Summary:

- Despite the headwinds facing the economy, NIKE’s most recent quarter results weren’t that bad.

- NIKE has a much higher Operating Margin than many of its peers, despite its size indicating that it is well run.

- A slowing economy is a key risk for NIKE’s stock given its high valuation.

Wirestock

NIKE (NYSE:NKE) is an iconic company that needs no introduction. As a leading provider and retailer of sports apparel and footwear, the company’s check brand is an icon. This article examines NIKE’s stock to determine whether it is worth a look.

NIKE’s Top-line Performed Well Despite the Tough Macro-Economic Environment

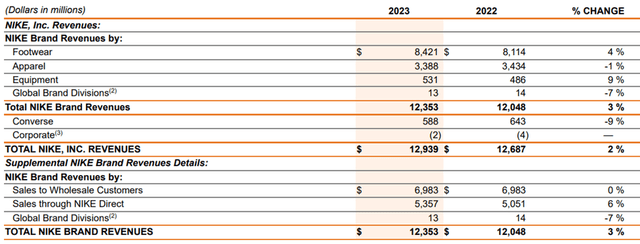

Despite the headwinds facing the economy, NIKE’s most recent quarter results that ended in August 2023 weren’t that bad. The company’s fiscal Q1 2024 revenues were up 2% ending at $12.9 billion. The growth was largely driven by NIKE Direct revenues and its subset NIKE Brand Digital sales which were up 6% and 2% respectively. NIKE Direct reported revenues of $5.4 billion or 41.8% of total sales. Wholesale revenues were largely flat at $6.9 billion.

NIKE Revenue (10-Q)

During the quarter, Gross Margin fell by 10 basis points to 44.2%. It’s remarkable that NIKE was able to defend its pretty high gross margins given the current macroeconomic situation as well as inflationary pressures. According to the SEC disclosures, the company undertook “strategic pricing actions” to offset the impact of increased product costs. The ability to pass on cost increases via price is a testament to the strength of the NIKE brand.

Like most companies post-pandemic, the company initially ran into supply chain issues. However, the majority of these issues were resolved by fiscal Q1 2024. NIKE now is experiencing normalized inventory transit times which is good news as the Christmas shopping season is fast approaching.

NIKE to Drive Earnings via Efficiency Improvements

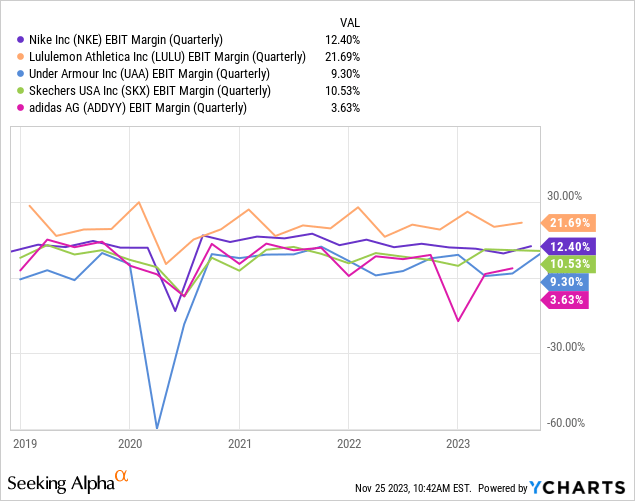

Speaking of fixing supply chain issues and maintaining proper inventory levels, what has really surprised me about NIKE is how efficient it is for a company its size. Looking at the Operating or EBIT margin of NIKE and its competitors, it can be seen the former is much more efficient than many of its peers. In fact, apart from Lululemon (LULU) which enjoys premium pricing power, NIKE has outperformed its peers when it comes to EBIT margins. Currently, NIKE has a 12.4% EBIT margin which is approximately double its main rival in sports apparel adidas (OTCQX:ADDYY).

The company is making strides to make its operations even more efficient as it has made substantial investments in supply chain monitoring and logistics. As mentioned in the company’s latest earnings call;

“We are turning the corner in driving more profitable growth while also recovering on transitory cost headwinds. This includes structural improvements in profitability in areas such as supply chain, with reduced digital switch shipments and improved digital fulfillment costs enabled by investments in our regional service centers, and a new transportation management system”

During the call management discussed driving efficiency in its supply chains as the supply chain increased in size in the past few years to address growing demand. Some specific examples discussed on the call include lowering outbound fulfillment costs by building regional service centers closer to customers. Another example is the onboarding of a new Enterprise Reporting System to track logistics. On an operational basis, NIKE is expecting a 150 basis point margin improvement next quarter alone.

