Summary:

- Nike stock has dropped significantly, facing headwinds from financially impacted consumers and high interest rates.

- Despite challenges, Nike’s dividend safety is strong, with healthy cash flow and an A-rated balance sheet.

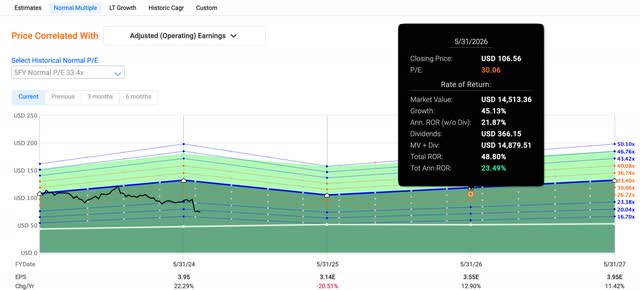

- With a P/E ratio below its historical average, Nike offers potential for strong upside in the medium-to-long term for investors willing to hold.

- You also get paid a well-covered dividend while you wait. Additionally, the drop in share price has pushed NKE’s yield above 2%, which may be attractive for some investors.

- Nike has a 2025 price target of $106, offering investors roughly 49% upside for those willing to hold for the medium-to-long term.

Robert Way

Introduction

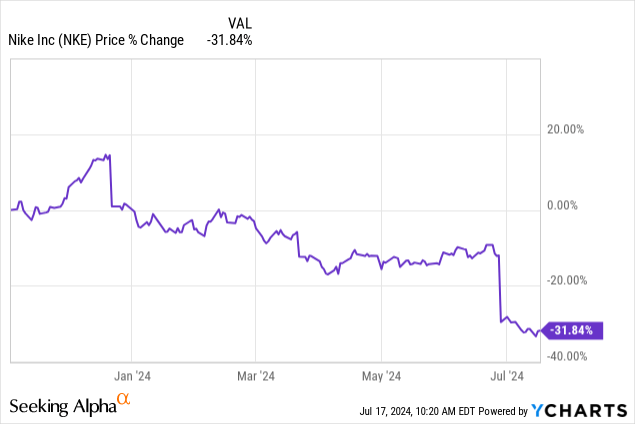

NIKE (NYSE:NKE) (NEOE:NKE:CA), one of the world’s most recognizable brands, has been getting battered lately, down more than 30% YTD. The company definitely has some issues they have to work through, but I like to consider myself an astute opportunist. I tend to keep a cool head and can usually see through the turmoil to find value in a company after being oversold.

I’m a long-term investor who usually looks to hold my companies for at least a minimum of 2 to 3 years, of course, unless they change fundamentally. This allows me to continue to dollar-cost average, bringing my cost basis down, and wait for the potential upside while collecting steady dividends. In this article, I discuss the company’s fundamentals, dividend safety, and why Nike could reward investors with some strong upside in the medium to long-term.

Previous Thesis

I assigned a buy rating to Nike back in November in an article: 4 Reasons To Play Defense With This Dividend Growth Stock. Since then, however, the stock has performed poorly, down nearly 33% while the S&P is up roughly 30%. It’s obvious the company has dealt with headwinds over the past 8 months, which I’ll touch on later in the article.

I discussed the company’s safe and growing dividend, raising it 113% since their last stock split in 2015. They also conducted frequent buybacks over the years, showing the company’s financial strength. Their balance sheet also supported this with strong cash to debt ratio and net debt to EBITDA of just 0.45x.

Headwinds

Since November, NKE is down notably, as you can see from the chart, going from $127 to the current price of $73. The apparel giant has experienced lower sales, a result of financially impacted consumers. This is likely because of the high interest rate environment, as rates rose rapidly to battle inflation.

As consumers continue to struggle and cut back on discretionary items like sneakers and clothing, this has impacted the company significantly. In my opinion, this will likely continue for the medium term.

Although rates are anticipated to decline sometime this year, this will be a gradual decrease. And like rate hikes that took some time to be felt throughout the economy, rate cuts will likely be the same.

