Summary:

- Nike’s share price has fallen significantly due to slower growth, but its strong fundamentals and the return of a former CEO make it a buy.

- Despite recent revenue misses, Nike’s robust free cash flow and aggressive share repurchase program support long-term growth and dividend safety.

- Nike’s competitive advantages include strong brand recognition, global operations, and high R&D spending, positioning it well against competitors.

- Current valuation metrics suggest Nike is undervalued, with a solid dividend yield and potential for significant upside if growth challenges are addressed.

Robert Way

Nike (NYSE:NKE) is a global leader in selling athletic footwear and apparel. The share price has fallen significantly on slower growth. Nike still has many strengths, and the return of a former CEO should help it recover. The dividend yield is at a decade high, the dividend safety is solid, and the company will probably become a Dividend Aristocrat. The equity is undervalued and an attractive dividend growth stock. I currently view Nike as a buy.

Overview of Nike

Nike was founded in 1964. It is the global leader in developing, marketing, and selling athletic footwear and apparel. It also sells sports equipment, accessories, and services. Major brands include NIKE, Air Jordan, Converse, Chuck Taylor, All-Star, and others. The firm sells products through its website, retail stores and outlets, national chains, and direct-to-customers (“DTC”). The global retailer has about 18% of the worldwide market share, and Interbrand lists it as number 14 among the top 100 global brands.

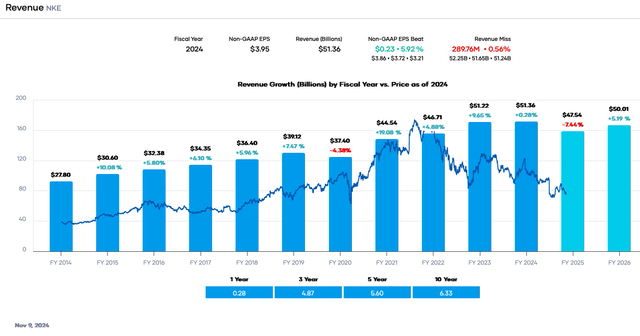

Total revenue was more than $51,362 million in fiscal 2024 and $50,012 million in the last twelve months (“LTM”). The firm’s fiscal year usually ends on May 31st.

Revenue and Earnings Growth

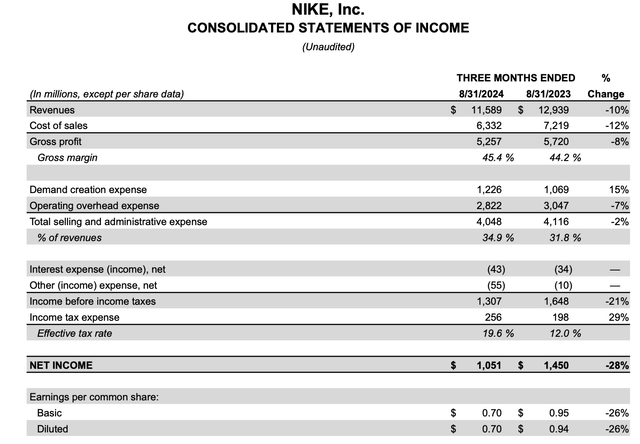

The firm reported first-quarter fiscal year 2025 results on October 1st, 2024, that missed revenue but exceeded earnings per share (“EPS”) estimates.

Revenue decreased about 10.4% to $11,589 million but missed analyst estimates by $50 million and adjusted diluted EPS of $0.70, beating estimates by $0.18 on higher margins and lower expenses. However, this global retailer has increased brand marketing by spending on key sporting events to create demand. Additionally, the firm continued its aggressive share repurchase program. The share price fell after the results were announced and has trended down since the results were released. Consequently, the share price declined substantially in 2024. It is down ~30.1% year-to-date and ~30.6% in the last twelve months. Moreover, the share price is down nearly 57% since its peak in November 2021.

Nike Investor Relations

Nike’s revenue has increased annually except in fiscal year 2020 because of the COVID-19 pandemic. The firm’s business model is simple to understand. Create demand for its athletic footwear and apparel and distribute it through an omnichannel approach. The company has done an excellent job in this regard, the 10-year average growth rate is 6.3%, while the 5-year growth rate is a bit lower at 5.6%.

