affect its moat and the very difficult sector in which it operates. Of course, each investor has its own circle of competence, but, in my particular case, Nike would be outside my circle of competence. Even considering this factor and my previous assumptions, I consider that the stock price is fair right now.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.