Summary:

- Nike, Inc. has been facing quite a few challenges over the latest quarter, as data shows a significant weakening in the apparel industry, most likely resulting in higher inventory levels.

- A post-covid recovery in China has so far not been evident, as economic data shows that the Chinese economy is struggling as a result of multiple issues, which impacts Nike.

- Nike’s significant market share, strong brand recognition, and focus on digital sales still position it well for future growth and margin increases.

- I upgrade Nike stock to a buy ahead of its fiscal Q4 earnings release, despite concerns about a weakening sportswear industry and a slow recovery in Chinese apparel sales, as the valuation has come down accordingly.

Thank you for your assistant

Investment thesis

I upgrade my rating on Nike, Inc. (NYSE:NKE) to a buy and update my revenue and EPS estimates prior to the fiscal Q4 earnings report to be released post-market on Thursday, June 29. Shares have finally reached an acceptable price point for the first time in months, in which there seems to be enough downside protection to initiate or increase a position in this incredible company, despite the weakening sportswear industry.

Nike will report its FQ4 and FY23 results in a few days. However, there are concerns regarding the macroeconomic environment and recent industry weakness, which could impact Nike’s earnings. The weakness in the sportswear industry has been evident, as seen in Foot Locker’s downgraded outlook. Furthermore, the slow recovery in Chinese apparel sales could be an additional headwind for Nike’s short-term expectations.

Despite these challenges, the long-term outlook for Nike remains positive. The company holds a significant market share in both the Chinese and global sportswear industries, allowing it to capture future growth. With its strong brand recognition and increasing focus on digital sales, Nike is well positioned to drive up margins and achieve double-digit EPS growth over the decade.

In this article, I will take you through the latest developments and financial results and update my estimates and view on the company accordingly.

A weakening apparel industry, a slow recovery in China, and Nike’s impressive competitive position and growth opportunities

Nike is about to report its FQ4 and FY23 results later this week. Coming from an impressive performance in fiscal Q3, investors expect Nike to show another solid performance. Meanwhile, the macroeconomic environment has been deteriorating quite a bit over recent months, as highlighted by collected data. So, what can we expect Nike to report in the upcoming earnings release this Thursday, and how does it compare to analyst estimates and my own previous (bullish) estimates?

Morgan Stanley analysts point to recent sportswear channel checks that show a slowdown in demand for sportswear, which potentially has created some additional inventory gluts, highlighted by recent promotional activity by Nike. The result could be a somewhat negative EPS surprise below the street expectations. Inventory last quarter increased by only 16%, down from 43% in FQ2 as management was seeing very positive momentum above expectations. Yet, considering the recent weakness in the industry as highlighted by Morgan Stanley, I expect this to increase once more in the upcoming earnings report as momentum has slowed. Inventory struggles and promotional activity could weigh on the FQ4 results, especially margins. Also, this could have a meaningful negative effect on the FY24 outlook from management.

This weakness in the sportswear industry was already highlighted when Foot Locker (FL) reported a big miss and a downgraded full-year outlook in May. The CEO pointed to a tough macroeconomic backdrop as sales declined and the company was forced to increase promotions as also inventory increased by 25%. As the company projected 2023 to remain challenging, it lowered the FY23 outlook quite a bit. Now, Foot Locker and Nike are hard to compare as these are completely different companies with different business models and a very significant difference in moat. Still, these do operate in the same weakening industry, and so it is essential to consider this going into Nike’s Q4 results. Clearly, expectations should not be too high.

Additionally, the expected recovery in Chinese apparel sales has also not been very impressive thus far. Lululemon Athletica’s (LULU) latest quarterly results did show a strong Chinese performance, so I expect Nike to show a similar pattern, but still subdued. Meanwhile, China is a crucial market for Nike, and a slower-than-anticipated recovery here could be an additional tailwind to short-term expectations.

So far this year, growth statistics from Chinese industrial output, retail sales, and property investment have all fallen short of analysts’ projections, and the expected economic recovery seems to have been overestimated. Or at least so far. There have been some positive recent developments like lifting the forty-eight-hour PCR testing requirements for inbound travelers. Still, a tense relationship with the U.S. government remains a drag on economic growth, according to the Council on Foreign Relations.