Portfolio Insight

Nike’s growth is primarily organic. It makes few acquisitions. The combination of rising market share, greater volumes, higher prices, and geographic expansion has fueled long-term growth. The firm competes in essentially all athletic footwear and apparel categories globally. It employs a strategy to continuously innovate faster while making it easier for customers to purchase Nike’s products.

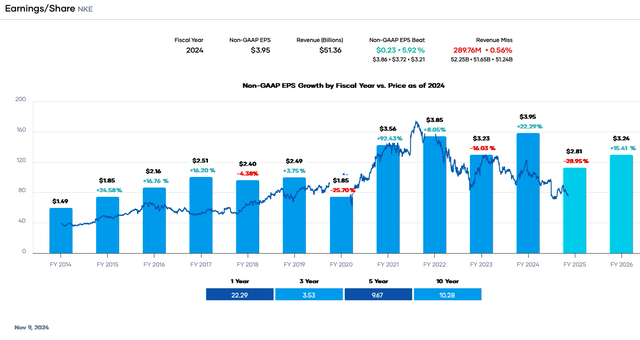

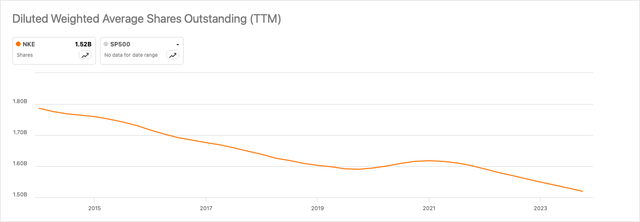

Similarly, EPS has risen in most years in the past decade except in fiscal 2018, 2020, and 2023. The pandemic caused significant disruption to sales, and customers stayed home. That said, EPS recovered quickly. The EPS growth is boosted by consistent share repurchases, significantly reducing the share count by roughly 15% in the past decade. Consensus estimates are for $2.81 per share in fiscal year 2025, a ~29% decline from fiscal 2024. However, the long-term growth average is 9.7% for five years and 10.3% for ten years.

Portfolio Insight

Seeking Alpha

Although Nike is facing near-term challenges, a new CEO and a return to its roots should permit Nike’s revenue and EPS to continue rising in the foreseeable future because of demand and market expansion. The firm’s robust free cash flow (“FCF”) lets it spend on-demand creation, marketing, and innovation in ways its smaller competitors cannot. One wild card is sales in China, which have not yet recovered because of that country’s economic malaise.

Another potential source for top and bottom-line growth is acquisitions. That said, Nike does not follow a growth through acquisition model. However, it has bought and reinvigorated brands in the past, such as Converse, which now generates $2+ billion in sales. Other niche brands Nike purchased were later sold for a profit.

Recent Challenges and Risks

Nike’s main challenge is its missteps regarding shifting to a DTC from a wholesale business model. This has been well discussed, but the impact has been disappointing growth, especially compared to its competitors such as Hoka and On. Although DTC made sense during the pandemic, it affected brand building and caused other issues. The return of a former CEO may address this challenge.

Besides the above issue, Nike faces risks from enhanced competition, supply chain disruptions, and foreign exchange volatility.

Competitive Advantages

Nike’s competitive advantage is its brands, scale, and innovation. The firm’s marketing prowess has resulted in growing sales and market share. The Interbrand ranking and immense effort at sponsorships across sports reinforce this perception. Next, the firm has global operations, allowing it to meet demand and changing tastes almost anywhere. The firm also spends more than its peers on R&D, which leads to new products and features.

Dividend Analysis

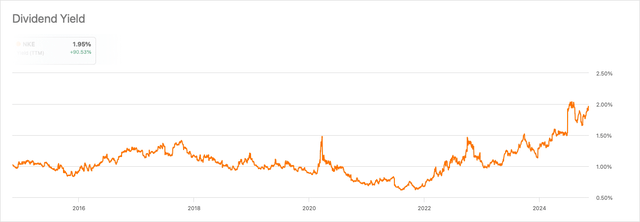

Nike’s share price weakness since 2021 has caused the dividend yield to surge to near decade-high and well above its 5-year average of 1.12%. The forward yield is now about 1.95%. This suggests significant undervaluation.