These cost improvements and efficiencies flow straight to the company’s bottom line. This shows that despite revenues increasing at a steady pace, NIKE has room to drive EPS growth via these initiatives. From the conference call this was discussed as well:

“As it relates to overhead, the numbers that I referenced actually impact our gross margins, our lower digital fulfillment cost that sits in our gross margins. And it’s something that we’ve been focused on for some time. We started investing a couple of years ago in regional service centers in North America and in Europe and in pickup points closer to the consumer in Europe, all with the intention of building a supply chain that enables us to serve demand closer to consumers.”

Consumer Confidence

In October the Consumer Confidence index once again declined slightly to 102.6 from the revised 104.3 figure in September. The Expectations index also fell slightly to 75.6 in October from 76.4 the month prior. These two metrics show that Consumers are fearful of the future with regard to the economy. In fact, the Expectations index being below 80 is usually a signal for a looming recession.

It should be pointed out that these expectations run counter to what we are seeing in consumer spending in the last few months. The majority of consumers said that a recession is ‘somewhat’ or ‘very likely’. This signals that consumers could start pulling back on their spending in the near future. Therefore, we could start seeing the impact on consumer discretionary items like NIKE products. Given NKE stock’s relatively high valuation (discussed below) a “hard landing” type recession could result in substantial downside risks. A slowing economy both domestically and globally is a key risk for NIKE stock that investors should be mindful of.

NIKE Seems to be a “HOLD”

Regarding the company’s forward guidance, according to management, NIKE is expecting retail sales to continue to grow at a constant rate at around mid-single digits similar to Q1 2024. Wholesale is expected to perform better at a 27% currency-neutral growth in Q2. In other words, management is still optimistic about future sales growth.

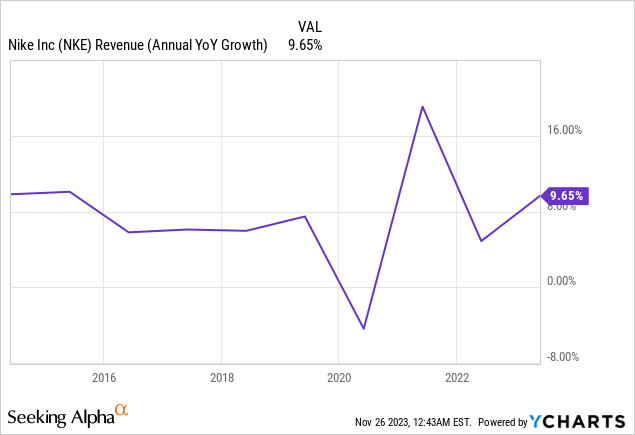

Throughout business cycles, NIKE has been able to grow its top line at a relatively healthy rate ranging from the high-single digits to the low teens. According to data from Seeking Alpha, NIKE’s top-line YoY growth has been much higher than its sector median at 9.2% compared to the sector’s 5.5% growth.

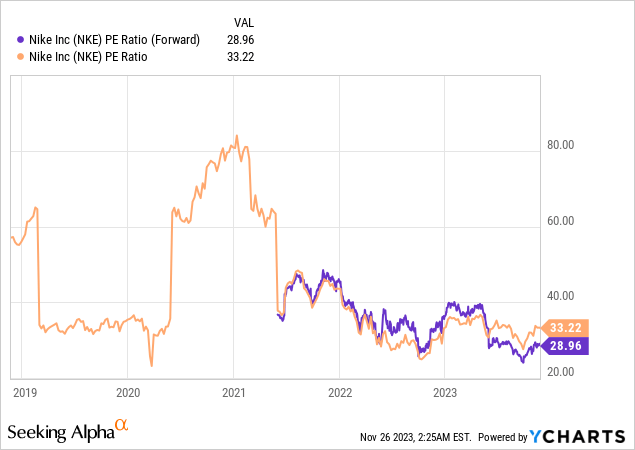

The downside though is that NIKE’s stock is trading at a premium multiple of 33.2x trailing twelve-month EPS and 28.9x forward EPS. This is much higher than the sector’s median at 13.3x twelve-month EPS and 14.8x forward EPS. Despite seeming to be expensive, NIKE has always traded at a premium valuation. Its P/E ratio never dipped below 20x in the past 10 years.

A 28.9x forward EPS translates to an earnings yield of 3.4%. I believe in the current high-interest rate environment, NKE stock appears to be very expensive. Although the Fed has signaled a possible pause in interest rate hikes, rates have been the highest it’s been in years. The company’s stock always carries a premium due to its solid business.

However, I don’t think investing in NKE stock at these levels will result in any “alpha” or “outperformance”. It’s important to remember that a good company does not always mean it is a good stock. An investment in NKE stock over the last 5-years has failed to outperform the S&P 500 by nearly double. It is for this reason, I have a “Neutral” or HOLD rating for NIKE.

NKE stock performance (Seeking Alpha)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in LULU over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.