As a result of the slow recovery, S&P Global has lowered its GDP growth expectations for the country from 5.5% to 5.2%, also fueled by the weak confidence among consumers and in the housing market. Analysts are expecting a faster recovery by the second half of the year, but we should not expect any Chinese fireworks in Nike’s Q4 earnings report.

Of course, long-term expectations from China remain very much positive, with the Chinese sportswear industry still expected to show a growth CAGR of above 9% through 2025. With Nike currently holding a 22.9% market share in the Chinese sportswear market, the company is exceptionally well positioned to capture this growth, while using its global brand strength to further expand its market share.

Meanwhile, the growth outlook for the global sportswear industry also remains resilient, with an expected growth CAGR of 6.9%, driven by the increasing health consciousness among the global population and the increase in female participation. With Nike holding a mighty global market share of over 30% and, according to several sources, closer to 40%, the company should be able to capture this growth. Also, in footwear, which accounts for nearly 35% of the apparel industry, Nike holds a staggering 66% of the market.

While this impressive position allows Nike to fully benefit from industry growth, it also limits further market share gains. Importantly, I do not see any reason for Nike to start losing share, as its brand is still incredibly popular and is even starting to become more of a fashion brand (as opposed to sportswear) among younger generations thanks to its very recognizable brand. Wearing the Nike Swoosh on your shirt or shoes has long been, and still is, a fashion statement. This is also why some more limited Nike sneakers sell for ridiculous prices on the second-hand market.

Back to my point, Nike is still an incredibly popular brand, with plenty of room for further growth and even slight market share gains. Especially if Nike were to focus its efforts on emerging countries like India and Latin America, it should be able to slightly outperform overall industry growth, as it has been doing over the last two decades as well.

And as the company further increases its digital presence and Nike Direct sales as a percentage of overall sales, I believe it should also be able to further drive up margins over the remainder of the decade, causing it to report even more impressive EPS growth approaching the double digits.

Yet, a somewhat surprising development over the last quarter was the fact that Macy’s (M) reintroduced Nike apparel in its stores, which goes against the trend seen over the last decade in which Nike has been focusing on reducing sales originating from wholesale partners and instead focusing on its own Nike Direct sales. This reintroduction of products in a selection of Macy’s stores potentially shows that Nike realizes the importance of the channel in reaching a customer base not accessed through the direct-to-consumer channel, according to BTIG analyst Janine Stichter.

The move by Nike has given me somewhat mixed feelings, though. The move could potentially boost sales for Nike, as it could indeed give them access to a customer base that they are unable to service through their Nike Direct channels, which is, of course, a positive. Meanwhile, Nike Direct offers much stronger margins and control over pricing compared to sales through these wholesale partners. Therefore, Nike moving slightly back into the wholesale strategy could negatively impact margins or keep it from improving them.

This move also makes me wonder whether we will see more revitalized partnerships with wholesalers by Nike, like, for example, with Foot Locker. I guess time will tell, but as I said before, I am not quite so sure this would be the right move by the company.

Outlook & NKE stock valuation

Analysts currently guide Nike to report FQ4 revenue of $12.59 billion and EPS of $0.67, down from a previous $12.61 billion and $0.70 right after the FQ3 earnings report as we have seen quite some downward revisions over recent weeks. Current estimates do reflect Nike’s own expectations of relatively flat revenue growth YoY and some pressure on margins which drives a meaningful YoY decrease in EPS.

This is what I wrote back then concerning the Q4 outlook:

Nike now expects to report FY23 revenue to grow by high single digits, compared to a previous expectation of mid-single-digit growth. This includes approximately 600 basis points headwinds from foreign exchange rate headwinds. This means that Nike expects barely any growth for the fourth quarter, which seems quite conservative indeed, but this is partly due to a moderation in wholesale growth due to a tougher comparable quarter. Nike expects FY23 margins to decline by 250 basis points as a result of further inventory markdowns, high freight costs, and higher input costs.

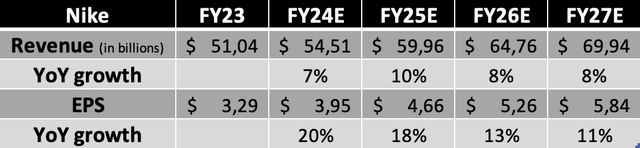

As a result of the above-discussed recent developments and worsening macroeconomic environment, I am also lowering my own expectations for FQ4 and adjusting my FY24 projection as a treacherous economic backdrop and a remaining recession risk could also potentially cause some caution in the FY24 outlook from management. This results in the following expectations.