As the company focuses on rebuilding their brand with consumers and retailers, they recently brought back a former executive to help earlier this month. The apparel giant brought back the former exec to execute on their marketplace strategy.

This reminded me of when Starbucks (SBUX), another behemoth that has seen its fair share of headwinds from the current macro environment, brought back former CEO Howard Schultz in 2022.

Although NKE’s situation is a bit different, bringing back former members as the company is struggles is something that lets investors know how serious the situation could be and that they are tapping talent to move forward.

Furthermore, the company is also struggling in a key market in Greater China. Brick-and-mortar traffic declined double-digits from 2023. Being the World’s second-largest economy, the country continues to battle deflation as consumers have held back on spending. Additionally, a slower growing economy in China will have a huge impact on companies like NKE who gets a large percentage of their sales from the country.

In both North America & Greater China, footwear & apparel also declined from the prior year, a result of financially-constrained consumers. To combat this, NKE has rolled out $100 and under footwear in multiple countries to attract cost-conscious consumers and hopefully get sales back on track.

Guidance Cut

Nike was forced to cut guidance for the full-year as sales are likely to decline in their upcoming Q1. As previously mentioned, this is due to financially-impacted consumers who are spending less on Nike’s merchandise.

Investors know that whenever a company cuts guidance, the share price will likely experience a steep sell-off. If you can sift through the noise, then you may be getting a bargain opportunity, especially if you’re a long-term investor.

Latest Earnings

Despite all the headwinds and downward pressure on consumer financials, NKE managed to see a slight increase in revenue year-over-year for FY24 during their Q4 earnings last month.

Year-over-year, this grew from $51.217 billion to $51.37 billion. For the quarter, however, revenue declined roughly 2.5% to $12.61 billion from $12.94 billion in Q1’23. It did increase from $12.43 billion in Q3.

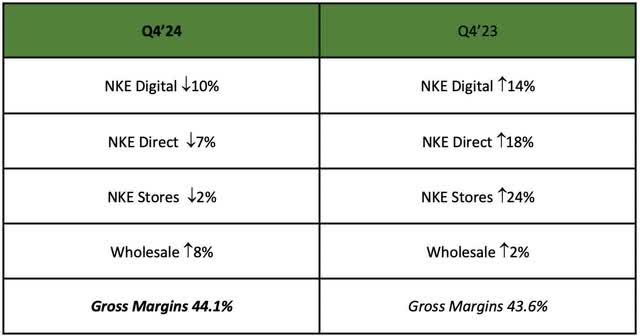

EPS also ticked up to $1.01 from $0.98 in the third quarter and $0.94 in the first. In the company’s segments, they did see the financial pressures from consumers weigh on the business. NKE Direct was down 7% while stores and digital were down 2% and 10%, respectively.

Wholesale, however, did see some growth, up 8%. Gross margins also increased to 44.7%. This was 43.6% in Q4 ’23. In comparison to the same quarter in the year prior, NKE’s numbers were significantly worse, also likely causing shareholders to worry.

In the chart you can see the decline year-over-year with the exception of Wholesale up 6% and gross margins up slightly. But management is combating this decline, investing $1 billion in consumer-facing activities in the coming year.

Additionally, they are managing expenses to reallocate funds to maximize their impact with consumers. They are also focused on attractive price points, with footwear products below $100. It remains to be seen how this will resonate with buyers. But for now, NKE has their work cut out for them.

Dividend Safety

Since my last thesis, one good thing NKE has done is raise the dividend. They increased this by nearly 9% in late November to $0.37. At the current price, this gives them a yield slightly above 2%. This may not be attractive for some investors, but this is well-above their 4-year average of roughly 1%.

The company did also buyback 50 million of its shares as part of its buyback program. Although I do anticipate this to slow down as they focus on reallocating capital to scale the business to resonate with consumers. But this does increase their dividend safety. Furthermore, NKE’s cash from operations was $7.4 billion for the full-year, thanks to their working capital improvements.