Seeking Alpha

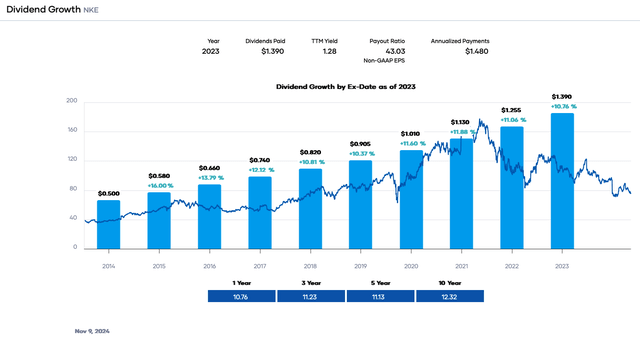

Nike is also a Dividend Contender with a 23-year streak of increases. The annual growth rate has been remarkable and at a double-digit rate for the past five and ten years. Even though the payout ratio is slowly rising, we expect further increases to maintain the streak.

Portfolio Insight

The dividend is supported by excellent safety. The forward payout ratio is around 43%, based on an estimated 2025 EPS of $2.81. This value is excellent and below my target of 65%. The firm usually generates billions in FCF, which more than covers the dividend requirement of $2,203 million. The FCF has fluctuated in the past five years because of recent challenges and the pandemic. Assuming an FCF of $5,000 million in this fiscal year, it gives a dividend-to-FCF ratio of 44%, easily less than our target percentage of 70% or better.

Another positive attribute is Nike’s balance sheet. It carries $12 million of short-term and current long-term debt and $7,998 million of long-term debt. It is offset by about $10,2994 million in cash and equivalents, giving a net cash position. Nike’s long-term operational performance and solid financial position have resulted in the credit rating agencies issuing an AA-/A1 high-grade or upper-medium investment grade rating.

Lastly, Nike receives an ‘A+’ dividend quality grade from Portfolio Insight, placing it in the 95th percentile. It measures earnings performance, revenue performance, dividend performance, profitability, and financial strength. At the same time, the Seeking Alpha Quant system gives a ‘B-’ for safety, an ‘A-‘ for growth, and an ‘A’ for consistency. However, people should be confident about dividend safety at this juncture despite some negatives.

Valuation

Nike’s share price is greater than 50% below its all-time high. Lower expected EPS in fiscal 2025 and a decreasing stock price this year has caused the forward price-to-earnings (P/E) ratio to drop to ~27.0X. Still, this value is at the lower end of the 5-year trailing average and below the 10-year range.

Analysts estimate the company will earn at least $2.81 per share in fiscal 2025, much less than in fiscal year 2024. We will use 25X as a reasonable, fair-value multiple and below the five-year average, accounting for recent difficulties. As a result, our fair value estimate is $70.25. The present share price is ~$75.88, indicating that Nike is overvalued.

Applying a sensitivity calculation using P/E ratios between 24X and 26X, we obtain a fair value range from $67.44 to $73.06. Hence, the stock price is approximately 104% to 113% of the fair value estimate.

Estimated Current Valuation Based On P/E Ratio

|

P/E Ratio |

|||

|

24 |

25 |

26 |

|

|

Estimated Value |

$67.44 |

$70.25 |

$73.06 |

|

% of Estimated Value at Current Stock Price |

113% |

108% |

104% |

Source: Dividend Power Calculations

How does this calculation compare to other valuation models? Portfolio Insight’s blended fair value model, combining the P/E ratio and dividend yield, estimates a fair value of $108.32 per share. The two-model average is ~$89.29, indicating that Nike is undervalued at the current price.

Wall Street analysts have an average price target of $91.58, or 20.69% higher than the current value and more than our two-model average. However, analysts are divided in their ratings with 15 strong buys, four buys, 17 holds, one sell, and two strong sells. In addition, the Seeking Alpha Quant system rating is a hold at 2.84 because of valuation, growth, momentum, and earnings revisions. However, the profitability score is an ‘A+.’

Final Thoughts

Nike has historically been an outstanding investment, albeit volatile, because of economic downturns. It has increased market share, sales, and EPS over time, allowing it to pay an increasing dividend and repurchase shares. The valuation picture is complex, but the composite view is that Nike is undervalued, especially if the new CEO can return the firm to its former glory. This, combined with the acceptable yield, solid dividend safety metrics, balance sheet, and growth potential, makes the equity attractive. I currently view Nike as a buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NKE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.