Long-term projection (Daan Rijnberk)

Shortly explaining these estimates, I now expect Nike to report FQ4 revenue of $12.67 billion and a lowered EPS of $0.73 to account for some macroeconomic pressure and lower margins to accommodate for higher markdowns and inventory levels, as well as a slow China recovery. Following this, I also lowered my expectations for FY24 as I expect the current industry weakness to persist through the first half of its fiscal FY24. This will result in higher-than-anticipated markdowns and pressure on sales.

The China recovery, which is expected to pick up steam in the second half of 2023, will be a tailwind for Nike as it has a lot of exposure to the country, and this will be able to offset some of the weakness. Overall, I expect Nike to grow revenues by 7% in FY24. Meanwhile, I expect margins to improve throughout the year, resulting in a strong rebound in EPS of 20% YoY.

While I have lowered my expectations for the next two years, I upgraded my expectations for the following years on strong industry trends and growth expectations. Nike remains the most prominent and influential player in the sportswear industry while it is increasingly becoming a true fashion giant. As I expect Nike to keep improving margins over the years, I project EPS to show solid double-digit growth.

Moving to the valuation, Nike is currently valued at a forward P/E of 28.6x FY24 EPS, which is about 20% below its 5-year average valuation and quite a bit below the typical premium the stock tends to be valued at after it has fallen by over 6% since the last earnings report. This means shares today trade at a much more reasonable valuation and are even looking quite attractive. Yet, investors should take into consideration the decreased near-term outlook as the company is facing its fair share of headwinds that will be a drag on growth and especially margins. Therefore, a somewhat lower valuation multiple seems justified.

At the same time, I remain incredibly enthusiastic about the long-term potential of the company and its unmatched brand strength. With the expectation of double-digit EPS growth, an incredible brand to support it, Nike’s solid efforts in China and Nike Direct, and its strong global position, this company really is a no-brainer for any long-term investor as it will keep compounding for many years. But is it attractive enough today?

I believe the factors mentioned above justify a premium valuation for the shares. Last time out, I discussed that a 31x P/E ratio seemed fair for the shares. Today, I am lowering this ever so slightly to 30x to account for the near-term weakness it will be facing and the expected higher inventory levels. Therefore, based on a forward P/E of 30x and my FY25 EPS estimate, I arrive at a price target of $140, up from a previous $126, and leaving an upside of 24% from a current price of $113. (Please note, this target price is solely based on its forward P/E and is only for indicative purposes.)

For comparison, 37 Wall Street analysts currently maintain a price target of $132 combined with a buy rating.

Conclusion

The FQ4 earnings report to be released by Nike on June 29 could surprise investors both positively and negatively. The industry momentum has clearly weakened over the quarter, as highlighted by collected data and peer results. This could impact Nike and result in higher inventory levels and decreasing margins. Meanwhile, Nike’s incredible brand strength and resiliency could largely offset this industry weakness and surprise investors, but this seems rather unlikely.

Therefore, to account for somewhat lower margins and higher inventory levels, I have decreased my FQ4 and FY24 expectations. Yet, as the share price has also fallen back to $113 from a high of around $128, shares are still attractively valued due to the expected recovery in EPS over the next two years. Based on my FY25 EPS expectation, I calculate a price target of $140.

As a result, I believe Nike shares are now finally attractive enough to warrant a buy rating on the shares, despite the expected weakness. I believe the current share price offers enough downside protection and already accounts for some upcoming weaknesses. Meanwhile, the long-term outlook remains impressive and resilient, and I believe the current price offers decent value to long-term investors as I believe shares are a buy below $115 per share.

Whether you should buy before the earnings release? This is a challenging question to answer as this one could be full of surprises. As the current share price is attractive enough, I see no problem in buying some shares today and a positive surprise on Thursday will most likely result in a share price jump back into the $120 level. At the same time, the industry weakness could have affected Nike quite severely, resulting in further downside to below $110, although most of this downside seems to have been priced in already.

Overall, I like Nike shares at their current price from a long-term perspective and therefore rate them a buy today.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NKE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.