This was a 27.5% increase from $5.8 billion for fiscal year 2023. So, for investors worried about the company’s dividend safety, NKE’s cash flow is healthy, growing double-digits year-over-year. Additionally, their payout ratio has averaged 37% the past 3 years.

Using next year’s dividend estimate of $1.49 and their shares outstanding, NKE’s payout ratio is a very safe 31%. So, even if their cash from operations saw no growth and capital expenditures picked up significantly in 2025, the company has some wiggle room regarding their dividend safety.

Pristine Balance Sheet

Aside from the A credit rating, NKE’s debt is nothing to be of concern as their cash balance is enough to satisfy their long-term debt balance of $8.9 billion. At the end of the quarter, NKE had nearly the same amount of cash & equivalents amount.

In March, they entered into a year-long commitment for additional liquidity of $1 billion, with an option to increase up to $1.5 billion. This matures in March of 2025. So, from a balance sheet standpoint, NKE is in a comfortable position. So, if investors are worried about higher for longer interest rates, this will have minimal impact.

Undervalued?

At the current price, NKE is trading at a P/E of less than 20x, well-below their 5-year multiple of more than 33x. Earnings are anticipated to decline in 2025. But looking out past next year, earnings are expected to grow at double-digits of nearly 13% and 11.5% respectively. The company may not return to its normal multiple above 33x, but playing devil’s advocate, I think they are a premium company that could see a P/E of 25x – 30x earnings.

Currently, their P/E is only slightly above Skechers (SKX) nearly 18x, signaling the stock could be undervalued. However, Nike is a much larger company and well-known brand in comparison. And after hitting a new 52-week low $71.24 recently, I think the apparel giant may be a deep value play. Using a P/E of 26x, which I think is fair for a company of Nike’s caliber, investors still get some strong, double-digit upside of 49% if willing to hold for a few years. You also get paid a well-covered and growing dividend while you wait.

Downside Risks & Conclusion

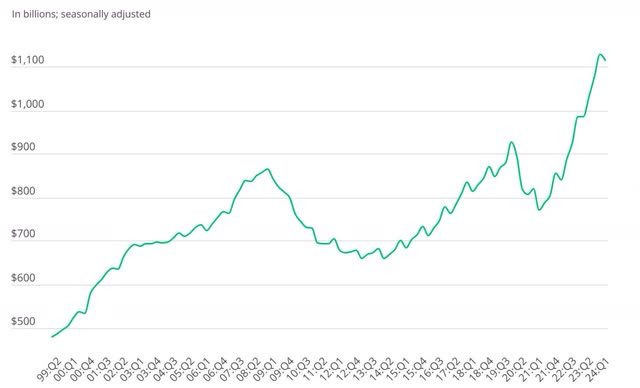

NKE’s biggest risk obviously is financially-strained consumers. Due to higher interest rates, consumers have been looking for more value. And likely have cut out spending on discretionary items like apparel or footwear.

Additionally, looking below, credit card debt has continued to increase in the past few years as consumers have relied heavily on them in the current macro environment. NKE could also see further downside if the economy happens to fall into a recession, or if we experience another unexpected downturn, negatively impacting sales. The next year or two will be tough for the company going forward.

However, I do expect NKE to continue to find innovative ways to reach customers, like the previously mentioned $100 and under footwear recently launched. But, if not, they could see further decline in their segments, thus increasing further downside risks. Moreover, as interest rates gradually decline, the company will likely see an increase in demand for the products.

They are the #1 brand in the eyes of many consumers, especially among the Gen Z population. Furthermore, their balance sheet supports further growth initiatives to help them reach a wider customer base. If you believe Nike will remain a dominant force in the apparel world, then the stock may be a great buy right now.

Additionally, I think their issues are fixable, and I like their well-known brand & exposure to long-term growth markets like Asia & Latin America. As a result of this, along with their strong balance sheet, P/E less than 20x, and a well-covered dividend, I continue to rate Nike a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.